Jared

@jaredhstocks

Followers

12,654

Following

139

Media

541

Statuses

3,009

Explore trending content on Musk Viewer

#LCDLF4

• 254445 Tweets

Renzo

• 149067 Tweets

Costello

• 114398 Tweets

Romeh

• 72945 Tweets

#WWERaw

• 70030 Tweets

SAROCHA REBECCA ON RED CARPET

• 64909 Tweets

Maripily

• 50376 Tweets

Lupillo

• 50217 Tweets

FELIX ENAMORA A BARCELONA

• 35647 Tweets

BLINDAJE FURIOSO

• 32592 Tweets

#ฤดูฝนนี้ไทยทึเมมีน้องสมบัติ

• 31376 Tweets

STRAY KIDS HITS HOT100

• 28518 Tweets

Scarlett Johansson

• 27715 Tweets

MADAME FIGARO X GULF

• 24290 Tweets

定額減税

• 21934 Tweets

Kingdom Hearts

• 20666 Tweets

Fani Willis

• 20358 Tweets

梅雨入り

• 20227 Tweets

Birds Nurturing

• 17701 Tweets

給与明細

• 14249 Tweets

#Canucks

• 13449 Tweets

Gunther

• 13056 Tweets

金額明記

• 12279 Tweets

Amber Rose

• 11949 Tweets

Lyra

• 11807 Tweets

#ゴンチャの新作

• 11136 Tweets

Keys For Healthy Life

• 11002 Tweets

Otis

• 10003 Tweets

Last Seen Profiles

Pinned Tweet

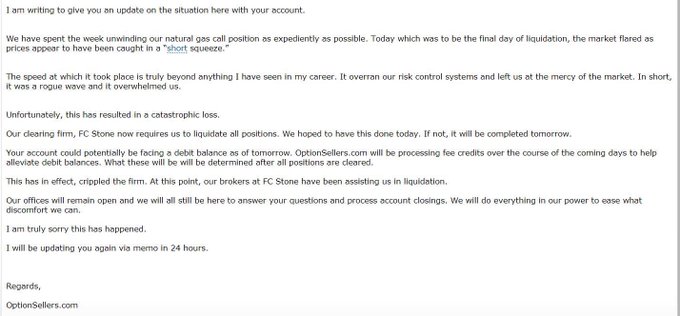

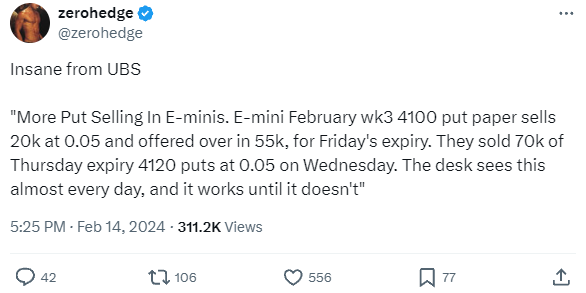

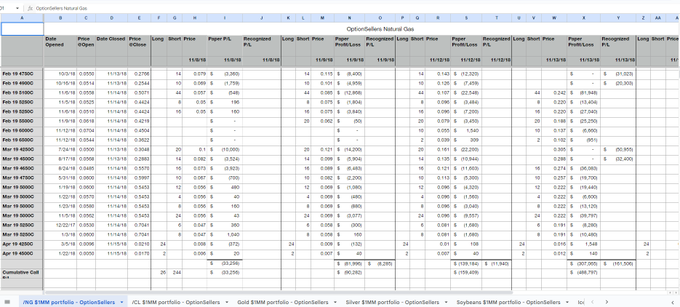

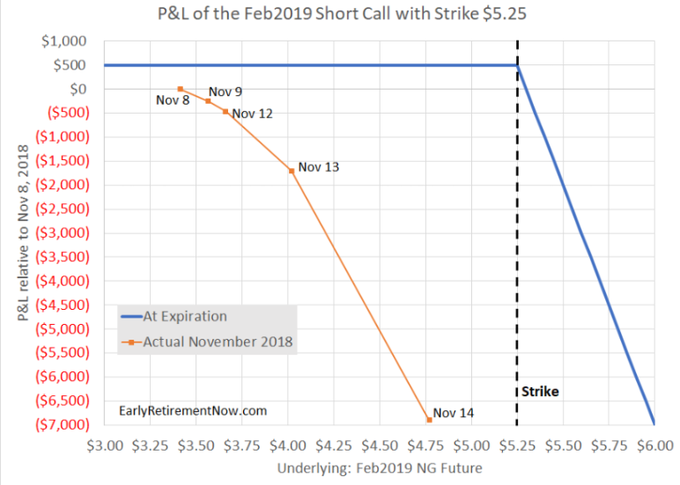

1/ Selling “penny puts” in the $SPX complex has become commonplace in today’s markets, it’s essentially now a socially acceptable practice amongst portfolio managers. This is the story of James Cordier from Optionsellers, a fund that blew up and the infamous $150M margin call.

