The Kobeissi Letter

@KobeissiLetter

Followers

503,780

Following

511

Media

3,320

Statuses

15,254

Official X account for The Kobeissi Letter, an industry leading commentary on the global capital markets. Email us: support @thekobeissiletter .com

United States

Joined June 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 301638 Tweets

Baba

• 107534 Tweets

Valencia

• 75395 Tweets

Madonna

• 51493 Tweets

Francis

• 47639 Tweets

Lewandowski

• 45363 Tweets

Araujo

• 43648 Tweets

Idolo

• 43428 Tweets

Rock in Rio

• 41655 Tweets

Peruzzi

• 40847 Tweets

Seinfeld

• 36985 Tweets

$BRETT

• 35980 Tweets

Burna

• 33717 Tweets

Farouk

• 29638 Tweets

Fermín

• 27635 Tweets

Nancy Pelosi

• 23977 Tweets

#KızılGoncalar

• 23309 Tweets

Katy Tur

• 19839 Tweets

オリンピック出場

• 18645 Tweets

Ter Stegen

• 18236 Tweets

JAMB

• 15427 Tweets

Girona

• 12994 Tweets

Wizzy

• 10641 Tweets

Gbedu

• 10174 Tweets

Popsy

• 10165 Tweets

Last Seen Profiles

The Kobeissi Letter Retweeted

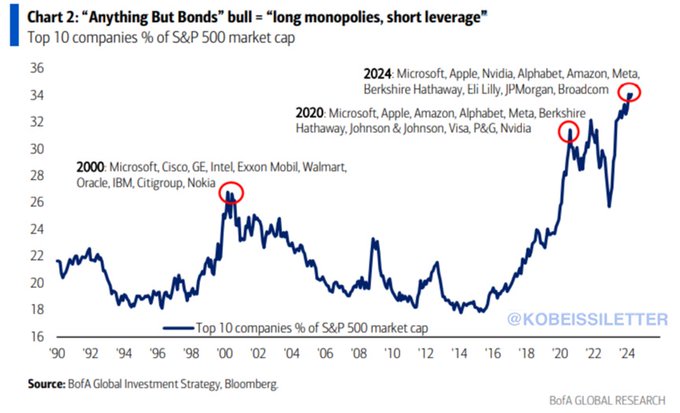

"We have been cautiously bullish for the last 8 months," says

@KobeissiLetter

's

@TKL_Adam

. "Sentiment is just so euphoric right now and so strong that it's tough to even fight it." $SPX

2

6

15

Tune in LIVE on CNBC in 5 minutes!

Looking forward to joining Brian Sullivan,

@SullyCNBC

, at 7:00 PM ET on CNBC.

Discussing markets ahead of the long anticipated May Fed meeting.

Also talking about tech stocks and the recent volatility which has created some great trade opportunities.

Tune in LIVE!

5

2

25

6

2

31

The Kobeissi Letter Retweeted

Looking forward to joining Brian Sullivan,

@SullyCNBC

, at 7:00 PM ET on CNBC.

Discussing markets ahead of the long anticipated May Fed meeting.

Also talking about tech stocks and the recent volatility which has created some great trade opportunities.

Tune in LIVE!

5

2

25