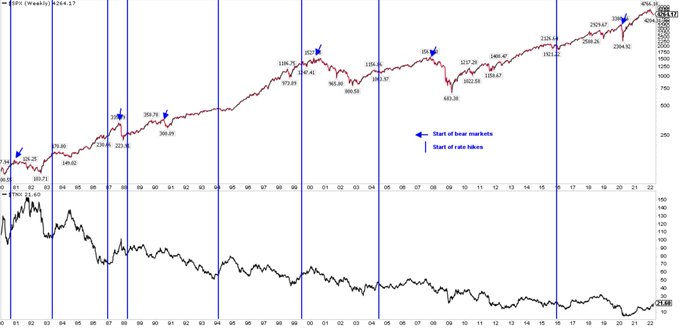

Tomorrow the FOMC is expected to raise rates for the first time in the current cycle. You’d have to go back before even the geezers on FinTwit were born to find a case where equities peaked BEFORE the first hike. Shown here is just the last 40+ years

22

85

391

Replies

If you’re wondering how stocks and bonds reacted after each hike during the last cycle

1

2

20

The 10-2 spread was this tight 2-1/2 yrs and 1-1/2 yrs before the end of the prior two bull markets, respectively. It was 20bp tighter when the FOMC last raised rates in 2018 and $SPX gained another +35% before Covid. So yeah, freak out

5

7

26

During the last rate hike cycle, we had China's hard landing, an ‘earnings recession’, the EU disintegration/Brexit and an idiotic trade war. You’ve forgotten all of this so it seems like risks are uniquely higher this time. This is recency bias

7

12

72

2

2

10

“3 steps and a stumble”: Can’t say anything especially noteworthy happened during the last cycle (circle)

0

4

26

@ukarlewitz

An issue this time too will be causation.

the QE end was a couple of days ago and with the FED tomorrow it could mistakenly be thought as the reason.

Historically the markets reacted far more to a QE end induced liquidity retrieval.

0

0

5

@ukarlewitz

Past performance is not indicative of future results 😉

Only kidding. Idgaf what happens.

0

0

13

@ukarlewitz

@CanteringClark

Is my interpretation correct here? immediately following historical rate hikes, markets continued on an upward trajectory before correcting to down side ? Thanks

2

0

4

@ukarlewitz

Last taper tantrum basically reversed the carry trade by EM debt scurrying for $ to repay dollar denominated debt. Swiss had too much upward pressure on franc that they created a SWF to invest in — well, US stocks. I’d be curious to see that timing overlay here

0

0

0

@ukarlewitz

When did they hike this late in business cycle? (Never)

When did they hike with inflation this high? 1970s.

Why did stocks crash in late 2018 but not earlier when Fed hiked? Bc in Dec 18 they hikes into a slowdown.

That's the difference. Hike into slowdown = down markets.

2

1

13