Wasteland Capital

@ecommerceshares

Followers

95,113

Following

761

Media

3,848

Statuses

27,804

Escaped the Vampire Squid, surviving in the wasteland. Investing in bottlecaps, US UK EU & global assets. Also, jokes. Liking is not endorsing. Do your own DD.

London

Joined March 2012

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

SEVENTEEN

• 1177711 Tweets

Davido

• 604288 Tweets

Lakers

• 236065 Tweets

Nuggets

• 111624 Tweets

Jamal Murray

• 74452 Tweets

Denver

• 53528 Tweets

Darvin Ham

• 48848 Tweets

#Covishield

• 46362 Tweets

Jokic

• 34015 Tweets

#ArrestNarendraModi

• 26519 Tweets

Hamilton Hall

• 25529 Tweets

渡航費用12.6億円

• 23317 Tweets

政務三役31人

• 21729 Tweets

MakananKHAS SeruASIK

• 18510 Tweets

Reaves

• 17897 Tweets

JajanENAK DikotaGUE

• 17721 Tweets

風呂キャンセル界隈

• 17268 Tweets

円安放置

• 15650 Tweets

無料10連

• 15553 Tweets

外遊三昧のア然

• 15189 Tweets

桂由美さん

• 14854 Tweets

エスクプス

• 14139 Tweets

Vando

• 13180 Tweets

ヴィルトゥオーサ

• 12113 Tweets

Anthony Davis

• 12056 Tweets

タワレコ

• 10336 Tweets

Last Seen Profiles

Pinned Tweet

H1 21 came to a close, and the

#WastelandCapStash

portfolio is now up 179.4% since last summer’s start and 42.2% YTD. The portfolio added 7.2 percentage points in June on a YTD basis.

Open positions below. (1/3)

Milestone: I’ve reached the 1-year anniversary of the

#WastelandCapStash

portfolio! 🥳 It’s up $165.3% in USD since start a year ago. The starting $1m is now $2.65m. It’s +35.0% YTD.

You can click through these tweets to see it from the start. Open positions below (1/4)

