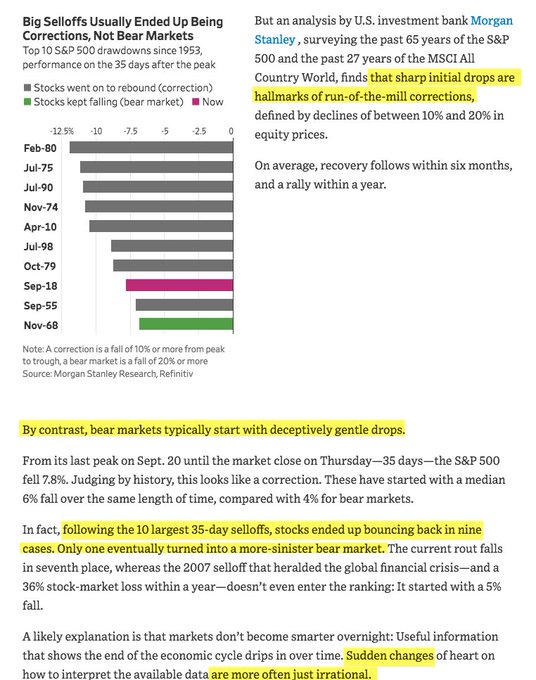

WSJ: following the 10 largest 35-day selloffs (this one is ranked 7th), stocks ended up bouncing back in 9 cases. Only 1 turned into a bear market

11

97

268

Replies

@ukarlewitz

Another insightful blog as top callers and uber bears tweet that this is just the start of an epic sell off circa 2008-early 2009. Thanks 4 sharing!

0

0

3

@ukarlewitz

@edwardnh

Sounds like a lot of the stuff they told us to tell clients in late 2007

0

0

0

0

0

2

@ukarlewitz

How does this not include the 1987 crash or 2000-2002 downturn or 2008-2009? Seems like very narrowly defined criteria, cherry-picked to put forth a bullish narrative.

0

0

4

@ukarlewitz

@BioValues

February tends to tell you what the year end will be...October is crucial month that can tell you if bear market us starting...if this continue s into q4 then its a bear bear bear

0

0

0

@ukarlewitz

Yeah it’s the pace of the sell off that converts the bears. Ironically, It’s too bullish unless it’s a developing crash wave... which is ultra low odds atm.

1

0

0

@ukarlewitz

Days with 2% drops

2004: 0

2005: 0

2006: 0

2007: 11

2008: 41

2009: 28

2010: 10

2011: 21

2012: 3

2013: 2

2014: 4

2015: 6

2016: 5

2017: 0

2018: 10 (so far)

🐻🐻🐻

0

2

3