Urban Carmel

@ukarlewitz

Followers

84,239

Following

158

Media

6,101

Statuses

38,742

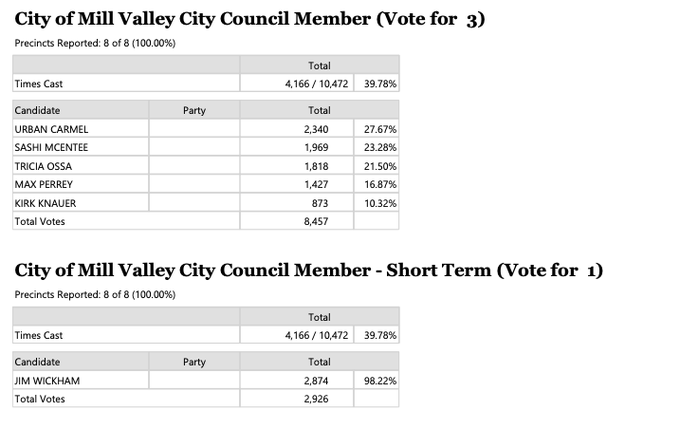

Wharton. McKinsey. UBS. Securities industry since '94. Asia ex-pat in '80s-90s. Elected to Mill Valley City Council in '20. Blocked by Zero Hedge since 2010.

