Samantha LaDuc

@SamanthaLaDuc

Followers

55,450

Following

2,218

Media

3,780

Statuses

45,055

Proud Founder + Mother. Humbled Contributor: Bloomberg, CNBC, YahooFinance... Curious Cross-Asset Analyst. Persistent Trader on Chase, Swing + Trend Timeframes.

www.samanthaladuc.com

Joined July 2012

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Lakers

• 226927 Tweets

#TheKingdomsConcert

• 178065 Tweets

Lebron

• 127209 Tweets

Nuggets

• 107920 Tweets

#TheGrandConcertEnglotinUSA

• 75243 Tweets

Jamal Murray

• 71607 Tweets

Denver

• 52486 Tweets

Darvin Ham

• 46360 Tweets

#Covishield

• 35186 Tweets

Jokic

• 32967 Tweets

KDLEX CONCERT TIX RELEASED

• 18965 Tweets

Cancun

• 18173 Tweets

Hamilton Hall

• 17747 Tweets

渡航費用12.6億円

• 17254 Tweets

政務三役31人

• 16247 Tweets

風呂キャンセル界隈

• 14994 Tweets

MakananKHAS SeruASIK

• 14853 Tweets

無料10連

• 14341 Tweets

JajanENAK DikotaGUE

• 14324 Tweets

エスクプス

• 14268 Tweets

桂由美さん

• 14028 Tweets

Vando

• 13025 Tweets

円安放置

• 11987 Tweets

Anthony Davis

• 11652 Tweets

外遊三昧のア然

• 11176 Tweets

リスト付き

• 10113 Tweets

Last Seen Profiles

SORRY FOLKS 🤯🔝

CoreWeave:

Is backed by $NVDA

Buys $2.3B in $NVDA chips

With $2.3B LOC financed by Blackrock

Using the the $2.3B $NVDA chips as collateral

Blackrock owns 182M shares of $NVDA

$NVDA claims $2.3B data center beat

$NVDA gaps up 11% in AH - of which ALL was unwound…

Ahhh, now it makes sense!!

"Blackrock alone owns 182mm shares...pays for the loan and then some"

@beatlesonbankin

$NVDA

Investors in the 08.03.23 CoreWeave $2.3B line of credit: Blackrock in large part 🫰 $BLK

15

31

199

187

487

2K

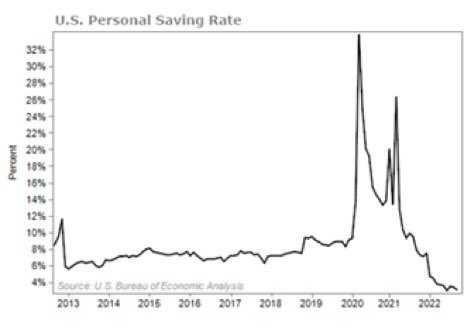

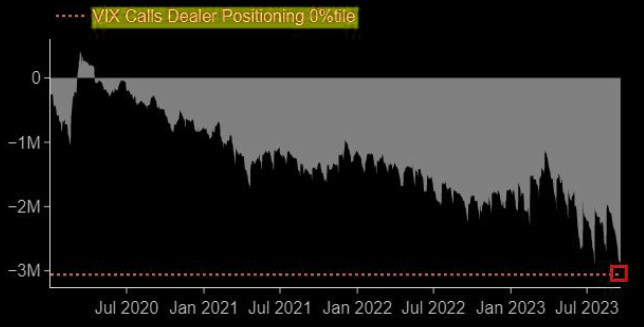

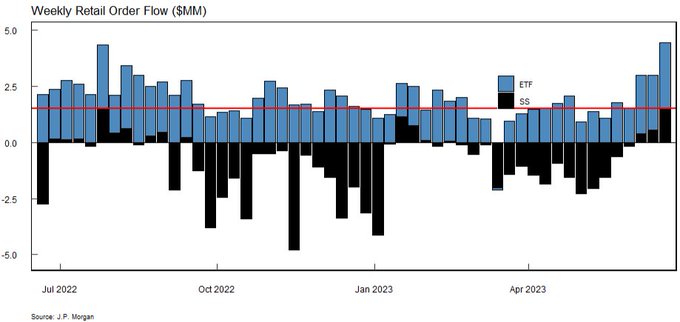

I will admit, this chart worries me.

Personal interest payments (blue) now exceed wages (red) for the first time - indexed to 2007 -

H/t

@SuburbanDrone

136

451

2K

Be careful who you worship or what you wish for Bitcoin-ers.

Michael Saylor hoarding a commodity of “limited supply” is not safe for HODLers of Bitcoin, just because price is rising.

Consider the risk:

Michael Saylor is a modern-day Nelson "Bunker" Hunt - the famous Hunt…

😭How to make a market!

