Joseph Wang

@FedGuy12

Followers

195K

Following

12K

Media

780

Statuses

6K

Subscribe at https://t.co/VGtUvtX2QK for latest thoughts and analysis. YouTube: https://t.co/wTjbN1iNQ8

Joined July 2012

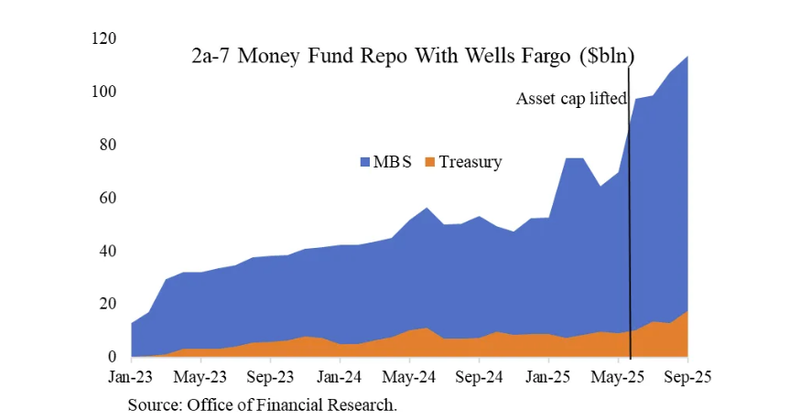

Post-cap Wells Fargo notably increased balance sheet intensive activities like repo and their securities inventory. That likely contributed to a lower RRP and wider swap spreads. This hints at what future reductions in bank balance sheet costs could do. https://t.co/E0mxVFUdXn

fedguy.com

Lifting the asset cap led to a smaller RRP and wider swap spreads. Other balance sheet expanding changes like SLR reform will be similar.

5

9

63

Markets Weekly October 25, 2025 6% Mortgage Still Too High Big Day for Argentina Gold and Silver Implode https://t.co/DkensjtEQY

6

4

58

It looks like foreign official sector doesn't like to park securities at the Fed any more. Big drop in custody holdings, but TIC data does not show a decline in foreign official Treasuries. So they still want Treasuries, just don't want to keep them at the Fed.

17

51

251

Some videos doing the rounds about "basis trades", how they will blow up the world because overnight repo rates spiked a couple of basis points. These are getting huge amounts of views and likes, as anything that is completely wrong and doomer-ish always does, because it's the

13

8

107

Slight pullback in gold last week was met with big inflows into GLD. Looks like they are clamoring to get in.

15

28

349

Repo rates have gone up largely because the demand for repo financing is insatiable. When you run a forever $2t deficit you need a lot of financing, including from leveraged investors. Any Fed balance sheet stuff is secondary.

12

43

314

SOFR trading about IOR is totally normal. It has traded that way for months in the past. All that means is that demand for repo financing is exhausting MMF cash, and going forward marginal financing will come from bank treasurers whose opportunity cost is IOR.

26

62

515

Markets Weekly October 18, 2025 Regional bank scare Economy still fine Gold and Silver ascend https://t.co/nRrRYsNU8G

6

10

75

In a new note, we demonstrate that the massive buildup in hedge fund Treasury positions in the past decade has had substantial effects on the national accounts data. This is due to underreporting to TIC of Cayman Islands Treasury holdings associated with these hedge funds.

5

34

143

WSJ reports that Beijing's strategy is to tank the stock market and force Trump to offer big concessions. https://t.co/JDLIaRZlJR

wsj.com

Chinese leader Xi Jinping thinks the president will fold before launching new tariffs that would roil markets.

288

362

2K

I wish Trump would come back twitter. Truth social seems so scammy and is filled with bizarre ads.

19

3

107

Ending QT sounds dovish, but the balance sheet's final form could be pretty hawkish. That is what commentary so far suggests, even from the dovish members.

While Trump appointees led the call for cuts, a couple are also sounding very hawkish along the size, composition, and pace of moving towards of the Fed's ultimate balance sheet. They may be trading rate cuts for higher long dated rates. https://t.co/gfdBm1e0ls

31

37

328

Powell's claim that IOR doesn't cost tax payers just isn't true. As he notes, Fed income is remitted to Treasury. IOR increases Fed interest expense, which reduces Fed income. So the higher IOR, the less remittance to Treasury. (btw there are still good reasons to have IOR)

37

27

270

Note that short term borrowings increased with repo assets, so it's likely matched book where they can borrow from money funds and lend. This way MMF don't have to park cash in RRP.

6

2

40

Sounds like China can get everything they want if the stock market were to go lower.

NEW: Trump changed course to a more deescalatory tone versus China as he discussed with aides ways to say something publicly that could halt the market drop Trump spoke with Treasury Secretary Bessent about such a message. W/@Lingling_Wei @GavinBade

https://t.co/MOx0LPilNY

52

43

453