San Francisco

Joined May 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Gojo

• 300954 Tweets

Yuta

• 168931 Tweets

キスの日

• 115106 Tweets

Gege

• 90647 Tweets

बुद्ध पूर्णिमा

• 72223 Tweets

鈴鹿詩子

• 69716 Tweets

PANLY KOBARAH

• 57646 Tweets

サマソニ

• 54663 Tweets

#LINEMANคุ้มชัวร์xBUS

• 45072 Tweets

भगवान बुद्ध

• 37047 Tweets

シャドウバン

• 19199 Tweets

LINEMAN x THAINEX

• 18389 Tweets

I.N SHINES WITH DAMIANI

• 13112 Tweets

レガレイラ

• 13059 Tweets

詩子おねえさん

• 11642 Tweets

トラップ

• 10689 Tweets

Last Seen Profiles

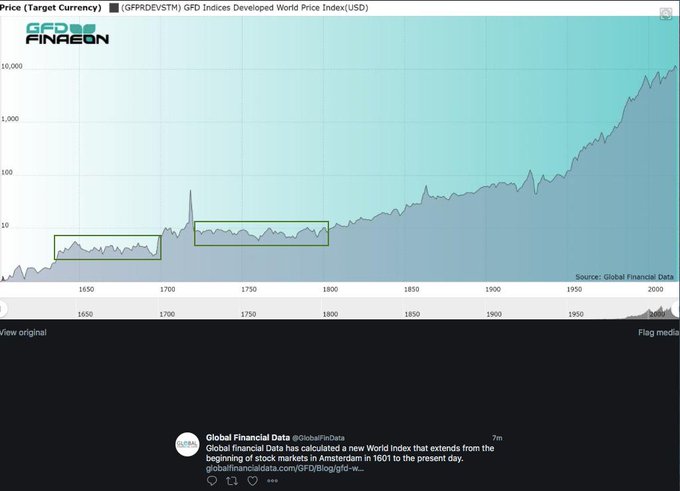

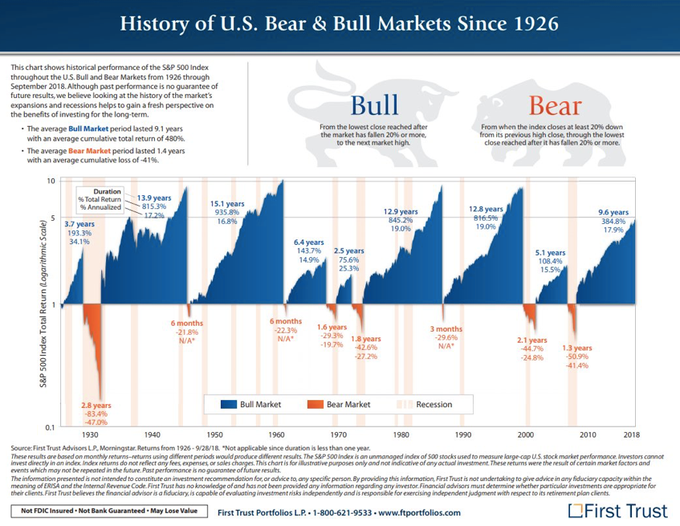

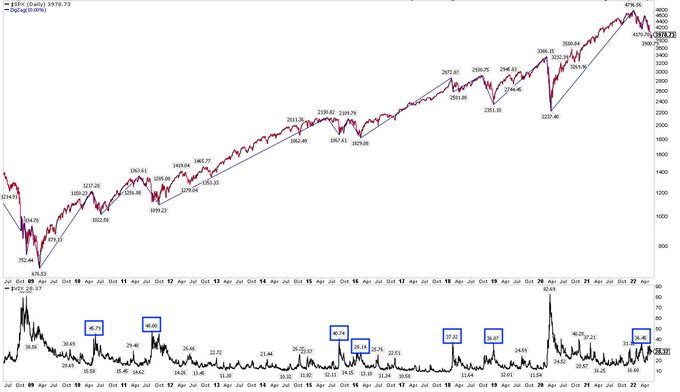