This is just incredible… 😉

$MSTR “using fiat money to buy

#btc

and paying back the debt issuers in btc (essentially mstr stock which is now based on btc) who are happy to take $mstr stock because the returns are way better than the .65% they'd receive…

69

32

212

471

126

851

“For those that don’t know, Ruffer returned 16% in the 2008 crash, nailed the 2015 flash crash, nailed the 2018 XIV (Volmaggedon) implosion, and nailed the 2020 COVID crash making $2.2B. They have a very accurate and long track record of these bets.”

H/t

@jaredhstocks

59

207

857

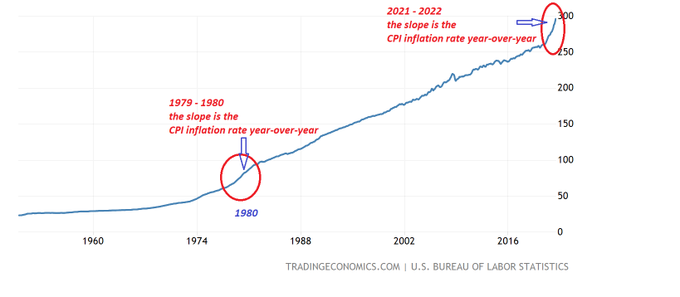

I’m slightly uncomfortable tweeting this but I will anyway 🤯

IF July 2022 CPI should use 1980-based CPI calculation…

“July real-CPI = 18%

1980 real-CPI = 15%

1) July 2022 real-CPI is higher than 1980 CPI if using the same formula

2) July real-CPI is highest since 1950”

47

187

739

As he also points out:

"$NVDA is worth more than double what the entire global semiconductor industry will see in revenue in 2023 and nearly double what it will see in 2024.

When a stock is priced at double the valuation of its entire industry's sales, it's a bubble."

70

155

734

How cool is that:

BofA's points out that longer dated $SPX puts haven't been this cheap in "modern times":

"Since our data began in 2008, it has never cost less to protect against an S&P drawdown in the next 12 months." H/t

@themarketear

46

105

660

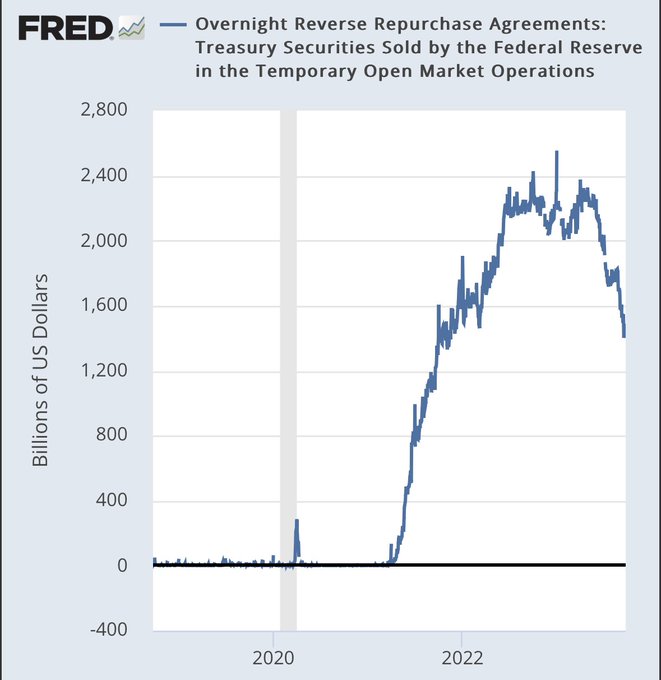

Under-rated tweet!

My bet: market starts to price THIS in Q4 '23/Q1 '24 and doesn't wait until next June!!!

"$0.9T of the 1.1T in Bills was funded by withdrawals from RRP (roughly 80% of issuance)

Draining RRP funds allows the Treasury to issue nearly a trillion per quarter of…

48

156

633

Best run hedge fund out there.

$NVDA issued a $10B buyback on the Oct lows and monetized with a $10B shelf offering in March. He’s doing it again!

