Javier Blas

@JavierBlas

Followers

326K

Following

51K

Media

12K

Statuses

54K

Energy and commodities columnist at Bloomberg. Co-author of the 'The World for Sale' https://t.co/GAcVleqiqp Any views expressed are my own. [email protected]

London

Joined August 2013

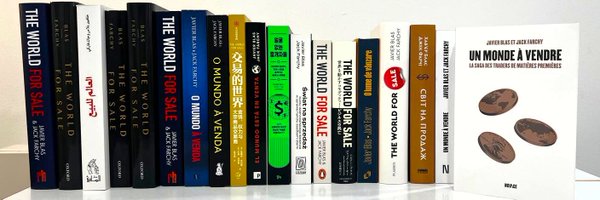

This week, The World for Sale comes out in paperback. It explains how oil and commodity markets work, how they influence geopolitics, and the extraordinary power of a few traders you've probably never heard of. Please take a look

350

639

4K

Orsted down >20% in early trading. After the plunge, its market cap is down to ~$15 billion. (The problem with this company is that historically its leadership has been in business of building at **any costs** GW of wind power, rather than **profitable** GW of wind power).

European wind giant Orsted says it will conduct an emergency >$9 billion equity raising to shore up its balance sheet (the rights issue isn’t a surprise, but the size is nearly double market expectations). The right issue equals to ~50% of the company’s current market cap.

27

84

329

It’s official: Donald Trump says he will meet with Vladimir Putin in Alaska next Friday (Aug 15). The announcement suggests there’s, at the very least, an understanding of a deal | #OOTT

25

38

147

Sounds like New Delhi will keep buying Urals? . ". my friend President Putin. ".". reaffirmed our commitment to further deepen India-Russia strategic partnership. ". #OOTT #India.

Had a very good and detailed conversation with my friend President Putin. I thanked him for sharing the latest developments on Ukraine. We also reviewed the progress in our bilateral agenda, and reaffirmed our commitment to further deepen the India-Russia Special and Privileged.

28

28

194

OIL MARKET: Exxon Mobil starts its 4th FPSO in Guyana, four months ahead of schedule, targeting output of ~250,000 b/d (and lifting installed output in the country to ~900,000 b/d). Four more FPSOs expected by 2030. In 2H 2025, non-OPEC+ production is booming | #OOTT.

13

50

206

The head of Glencore's huge coal-trading operation is leaving in the biggest shake-up of the company’s trading unit in years. @jfarchy #Coal #CoalTwitter.

bloomberg.com

The head of Glencore Plc’s huge coal-trading operation is leaving in the biggest shake-up of the company’s trading unit in years.

One of the most amazing details of Glencore's 1H 2025 results is how little money its energy traders made. On EBIT basis, Glencore's energy traders (crude, oil products, gas, LNG, and coal) made ~$40 million in six months. "Of course, I’m not happy," says CEO Gary Nagle. #OOTT.

4

12

69

Record high beef prices are the main reason behind the rebound in global wholesale food prices — see here for more:

bloomberg.com

A shrinking herd is pushing the cost of meat to record highs.

22

29

127

OIL MARKET: The short-term oil price view from ConocoPhillips CEO Ryan Lance: "It's a bit imbalanced, more supply than demand." #OOTT

4

12

140

BIG OIL 2Q EARNINGS: With the earning reporting on the back mirror, interesting to look at share performance over the last year. Chevron emerges as the clear winner, up 7.6%, almost parallel to the 8.1% drop for Exxon Mobil. Looks like Mike Wirth has his mojo back | #OOTT

7

8

59

COLUMN: A bullish case for oil -- eventually. "When a bet goes wrong, investors are often tempted to hold on, convincing themselves that their short-term trade was always meant to be a long-term position.". #OOTT .

bloomberg.com

Crude prices will head lower before any rebound.

11

12

99

It's ~6 months since the Greenland-mining mania. Anything happening? Much rare earths? Unobtanium?. #CommodityHypeOfTheYear.

12

16

191

BREAKING: Kremlin says Putin-Trump meeting in next few days has been "agreed." Both sides working on it. No further details | #OOTT.

16

56

213

COLUMN: A bullish case for oil - eventually. "For now, everything points to lower prices in the next few months [. ] Over time, the current low prices will create the foundations for the next cyclical upturn. But that’s far, far away.". #OOTT @Opinion

bloomberg.com

Crude prices will head lower before any rebound.

14

32

157

And here India's response: . ". unfair, unjustified and unreasonable. ". ". India will take all actions necessary to protect its national interests. ". #OOTT #India

mea.gov.in

Statement by Official Spokesperson

3

8

41