Kailash Concepts

@KailashConcepts

Followers

16,355

Following

2,770

Media

3,015

Statuses

16,525

Behavioral #Finance , Portfolio Strategy & #Quantamental Tool Kits Built by a Team with 70+ years of Experience Disclaimer:

Join free here:

Joined June 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Bridgerton

• 389988 Tweets

Cohen

• 288294 Tweets

Butker

• 229551 Tweets

Colin

• 112053 Tweets

billie

• 81837 Tweets

Catholic

• 77436 Tweets

Penelope

• 70236 Tweets

Daniel Perry

• 43484 Tweets

Fermin

• 31805 Tweets

Marcelo

• 29334 Tweets

Greg Abbott

• 28927 Tweets

Fall 2025

• 27479 Tweets

GTA 6

• 26552 Tweets

Katy Tur

• 25921 Tweets

Leeds

• 25451 Tweets

Megalopolis

• 24902 Tweets

Deschamps

• 23545 Tweets

iMessage

• 22124 Tweets

Olise

• 20654 Tweets

#SVGala11

• 18221 Tweets

Coppola

• 17581 Tweets

ひーくん

• 16079 Tweets

Laporta

• 14285 Tweets

Jarry

• 13559 Tweets

Norwich

• 13291 Tweets

Aleyna

• 12249 Tweets

Miri

• 11782 Tweets

Lacazette

• 11394 Tweets

Last Seen Profiles

Pinned Tweet

We just published a single

#stock

write-up on $ARIS

"you have a rapidly growing company with a tremendous economic moat repurchasing shares and throwing off enough cash to pay double the dividend you receive as an owner of a large-cap index."

1

1

6

1/ Everyone is talking about

#copper

right now.

"Challenges in opening new mines expected to leave production lagging behind rising demand"

10

37

154

1/

@DoombergT

put out one of the best summaries of the tremendous success created by massive chemical facilities like BASF’s in Germany that most of us never have to see.

3

12

136

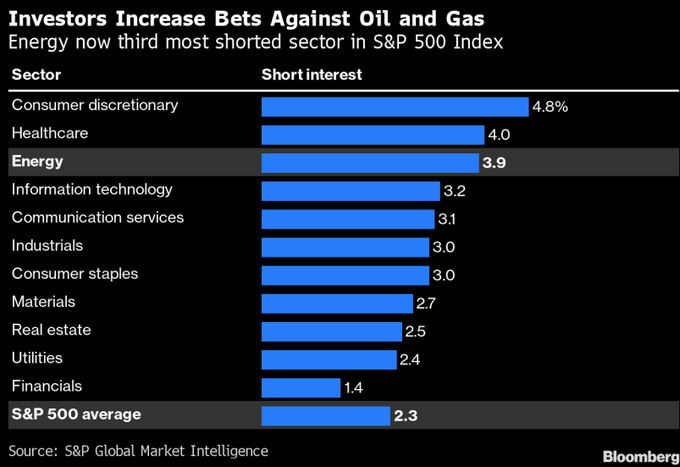

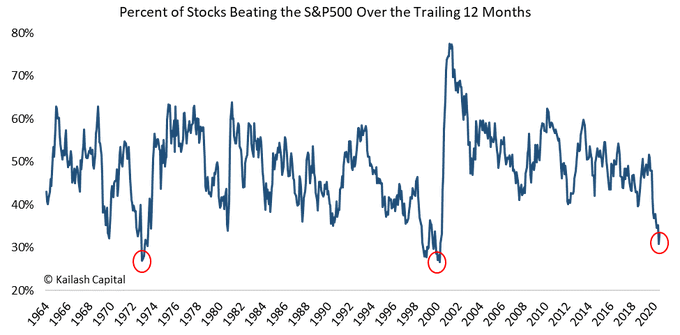

Virtue-divestments = higher cost of capital = means the suppliers of said capital achieve higher returns.

We've had a few people, who do NOT own energy, tell us that our long energy thesis is now "consensus" (without irony)

Let this chart put that to rest:

4

11

97

BEVs have 2x the inventory supply of ICE motors.

