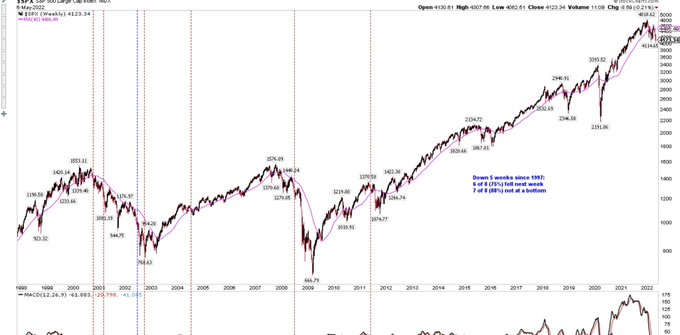

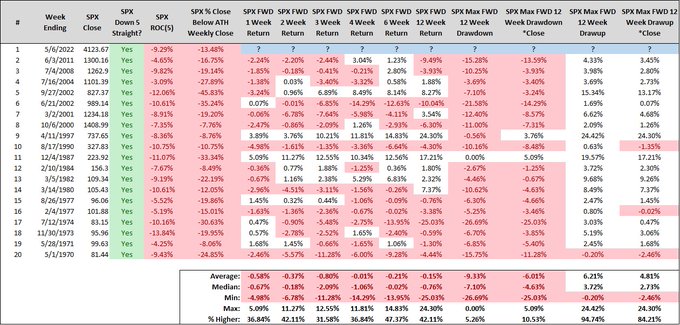

$SPX down 5 wks in a row for the first time in 11 years and only the 9th time in 25 yrs. Notes on chart

29

133

543

Replies

1

5

37

$SPX seems likely to finish lower 6 weeks in a row (scroll up). Since 1990 (not shown), it has fallen on Week 7 once (March 2001; red circle). Week 6 was the low once (Oct 2002; red arrow). Small n. Charts from

@TradewellApp

1

14

36

For completeness, $SPX fell 6 wks in a row once between 1990 and 2000 and it was up in Week 7 (Aug 1990) but that was not the low (which came in Oct 1990)

2

3

20

Mostly what you should take away from this is that down 6 wks is a rare event (7 instances in more than 30 yrs). With that major caveat, 6 of 7 up the next week and 6 of 7 not at The Low

2

9

73

$SPX ends the week down-2.4%, just the 8th 6-wk loss in more than 30 yrs

3

5

31

Since 1980, $SPX has fallen 7 wks in a row only twice (arrows). In 1980, it was The Low. In 2001, it fell another 6% the next wk, rocketed 15% the next 2 mo and then dropped another 1-1/2 yrs. n=2

5

9

65

As of right now, it’s the worst 7-wk in a row tumble on record. -15.7%

3

10

44

Worst start to a year since Tricky Dicky.

0

2

15

@ukarlewitz

And $SPY $SPX $DJI $DIA $IWM first April Bearish Engulfing Candle in 20yrs. $QQQ, never before this April.

Think about that.

0

1

4

@ukarlewitz

@Jedi_ant

This is the soft landing, instead of just getting March 2020 and stop the pain they are going to bleed this thing out slow. This will destroy a generation of investors for sure.

1

0

6

@ukarlewitz

@87AlwaysRed

Remember that huge market rise after the corporate tax reform? Wait until Biden’s tax increase and minimum tax on corporations

0

0

5

@ukarlewitz

Percentage of stocks above 200 day MA.

5 Red QTLY Candles

Comparison with same March 2008

1

0

2