41

99

613

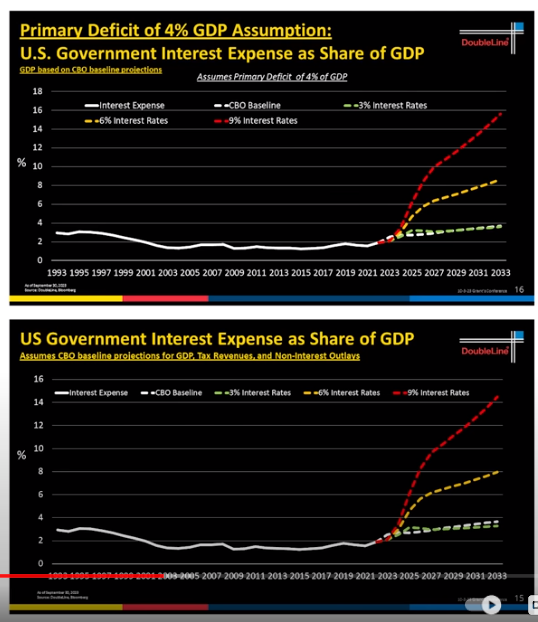

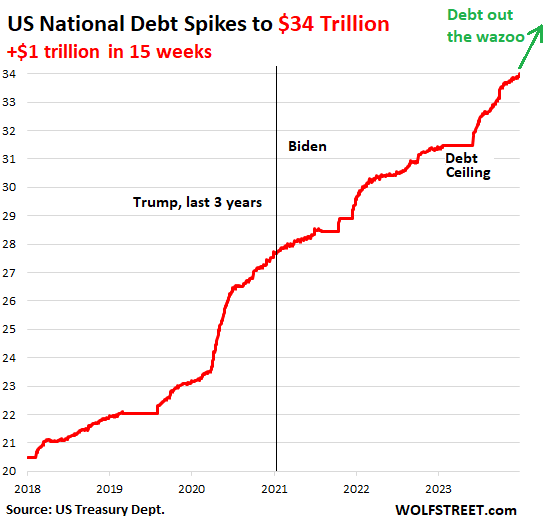

Simply:

Bond yields are tied to supply.

Supply of treasuries are tied to fiscal deficits.

Gigantic fiscal deficit from an irresponsible Congress forces Treasury to print massive paper as Fed tries to dampen the affects from inflation caused by govt spending with ineffective…

47

102

620

OMG THIS IS FUCKING BRILLIANT

(And mama doesn’t swear very often)

#Magnatar

#Nvidia

#Coreweave

#Blackrock

$NVDA

Who is Coreweave and where is their money coming from? Nobody is asking!🧐

#Coreweave

#Nvidia

$NVDA

#Magnetar

301

664

2K

46

110

586

Another interesting $NVDA tidbit:

"39% of Q2 revenue and 32% of first half revenue came from JUST TWO CUSTOMERS (emphasis mine), of which one is a distributor."

It's one thing to pull forward demand on China (now Middle East) 'embargo' list, but that's some concentration risk!

36

111

546

Banks have some balls.

We won't participate in U.S. Treasury markets if you don't backstop us AND "permanently exclude on-balance sheet US Treasuries from total leverage exposure". 🙈🙅

55

127

524

Right after my post on $NVDA data center 'beat' went viral (few million impressions) on 08.24.23...

WSJ did a puff piece on CoreWeave 08.25.23:

Then Bloomberg announces 08.30.23 that Nvidia-backed CoreWeave is looking for a…

67

99

517

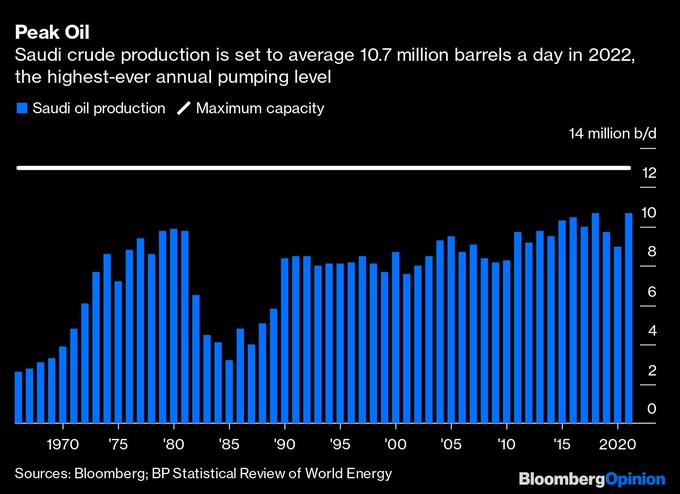

Irony: US policies undermining O&G investments in name of ESG was just exporting pollution to Russia, China, SA to deal with 'dirty oil'. But now, "How dare they cut!"

Curious: So US oil output cuts (via bans/regulations against drilling, fracking etc) shouldn't be counted...🤔

34

81

492

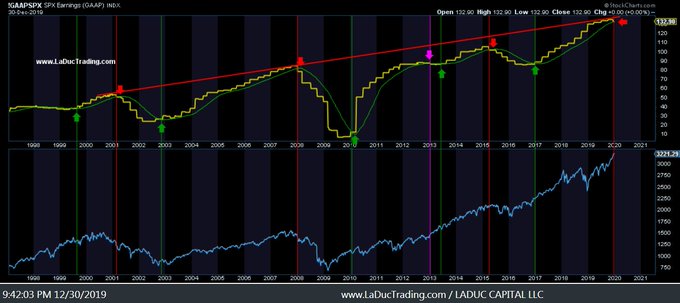

My absolute favorite chart going into 2020 ...