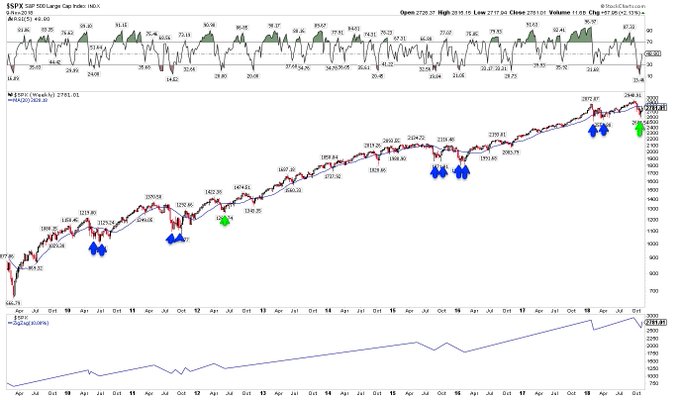

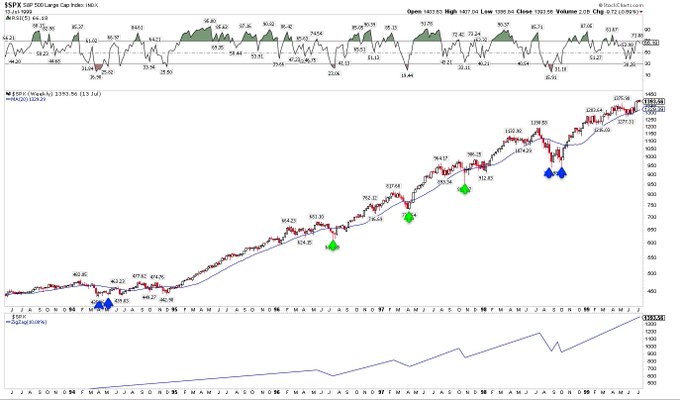

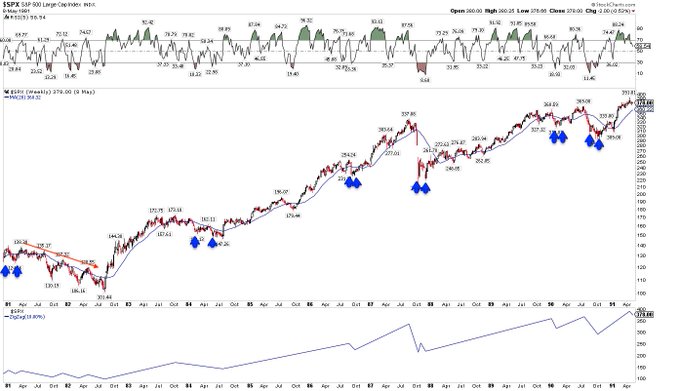

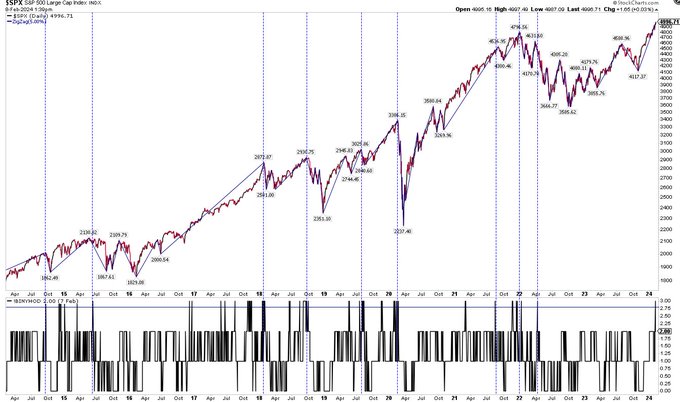

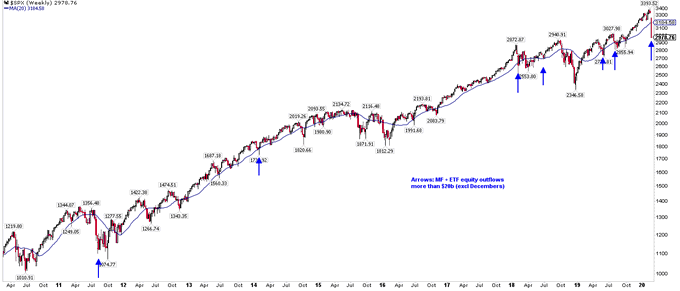

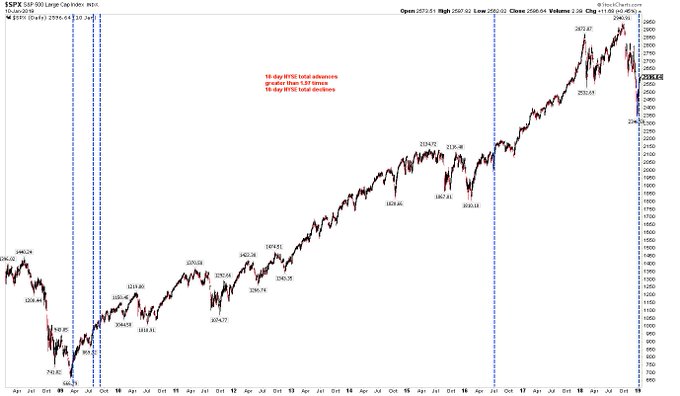

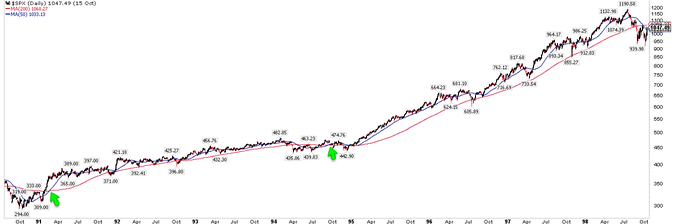

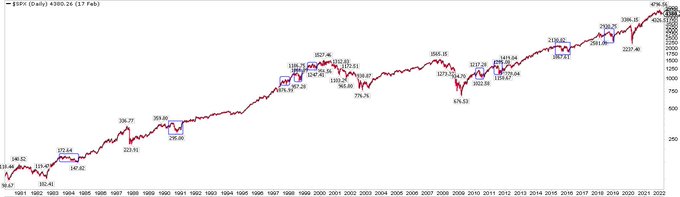

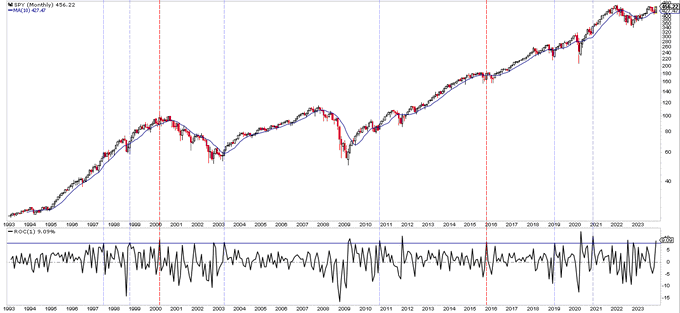

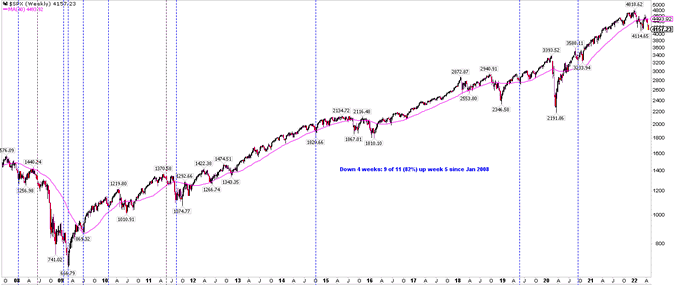

If you bought the S&P in 1997 and held it for the next 20 years - a period which included two recessions and stock market crashes of 50% and 60%, the largest of the past 80 years - your return would still have been 300%