Bit early for an inventory pile-up in a business where investors have exponential expectations baked into multiples, no?

11

11

79

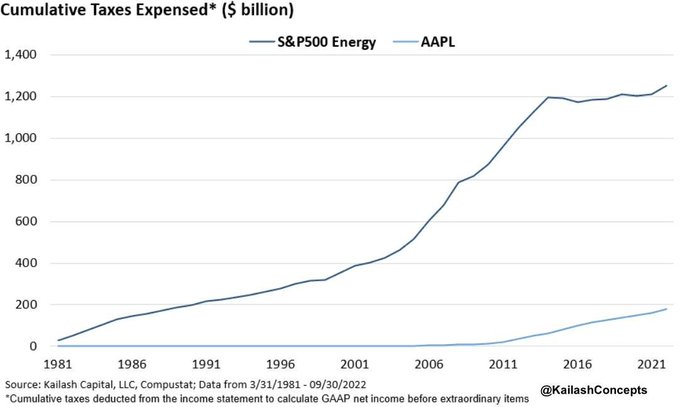

1/ The chart below shows the cumulative taxes expensed by the constituents of the S&P’s energy sector vs. Apple.

Legendary for their tax evasion skills, KCR has not heard our politicians propose a windfall profits tax on Apple.

4

15

77

@KobeissiLetter

The national debt and the burden it will place on future generations should be front-page news every single day. It is existential and should be treated as such.

3

5

74

@GuyDealership

Could not agree more.

How many people have cars with perfect motors and transmissions and weird electronic glitches making the vehicle intermittently inoperable?

