🇺🇸 GammaLab

@gammalab_tweets

Followers

7,960

Following

323

Media

1,832

Statuses

4,823

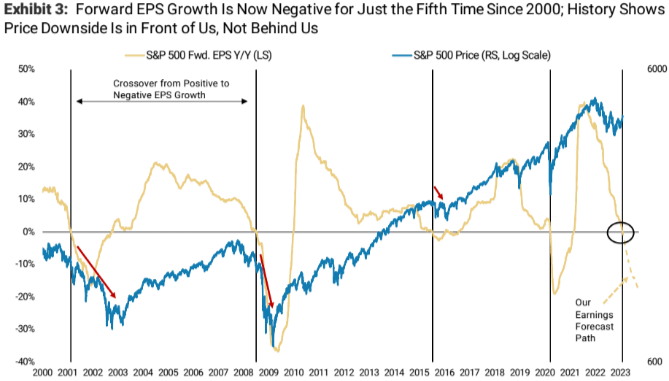

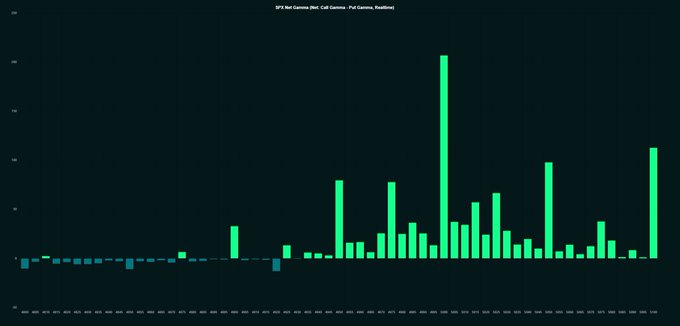

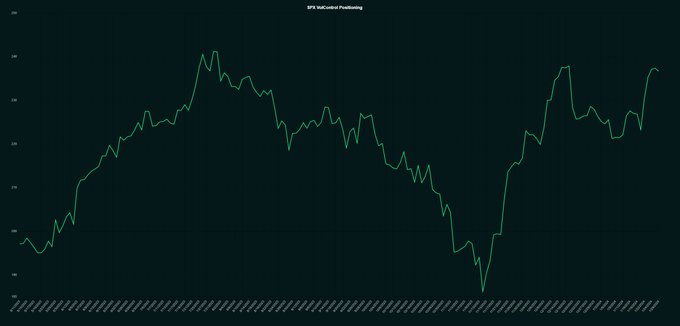

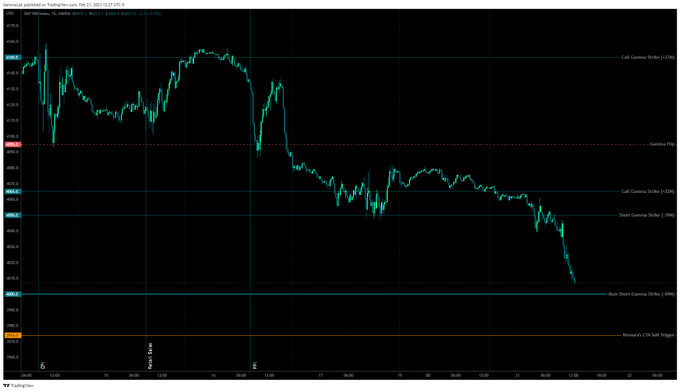

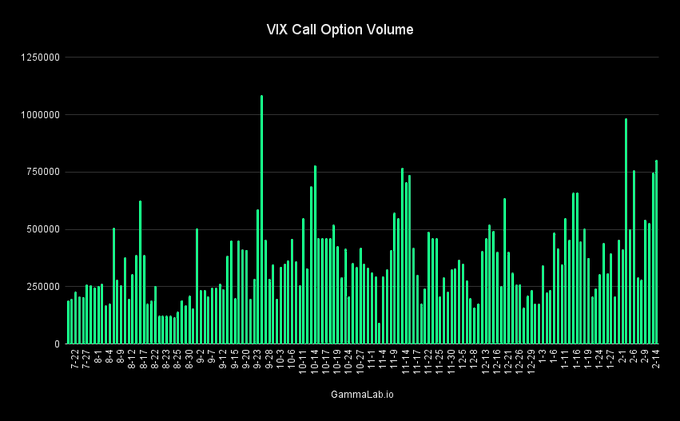

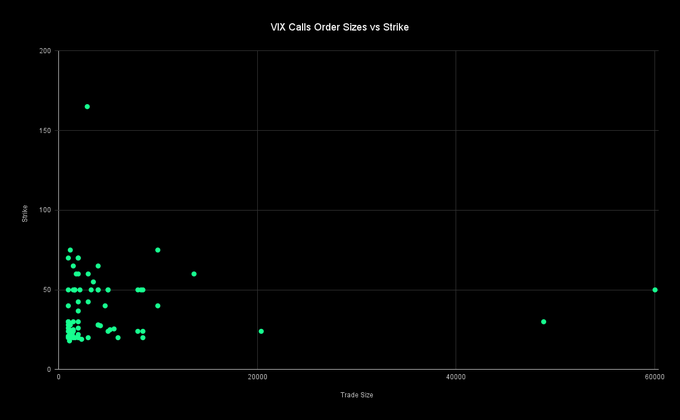

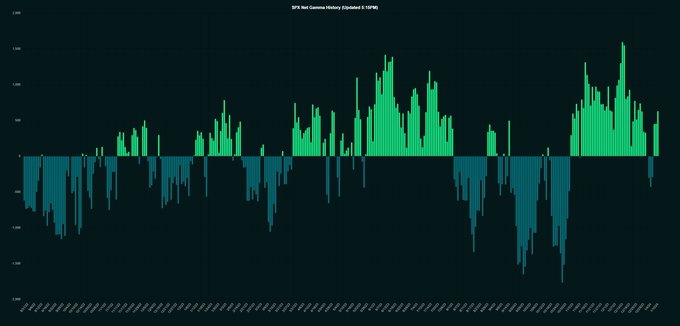

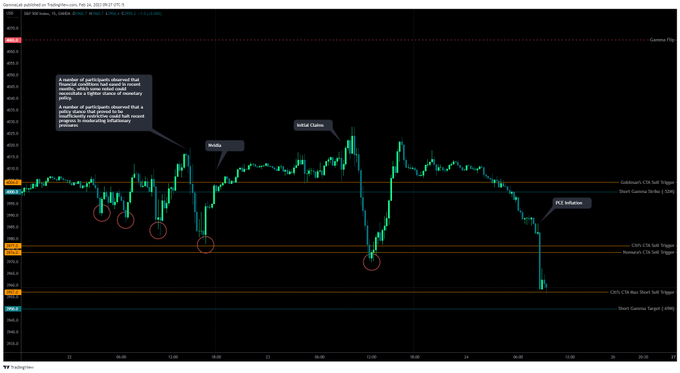

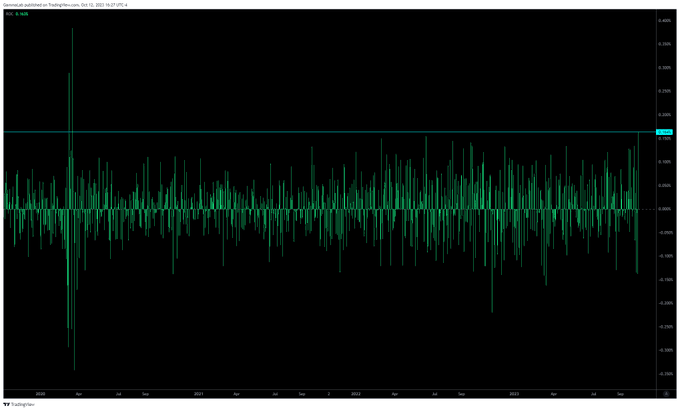

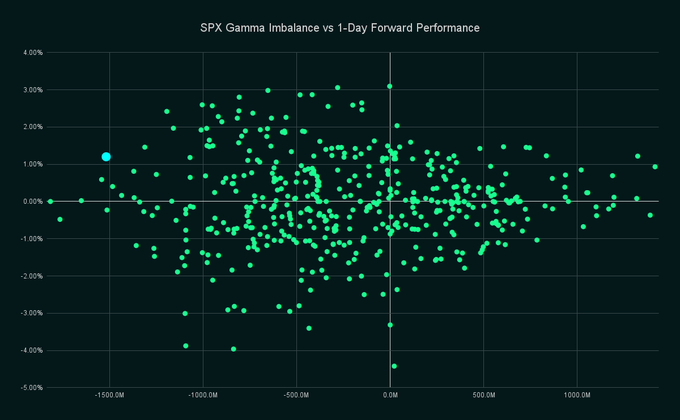

