Vincent Daniel

@VD718

Followers

11,709

Following

2,437

Media

20

Statuses

1,954

Co-founder of Seawolf Capital- Mets, Jets and Value Investing Go Hand in Hand

Joined June 2012

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Pedro Sánchez

• 314437 Tweets

wonwoo

• 257460 Tweets

Wizkid

• 223901 Tweets

#CDTVライブライブ

• 135800 Tweets

woozi

• 122436 Tweets

Davido

• 118483 Tweets

#SixTONES_音色

• 78435 Tweets

新刀剣男士

• 64520 Tweets

Humza Yousaf

• 52157 Tweets

フルサイズ

• 50704 Tweets

#Fes蓮ノ空オープニングライブ

• 47415 Tweets

Thiago Silva

• 46036 Tweets

First Minister

• 45049 Tweets

為替介入

• 44478 Tweets

#SixTONES_アンセム

• 39296 Tweets

Don Jazzy

• 39081 Tweets

CGPJ

• 34958 Tweets

비하인드

• 33216 Tweets

スレイヤー

• 27087 Tweets

ライラック

• 15142 Tweets

feat.葛葉

• 15104 Tweets

OFF旅

• 10404 Tweets

#温泉地総選挙

• 10184 Tweets

Last Seen Profiles

Hey

@LukeGromen

, do you think it’s about time for the ‘It’s Just an Asset Swap’ and ‘QE doesn’t do anything’ believers to admit that perhaps, they are wrong?

8

7

121

If one of my longs produced numbers and a sobering conference call like TSLA’s 3Q23 quarterly results, it would be down at least 10%- and yet their is a 50/50 shot TSLA stock will be up tomorrow- God bless their investor base and market structure.

Is it me, or is this call an ABSOLUTE disaster? Thoughts

@GerberKawasaki

? Thoughts

@garyblacks00

?

62

14

228

11

6

103

Really funny headline when you stop and think about it- A bank that makes loans for a living starts a division to make loans. Guess those risk weights too hard to handle.

9

5

85

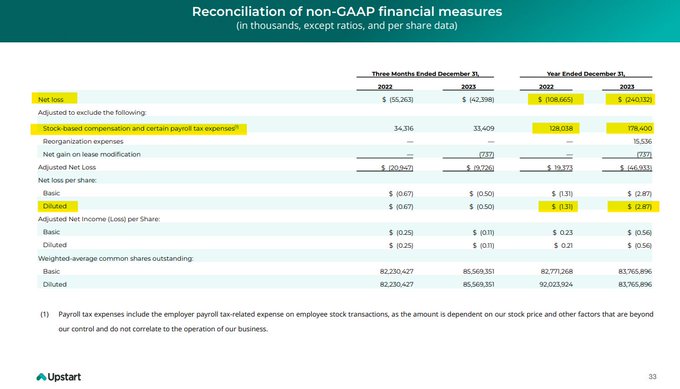

I would thought a superior AI underwriting process would have sniffed out deterioration in ‘prime’ credits before originating the loan. That said, seems like the company’s AI correctly guided mgmt to sell stock.

6

3

84

Awesome job Jack and thanks for having us on the podcast!!

My latest interview with

@VD718

and

@Seawolfcap

out now:

THE NEXT BIG SHORT: THE DEBT SUPERCYCLE

Filmed for 2 hours in-person during Powell's FOMC speech 🔥

Watch on

@Blockworks_

👇

26

26

162

10

13

78

Thanks for having us on guys. Always fun to talk shop and share views and ideas.

Value: After Hours with

@farnamjake1

@Seawolfcap

and

@VD718

is LIVE TODAY at 1.30pm E / 10.30am P / 6.30pm UTC / 4.30am AUS

Watch it on the Acquirers Podcast channel: …

Turn on notifications to the channel to be sent a reminder.

3

3

41

4

5

78

The correlation of people asking for some form of bailout/deposit protection and also wanting higher unemployment so long duration risk assets to appreciate seems to be very high.

2

11

72

I really don’t get the love affair for this name. So many yellow and red flags- I do agree, perfect execution in applying Silicon Valley Accounting Principles (SVAP).

12

4

69

M&T has great mgmt pedigree. I remember meeting former CEO Robert Wilmers with

@Seawolfcap

and seeing his bike parked near corporate headquarters in NYC- Very bank geek stuff but I felt I was looking at a royal treasure.

