ʎllǝuuop ʇuǝɹq

@donnelly_brent

Followers

70,859

Following

814

Media

2,303

Statuses

23,147

President of @Spectra_Markets . Author of am/FX and Alpha Trader. I like trading, table tennis, my family, writing, hard/fast music, and poker. Not in that order

ct

Joined May 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Knicks

• 136461 Tweets

Amethi

• 129509 Tweets

राहुल गांधी

• 116510 Tweets

Bucks

• 83154 Tweets

Sixers

• 69760 Tweets

Brunson

• 65115 Tweets

Pacers

• 61208 Tweets

Racing

• 60058 Tweets

憲法記念日

• 57017 Tweets

Embiid

• 54357 Tweets

Philly

• 54335 Tweets

Game 7

• 45958 Tweets

#Raebareli

• 44055 Tweets

#PONDSXTZUYU

• 38465 Tweets

憲法改正

• 36071 Tweets

Leafs

• 33494 Tweets

Dua Lipa

• 33469 Tweets

Maxey

• 30825 Tweets

Bruins

• 27106 Tweets

Rony

• 25243 Tweets

76ers

• 24771 Tweets

FREENBECKY IS OUR HOME

• 23114 Tweets

Estevão

• 21058 Tweets

Tobias Harris

• 20114 Tweets

連休初日

• 19996 Tweets

Josh Hart

• 18875 Tweets

ゴジラ-1.0

• 18475 Tweets

#FattuPappu

• 18425 Tweets

स्मृति ईरानी

• 17200 Tweets

Hield

• 16771 Tweets

Pachuca

• 15982 Tweets

Smriti Irani

• 15692 Tweets

チャレンジクルー

• 13908 Tweets

किशोरी लाल शर्मा

• 11563 Tweets

Ester

• 11498 Tweets

Hayırlı Cumalar

• 11278 Tweets

Pumas

• 10499 Tweets

Last Seen Profiles

@BillAckman

@SVB_Financial

@jpmorgan

@Citi

SIVB used low lending standards to attract unprofitable tech cos then took their deposits and gambled on MBS. You want to encourage that again next cycle?

A bit of short term pain is necessary. Everyone knew the 250k rule and they ignored it so they could get preferential loans…

162

299

3K

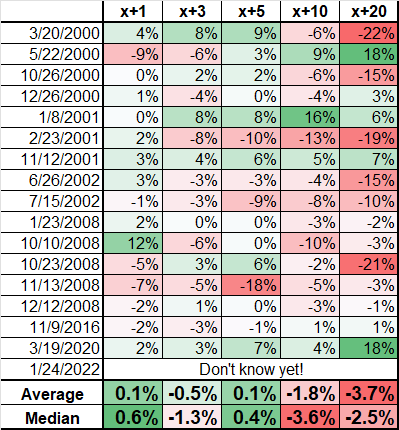

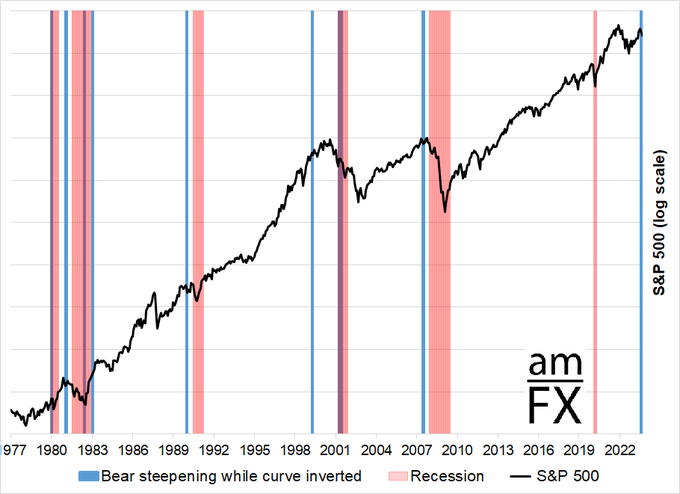

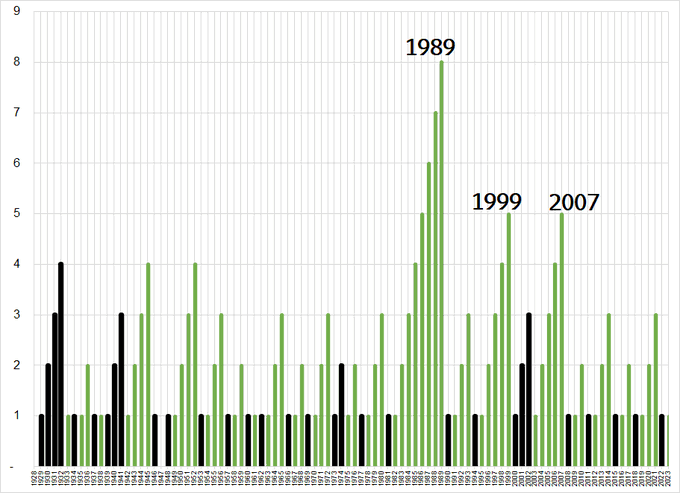

Today the NASDAQ reversed a >4% intraday loss to close the day higher. Here are the other times that happened and the fwd returns in x+# of days.