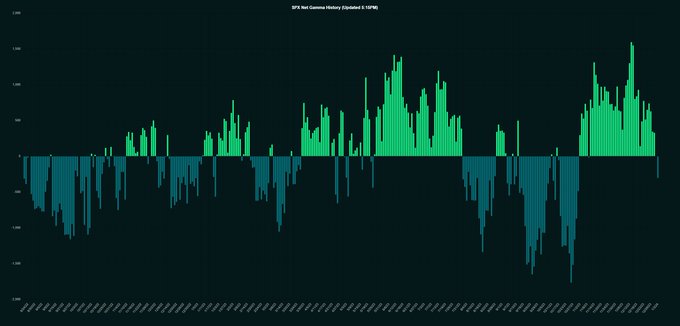

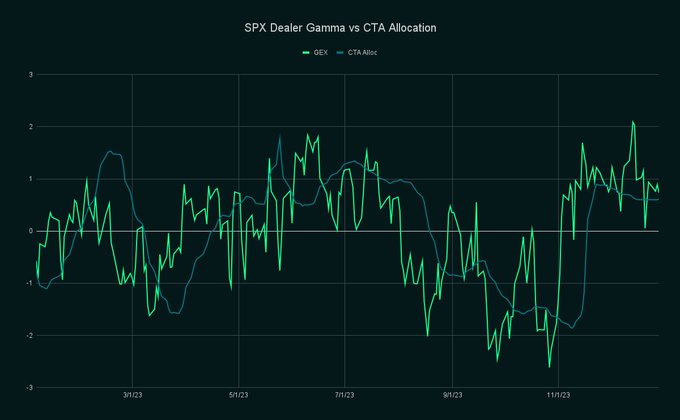

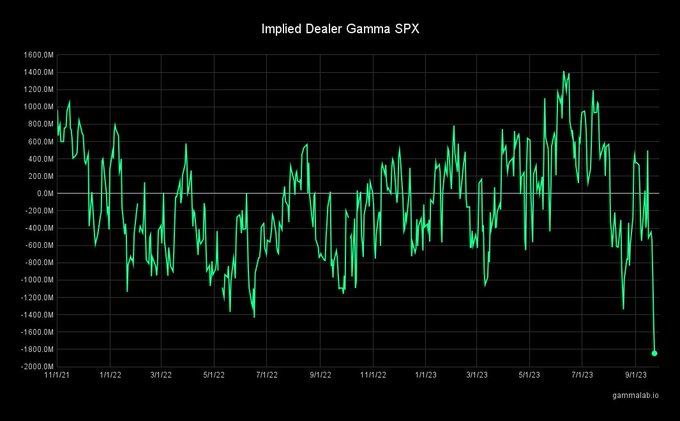

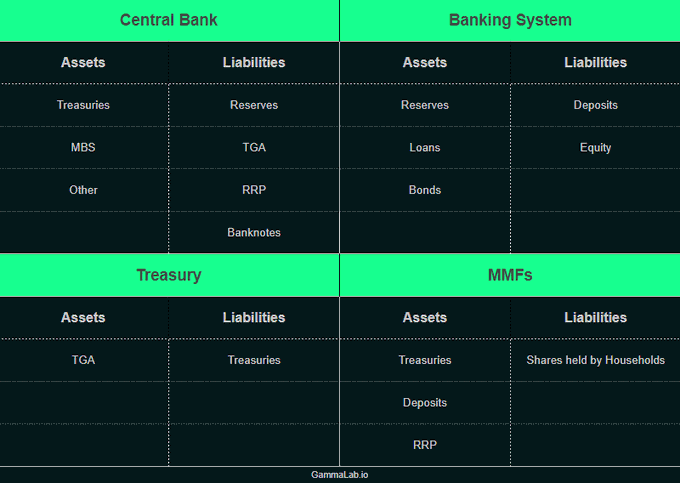

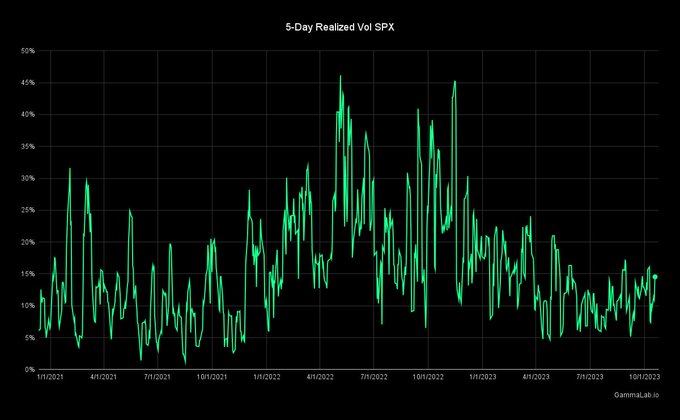

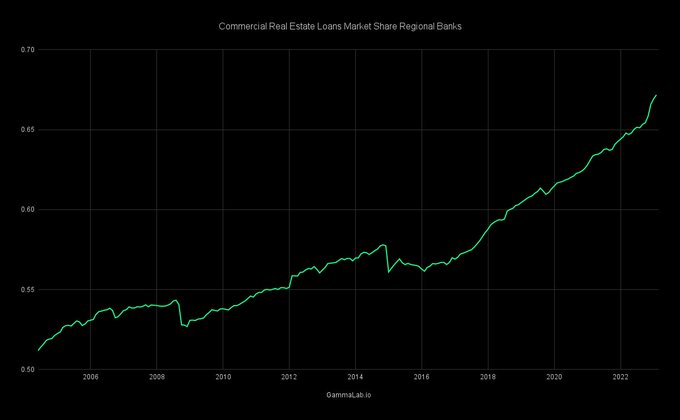

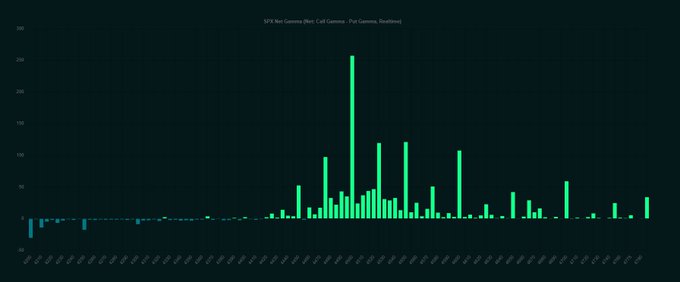

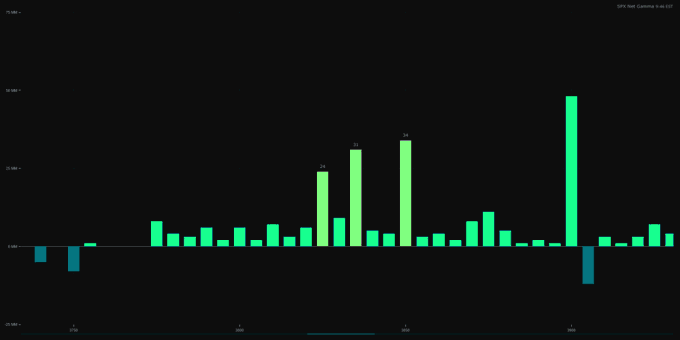

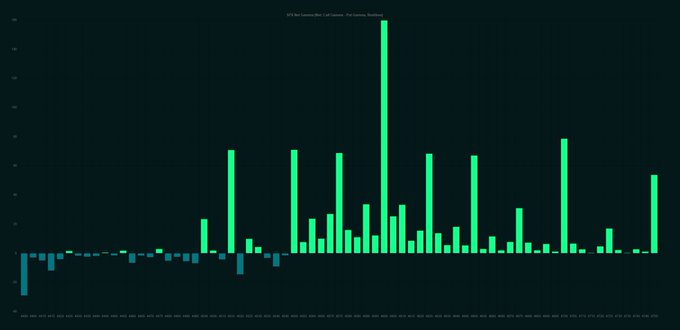

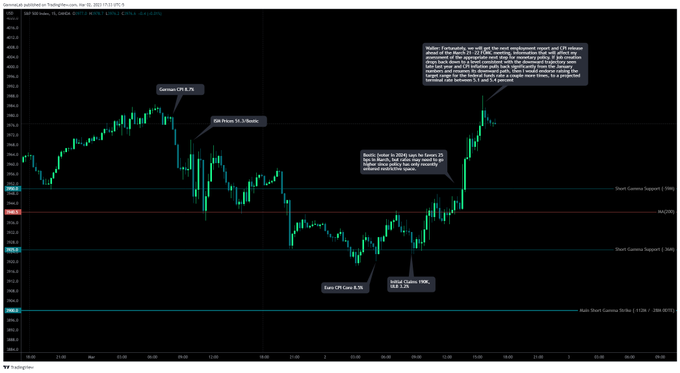

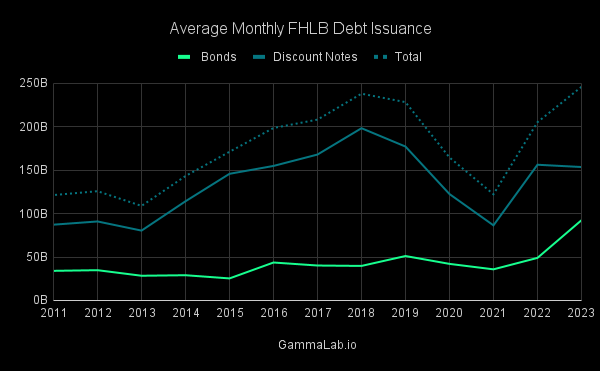

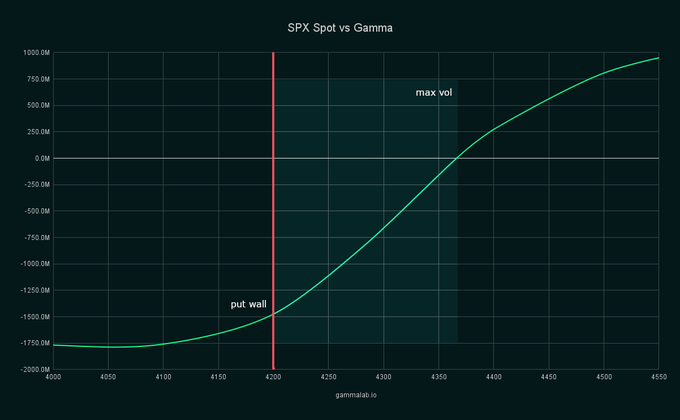