4

4

66

Thanks for having me on Jack- always enjoy talking markets with you. Currently listening to most recent Coinbase podcast. Keep up the great work.

Great quote from

@VD718

:

"You show me the asset with the low risk weighting, and I will show you where the next bubble is."

So much learning in this one... especially on the banks

We talk energy & uranium, too

2

6

28

7

3

61

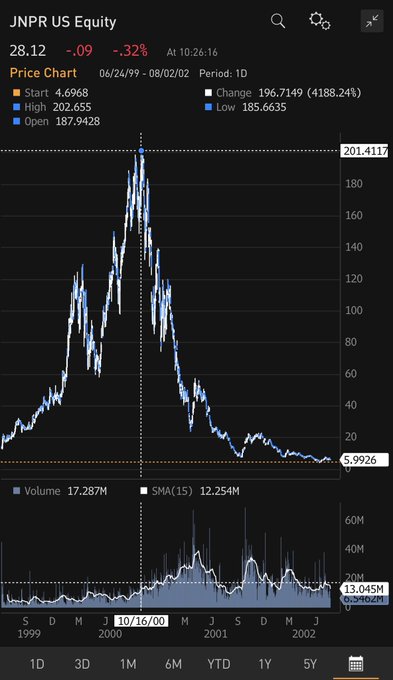

@dailydirtnap

Zero cost of capital strategy in a capital intensive industry gone bad when the Fed pulled liquidity

1

2

56

Great episode guys - Both

@CameronDawson

and

@LukeGromen

brought their A games!

A supersized OTT is in your feeds!

First,

@CameronDawson

joins

@GuyAdami

,

@dmoses34

& Dan to talk about late-cycle behavior, earnings & her year-end outlook

Then,

@LukeGromen

joins to discuss all things macro (yields, gold, oil, & more)

Sponsors

@CMEGroup

@iconnections_io

@ro

13

10

53

5

8

54

@BriannaWu

I am starting to think he is conducting a science experiment/study on human gullibility

0

1

53

Thanks for having us on today-great session!

Vinny

@VD718

Daniel and Porter

@Seawolfcap

Collins join

@farnamjake1

and me on Value: After Hours LIVE TODAY at 1.30pm E / 10.30am P / 5.30pm UTC / 3.30am AUS

Watch it on the Acquirers Podcast channel:

Subscribe to be sent a reminder:…

10

2

74

3

2

57

Someone has to buy our debt (also called treasuries) at relatively low coupons. Banks were always the logical levered buyer- I would have thought the whole SIVB fiasco would have exposed the flaws but…someone has to buy the debt.

7

6

51

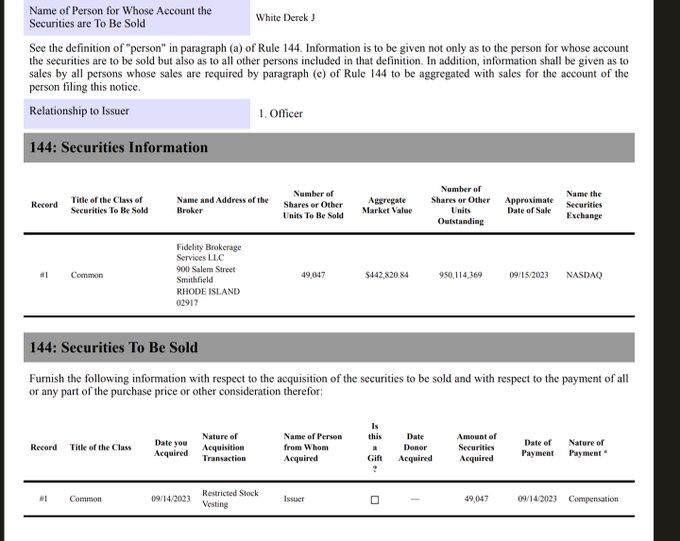

One major difference between current markets and yesteryear is the lack of price discovery from elevated insider activity. In the past, insider sells or buys were signals- Today?…who cares. I attribute it to current market structure.

Another $SOFI insider sale.

@Derek_j_white

, CEO of Galileo Technologies, SoFi's Tech Platform, filed a form 144 to sell 49k shares worth $443k. Somehow I missed this one yesterday with the other filings.

Per his most recent Form 4, it's about 11% of his current $SOFI shares.

