If you’re looking at small caps, remember $SPX is 80% of total US market cap and $RUT is about 8%. It’s the tail, not the dog.

Also, this

10

48

269

Replies

If you are bearish, would you favor speculative high beta small caps? Of course not. Would you favor a few widely followed and "safe" mega caps? Yes.

Breadth and sentiment are saying the exact same thing. That's how this works

4

6

45

1

3

39

.

@hsilverb

the only one with a clue in this article.

The number of silly articles bemoaning cap weighting when it’s what we all collectively own and thus “masking” nothing just grows.

4

8

46

3

0

5

That time during most of the 1980s and 90s when small caps underperformed and $SPX went up +1000%. Also, the past 12 years by +300%

6

3

17

A few stocks accounting for most of the gains is actually typical

Lots of comments about poor market breadth. Some are valid but one that isn’t is saying most of the gains are driven by a few stocks. That’s how cap-weight indices work. YTD 4 stocks account for 50% of NDX gains. When NDX is up 10-25% median is 3.

@NDR_Research

1/3

4

38

156

1

3

30

1

1

8

“More often than not, the divergence between sectors and the S&P 500 tended to resolve itself with an upward bias”

1

8

23

One of those things that the pundits refuse to believe despite an abundance of evidence.

1

5

17

If you are bearish, you will be very selective and breadth will be narrow. If you are bullish, you will invest more speculatively and breadth will be broad.

Almost no one gets this

2

14

53

@sentimentrader

Wrote this in 2017; $SPX went another 20% higher in the next 8 mo.

You will spot the ‘breadth divergences’ that matter only in hindsight.

5

3

48

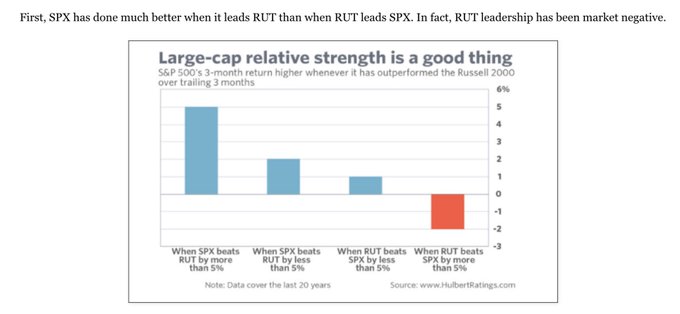

Note the annualized returns when $RUT lags $SPX. Nothing's ever perfect but this is normally a positive. From the awesome

@DeanChristians

1

13

40

Small caps up 8% this month. AAII bulls jumped to an 18-mo high this week. That's how this works

2

3

20

The much maligned narrow breadth has typically been followed by positive market returns in the past 40+ yrs

Another $SPX target increase, this time from GOLDMAN — to 4500 (prior 4000):

“.. prior episodes of sharply narrowing breadth have been followed by a ‘catch-up’ from a broader valuation re-rating. The potential profit boost from

#AI

has expanded the right tail for equities ..”

15

42

177

2

3

17

Endless chatter about bad breadth yet $SPX goes on to gain +17% YTD. The mystery is why so few are learning after making the same mistake repeatedly. It's Kahneman again

2

1

15

It takes bulls to make a bull market, so bullish sentiment is needed after a prolonged period of bearish sentiment (like now).

Likewise, breadth eventually needs to expand to sustain an uptrend. That appears to be happening

1

2

26

All the ink spilt over weak breadth has been for naught. SPX up ~75% of all years since 1986. This dead horse is as hard to kill as the ones for QE/QT, margin debt and stock buybacks

2

2

22

Since the Jan 3 2022 peak in $SPX, the main indices and their equal weigh versions are all down nearly identical amounts, they just took different paths to get there

2

8

42

We've had a breadth thrust of sorts the past 5 days. Only once was there not a higher high in the next week (95% win rate)

4

16

57

Higher high today (day 2). Did you follow the odds?

1

4

21

The outperformance of small caps since early June makes sense as it coincides with increasing investor confidence. You step out with unprofitable, speculative small companies when you are bullish (from JPM)

3

3

18

The drop in $SPX started when the advance/decline line hit a fresh 20-mo high and pundits were excited about good breadth. Scroll up if that is surprising

1

4

36

"Good breadth" (1999-2011) stocks go up. "Bad breadth" (2011-present) stocks go up.

1

1

26

$SPX now down 10% since advance/decline line hit a high.

1

2

25

6-months later, and 'bad breadth' was followed by a 10% gain. This thread explains how this was not unexpected, but whatever

2

1

19

Small caps up 25% the past two months and NAAIM active managers are now leveraged long. That's literally how this works

1

0

12