3

0

65

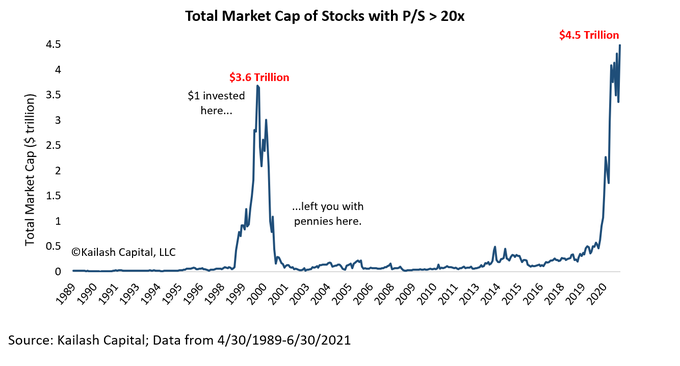

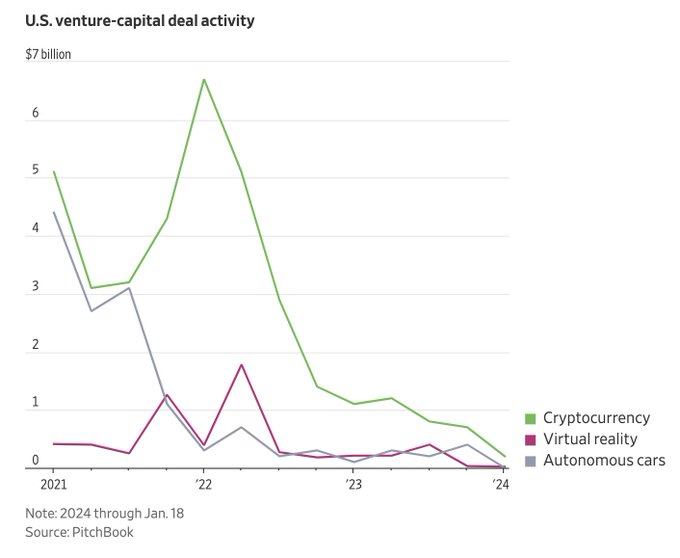

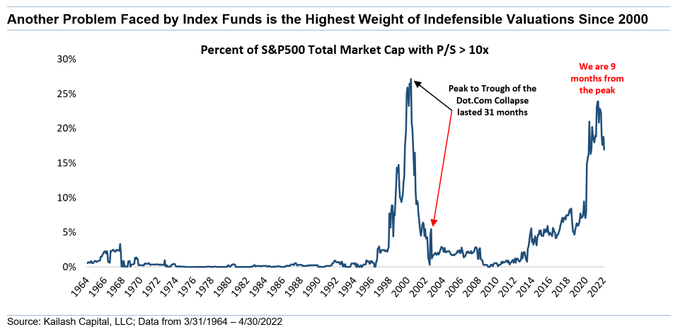

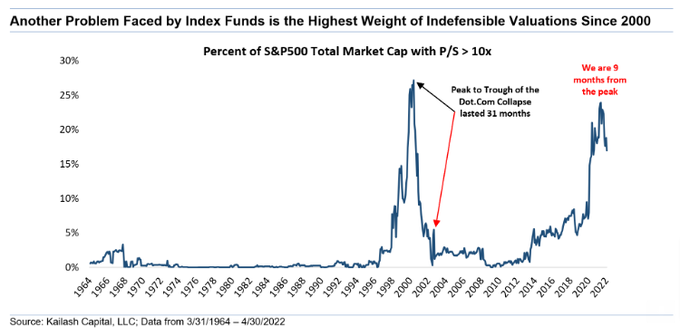

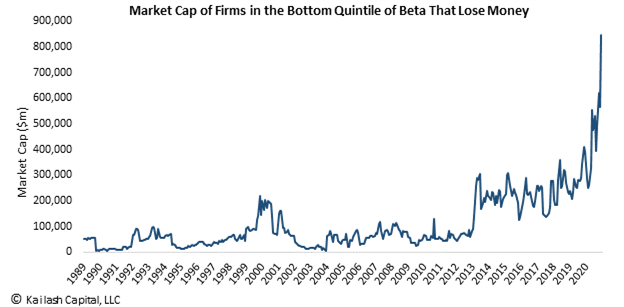

This chart is another example of the reckless speculation underway today. Please read our blog to see how these speculative 20x price-to-sales firms did post the bubble and how they look today.

#stocks

#Speculation

#valueinvesting

$NKLA $SNOW $RIOT

2

14

63

@KobeissiLetter

The concentration within these seven stocks is extremely dangerous.

Is this a function of herd behavior or genuine due diligence?

8

2

63

@KobeissiLetter

What in the world is going on with car insurance inflation?

Could it possibly be due to the high repair costs associated with EVs?

19

3

64

@JohnDSailer

Institutions that operate on merit will outperform institutions that operate on identities over the long-term.

3

5

55

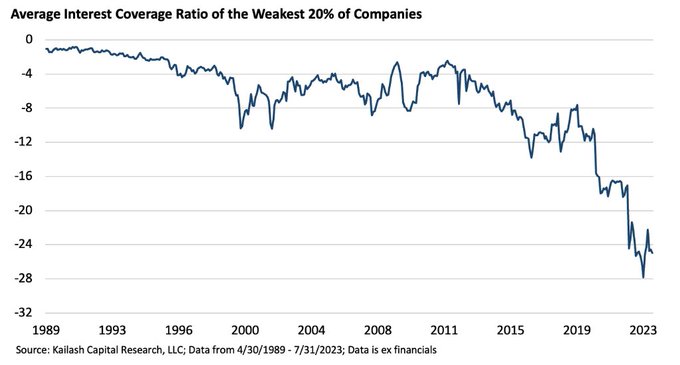

@MichaelAArouet

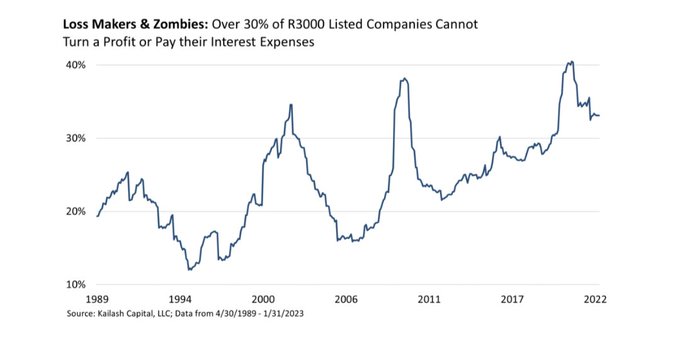

Over 33%, or ~1,000 of America’s largest listed companies, lose money or cannot afford to pay their interest expense. Let that sink in.

