Global fund managers:

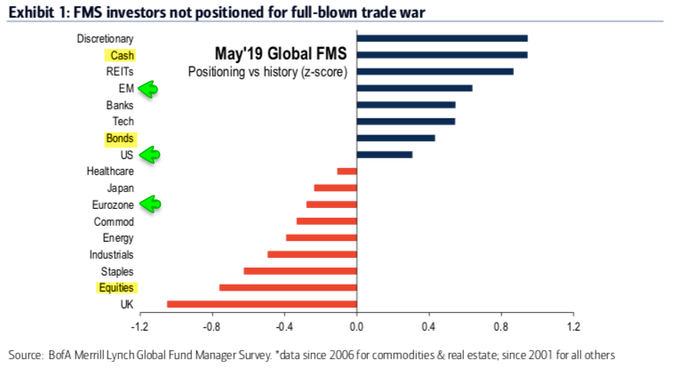

- Overweight cash

- Equity allocations almost a standard deviation below avg

- Bond allocations at a 7 yr high

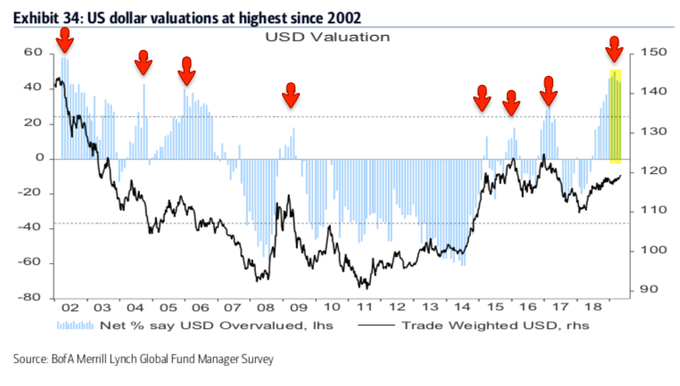

- View $USD as most overvalued in 16 yrs

New from The Fat Pitch

10

99

281

Replies

@ukarlewitz

Bull market ended in Jan 2018 all over the world. If globalism has connected the world exponentially over the past 2 decades why would our market be the ONLY market to continue on while everything else remains 10,15,20+% off their highs?

1

1

8

@ukarlewitz

As a reminder, lumber prices are a great leading indicator of future earnings. When lumber prices fall over a 12-month period, then EPS follows 6 months later. Although there is no immediate recession on the horizon, a market downturn is possible

0

6

9

@ukarlewitz

I’m probably reading something wrong but shouldn’t it be “underweight” in the text for European Equities section?

0

0

0

@ukarlewitz

Sure, but if we look at how they were positioned in September 2018, you can see they were more overweight cash than today (z=1.2 standard deviations in sept vs 1.0 today)

0

0

2

@ukarlewitz

@theycallmetex

That means the buying power is staying on the sidelines and that means once the “conviction” kicks in they will push prices even higher

1

0

3