Trend Reversal Timing Tool has worked 7 out of 8 times since 1999. Heck of a timing tool! Can we go for 9?! 😉

#GAAP

$SPX

37

111

479

This just blew my mind:

Coke is the

#1

item purchased on the largest government nutrition program (SNAP). And this author asserts over 40% of $KO US revenue comes from food stamps. 🤯👎

63

77

477

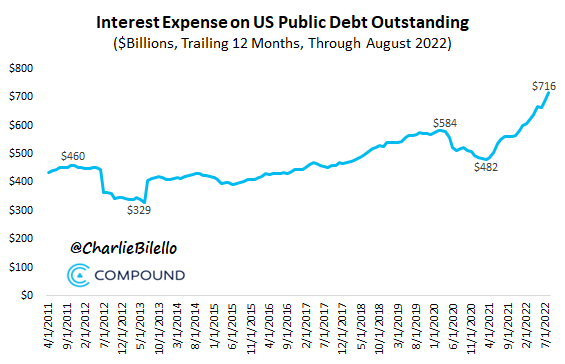

FED WANTS INFLATION

We get 6% in Fed Funds rate (soonish) with my call (since last year) of 4.7% in 10Y.

WHY HIKE if inflation has fallen?

The Rich (Big $ Cash) earn 6% AND interest on US Govt debt ($32+T) pays 6%.

That’s STIMULUS! 🔥

Think GDP growth 😉

Which further…

93

52

475

Serious question:

Why is Bitcoin “squirreled away & doesn't trade”?

A CURRENCY is by definition a means of exchange, and that is in active circulation.

A COMMODITY is by definition a raw material that can be bought and sold, and that is in active circulation.

An ASSET is by…

@BFairclough23

@Dr_Gingerballs

@LynAldenContact

Yes

#NotYourKeysNotYourCoins

It matters that, unlike other commodities (incl gold), there's no clearinghouse for

#bitcoin

, which can paper over "temporary" insolvency--nor will there ever be, most likely, bc the vast majority of

#BTC

is already squirreled away & doesn't trade

12

14

140

365

48

443

OMG I MADE MORNINGSTAR 🤯

And not in a good way!!

Bernstein analyst Wallace Witkowski discredits me as 'Twitter rando' - not by name but it’s my original tweet he’s attacking! While completely ignoring the slimy connection of $NVDA to CoreWeave and Magnatar!

@JG_Nuke

What on…

120

41

430

💯- 'People must survive price levels, not rate of change.'

Another words:

How Wall Street measures inflation is different from how Main Street measures inflation (and neither are measuring Monetary Inflation which is the driver of both.)

As 'Rudy' shows:

This chart of…

26

98

417

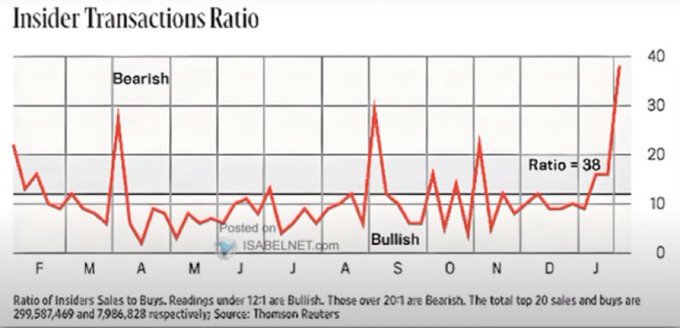

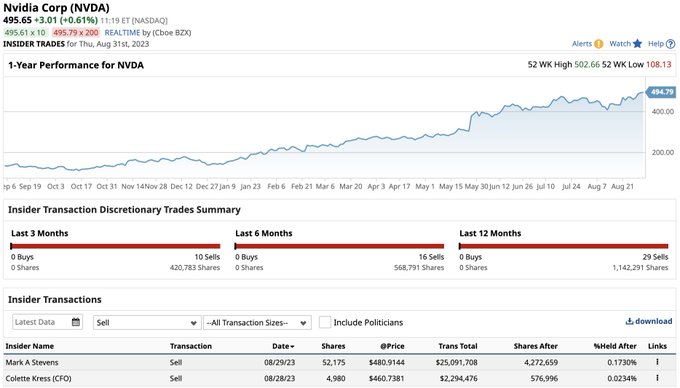

$NVDA insider sales over the past 12 months with zero buys. Curious eh?

57

76

407

This tweet got no respect, but I think it bears reminding. Lol

Not only are $NVDA sales sales down 14% from 1yr ago, AND they offered no guidance, but just YESTERDAY, the NVDA CEO Huang warned they are worried about losing the China market.