2

10

52

@charliebilello

In defense of Campbell, at least their executives are way less likely to suddenly disappear.

1

0

54

@KobeissiLetter

This aberrant market cycle will be intensively analyzed in business schools for generations.

2

2

53

@SamanthaLaDuc

A Buffett Indicator reading above 200% is strong evidence of significant overvaluation.

1

1

45

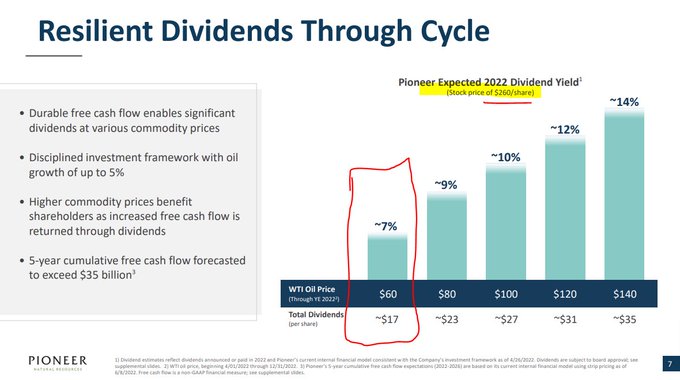

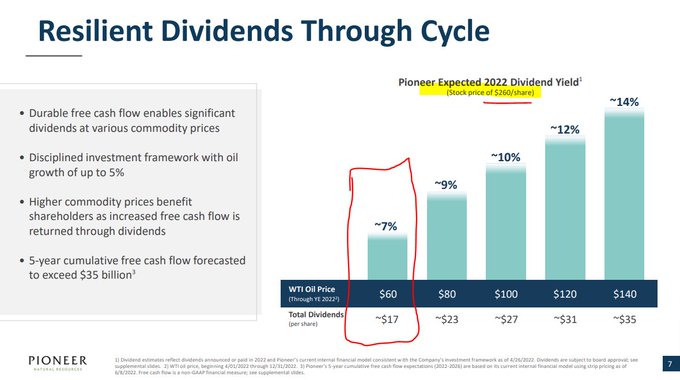

8/ The slide below is from a

@PXDtweets

presentation at the start of June and shows the dividend on Pioneer’s stock at various levels of WTI crude oil.

2

4

44

1/ Terrific chain. Simple “positive” & “negative” examples of how to clean up ESG.

One positive example follows below. 👇

1

14

42

@chigrl

Germany's "green" revolution ended up hamstringing its economy...hopefully other nations are taking note.

8

3

43

@ecommerceshares

Someone on FinTwit recently said that Bezos' real genius wasn't logistics, merchandising or even AWS....

...it was selling a perpetual narrative and getting Wall Street to pay his workers at an ever lower cost of capital.

Cannot recall who, but well done.....

2

1

40

We just showed you that 20% of all listed US

#equities

cannot afford to pay their interest expense, much less pay the principal back... The vulnerable slice of the US equity market has never been so broad or so weak. Full stop.

1

19

41

@PXDtweets

@business

16/ What this suggests is that the market is pricing in oil at or below $60 when it is over $100.

1

3

41

For any advisor or FA who has bought into the dogma of “only indexes” we ask you: do you think having levels of painfully inappropriate valuations in your clients’ portfolios is a good idea? If so, why?

$TSLA

#TeslaPSRatio

#indextax

2

6

40

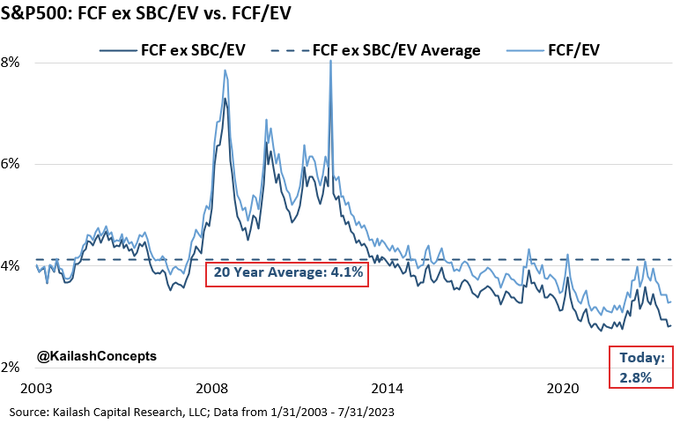

Backing out

#stock

based

#compensation

, the S&P 500 is more expensive than any time in the last 20 years based on free cash flow yields.