8

6

51

4

5

46

Thanks

@GuyAdami

for being concerned about my mental psyche post Mets debacle and Rodgers injury- I know it came from the heart. Great podcast and

@UrbanKaoboy

a super value added guest voice to your arsenal

New episode of OTT is in your feeds! Dan,

@GuyAdami

&

@dmoses34

chat the market's mixed messages, MS $TSLA upgrade, airlines $JETS & $GENI $SRAD

+

@UrbanKaoboy

joins to talk all things macro & what could trigger an oil sell-off

Sponsors

@CMEGroup

@iconnections_io

@FactSet

@ro

4

9

25

16

5

44

Laugh track anytime ‘Fed Independence’ is suggested

Wow .. Biden speaking in PA just now: "that little outfit that sets interest rates .. it's going to come down. They're going to come down"

Lower interest rates ahead??

#fed

250

153

1K

5

4

46

My question is why is anyone surprised. Did people actually think he wasn’t going to attempt to use the platform to his complete advantage?

6

2

43

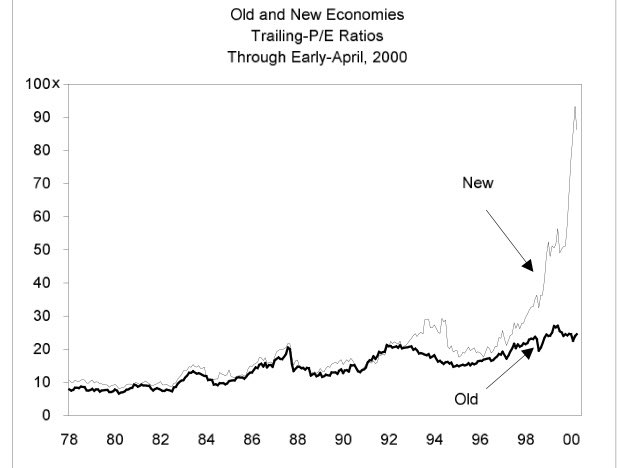

Great thread and informative for the peeps who were not old enough to experience 99/00. And for people who did live it, a solid trip down memory lane.

2

9

43

Great thread- this particular statement provides much color as to why we are seeing what we are seeing in the options market. Show me the risk weights and I’ll show you the excess leverage

3

11

43

Great podcast!

@DiMartinoBooth

on her game

There's a brewing credit crisis in car loans 🚗, according to

@DiMartinoBooth

.

Borrowers are now walking away from their cars because they know they can't pay the loan back.

Link to full interview:

Apple 🔊

Spotify 🔊

15

94

307

3

5

45

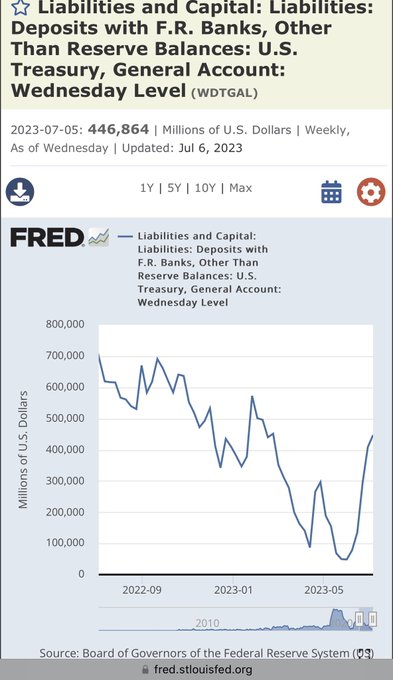

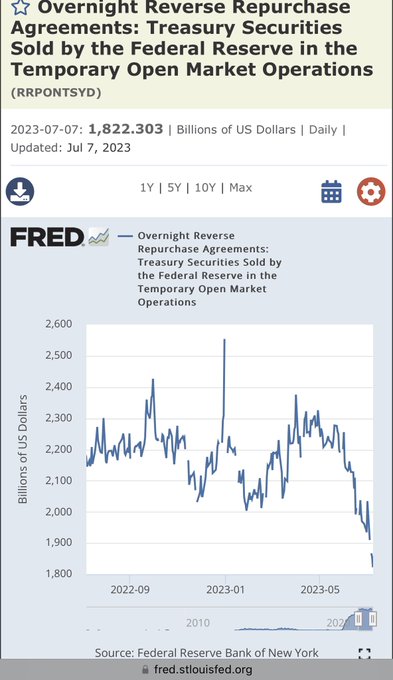

@LukeGromen

It’s funny Luke- few are talking about this trend and my guess is this will be on the front pages in a few months

1

2

42

Not sure why but it irks me that financial media feels like they need to dress like they are Kevin Costner in Yellowstone at Jackson Hole. When I visit Miami, I don’t dress like Pitbull- in the words of

@dmoses34

, make it stop.