“'our hands tied behind our back”…

66

77

394

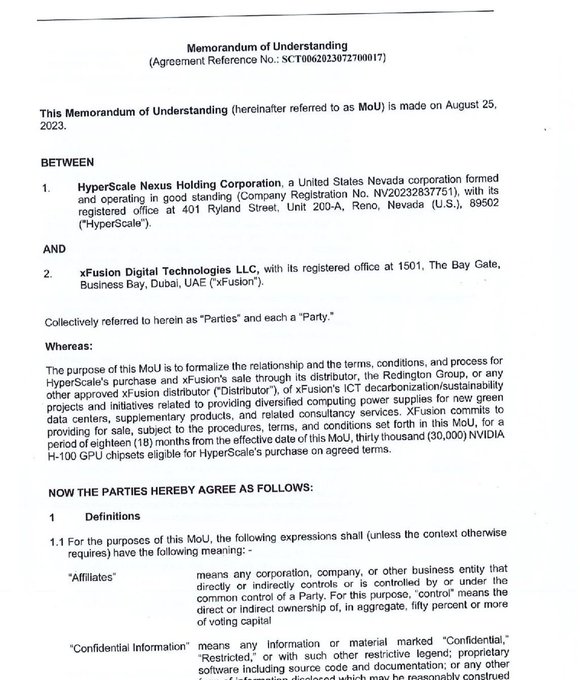

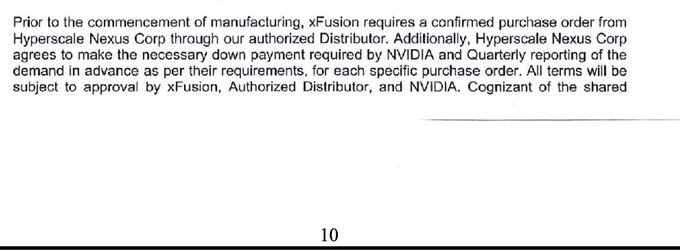

I mean, how can $NVDA not beat?

#Earnings

😂

“American Cannabis Company shifts focus from cannabis to datacenters, merging with HyperScale Nexus. Despite a small $2M market cap and $18M revenue, ACC ambitiously commits to a Bangkok data center project and plans a $1.1B purchase…

49

52

393

So tired of this narrative:

‘Getting inflation back to Fed's 2% mandate requires a slowing of wage growth which requires softening labor markets.’

No, it requires FISCAL CONSTRAINT!

Which will definitely be a drag on economy, labor and equity markets.

Fed is trapped/impotent.…

45

47

385

I heard: Revenues down 20%, eps down 30%, operating income declines by 60%...

But clearly the afterhours momo crowd heard:

AI, chatGBT and AI-As-A-Service (AAAS)!!!

But this👇smells like

#SoldToYou

coming soon.

$NVDA

33

48

376

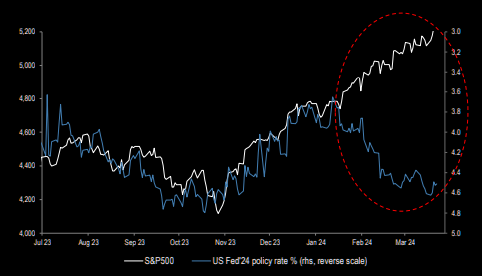

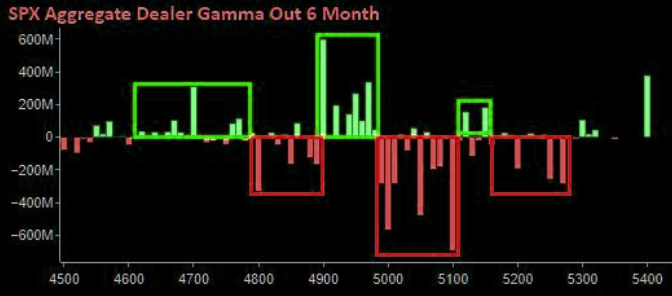

I know I'm ruining the 1999-Druckenmiller FOMO warning, but...

Here's a Dealer Gamma chart:

Dealers are buyers - whether we sell off to $4900 or break higher to $5100.

Unless/Until we get a MACRO trigger to disrupt the flows, there is more risk of an UPSIDE CRASH than downside…

36

74

381

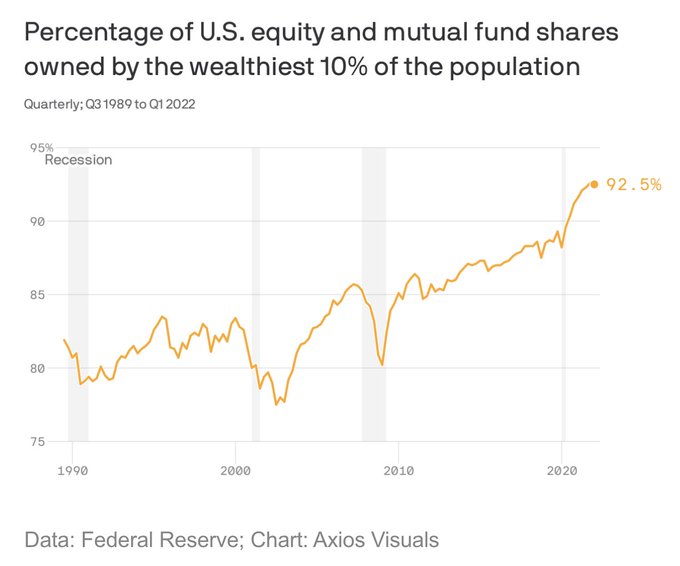

The wealthiest 10% of U.S. households now own nearly 93% of the stock market.

