Eric Basmajian

@EPBResearch

Followers

125K

Following

13K

Media

5K

Statuses

14K

The economist who works for you, not Wall Street | Founder of EPB Research specializing in business cycle analysis for asset managers & cyclical business owners

Joined February 2015

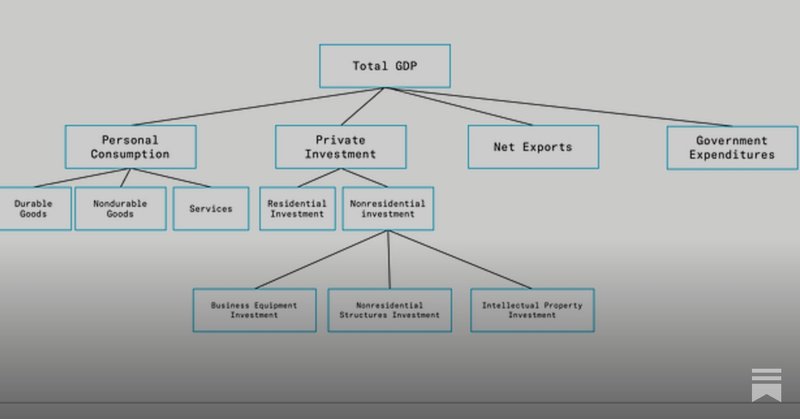

The 20% of the Economy That Drives 100% of Recessions Why conventional analysis fails — and the three sectors you should actually be watching. https://t.co/chqLrWB4rJ

blog.epbresearch.com

Why conventional analysis fails — and the three sectors you should actually be watching.

15

47

243

For the private sector, the job opening rate is stable. Hiring rate and quits are remain extremely weak while the layoff rate ticked up slightly. It remains an extremely tough labor market for new entrants and those looking for a job. Layoffs are still generally low.

4

11

56

Can any auto industry experts weigh in? I’ve heard many theories including production is for rental car fleets or smaller business truck/vans for last mile delivery (Amazon).

Production of consumer autos & trucks is declining sharply 📉 Production of business vehicles is exploding 📈 What's the best explanation for this?

12

9

56

Production of consumer autos & trucks is declining sharply 📉 Production of business vehicles is exploding 📈 What's the best explanation for this?

26

9

126

There are major divergences ongoing in motor vehicle production, the most important segment of manufacturing. Light trucks 📈 Heavy trucks 📉 If you're interested in our framework and these reports, you can learn more or get in contact with us here: https://t.co/h42pTlIn8w

0

4

19

This week, we dove into the manufacturing cycle & what's driving industrial production. Each week, we cover business cycle trends and focus on key sectors like residential construction & manufacturing. Our latest blog highlights our cycle framework: https://t.co/chqLrWBChh

4

7

31

All the signal is in Cyclical GDP. During non-recessionary periods, Cyclical GDP grows at an average rate of 8.0% in nominal terms. During recessions, it contracts at -5.2% on average. Focus on "Cyclical GDP." Read more here: https://t.co/chqLrWB4rJ

4

12

80

The 20% of the Economy That Drives 100% of Recessions Why conventional analysis fails — and the three sectors you should actually be watching. https://t.co/chqLrWB4rJ

blog.epbresearch.com

Why conventional analysis fails — and the three sectors you should actually be watching.

15

47

243

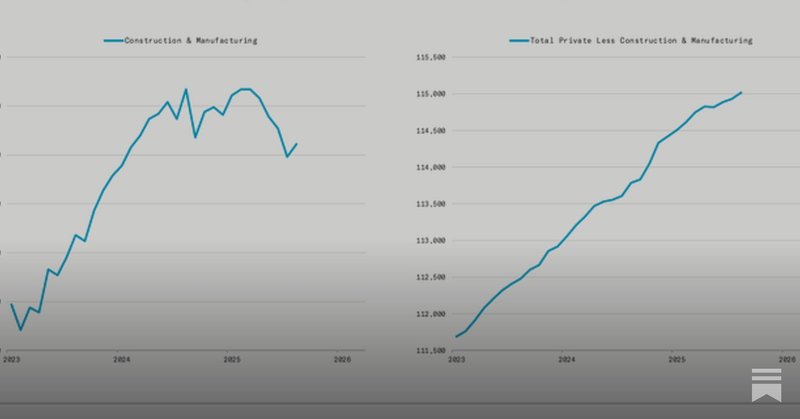

Some very interesting and somewhat abnormal trends are going on in the economy's most cyclical sectors. We discuss the details in our latest blog 👇

The 20% of the Economy That Drives 100% of Recessions Why conventional analysis fails — and the three sectors you should actually be watching. https://t.co/chqLrWB4rJ

2

3

45

Great post 🎩 @EPBResearch

The 20% of the Economy That Drives 100% of Recessions Why conventional analysis fails — and the three sectors you should actually be watching. https://t.co/chqLrWB4rJ

1

1

15

"Despite popular opinion, most segments of the economy do not contract and are generally extremely stable. That stability makes them useless for understanding where we are in the cycle—and where we’re headed next."

1

4

30

A big societal tension is that we have a large "social safety net" and not much scope to increase it further, but a small portion is distributed based on income rather than age.

1

1

10

Government transfer payments account for almost 20% of total personal income. But roughly 60% of those transfer payments are directed at the older demographic (Social Security and Medicare).

2

7

38

The corporate sector is running nearly 20% pre-tax profit margins. A secular increase from the early 1990s. Profound implications stem from these extreme profit margin levels including valuations, the labor market, and inequality.

11

40

181

Cyclical vs. Non-Cyclical Payrolls It’s always most important to analyze the health of construction & manufacturing because you can spot potential inflection points first, as they occur in these sectors before bleeding into the aggregate statistics. https://t.co/9OWAVVQlDG

9

18

108

Benchmark revisions to the industrial production data revealed that manufacturing output is lower than previously estimated.

5

17

72

What’s a better societal trade off when faced with the choice:

17

2

20

Excessive debt suppresses the population’s real income growth. To bridge an income deficiency, people take to speculation since the path of savings appears hopeless.

18

20

170