4

5

60

43

30

367

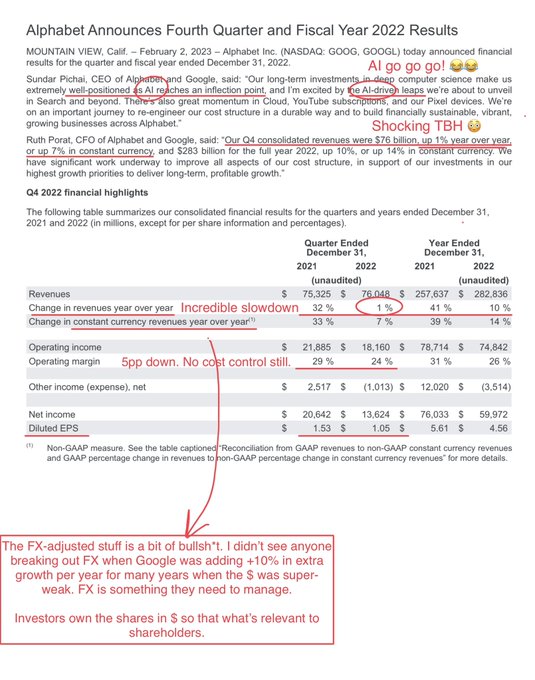

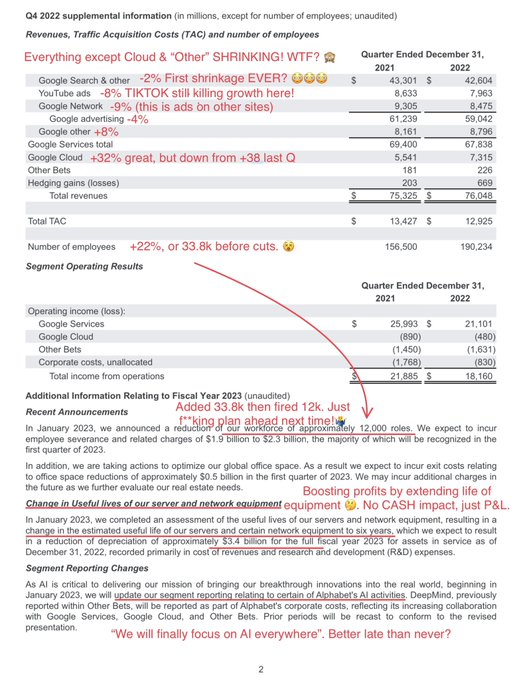

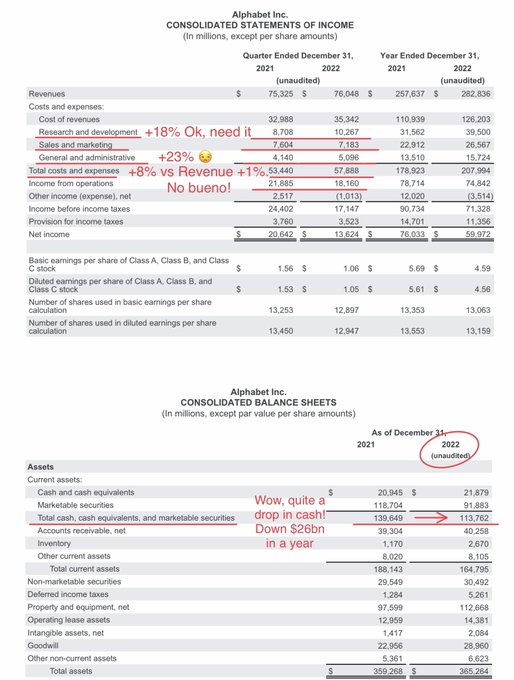

$META Flaming dumpster fire 🔥 miss, guide even worse. Rev DOWN 4% yet costs up 19% 😵! Users flat, but average ad price -18% y/y. 🤮 Not Inflation! Capex 2x+. Added 19k employees +28% y/y 😱. Zero cost control. Expects costs to grow from ~$85bn ‘22 up to $101bn in ‘23. 🤯