44

195

1K

@Barchart

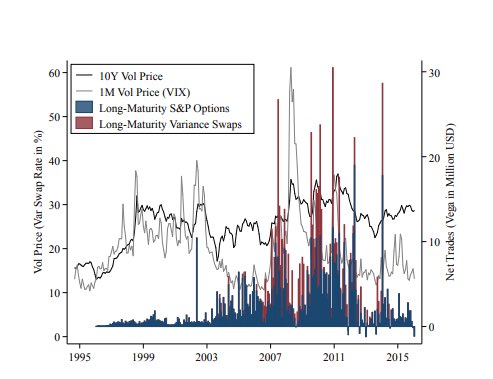

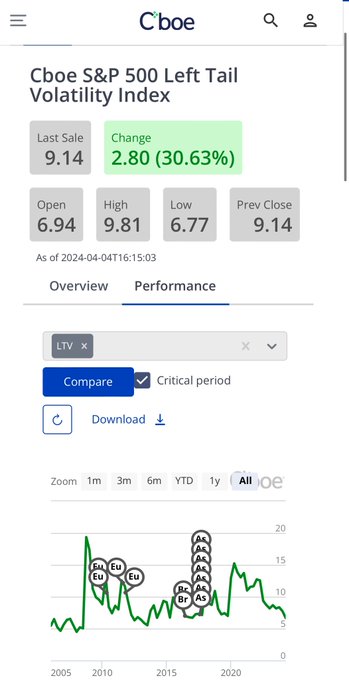

For those that don’t know, Ruffer returned 16% in the 2008 crash, nailed the 2015 flash crash, nailed the 2018 XIV (Volmaggedon) implosion, and nailed the 2020 COVID crash making $2.2B. They have a very accurate and long track record of these bets.

27

48

430

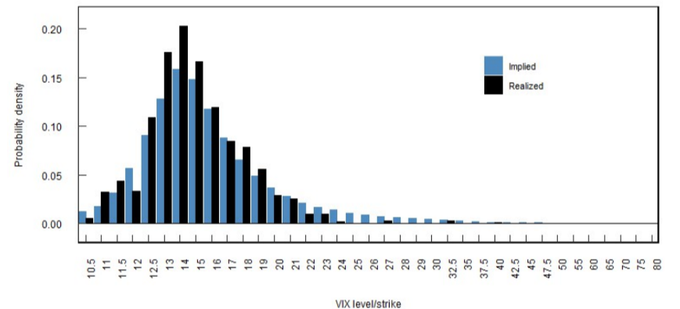

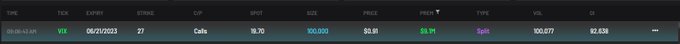

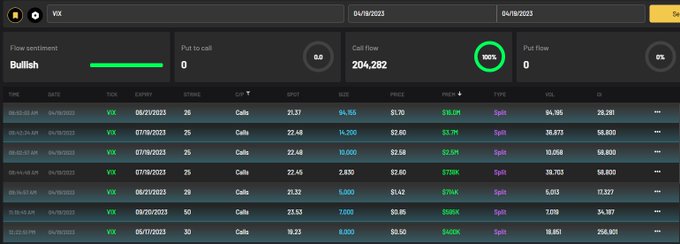

1/ As someone who trades index vol on a daily basis, every time a large $VIX call order comes in, it draws a lot of attention from less sophisticated investors who believe Volmaggedon 2.0 is here.

TL;DR ignore the noise… For now.