@Seawolfcap

1

2

40

@SantiagoAuFund

As we quarrel over the meaning of Buffett’s gold purchase (my take-perhaps too small to claim victory but definitely not a negative for current gold owners), what I find more interesting is his non-trivial reduction in his regulated bank positions.

6

2

38

Great podcast. Anyone who invokes Robert Moses to describe Powell’s view of his role in society warrants a listen. Well done

MacroVoices

@ErikSTownsend

and

@PatrickCeresna

welcome

@SimplifyAsstMgt

chief market strategist Mike Green

@profplum99

to the show to discuss the banking crisis, the debt ceiling debacle, de-dollarization, artificial intelligence and much more.

17

18

128

1

1

40

Going to be hard for the BLS to apply hedonic adjustments to this price increase

6

2

40

More a gold guy but you can own both. Great episode guys!

What's the better calamity trade: Gold or Bitcoin?

@RiskReversal

,

@GuyAdami

&

@dmoses34

discuss on the latest episode of "On The Tape."

Watch now:

0

2

3

7

4

39

Incredible presentation-the grift is off the charts

Thanks

@DutchRojas

This is absolutely SUPERB!

A brilliant job by

@bgurley

but the way the whole system works is just so damn depressing.

5

15

59

1

2

37

Great podcast, particularly

@profplum99

’s bottom up perspective of ODTE option trends- Thanks confirms an admitted bias on bank risk weight philosophy. Show me the low risk weight and I will show the next risk.

"When interest rates go up, people are going to start to default"

@profplum99

on "The Big Short" dynamics which he sees at play now in car loans & commercial real estate

Apple 🔊

Spotify 🔊

YT 📽️

2

4

33

3

8

36

@Seawolfcap

@rsosa8

SOFI is sum of the best accounting alchemy I have seen. Can’t sell the loan or don’t like the marks? just keep it on the books and mark it up anyway- what amazes me is the bank regulators allow these earnings to be considered capital.

3

1

34

@APompliano

I always find

@DoombergT

articles to be must reads and his latest on economic singularity was fantastic. Do you ever read their stuff?

5

1

34

@Papa60613

@hkuppy

We still own it- encourage everyone to do their own work but Kuppy’s analysis was spot on. CEO and management are top notch, own a ton of the company and love doing what they are doing.

3

1

33

@CorneliaLake

an unfortunate setup for the Yipit bros- datascraping analysis strongly suggested a weak quarter but scraping analysis could not foresee

@hkuppy

coming off the top rope with a chair and some long term thinking. Still have the weak quarter ahead of us!

3

0

33

My word this is refreshing- professor is spot on-

NEW ODD LOTS:

How to never have bank bailouts again.

@tracyalloway

and I talked to Stanford GSB professor Anat Admati, on her vision for redesigning bank funding in order to make the financial system far less fragile

13

21

102

2

2

33

Saw this on my thread yesterday and I immediately thought of the

@OnTheTapePod

podcast. Great job this week!

7

0

32

Gold hit 1,900!!!- I think we should change Danny’s name to Ace! Sorry you are on the opposite side of Danny’s wrath

@RiskReversal

.

@GuyAdami

,

@Seawolfcap

3

0

32

Thanks for having us on Ted! Great conversation

Big Shorts and big longs. My conversation with

@Seawolfcap

(Porter Collins) and Vincent Daniel from Seawolf Capital.

With thanks to

@Wellington_Mgmt

and Inflection Point Partners.

9

41

211

4

3

32

Great podcast. Paulo and Kuppy’s AMRK pitch!

.

@KevinMuir

&

@PatrickCeresna

welcome

@PauloMacro

to the show. They discuss which commodities have fundamentals improving under the covers, and how he is playing this new era. Then we have our good friend

@HKuppy

to announce a new stock that he has previously never mentioned!

26

39

250

0

2

30

Great thread- while I appreciate the buildup in TGA has not caused a liquidity reduction crisis as the funds are coming from the RRP, I fear complacency is shortsighted- my primary concern is structural fiscal policy-

1

3

30

For the most part, in general agreement, which is not my way (lol).