The main takeaway is this is bear market stuff. Not bullish.

inspired by a tweet from

@bespokeinvest

HT Gitt

53

239

1K

My new book is out!

Alpha Trader: The Mindset, Methodology and Mathematics of Professional Trading

25 years of trading and writing experience, distilled down into one highly-readable, mind-expanding book. Foreword by

@EpsilonTheory

. Enjoy!

Buy it here:

118

170

1K

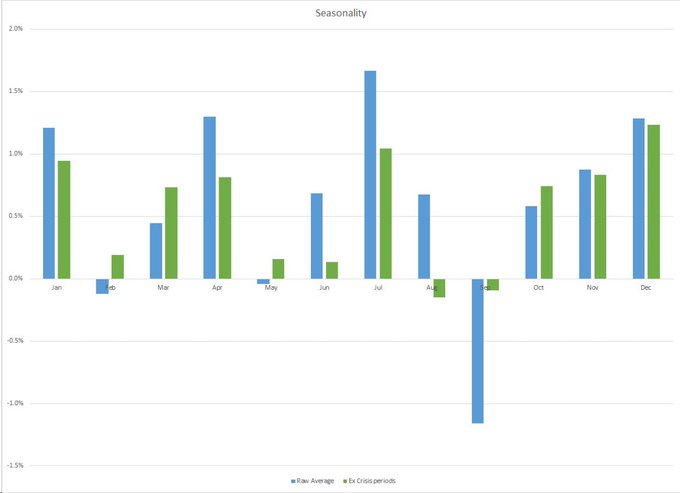

OK, I'll bite, Andy :]

Here's monthly SPX performance back to 1928, aggregate, and separated into two groups. One is before Halloween Effect was discovered (1986), and after. April outperforms in all cases. The sample size is 85 Aprils, pretty big. The reason is simple...

30

101

587

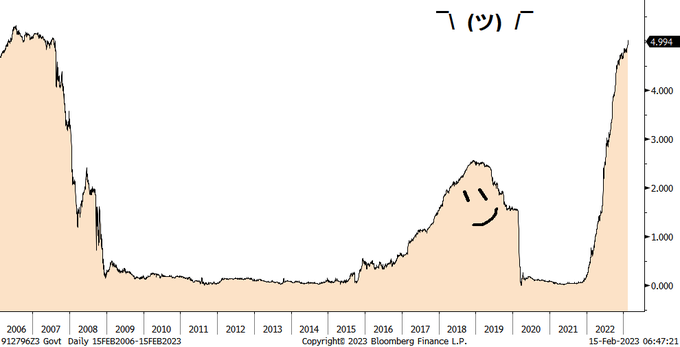

Watershed technical setup in 6-month t-bill yields as they have traced out a perfect Shrug Emoji pattern.

@pboockvar

24

57

532

This is what paying people for engagement will mean for Twitter. Nonsense and outrage bait overincentivized until it eventually crowds out most of the legitimate, useful content.

@elonmusk

97

31

476

@HenrikRummel

@BillAckman

@SVB_Financial

@jpmorgan

@Citi

People are arguing for a bailout of tech companies that went to an undiversified bank, attracted by low lending standards. You are too I suppose if you feel that is the smart take ?

