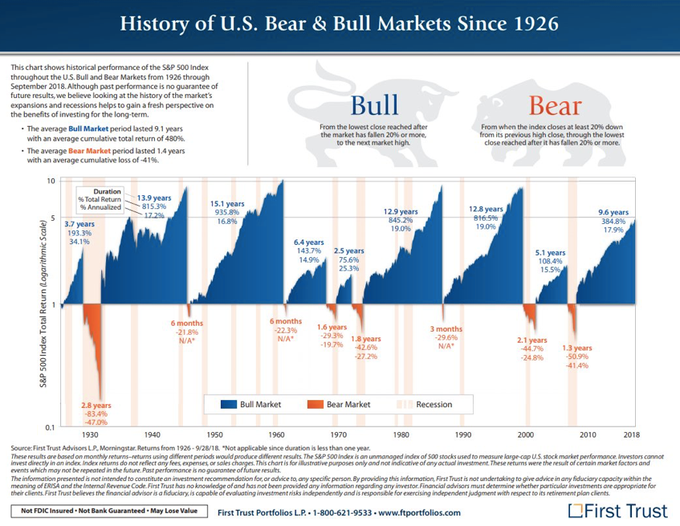

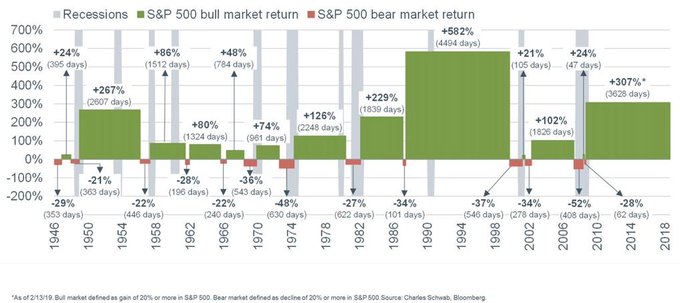

If you bought the S&P in 1997 and held it for the next 20 years - a period which included two recessions and stock market crashes of 50% and 60%, the largest of the past 80 years - your return would still have been 300%

28

106

316

Replies

@ukarlewitz

That’s 5.6% annualized. Surely could have bought a muni bond ETF and done better after taxes as well as risk adjusted? Would be interested to see in context of cash and bonds? There are other securities to invest also through many cycles.

1

0

2

@ukarlewitz

Exercises like that r always a product of the starting pt u choose, as u know. If u bought @ highs in 2000, your return is 78%. Obviously the thrust of your comment is correct, said some1 who has a LT portfolio, most of which have stocks with holding periods of 15 to 25 years.

1

0

1

@ukarlewitz

Except the condos on my block were $75,000 in 1997 and now at $600,000 today. A larger return.

1

0

0

@ukarlewitz

All financial market manipulation - we had consistent decline in interest rates all way down to next to nothing, then companies borrowing money to buy back shares turning equity to debt and then extra cash from tax cuts -> buy back more shares at ever higher prices. What’s next?

0

0

0

@ukarlewitz

Look at the buying power of the USD over that same period. Now make that argument again.

1

0

1

@ukarlewitz

Millennials will not invest as those before them. They distrust the system. They have been educated to distrust anything with risk and dislike the private sector. They hate profits. They want full assurances and dependency on government.

0

0

0

@ukarlewitz

@market_fox

Haven't all those returns come in the past roughly 10 years? If I'm not mistaken the SP500 returned 0% from 1996-2009.. that's if you just boughy SPY...could be wrong.. thinking of SPY chart.

0

0

0

@ukarlewitz

@GfI_Himmelreich

If you went Long—in 1997 And Sold “Some” into advances into Institutional Supply & Bought Pullbacks into Institutional Demand & Hedged the Rising Prices, you would be up 7,000%!

Buy & Hold—is for Amateurs!

#MarketTimer

0

1

1