Conks

@concodanomics

Followers

133,046

Following

1,097

Media

3,606

Statuses

23,750

Global market mechanics. Male. STIR & market plumbing enjoyer. Serious works can be found via . Writing a (hand)book. Not financial advice.

no DMs, no telegram/chatrooms

Joined August 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Supreme Court

• 334198 Tweets

NAMJOON

• 299685 Tweets

RM IS COMING

• 172030 Tweets

SCOTUS

• 148784 Tweets

renjun

• 135481 Tweets

Alito

• 90759 Tweets

Ferrari

• 70221 Tweets

Emory

• 69844 Tweets

Harvey Weinstein

• 61315 Tweets

Brighton

• 57566 Tweets

Draft Day

• 55992 Tweets

カタール

• 48933 Tweets

#TimnasDay

• 45474 Tweets

Struick

• 42816 Tweets

RPWP IS COMING

• 38441 Tweets

Newey

• 36940 Tweets

Kavanaugh

• 25376 Tweets

Korsel

• 24869 Tweets

Maye

• 24838 Tweets

Tarkov

• 19022 Tweets

Tiago

• 18334 Tweets

#الاهلي_الرياض

• 18127 Tweets

ALANE EM BELEM

• 12338 Tweets

Last Seen Profiles

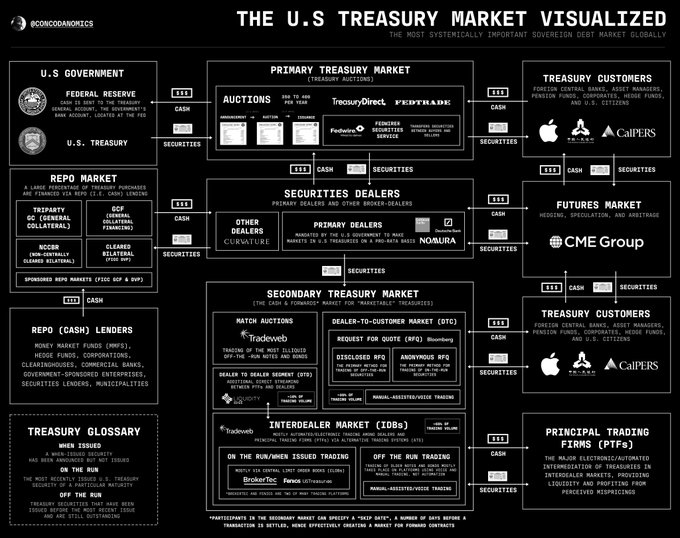

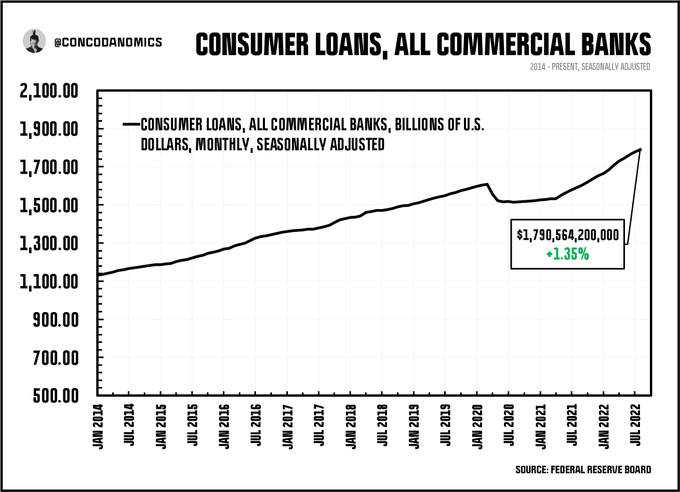

The Fed doesn't seem to care much that additional interest rate rises will inflict significant pain on the rest of the world. In a move that will likely make the history books, the United Nations warned the Federal Reserve to stop raising interest rates further...

13

121

1K