Because US Govt continues to privatize profits and socialize losses.

45

89

371

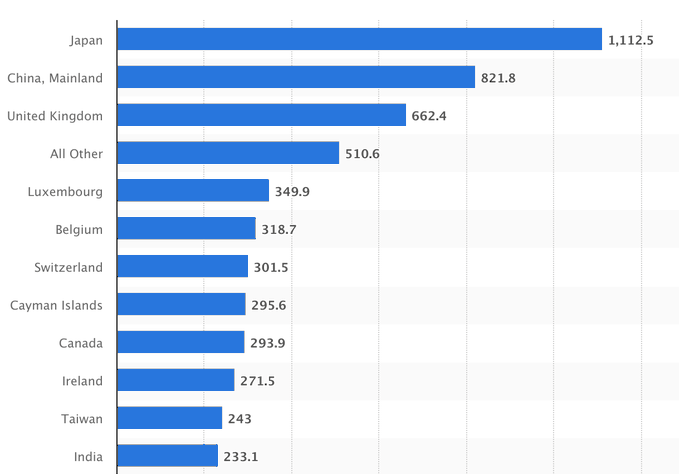

Japan is the largest holder of US debt and equities, holding over 1.1 Trillion US dollars worth of debt.

BOJ is making hawkish sounds just as the rest of the world's central banks are pausing.

2021-2023 were the years when the Yen had an incredible bear market due to YCC –…

@SamanthaLaDuc

Can you explain why this would be negative for us bonds or how this will impact the us market?

1

0

1

44

96

365

Now that mainstream media is questioning $NVDA accounting, what about …. $MSFT 😬

@philoinvestor

has a great piece on this financial engineering/valuation that is being ignored:

41

80

372

Great Question!

I was told early and often:

“Bond guys are the smartest in the room.”

That pissed me off because I didn’t really understand this specialized but critical function of the market, and I wasn’t a guy!

Still true: Most all financial commentary is targeted to Retail…

53

65

362

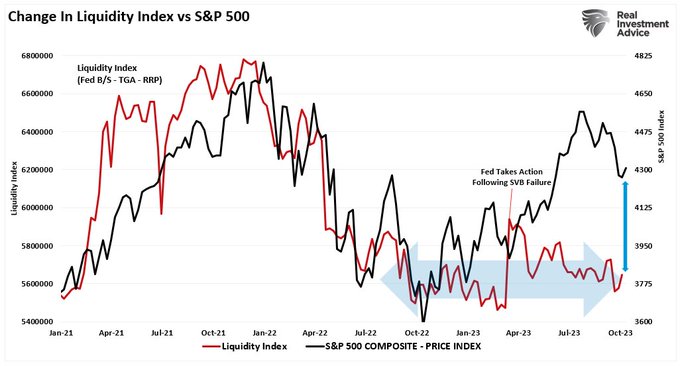

Liquidity is all that matters to market returns, and we have an ABUNDANCE of fake liquidity but SCARCITY of quality collateral.

So… a government pumping liquidity to backstop a shortage of collateral is not bullish the economy - Big Picture - it only:

1. delays hyperinflation…

Overall

#liquidity

has remained stagnant since the October lows other than the brief surge for bailing out the

#regional

#banks

in March.

11

21

111

34

67

360

Tomorrow should be fun.

$NVDA $MSFT

23

53

359

Soros is out all $NVDA stock and Drukenmiller has sold 1/3 of his position.

Maybe they read my article?🤷♀️

50

55

369

THEY DON’T WANT YOU TO LOOK!

Bernstein analyst Stacy Rasgon, you bastard, who just launched a smear campaign on my call and Jack’s research… IS LONG $NVDA!!

And with a much much bigger platform to espouse his pathetic excuse for a rebuttal.

As

@JG_Nuke

creatively reminds…

Why is

@MarketWatch

running interference for

@Coreweave

with personal attacks against myself,

@SamanthaLaDuc

and

@kashyap286

while ignoring a mushroom cloud of smoke on the horizon?

Full disclosure: 'Puerile' Content

#Rando

67

122

582

68

54

361

@Lisa00007369

Interesting - serious question then:

If one Bitcoin is sold in units of "Sats," and there are over 2 quadrillion of those, HOW can they claim scarcity, lack of dilution, hedge against inflation/DEBASEMENT.

This would seem to be common knowledge and well, “MATH”?