Data ex-financials

3

12

40

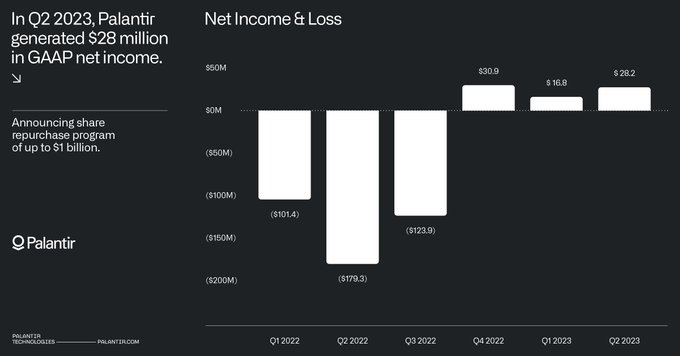

After backing out stock based comp they burned -$105ml in operating cash flow.

Can someone help me understand how a company that is burning cash can add value buying back their stock at 19x sales?

7

10

39

@CensoredMen

@robcollects11

Grateful to be living in America.

The stuff we are angry at one-another about is luxury problems.

Healthy reminder to see each other as "part-of" and try to set aside the "they" mentality so prevalent today.

Thank you for this!

2

4

39

@PXDtweets

9/ This is a company, like $DVN, that has adopted a very clear and simple payout structure. A base dividend that is fixed at $3.12 a share p.a. After paying that out, they return 75% of the remaining FCF to shareholders.

1

1

37

@KobeissiLetter

An indication that Americans are trying to maintain their standard of living in spite of inflation, which normally forces people to scale back.

2

1

34

@KobeissiLetter

@elonmusk

Yet another divisive controversy that pits Americans against one another on ideological grounds - when we should be seeking common ground to unite and solve the myriad problems facing the country.

9

2

32

@GuyDealership

This is after Toyota was shamed relentlessly because they didn't go all-in on EVs.

Refusing to follow the herd usually results in positive long-term outcomes.

2

2

34

@PXDtweets

12/ Let's look again: At $60 WTI this thing generates enough FCF to pay a $17/share dividend. At today’s share price that is a 7.2% dividend yield assuming oil plummets to $60 for the remainder of the year. The current indicated yield is over 13% according to

@business

1

1

34

@chigrl

Banks should focus on banking. Environmentalists can focus on the environment. This is not complicated.

4

0

34

@KobeissiLetter

Americans are drowning in debt, yet economists & other "experts" remain "puzzled" by the fact that Americans aren't enthusiastic about the state of the economy.

3

2

33

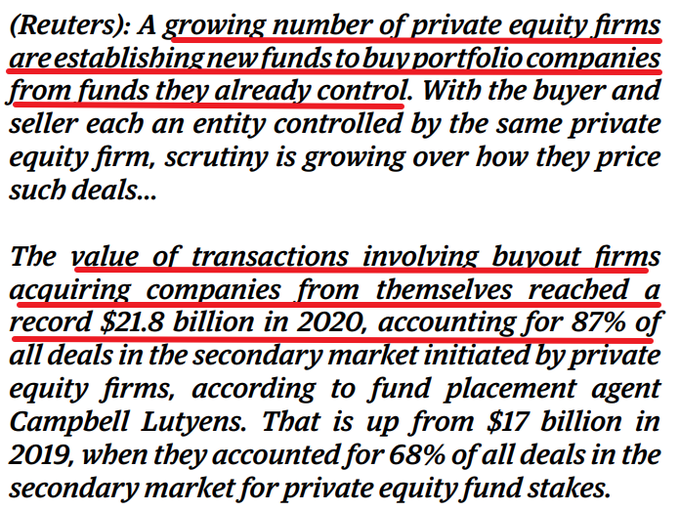

10/19 "A growing number of PE firms are establishing new funds to buy

#portfolio

#companies

from funds they already control."