28

105

317

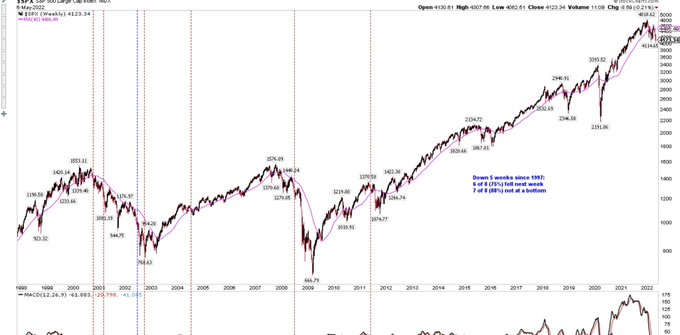

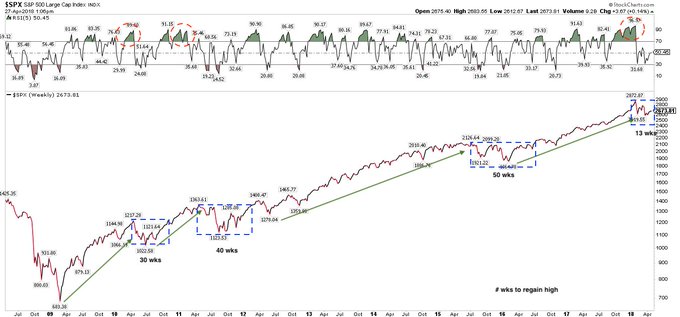

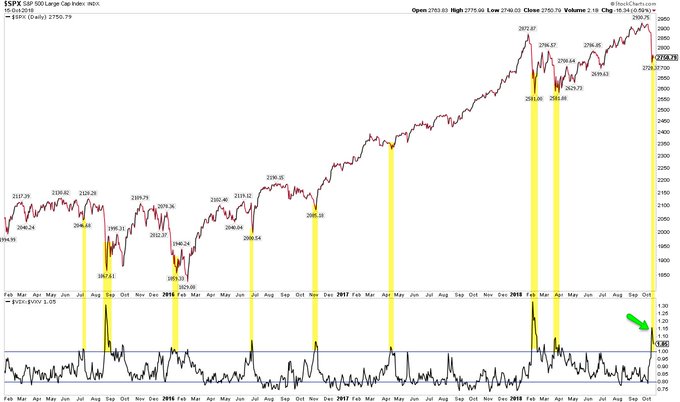

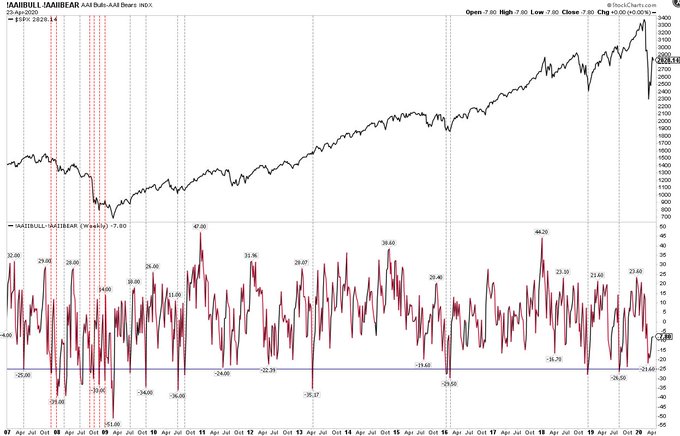

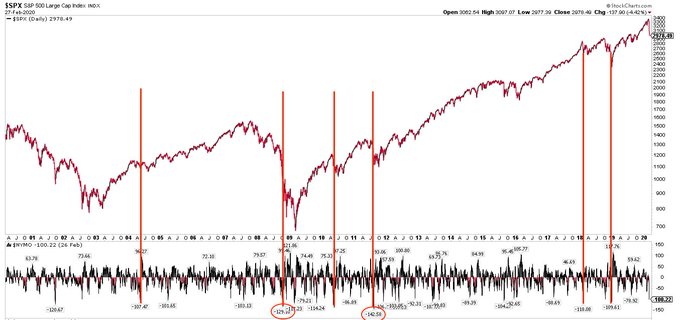

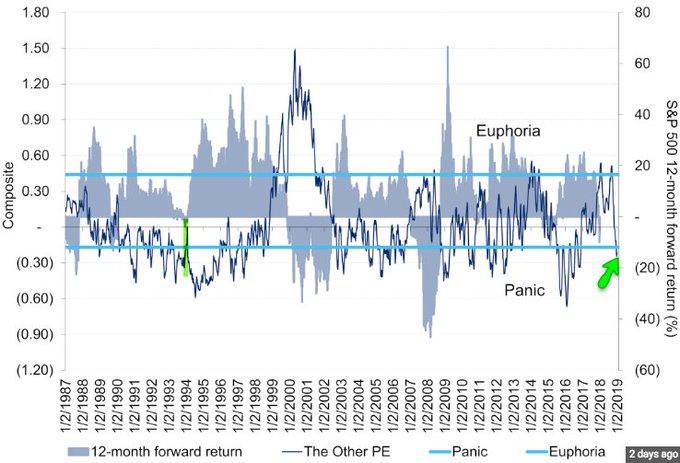

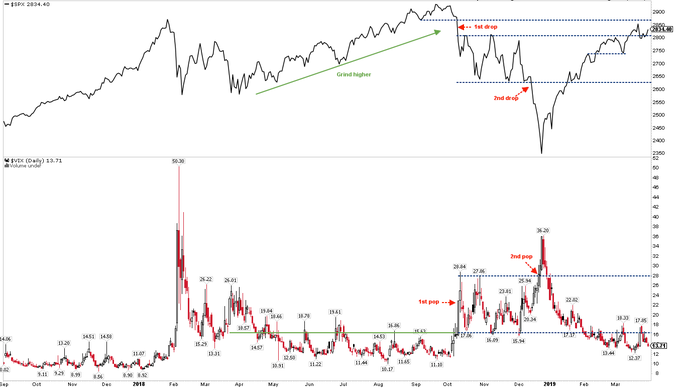

