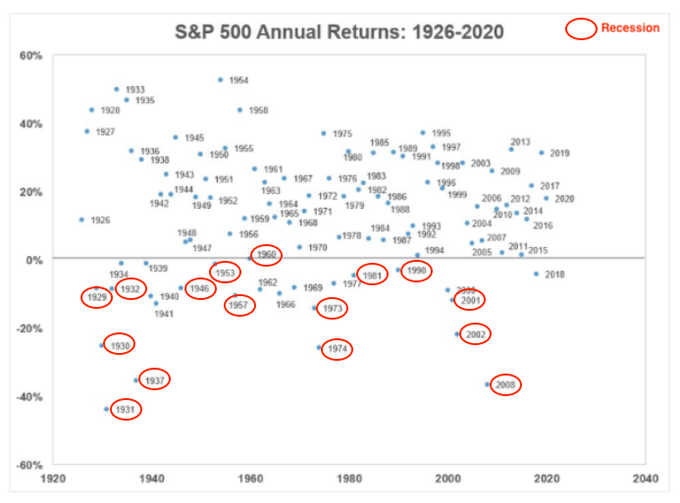

$SPX is down about 9% YTD. Anything can happen but, historically, for it to end the year with a loss like this, the economy would have to be in a recession (red circles) or the US in a world war. Chart from

@SethCL

; annotations are mine

15

70

265

Replies

@ukarlewitz

@SethCL

The gdpnow Atlanta fed , ecri wli and spreads hinting to recession. Are bottoms made at the start middle or end of recessions ? Or all over

0

0

0

@ukarlewitz

@SethCL

Recession or not this a bear market and in bear markets assets can go down a lot further than you think. Margin debt to GDP has never been higher.

3

5

29

@ukarlewitz

@SethCL

What about the insane accommodation that has been in place for years? 10 percent is a lot?

0

0

1

@ukarlewitz

@SethCL

At the risk of saying "this time it's different", I would think the starting point matters.. Ie. 2022 ytd or full year is gonna be measured against a pretty high beginning level in the SPX majors (PE, growth expectations)

0

0

1

@ukarlewitz

@SethCL

Valuation matters. Most of them are approaching pre covid valuation, but still more to come down. COVID and subsequent printing of $$ are outlier from the statistic perspective.

0

0

0

@ukarlewitz

@SethCL

It will end the year around 4800-4900 so a dip in late March Early April then a top in August before pullback to late Sep, early October then the rally, next year 2023, Q3 and Q4 will be very bad, Q1 and Q2 will be very good

1

0

1

@ukarlewitz

@SethCL

What about the bursting of a historic bubble? The P/E ratio of the S&P 500 is still above 20. There is the possibility of significant valuation compression ahead.

0

0

0

@ukarlewitz

@SethCL

We once were compared to the 30’s and many experts laughed, ….bet they got flat this year 🤨

0

0

0