Luke Gromen

@LukeGromen

Followers

250,854

Following

2,192

Media

6,181

Statuses

78,524

Founder & President, Forest for the Trees (FFTT). Author of "The Mr. X Interviews, Volumes I & II.” I never solicit via DM's. RT not endorsements.

Joined December 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 463920 Tweets

Baba

• 114630 Tweets

Valencia

• 78158 Tweets

Abeg

• 74030 Tweets

Peruzzi

• 70346 Tweets

Nancy

• 62348 Tweets

Wetin

• 55724 Tweets

Madonna

• 55339 Tweets

Pant

• 53252 Tweets

Francis

• 51741 Tweets

Lewandowski

• 47598 Tweets

Idolo

• 46389 Tweets

Araujo

• 45231 Tweets

Rock in Rio

• 44959 Tweets

Burna

• 43844 Tweets

Seinfeld

• 39619 Tweets

Jesus is King

• 36966 Tweets

Werey

• 34098 Tweets

Farouk

• 32277 Tweets

Fermín

• 29539 Tweets

Katy Tur

• 24979 Tweets

Grammy

• 24444 Tweets

オリンピック出場

• 21114 Tweets

Ter Stegen

• 19064 Tweets

Popsy

• 14724 Tweets

Wizzy

• 13721 Tweets

ANA CASTELA NO RIR

• 11152 Tweets

PRE SAVE FOI INTENSO

• 11140 Tweets

Last Seen Profiles

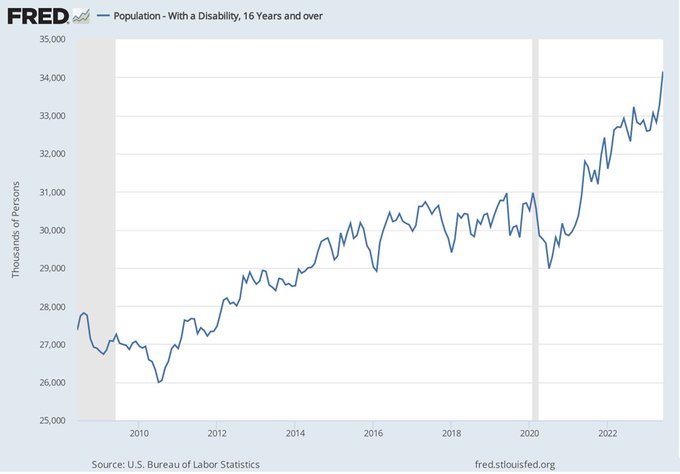

Powell's speech, in plain English:

"There is too much debt in the US & globally. It's hurting growth. This can be resolved 1 of 2 ways:

1) Widespread defaults (including on sovereign debt)

2) Inflate it away

Today we are accelerating Option

#2

."

133

932

4K

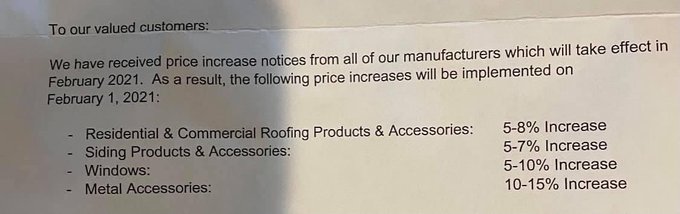

It gives me no joy to read this, but as an objective analyst, it is fascinating to watch western leaders (long accustomed to printing infinite fiat for finite commodities) begin to realize that the hardest currencies are not USD or EUR, but rather oil, gas, wheat, and gold.

179

603

3K

Called the local coin dealer today.

Him: “Silver spreads are up; 1 oz silver Eagles are $31/oz. We are really busy, lots of people in here we have never seen before, buying silver.”

Me: “Are they old or young?”

Him: “They’re like 30 yrs old.”

This might get interesting.

150

581

3K

A country where people cannot choose how they store their personal wealth is not a democracy; best case, it is an oligarchy...best case.

A global economic system where one can only buy commodities in one currency is not capitalism; best case, it is a "company town"...best case.

141

437

2K

I'm old enough to remember that 6 months ago, these same satellites were unable to detect that the Taliban were only 72 hours from taking Kabul, rather than 90 days from taking Kabul as the Administration asserted.