#RIP

148

647

4K

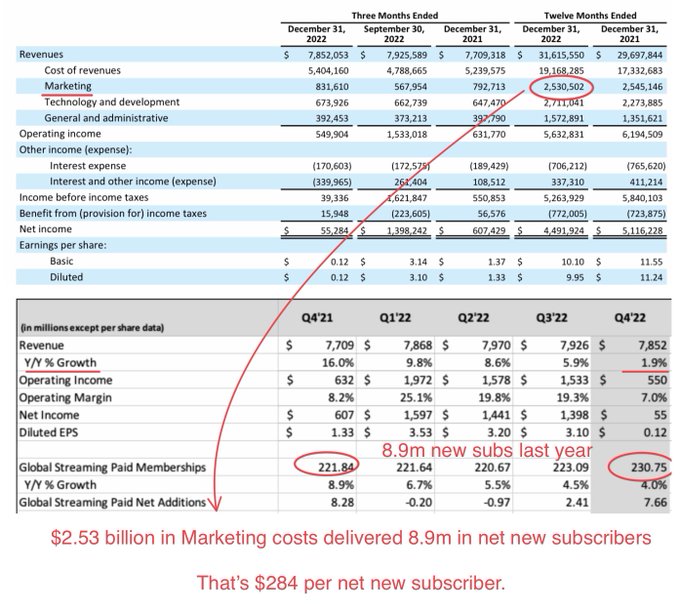

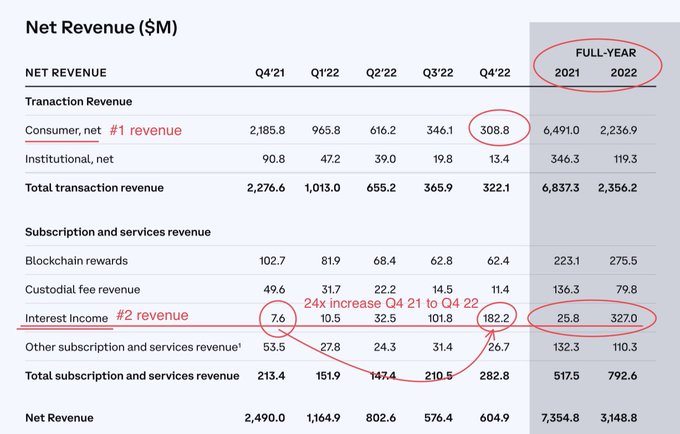

$COIN It’s truly ironic that the

#2

largest revenue line at the largest listed Crypto exchange is “interest income” they get from depositing their own & customers’ USD cash in US Treasuries.

Staking fiat with Uncle Sam is now their core business.

Just ironic.

116

353

3K

@MacroAlf

Hey Alf, if you’re going to repost my stuff WITH MY NOTES ON IT then please at least attribute it! Theft is uncool. ☹️

86

54

2K

$META bagholders about to get diluted by a freshly printed 425 million new shares giveaway to employees! That’s $53 billion in grants (!) at the current $125 price, or 16% of market cap! ✌️

“Low FCF multiples” LMFAO. You got ZUCKED!

H/t

@jimmydagreek76

@AyeshaTariq

99

255

2K

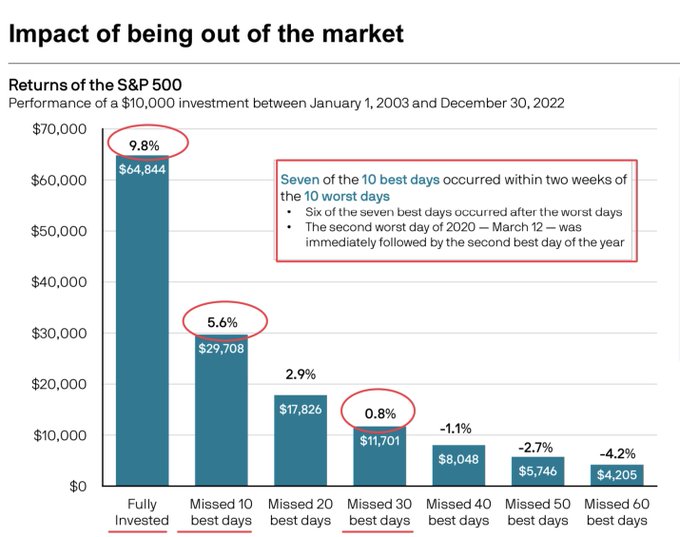

Wow: The S&P500 is exactly flat since the Fed started to hike rates. Imagine, we went from 0 to 5%+ rates and equities are… fine. 🥹 We did see a 17% max drawdown last fall… but all of that is now recovered.

114

209

1K

Credit Suisse Investment bankers: We just made $2bn in fees from dominating SPAC issuance this quarter. 800 people working full time 24/7 on deals.🙂

Credit Suisse Private bankers: Our team of two just lost $4bn on a margin loan to Bill Hwang’s family office. 😬

#LifeInBanking

19

74

945

European next-hour natural gas prices just went negative. 🥹

Not even “free gas”, you actually get paid to burn it. Because, just like oil during COVID, storage is full. Chart from

@JanVonGerich

Just as the doomsters predicted 🙄

37

232

900

It’s simply fascinating (and scary) that so many people in finance (of all levels) had no idea how banks actually work, considering they constantly interact with banks or work at banks.

On the other hand, it explains a lot. A LOT.

43

70

848

$AMZN issued $17.7 billion in stock equity comp (SBC) to employees in the last 12 months. It’s the equivalent of $145 in stock per US household (122m), more than the $139 Prime fee.

If this was an IPO or equity offering, it would be the

#2

deal globally after Porsche, $19.5bn.

32

95

849