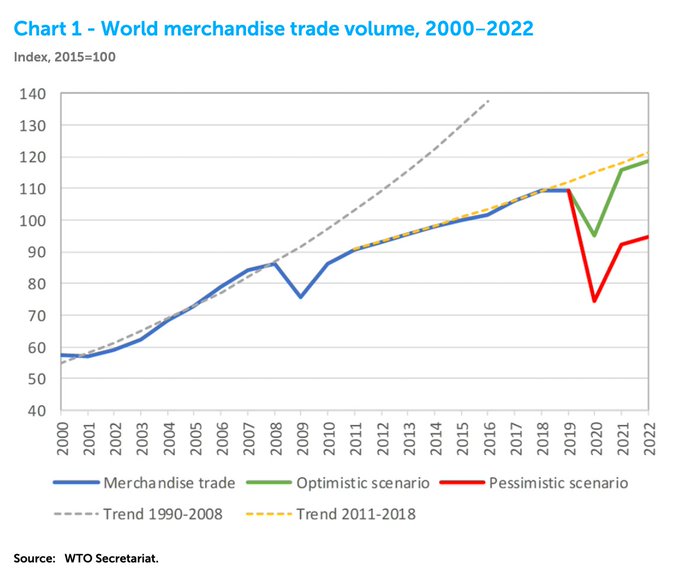

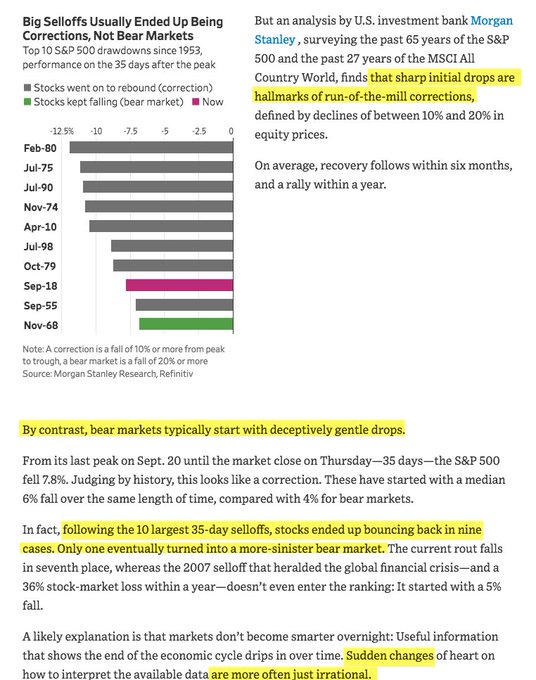

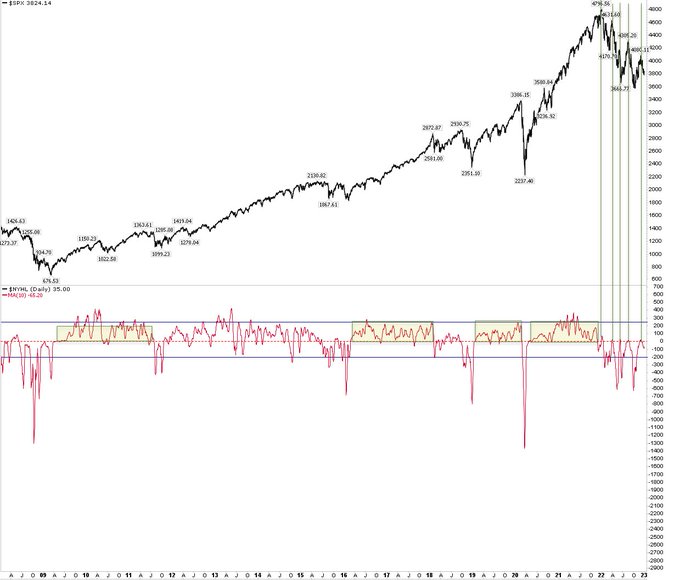

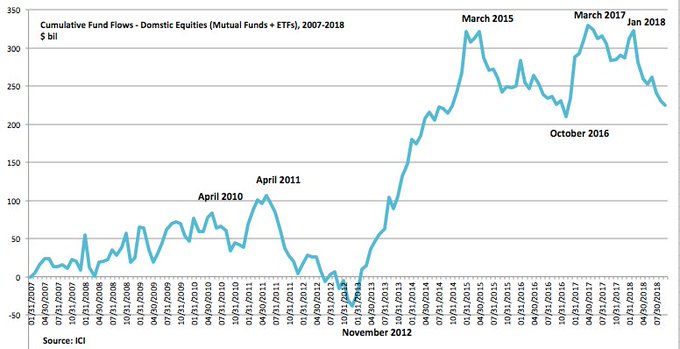

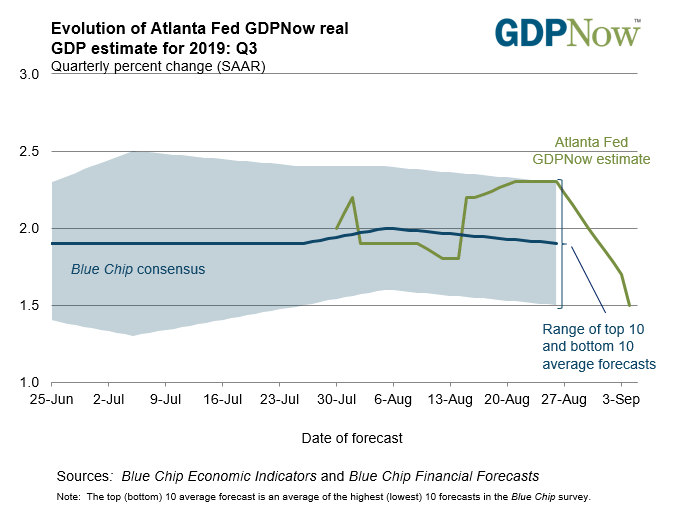

Plunge and bounce. All the market is doing now is debating whether we’ll be on the red line or the green line next year

World merchandise trade is set to plummet by btw 13 and 32% in 2020 - either of these numbers would be shocking & the range btw them is an indicator of our uncertainty right now.

@wto

basically saying we have no idea but its definitely terrible!