5

11

32

@KobeissiLetter

Historically, when market participants begin to adopt the "but this time it's different," in regards to bubbles, it always ends bad for them.

0

4

32

@LizAnnSonders

@nardotrealtor

Feel bad for the young people who are trying to make a life for themselves.

4

0

29

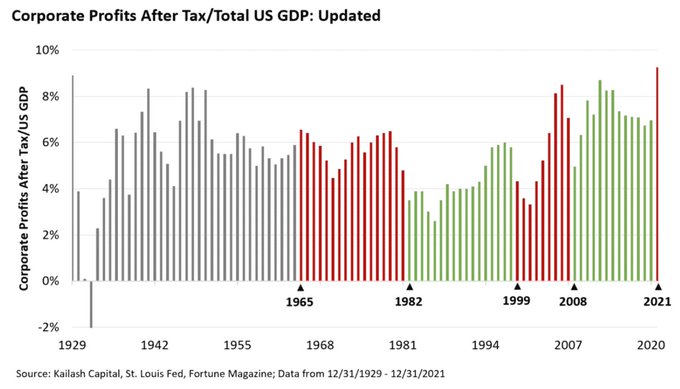

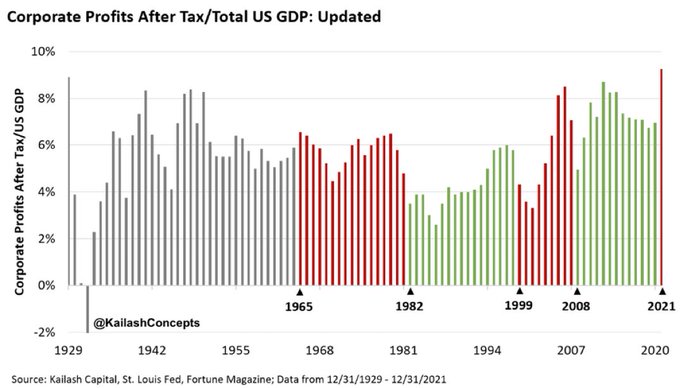

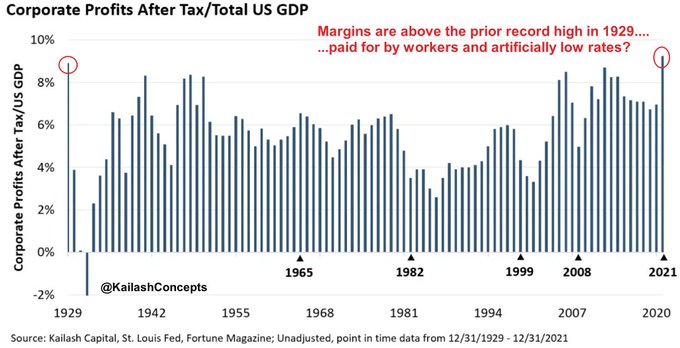

@LanceRoberts

Agree that margins will fall Lance – to where is what we wonder.

As you know: with margins above the prior 100 year peak in 1929, the risks are without precedent

As always, grateful for any thoughts

3

2

31

@chigrl

Did India not get the memo that they must transition to green energy, regardless of economic & social impacts?

7

3

27

@Josh_Young_1

Been doing this 27 years. Never seen a thesis sit in plain daylight like this before.

Bizarrely simple = paranoia I’m missing something = can’t find it = sit tight & we’ll do alright. -Matt

5

0

28

@EPBResearch

Oly if government, education and healthcare jobs don't actually count as jobs with pay right?

These jobs are as real as the epic employment boom by reckless VC speculators built on 0% rates and cheap low-quality debt no?

NOT POLITICAL COMMENTARY!