13

45

347

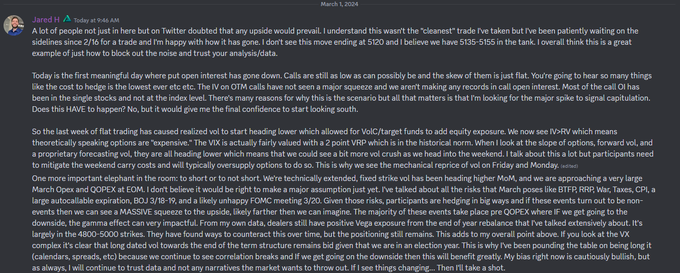

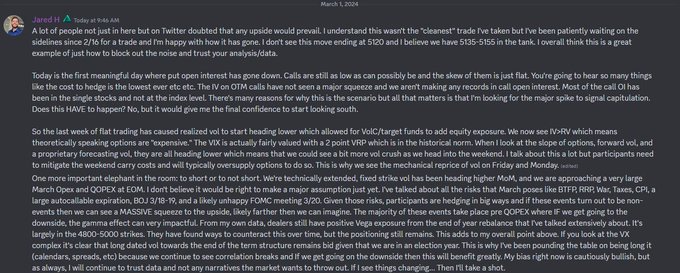

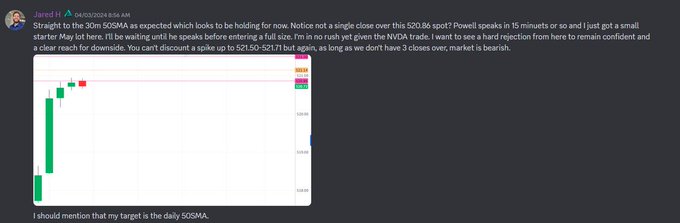

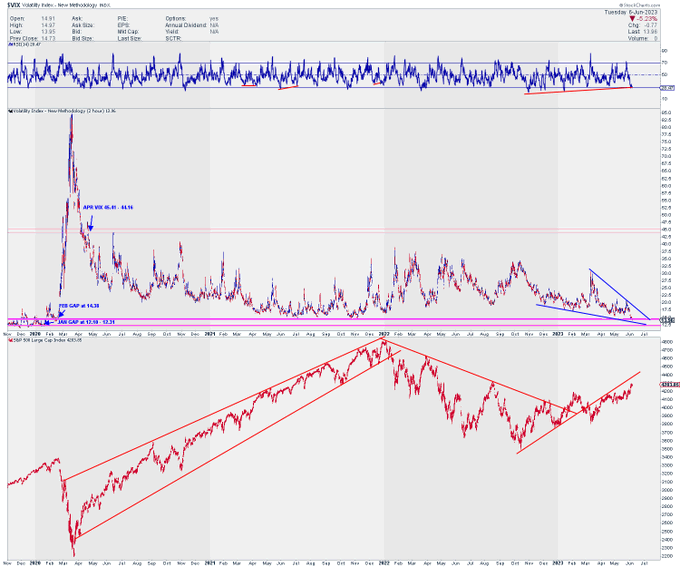

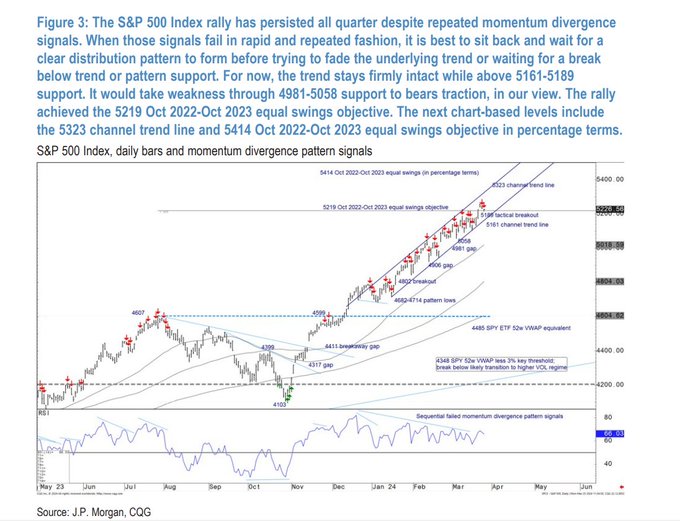

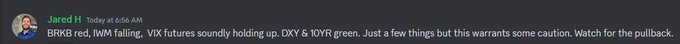

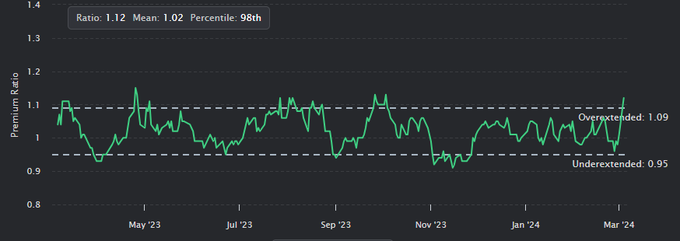

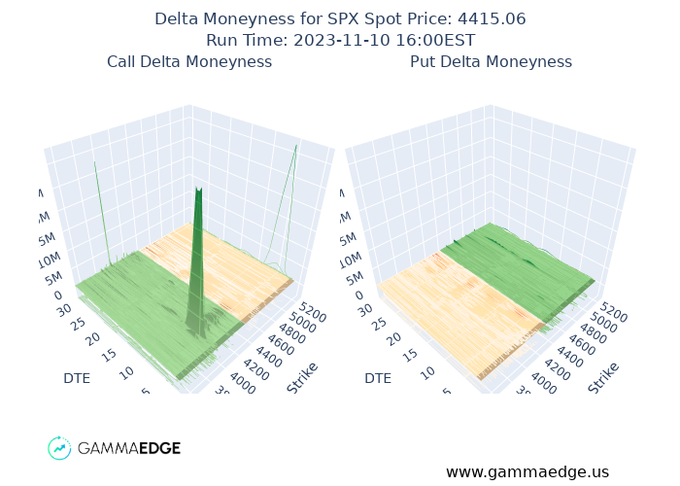

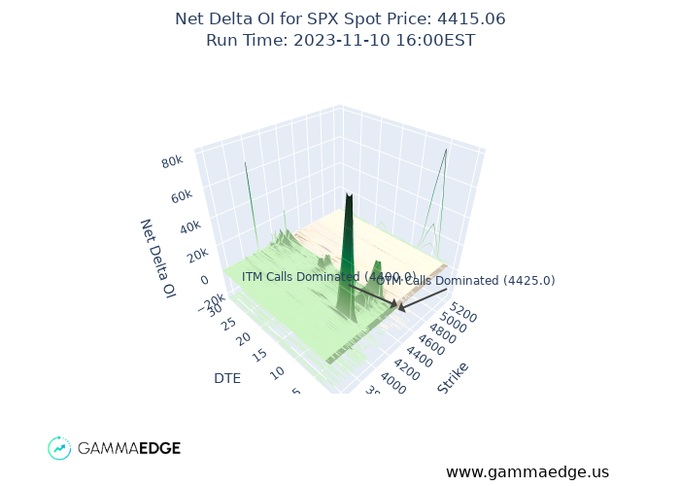

$SPX Is it finally time for a deeper pullback?

Essentially since November, I’ve had zero interest in playing any sort of SPX downside. I've discussed the possibility in this quoted tweet but have refrained from an entry, until now. I’ve mainly been sitting long VX to play the

46

45

343

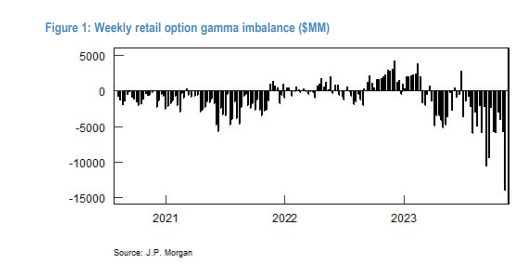

1/ I think this is an extremely important issue/example that needs to be drilled home, and what I believe sparks the next major tail event. While it’s “funny” to us, it shows the lengths as to what current PMs go through to try and generate a fraction of Alpha in today’s markets.

9

28

143

$SPX This move should come as no surprise to anyone, every warning sign was given. Vol has been reset, so natural buyers will need to support higher. If you didn't catch the bottom, DON'T FOMO here, at most 50SMA. Wait for the pullback next week (4220-4240) to confirm this move.