2K

65

351

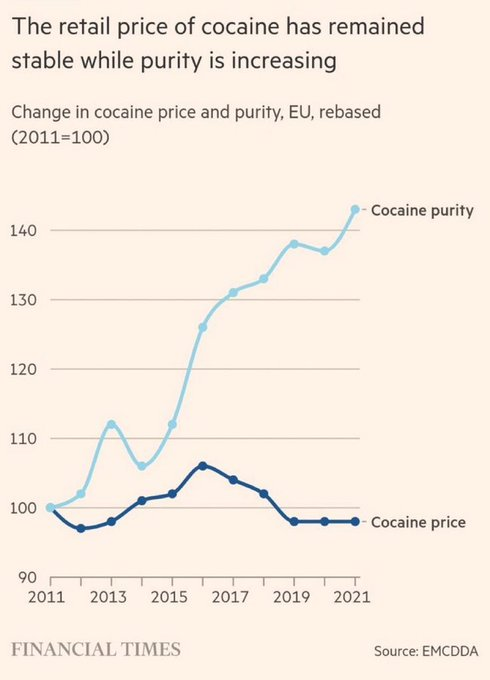

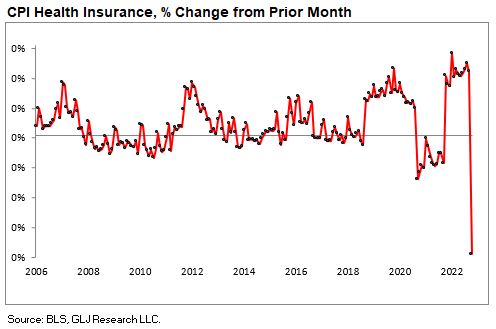

Bulls, not so fast...

#CPI

yday had some irregularities which will correct itself in the next print. In fact, re-inflation of energy is also likely to trigger higher CPI.

Gordon makes a great point:

"had health care costs stayed constant, Oct. CPI would have been ~5bps HIGHER"

34

84

346

Bill Gates going Growth To Value in a big way for his portfolio.

And lots of tech names where he is divesting 100%.

Gates, Zuck, Bezos … even Tommy Tuberville - in the selling mood. 🤷♀️🤔

H/t

@NGLFundamentals

38

90

352

Bespoke: "S&P now exactly flat on a total return basis since the close on Powell's first rate hike on 3/16/22."

So bulls are excited because 500bp higher in rate hikes meant nothing to equities?

We'll never know because price discovery hasn't been allowed.

A better question:…

40

59

336

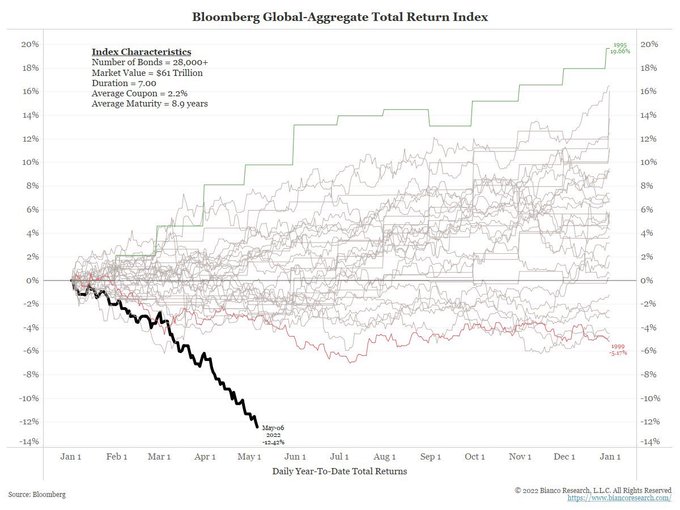

One chart on bond performance.

Two cryptic thoughts:

1. Risk parity got sick with Covid, but became terminally ill from deglobalization, war + global energy crisis.

2. Bonds are stocks without circuit breakers.

$TNX

#OOTT

$USD

45

60

312

told ya they would beat 😉😆💃

$NVDA 4Q DATA CENTER REVENUE BEATS BY $1.2B. Lol

"Despite a small $2M market cap and $18M revenue, ACC ambitiously commits to a Bangkok data center project and plans a $1.1B purchase of Nvidia GPUs from xFusion."

I mean, how can $NVDA not beat?

#Earnings

😂

“American Cannabis Company shifts focus from cannabis to datacenters, merging with HyperScale Nexus. Despite a small $2M market cap and $18M revenue, ACC ambitiously commits to a Bangkok data center project and plans a $1.1B purchase…

49

52

393

29

39

324

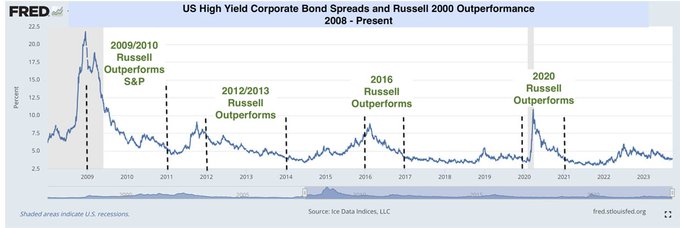

In a nutshell:

Hiking cycles end when the FF rate meets the 2-year. h/t

@McClellanOsc

Telling ya right now, market has not priced this in and growth has not corrected enough. But that's my book; you do you.