3

0

28

@DanielSLoeb1

Something to ponder

@DanielSLoeb1

Margins are at 100 year highs…higher than the prior peak in 1929.

2

2

27

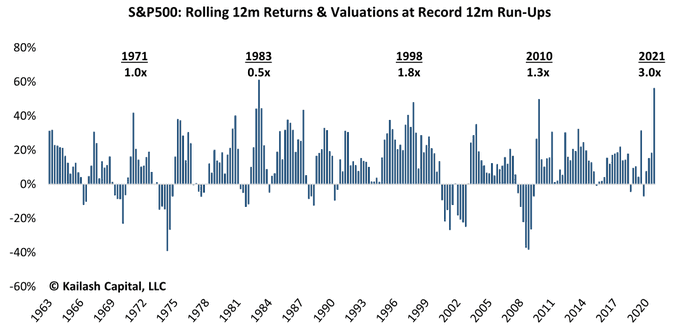

Stock Market Bubble - Record Returns & Record Prices:

The chart shows the rolling annual returns of the S&P 500 since 1963

The market has never run this far this quickly to a multiple this high.

#StockMarket

#SP500

5

6

26

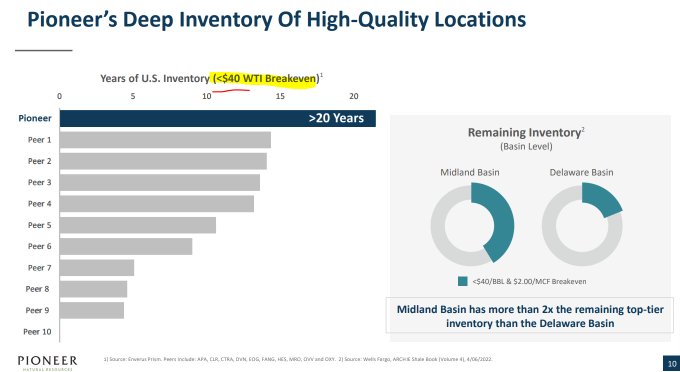

@PXDtweets

@business

13/ The slide below shows that they have drilling inventory of 20 years that allows them to break-even at $40 WTI. So the company is not running off the last few years of available oil or facing some huge problem from high-grading to pump margins short term.

1

1

27

@tedcross

Fantastic post.

One of the things very few people are focused on.

The world takes supply for granted. A hard shock could be coming.....

2

2

26

@PXDtweets

10/ After that they use the rest of FCF to buy back stock or pay-down debt which is net $3bn and going away quickly.

1

0

26

@MacroCharts

Sometimes it feels like there is money lying in plain daylight.

What could we be missing here?

Indexes almost back to the '21 peaks, multi-trillion dollar quality at 3% FCF yields with money markets yielding 5.5% and real-economy stocks at 10% - 20% FCF yields.

How this?

1

1

24

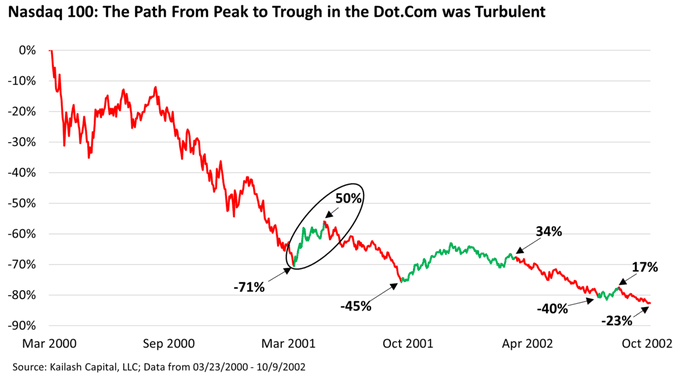

@GuyDealership

as bubbles deflate, they have rip-roaring short lived rallies followed by money siphoning declines.

1

0

23

@KobeissiLetter

From a logical perspective, it would be difficult to make a compelling case for a "comfortably long" mentality.

But the markets haven't reflected logical reality in quite some time.

4

0

24

@DoombergT

2/ Barring some very good fortune we are all going to be learning about the business of chemical plants.