1

3

29

Kudos to

@Seawolfcap

- for a trade, he effectively deployed

@dailydirtnap

’s A-hole index and bought

@gnoble79

’s NOPE ETF at peak Twitter hate. It’s an incredible trading tool Jared- thanks

3

1

28

@marketplunger1

I think we should look at 2023 GDP, excluding Taylor Swift concert consumption expenditures- coming from a person with a teenage daughter.

2

0

27

Balls indeed- as we come up on the 1 year anniversary of certain regional banks blowing up on….asset/liability mismanagement of long duration treasuries. Not surprised- need to find someone to buy coupon treasuries at low yields. H/t

@LukeGromen

0

4

28

Great podcast- Luke is a must listen to on all things macro.

MacroVoices

@ErikSTownsend

and

@PatrickCeresna

welcome

@LukeGromen

to the show to discuss if the U.S. Dollar is having that "Luke Gromen Moment" he has predicted for years, the stock market, the U.S. fiscal situation, gold and much more.

16

32

168

2

1

26

Well done Danny!

1

4

28

Congrats boys. Incredible call

I must say

@Integrity4mkts

call on $CVNA is so far the call of the Decade 2020's . Right for the Right reason, never blinked, made a fortune and did his business the right way.. He has my lifetime of respect and very very well done..

5

9

130

1

1

26

Great stuff Brett and thanks for the shout out

2

2

25

Solid podcast guys!

How

@FedGuy12

is seeing things:

- The recession doomers need to stop taking their "crazy pills"

- Stocks will "crush" bonds as record fiscal deficits reignite inflation

- Nominal GDP growth will continue to be strong as long as the U.S. government continues to print 2…

97

135

768

2

3

26

@profplum99

Don’t get me started with corporate tax policy- one of the easier remedies to help reduce structural imbalances

3

1

25

Great stuff and thanks guys- I was just happy I got to pull off a Pardon the Interruption Tony Reali moment on Danny and Guy

New pod!

@VD718

&

@Seawolfcap

join

@dmoses34

,

@GuyAdami

& Dan to talk about ominous moves in the market, fiscal dominance, volatility, gold, banks & they give stock picks

Sponsors:

@CMEGroup

@iconnections_io

@ro

@FactSet

12

13

65

2

3

25

Effing great thread

3

1

25

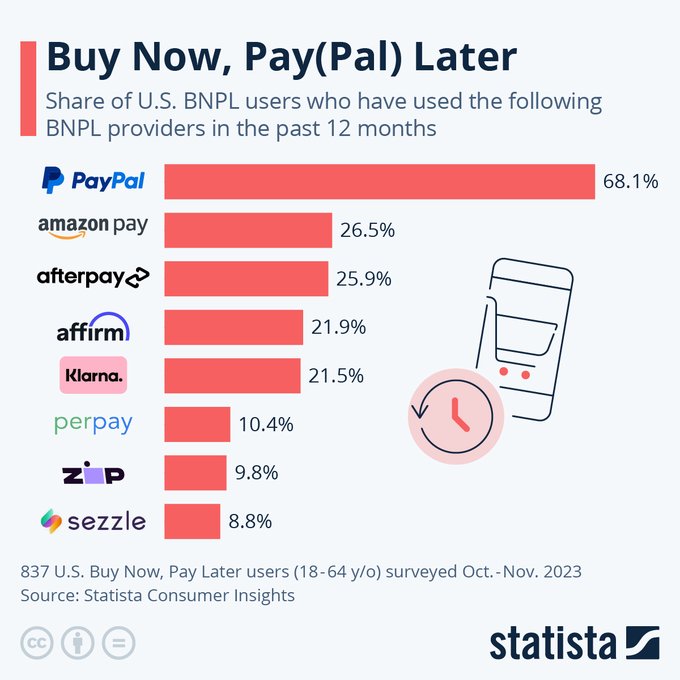

BNPL is the modern day Rudolph!

3

2

24

Great job. The Rosary bead conversation reminded me of Cannonball Run (for the old timers)

🚨 🔥🎙️

@MorganStanley

's indomitable Equity Strategist & CIO, Mike Wilson, joins

@GuyAdami

@dmoses34

&

@RiskReversal

to reflect on his bearish stance in 2022 (+epic tactical rally call), and debate how the economy & markets bottom in 2023.

