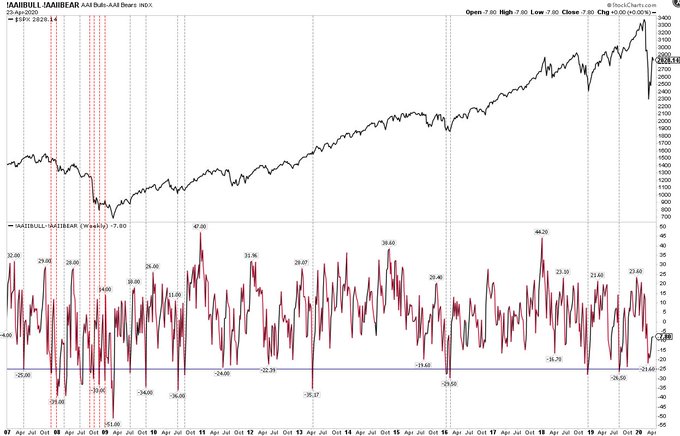

Two weeks later and ‘retail’ sentiment is still weak (-29%). Same conclusion $spx

20

71

371

Replies

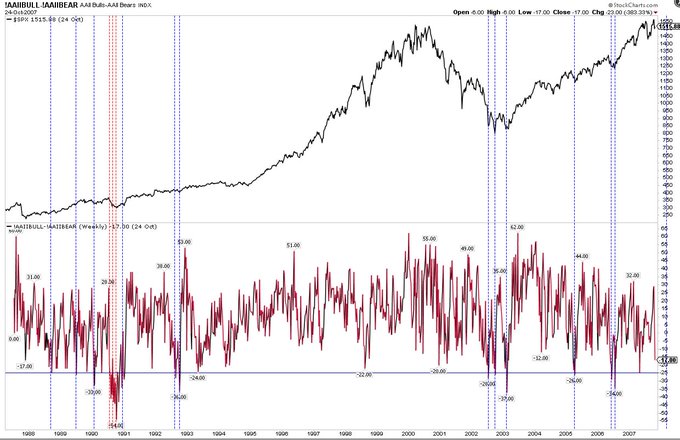

4 week retail sentiment (AAII) now lowest since March 2009. Meaningful in a bull market, not in a bear market

3

20

62

Sentiment round-up

Bearish: AAII, Consensus, fund flows, Fear & Greed

Bullish: II, Panic/Euphoria, one-month CPCE

Neutral: NAAIM, DSI, 10-day CPCE

5

10

56

1

2

18

2

2

22

Fund managers surveyed by BAML:

- High cash (5.7%)

- Bond weight highest in 10 yrs

- Still high equity underweight (1.8% std dev below mean)

- Within equities: US weight highest in 5 yrs, Europe lowest in 8 yrs (flight to safety)

8

27

80

One month equity only put/call (0.59) at a level where $SPX often runs into some turbulence. If it runs higher now, those gains usually (but not always) given back

3

18

84

Likewise:

0

5

31

@ukarlewitz

@macrofollower

Which is a rather weird reading because those same AAII investors were actually mostly buyers during the recent volatility they said. Put your money where you mouth is or liar liar pants on fire!?

0

0

0

@ukarlewitz

Silly silly bears. Most are scratching their heads. Folks. Stay away from divergences, some said lows were going to be retested in a month. They were wrong. Nazzy going to new highs here

0

0

1

@ukarlewitz

Most are arguing saying this is a bear market? How. Nazzy is close to all time highs

0

0

3

@ukarlewitz

CA staring at $54B budget shortfall predicting an 18% unemployment rate. Doesnt sound very V'ish recovery

1

1

0

@ukarlewitz

as far as i can see all the people have started buying stocks as earning were so great.

1

0

1

@ukarlewitz

I really suspect the AAII is a bit banjaxed at the moment because of the wall of Tech-bro Robinhood money. These guys have probably never heard of AAII and their views are not being captured.

0

0

0

@ukarlewitz

Retail always remains bearish why because they never buy dips even if they buy dips they sell early

0

0

0