87

279

2K

Signpost 👇

105

411

2K

A local bank I have used for years told me they are no longer allowing BTC transactions (on-ramp from my account there to an exchange), and no longer doing business with anyone that accepts BTC as payment.

Bank says it’s voluntary, not regulator mandated.

#OperationChokepoint

265

368

2K

Thanks for having me on to talk economics,

@TuckerCarlson

! Really enjoyed the conversation.

I’m told clips of the interview will air tomorrow night at 8p, full interview streams Thursday on Fox Nation.

@TuckerToday

180

133

2K

Putin causing US inflation was bad, but the really dastardly thing Putin did was forcing the US govt into 28 yrs of disastrous foreign, economic, & trade policies that ran US debt/GDP up to 130% & deficits to 10% of GDP, leaving the UST market vulnerable to high inflation prints.

114

338

2K

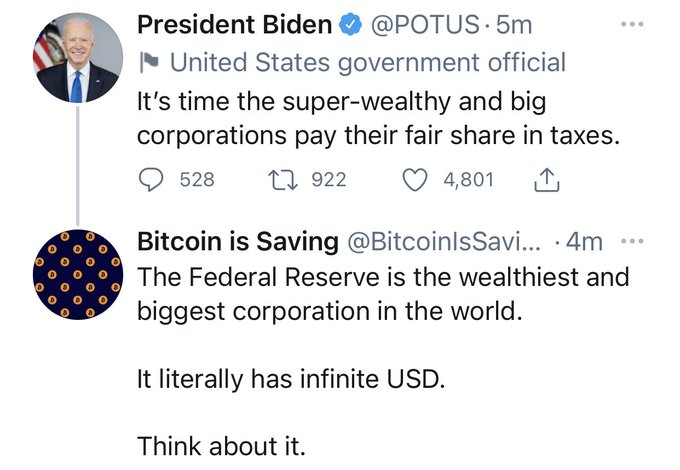

By banning BTC, China just broadcast to the world that it is afraid of BTC.

Are US leaders smart enough to use that knowledge and use BTC to America’s advantage, or are our leaders too dogmatic/conflicted/unimaginative?

#BTC

218

233

2K

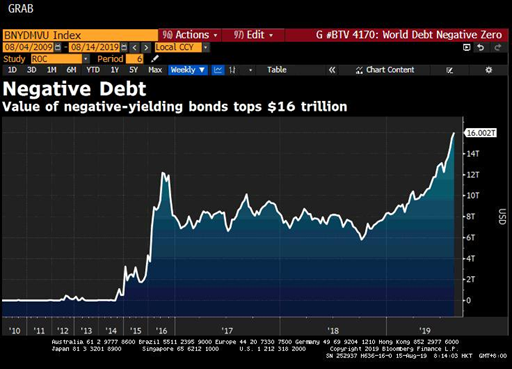

Global sovereign debt is so high that a recession that would normally resolve commodity shortages will also trigger western sovereign defaults without more Central Bank balance sheet growth.

We may be about to experience an incredible paradox: Printing into inflation.

#Gold

#BTC

126

391

2K

Fiat currency is backed by debt.

Debt is backed by energy.

We just removed one of the biggest energy "jenga blocks" underpinning the entire debt "tower."

#Gold

#BTC

#Inflation

115

319

2K

People stop dining out, restaurants will go under. As restaurants go under, commercial property owners will follow. As comm’l ppty owners go under, so will lenders. As lenders collapse, so will sovereigns.

A cheap & plentiful supply of energy underpins every asset but phys gold

107

347

2K

If only there was a technology that consumes electricity when electricity demand is weak & shuts off when demand is high so that utilities can better balance loads & better address peak loads.

Oh wait...there is. Another way that BTC consuming energy is a good thing.

84

240

2K

Also, Iraq has WMD, home prices have never fallen nationally, if you like your doctor you can keep your doctor, Trump has zero chance of winning, & all you’ll need is one jab to stop the spread.

92

288

2K

"There is no military on earth that can beat the US!"

True...but compounding interest is undefeated all-time against empires.

Remaining choices = Cut rates, cut DoD spending, cut Entitlements, or print whatever's needed.

145

333

2K

20-year old son last night: "Dad, the fraternity is accepting BTC as payment for dues."

Me: "Don't pay with BTC. Pay with USDs, keep your BTC."