Sponsored by

@CMEGroup

@iconnections_io

24

40

265

2

5

23

@GameofTrades_

In the case of delinquencies, I would suggest looking at levels rather than rate of change- Covid stim combined with NIRP created abnormally low levels of delinquencies.

2

0

21

@value_invest12

Stock was due for a squeeze on any ‘good’ news. EBITDA is a useful metric but ignoring interest expense on a highly levered company is poor analysis. Then again, in a narrative driven market, I guess you have to try to pull a rabbit out of a hat.

3

1

24

Great interview-Thankful for Charlie providing color on one of the more powerful movers of near term markets, vol targeting institutions- In my view, it’s a shame these massive institutions are allowed to lever themselves as much as they do- unproductive use of capital

MacroVoices

@ErikSTownsend

and

@PatrickCeresna

welcome Nomura's Charlie McElligott to the show to discuss how prior tightening cycles have played out in markets and his prognostications for what present Federal Reserve policy will mean for the markets.

8

17

63

2

3

24

@Seawolfcap

@Vinny_Daniel0

For me, going to Yankee Stadium for a do or die playoff game is the equivalent of personally handing the Bernank the Nobel Peace Prize- ain’t happening

@Vinny_Daniel0

.

3

0

23

I think he might want to guest host the SNL Christmas episode before he goes that route. Based on how he is treated by certain politicians and the media, it’s probably not as far fetched as it seems.

Hey

@SBF_FTX

why don’t you just stage a car accident and claim amnesia? That actually would be more believable than this song and dance you are doing now.

203

249

5K

3

0

23

Great job guys! Agree with the concept of the derivative tail wagging the dog as an increasingly important factor- Assuming greatest hits albums are banned (Zep) I am going to go with Purple Rain followed by The Chronic

4

3

23

Great podcast and thanks for the shout outs and hat tips- And Danny keep singing Janet’s ‘Control’!

🚨NEW POD🚨

@GuyAdami

,

@dmoses34

& Dan Nathan discuss the Dow win streak, central banks, tech earnings & deflationary risks

+

@JoeSaluzzi

of Themis Trading drops by to breakdown high-frequency trading & his white paper on DTCC leakage

Sponsors

@CMEGroup

@iconnections_io

@FactSet

9

5

17

1

3

22

Another great podcast and thanks for the shout out!

🎙️🚨

@GuyAdami

@dmoses34

@RiskReversal

on Fed Chair Powell’s Point of No Return (to the Senate), $TSLA investor day a dud + we answer listener questions.

+Tom Lee

@fundstrat

joins to lay out his bullish thesis for stocks.

Sponsored by

@CMEGroup

@iconnections_io

@FactSet

12

10

44

2

5

22

@agnostoxxx

Strong words from the cheap seats and very different tone when he was in a position of power-

3

0

22

@WallStCynic

Someone forgot to tell CVNA mgmt the zero cost of equity capital strategy is no longer in vogue. In some respect, the amount of insider sales suggests they get the joke

0

6

21

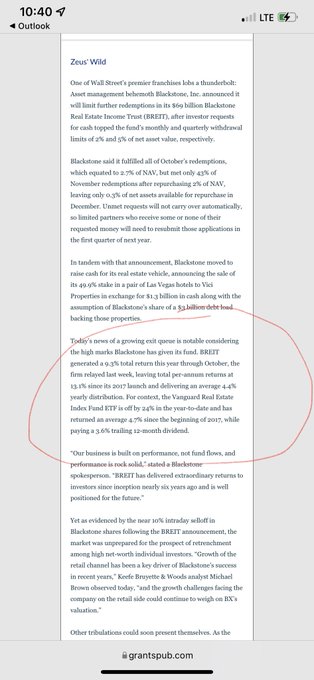

While they are ‘protecting’ existing investors, perhaps they should suspend investment fees and/or reduce NAV to more reflect actual value. Investment health might be aided by paying less fees.

5

0

22

Proud of the BREIT LPs. NAV was elevated and seems like they tried to hit the false bid. While I get the benefits of gating, we never used it- it’s the clients money- furthermore, I think GPs should suspend management fees if they gate.

1

1

22

@biancoresearch

Perhaps the saddest part of this analysis is the high probability that he would seek the exact opposite conclusion if it was a Republican administration. Give his deep partisan views, hard to take him seriously.

1

1

22