14

18

151

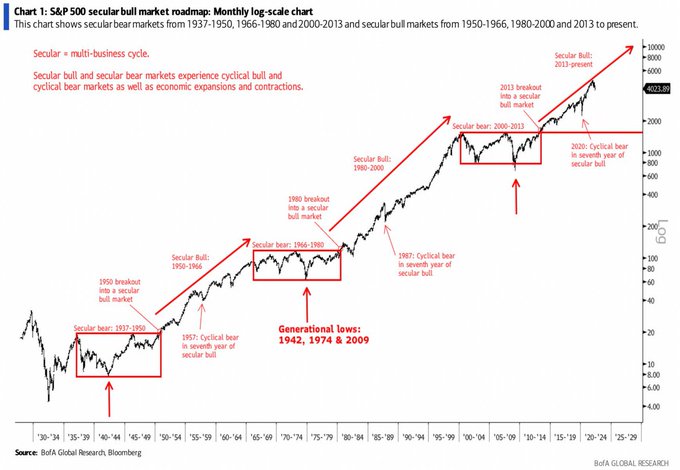

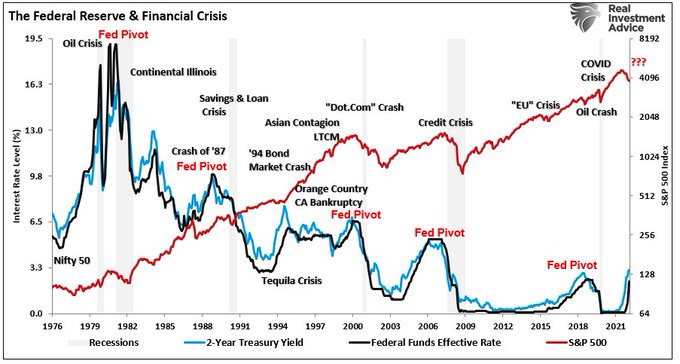

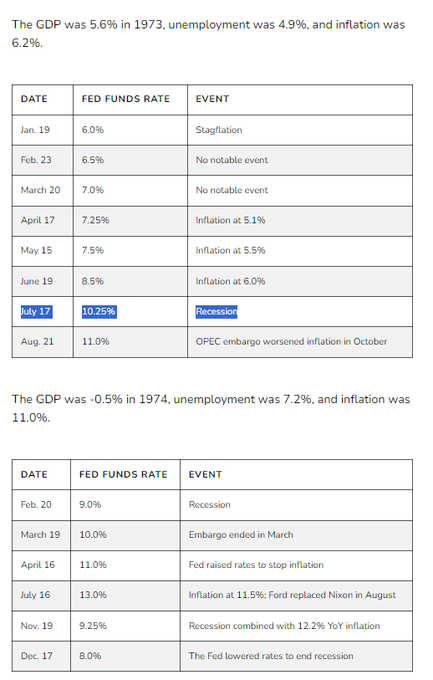

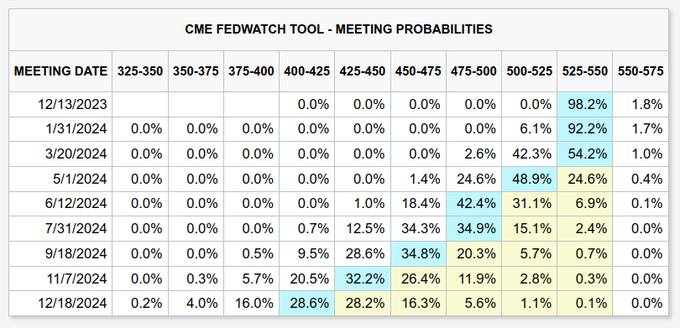

What a wild ride to $SPX 4750! As we look ahead into 2024... history often rhymes. 1970 (2020) and 1974 (2024) where equities made ATH before crashing to 10Yr lows. Arthur Burns cut/raised 2 times that year with the economy already in a recession by mid-1973. Will history repeat?

7

16

146

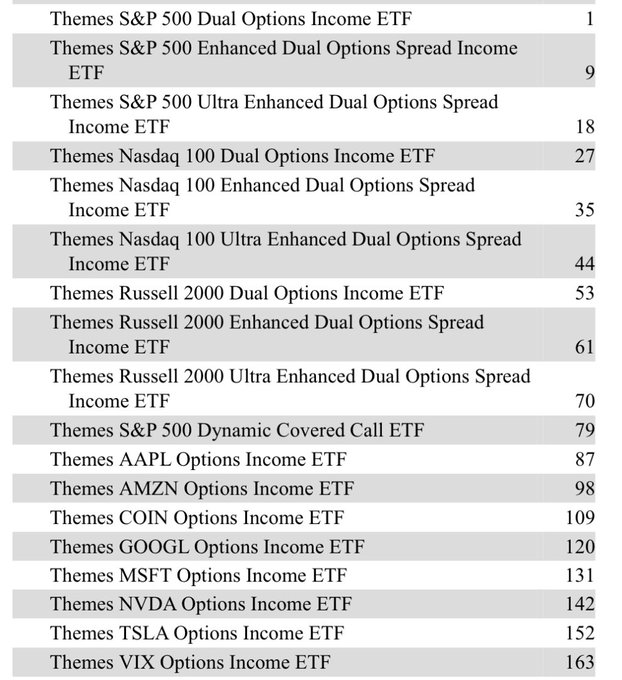

“The call and put options sold will have no more than 200% notional value of the funds net asset value.”