#GreshamsLawTeachableMoment

58

101

2K

Some money managers see BTC volatility as a bigger risk than the fact that US Federal debt has grown 8% CAGR for 15 years while USTs have yielded 0-5% that entire time🤦♂️

IN PLAIN ENGLISH: They'd rather have negative real returns on low vol than positive real returns on high vol.

Hearing from multiple people that their broker has not yet allowed them access to the

#Bitcoin

ETFs, including Merrill Lynch and Vanguard. And others demanding clients sign volatility liability waivers before 'unlocking' access.

Have any of you experienced this?

Still. Early.

326

227

2K

77

259

2K

Interesting body language...again

Russian President Vladimir Putin and Saudi Arabia Crown Prince Mohammed bin Salman |

#OOTT

🇸🇦 ⛽️ 🇷🇺

144

234

1K

153

210

1K

US policymakers: "China, you are short USDs. We are going to weaponize the USD against you."

China: "You're right. In response, we are putting in a price floor on lithium. Your lithium costs just rose by 10x; please pay in USD. Now we are no longer short USDs."

Where are lithium ion batteries made?

79% in China 🇨🇳

8% Asia (ex China)

7% Europe

5% USA

The 10 year trajectory has started to shift towards more

#EV

battery capacity in Us and Europe, but not by much

China still on track to dominate battery manufacturing (~70%) in 2031

26

221

540

76

320

1K

Central Bankers now face a choice:

The economy can collapse on a real basis because prices are too high (inflation), or the economy can collapse nominally because CB’s raised rates to combat inflation.

Every other fiat monetary system in history has reached this point.

74

298

1K

In grade school, I had a friend that did my homework for me.

One day, I started punching him in the face whenever I saw him.

For some reason, my homework supply chain started breaking down shortly thereafter. My grades suffered until I did my own homework. The End.

#ChinaUS

69

118

1K

120+ yrs of history suggest w/120% Federal debt/GDP, one cannot avoid a hard landing, only choose where the hard landing occurs:

a) The economy

b) The currency (ie inflation)

Unless Congress cuts 5-6% of GDP in spending immediately & permanently, "b" is more likely, but path…

99

293

1K

I would pay good money to see a debate between 1970 Neil Young (protest the government narrative about Vietnam) and 2022 Neil Young (censor anyone that questions the government narrative about COVID.)

111

111

1K

US SENATOR CORNYN: FOREIGN CENTRAL BANKS SHOULD REMOVE ALL THEIR GOLD FROM THE NY FED AS SOON AS POSSIBLE BEFORE WE SANCTION OR SEIZE IT.

Via

@AfurKnox

143

366

1K

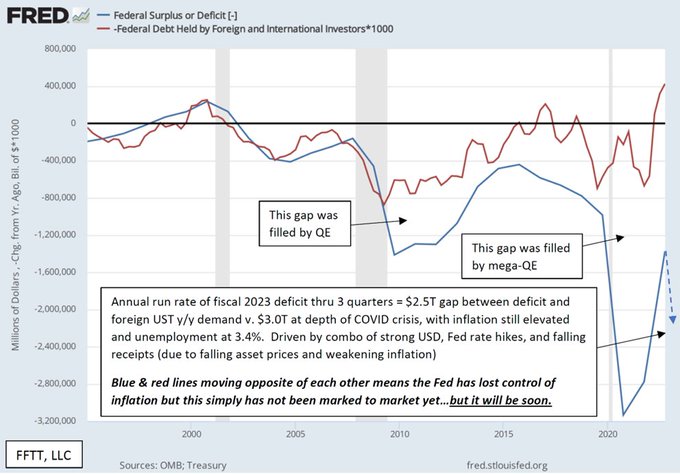

Coming soon:

Markets begin to realize and then discount that western sovereigns cannot afford their interest expense, Entitlements, & Defense budgets at either current interest rates OR a recession without a lot more Central Bank QE.

#NotEnoughPrivateSectorBalanceSheet

76

236

1K

“A surprisingly large % of US income tax receipts are tied to a rise in US stock prices. When the US stock market just stops rising…not falls, but just stops rising, that will put pressure on the receipt side of the US fiscal picture."

-Greenspan, 2015

US stocks = the economy

67

213

1K

Fascinating to watch the Fed (& many market participants) engage in the collective delusion that they can run the “Volcker 1979 playbook” with US debt, deficits, & Balance of Pmts akin to 1920 Europe.

When this collective delusion shatters, it will be spectacular.