$QQQ $NYFANG

15

61

315

It wasn't a glitch 😉

#2YR

After we were told a couple of days ago that the break out of the 2-year

#Treasury

yield was fake/bad data (even though it appeared on multiple platforms before disappearing). The 2-year Treasury yield is breaking out again.

Must just be bad data again... Definitely not at all…

11

36

132

24

46

314

ALL OF THIS HAPPENED.

We are close. $SPX should tag that belligerent wkly gap at 4218.70, even overshoot to $4300, and turn south decisively.

Or, we just start to go back to $3600 ~now.

35

24

303

Again, this is a very unserious market.

Gold miner Nilam Resources is up 1900% today after they announced to buy 24,800

#Bitcoin

This is a wild story 🤣

340

685

5K

122

33

303

We have transitioned from Monetary Dominance to Fiscal Dominance.

This isn't your 1970s yield curve inversion.

Where Volker loudly yelled at Congress for rising deficits while aggressively raising rates.

Inflation is compounding as fiscal deficits exponentially grow all the…

42

50

295

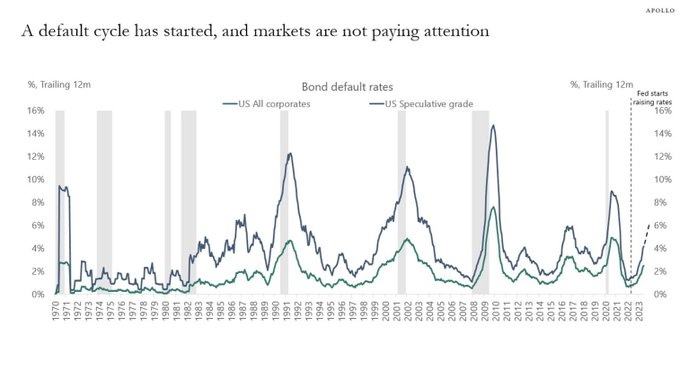

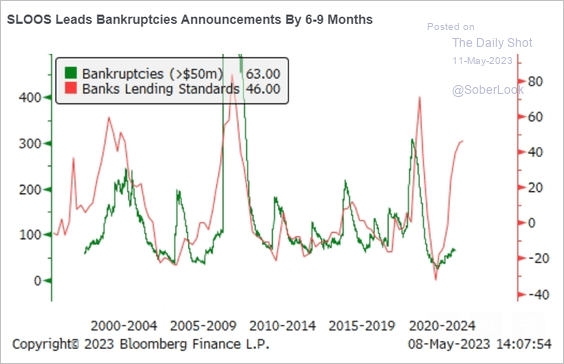

Bank stress is most certainly not over.

As Randy also points out, FHLB advances for 2Q23 are estimated to exceed $1Trillion, which will negatively impact bank NIMs. (Translation: that’s bad .)

10

65

290

THIS would be amazing if they could pull this off.

Can you imagine the fiscal savings our nation would realize just from the removal of insider trading by Congress, special interest kick-backs and bloated pork programs?!?

Mind blowing-ly bullish - if it happens.

Vegas odds?

37

32

289

I found another $NVDA 'customer'!

#Coreweave

#Magnetar

#Novogratz

and now

#Tether

🤯

Who could forget the controversy behind this scam!

Well, for those who care, here's ANOTHER shell company said to be buying Nvidia chips.

Oh, the company they keep!…

But ... 96% "VC Exit Predictor" 😂

That's cuz they know how to play this game called: EXIT LIQUIDITY

#AI

$NVDA

#Coreweave

#Magnetar

#Novogratz

No wonder we've been attacked in mainstream media. They don't want investors to see that Michael Novogratz introduced CoreWeave to…

7

21

96

43

66

281

12:45 announcement cemented it:

🔴 FED BIDS FOR 30-YEAR BOND TOTAL $0.

Bond bulls must defend here.

When/if 10Y gets back above 4.9%...

BRACE FOR IMPACT. $VIX

@SamanthaLaDuc

"Stocks Plunge, Yields Soar After Horrific 30Y Auction Tails Most In Two Years"

1

10

37

29

56

277

Jack, you have outdone yourself! 🎩🚬🔥 $NVDA

From episode 1 where I ask the question: “Is end demand real?”

To episode 2 on

#CoreWeave

+

#Magnatar

Now THIS! 🤯

Maybe investors should worry about the company that $NVDA keeps!

Part 3: Suspicious Shell Companies & Carbon Credits. The History of The People Behind Coreweave 🧐 $NVDA

#Coreweave

87

213

886

24

48

276

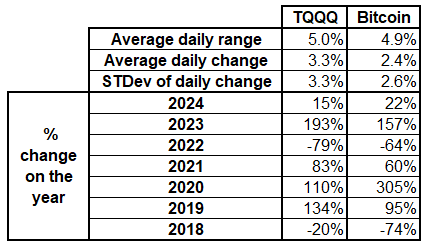

Lovely reminder:

#Bitcoin

is a 3x levered $QQQ play.

54

55

283