1

43

87

11

55

270

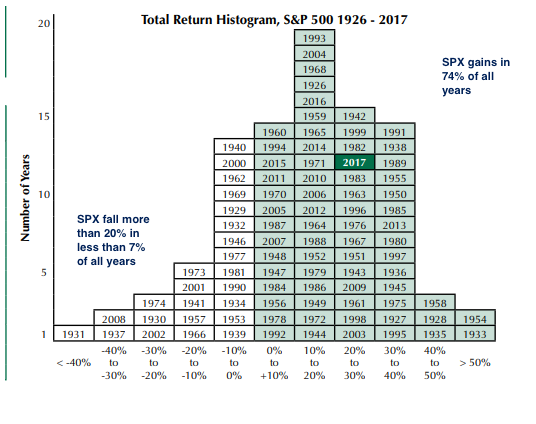

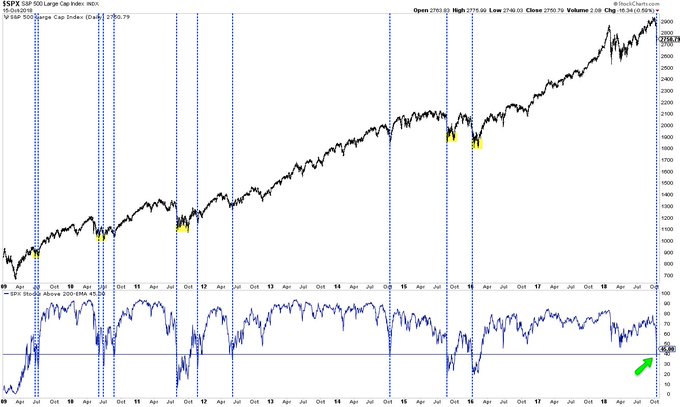

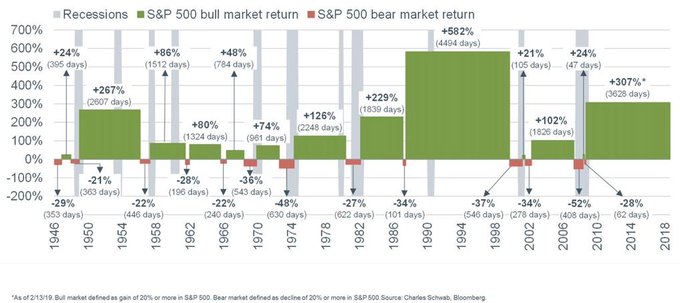

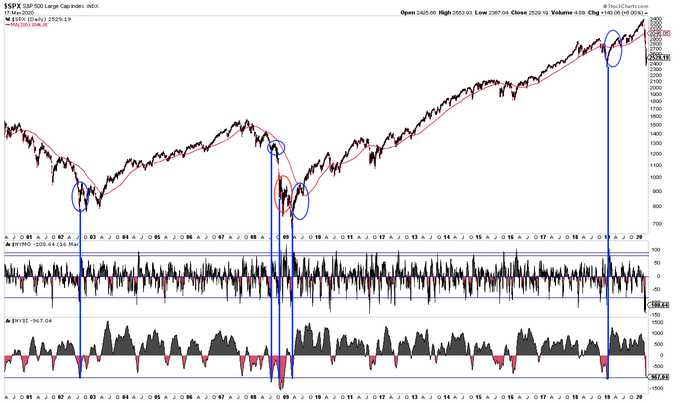

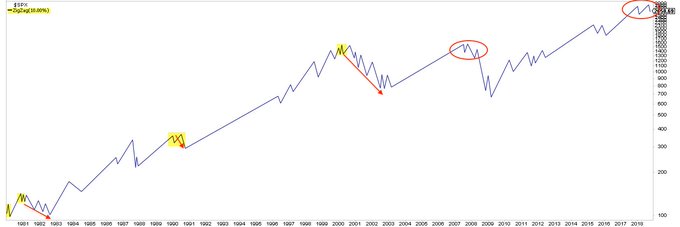

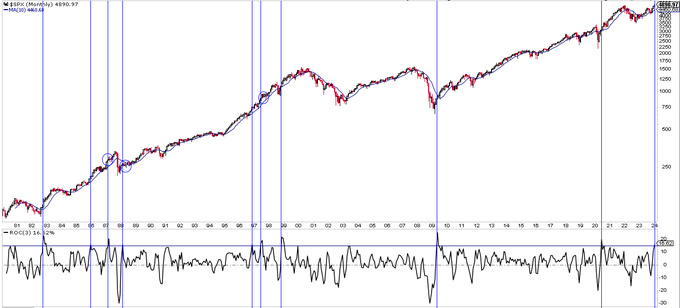

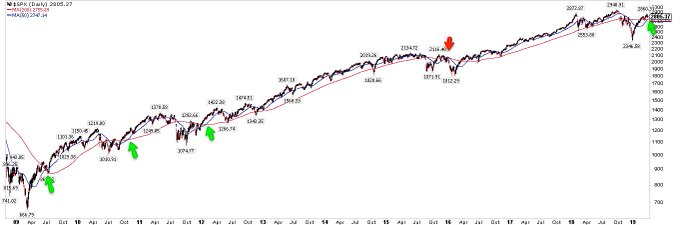

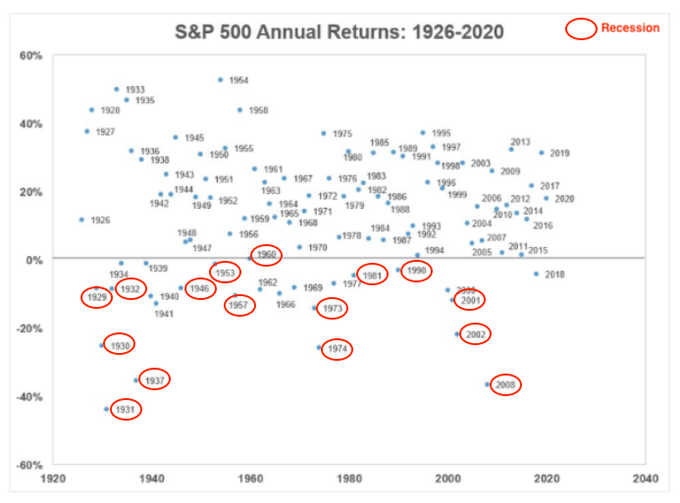

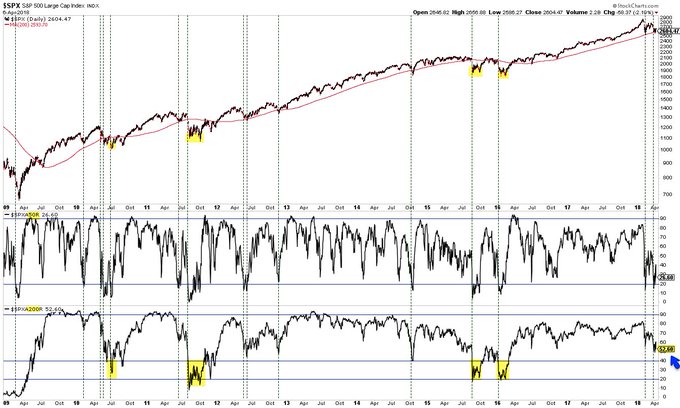

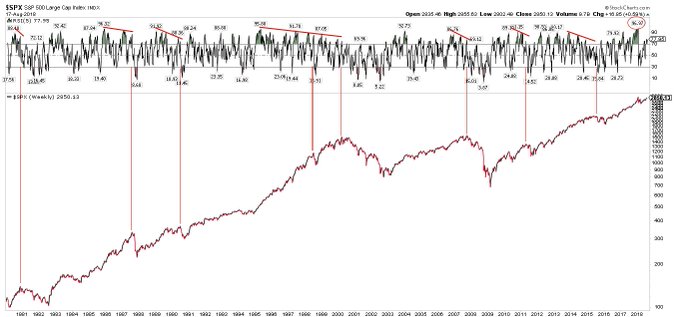

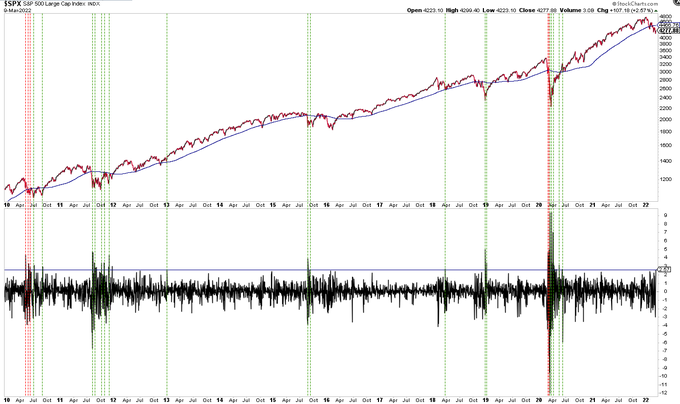

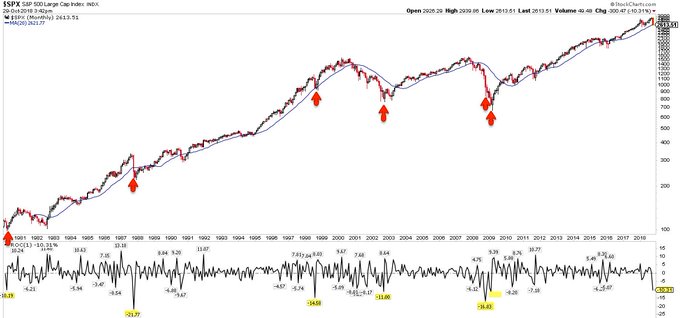