We analyze tens of thousands of option contracts daily to provide data that enables you to get a better picture about market liquidity.

United States

Joined October 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Bridgerton

• 405091 Tweets

Butker

• 242969 Tweets

Colin

• 122093 Tweets

billie

• 90086 Tweets

Catholic

• 79914 Tweets

Penelope

• 75926 Tweets

Xavi

• 60251 Tweets

Daniel Perry

• 52818 Tweets

#岩本照誕生祭2024

• 35516 Tweets

Greg Abbott

• 34481 Tweets

Fermin

• 33890 Tweets

Marcelo

• 29755 Tweets

GTA 6

• 29370 Tweets

Megalopolis

• 26881 Tweets

Leeds

• 26354 Tweets

iMessage

• 26103 Tweets

#SVGala11

• 25303 Tweets

優三さん

• 19061 Tweets

ひーくん

• 18001 Tweets

Laporta

• 15391 Tweets

Norwich

• 13572 Tweets

Miri

• 13067 Tweets

SIEMPRE QUE LO BESO

• 12178 Tweets

Gorka

• 11069 Tweets

Last Seen Profiles

@MikeBenzCyber

This guy got everything wrong and mislead generations of politicians, and now he wants to get rid of competing ideas?

4

8

240

@seanmdav

This senior executive needs to speak to the public on X for an hour instead of Elon Musk only.

4

3

107

@VigilantFox

@ManInAmericaUS

If it is an attack it has to be multipronged because the US population is too diverse genetically. Simplified scenario: 1) Initial attack, 2) Vaccination response, 3) Follow-up attack based on vaccination patterns. It's been well-described in academic literature.

3

9

44

@zerohedge

Stop it. Every time Dimon and Epstein appear in the same headline a bank fails shortly after (and gets rescued by JPM).

4

4

30