#Gold

#BTC

99

202

1K

BTC has the power to weaken countries in the same way that thermometers have the power to make Phoenix, AZ hot in the summertime.

BTC is merely a functioning "thermometer" on a nation's fiscal policies and leadership that can't be disabled like policymakers have done to gold.

59

211

1K

Central Bank Digital Currency implications, simplified:

Democrats, imagine the Trump Admin having the ability to completely control what you spend money on.

Republicans, imagine the Biden Admin having the ability to completely control what you spend money on.

Via

@JeffBooth

82

313

1K

The US won WW2 not because it was the US, but because it was the wartime economy with capital controls (as all combatant economies were) that outproduced all other economies.

It was made clear to me multiple times this week that some in the US have forgotten this lesson.

Via…

213

183

1K

1. Facilitating the de-dollarization of global energy flows is likely Putin’s real crime in certain Wash DC circles.

2. Don’t be surprised if US begins voicing concerns about some sort of Indian human rights violations soon.

Via

@WeekendInvestng

97

241

1K

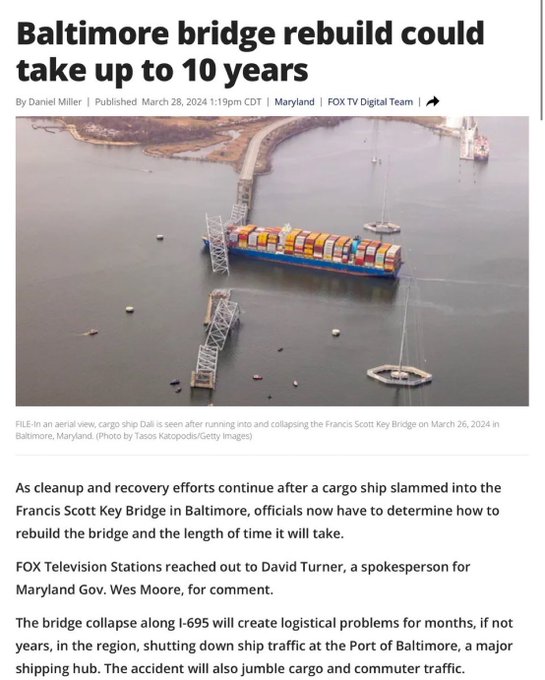

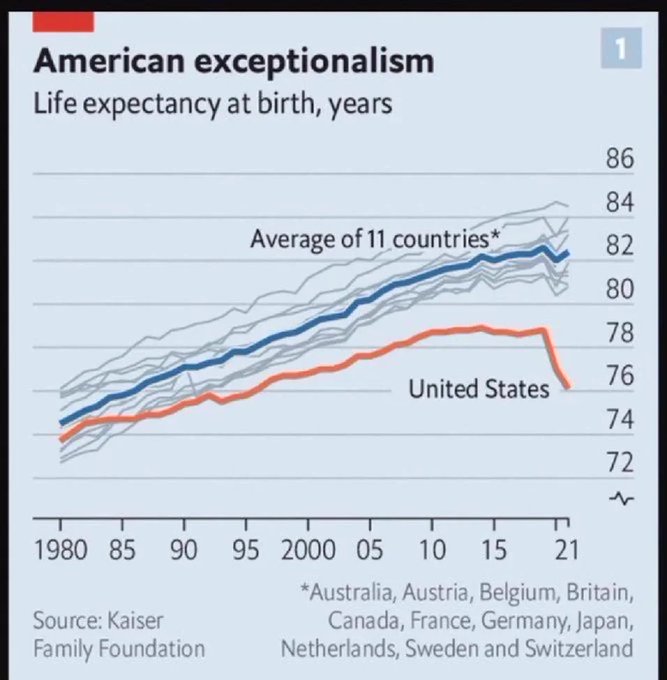

US & China have debt bubbles.

The difference is China got infrastructure, while we took Afghanistan from the Taliban & then gave it back to them, secured Iraq's oil for China, sent a quorum of our defense ind'l base to China, & also drove our life expectancy down dramatically.🤦♂️

75

238

1K

One of the most sensitive measures of liquidity & one of the last actual free markets standing (BTC) crashing 18% is IMO a sign the Fed is misreading their situation as badly as they misread supply chain problems & inflation.

The Fed is walking into a buzzsaw.

#PolicyError

85

112

1K