$SPX is down about 9% YTD. Anything can happen but, historically, for it to end the year with a loss like this, the economy would have to be in a recession (red circles) or the US in a world war. Chart from

@SethCL

; annotations are mine

15

70

265

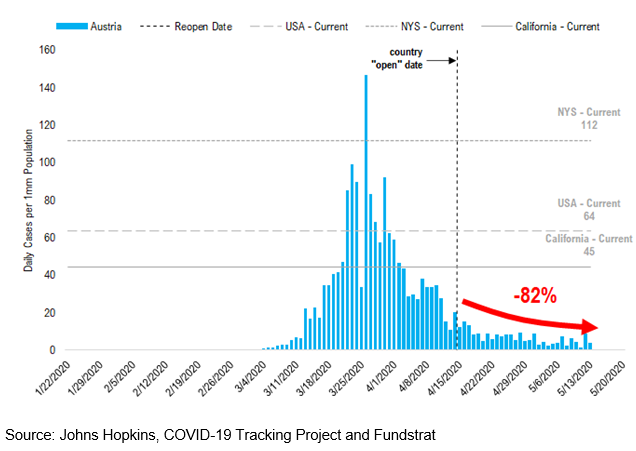

Austria Has 90% Drop in Coronavirus Cases After Requiring People to Wear Face Masks

@jonnajarian

Since the Austria eased restrictions 1M ago, daily COVID-19 cases have fallen another 82% since then...

18

43

139

23

84

215