1

5

24

@DonMiami3

In 1999, Buffett explained that if corporate margins got above 6% that meant workers were getting crushed and we'd have real social problems.

Well margins are over 10% today - above the last high in 1929.

The good news is we've been here & can recover

1

4

25

@PXDtweets

11/ The presentation was made when the stock was at $260 per share. It is now at $235.

1

0

25

@Josh_Young_1

@BisonInterests

Truly remarkable how uncomfortable it has been owning stocks up 60%+ in a down -20% tape

When it gets comfortable then I will worry….

1

0

24

Such an important piece of research by

@BisonInterests

We are willfully walking ourselves into catastrophe

Gas to Oil Switching – Winter is Coming

2

5

24

@KobeissiLetter

It will be interesting to see if we are witnessing profit-taking or if this is the early stage of a correction.

3

0

24

@KobeissiLetter

@GlobalMktObserv

Even Larry Fink is sounding the alarm now, stating that the situation is more urgent than he can ever remember.

0

1

22

@chigrl

How is it that such well-intended people do not realize they are effectively the "pro-famine" crowd?

Where do they think food, heating and A/C come from?

Routinely over 106 degrees in India with high humidity killing people. 80% of the population does not have A/C

4

1

23

At $3 trillion dollars $AAPL is:

An ex-growth

#techstock

trading at 30x earnings

That's a 65% premium to the risk free rate &

Worth more than the entire US

#EnergySector

...

Which controls the bulk of

#shale

assets which produced 70% more oil than

#SaudiArabia

.

Thoughts?

4

2

23

@Geiger_Capital

It's "boiling the frog" style incrementalism...slowly eating away at purchasing power.

0

1

23

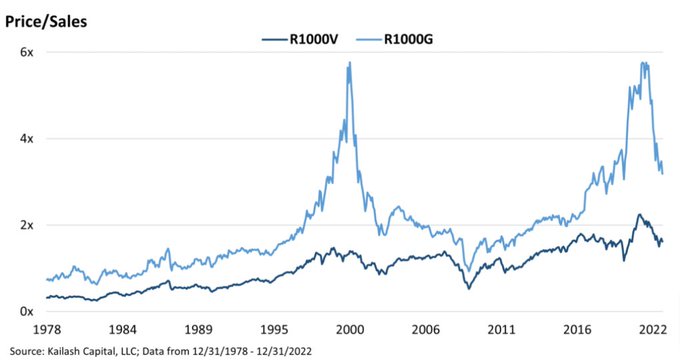

Look at the

#valuation

spread below. If you believe history rhymes, there may be more tough sledding ahead for

#Growth

compared to

#Value

.

2

9

22

Well said

@agnostoxxx

!

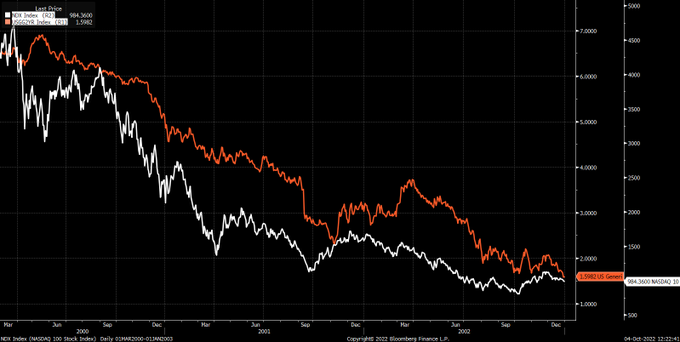

What IF...(BIG IF)

Yields peaked...

Dollar peaked...

BUT earnings keep going down the toilet?😏

Shocking right?

FYI this happened in 2000: the 2-year peaked at 7% then declined to 1.6% over 2 years. Meanwhile, the Dollar was flat whereas the $NDX lost ...80% of its value

#Pain

68

106

766

2

1

23

@DoombergT

10/ Turning on coal but not stopping the nuclear shutdown is an odd step that suggests German politicians and public (?) still think this issue is short-term. Maybe it is.

1

0

20

@JavierBlas

It's shocking that common sense statements like this are considered "controversial" to many people.

1

0

22