17

10

456

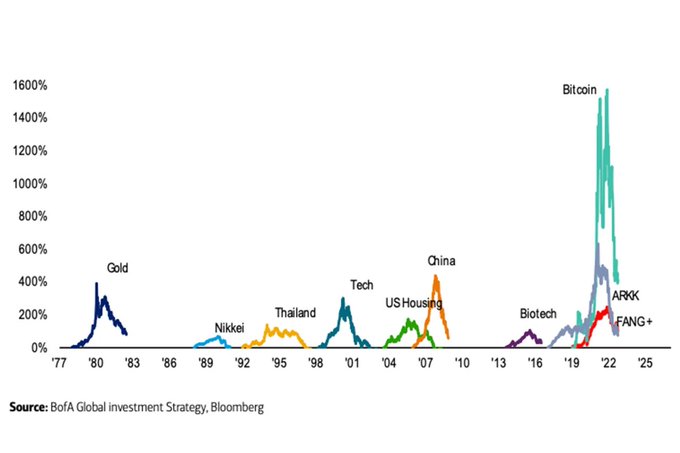

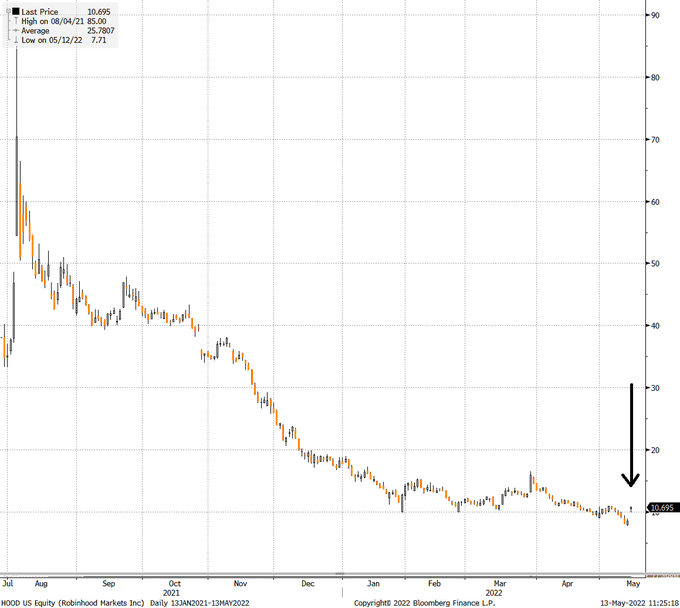

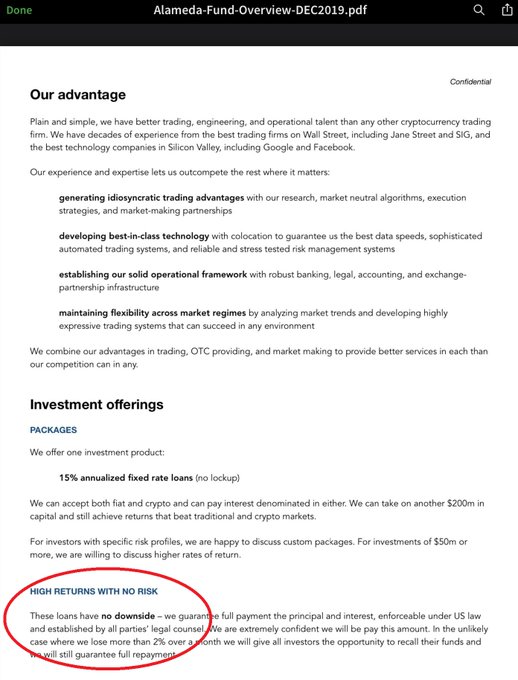

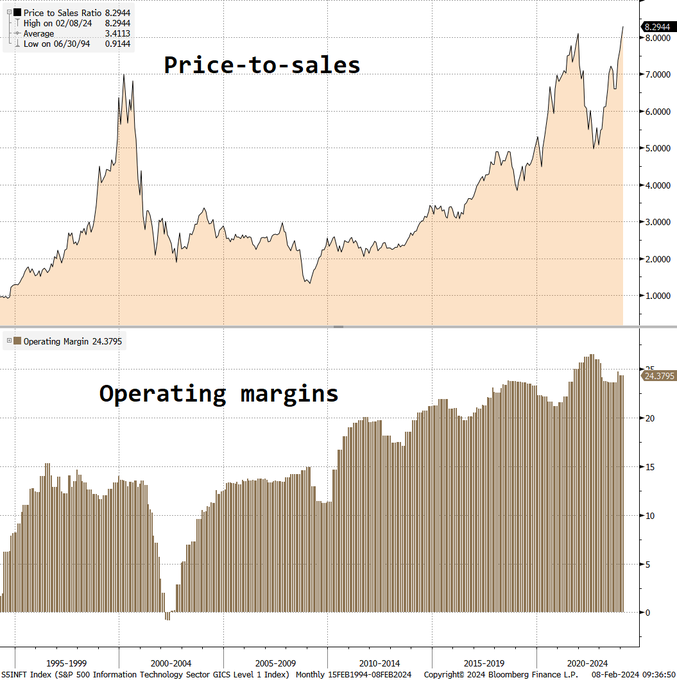

This is gross.

I am old enough to remember (eg) price to eyeballs in the late 1990s and Community Adjusted EBITDA etc. If you have to invent designer metrics to justify valuation you are in the 7th or 8th inning of the game.

A lot of people were asking are they really talking about

“ Price to Innovation P/I”

saying it’s the new P/E

Why yes here’s the clip with Morgan Stanley’s Best on

@moneymoverscnbc

90

74

360

61

49

455

The 2023 Trader Handbook and Almanac is out!

Available now in US and UK and will appear on all the Amazons around the world over the next 48 hours.

Retweets appreciated. Gracias.

US link

UK link

@ross_justin_d

68

103

391