Okay so let’s leverage up 2x on 1DTE OTM strangles with realized in single digits and 4 years since the last major vol spike. It can’t go tits up right?

Dealers still need

15

31

122

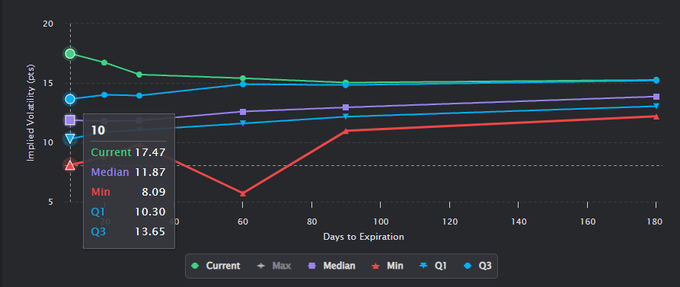

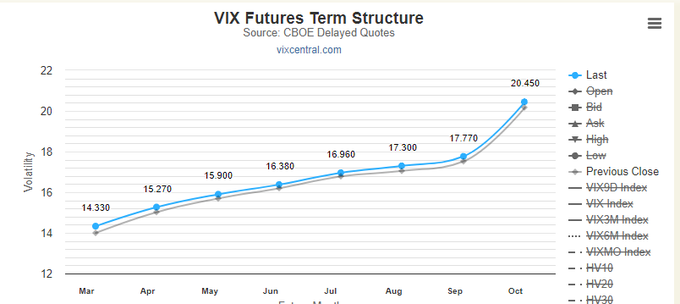

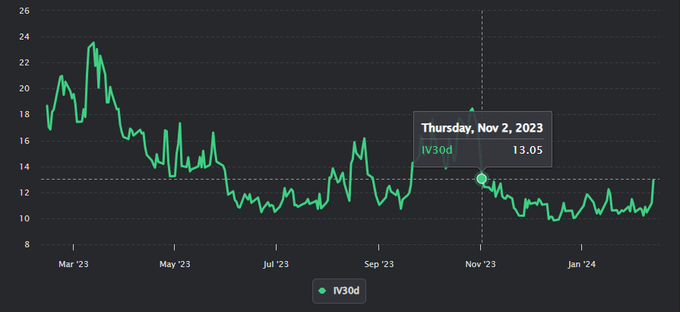

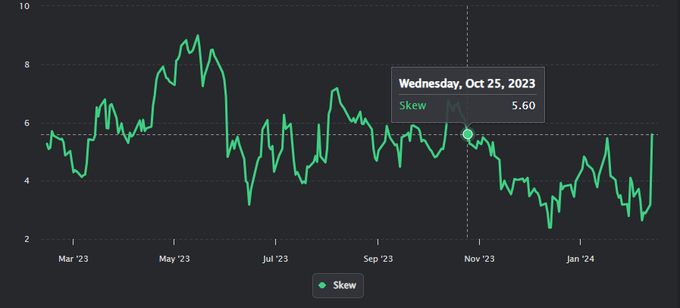

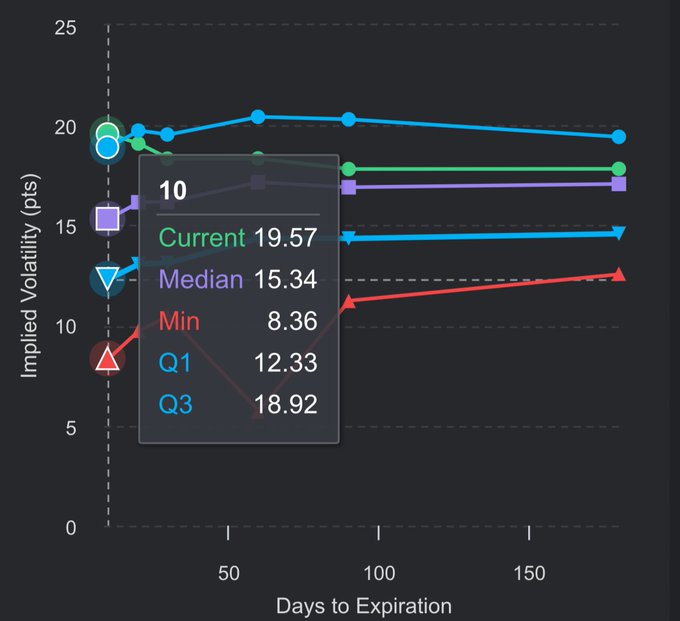

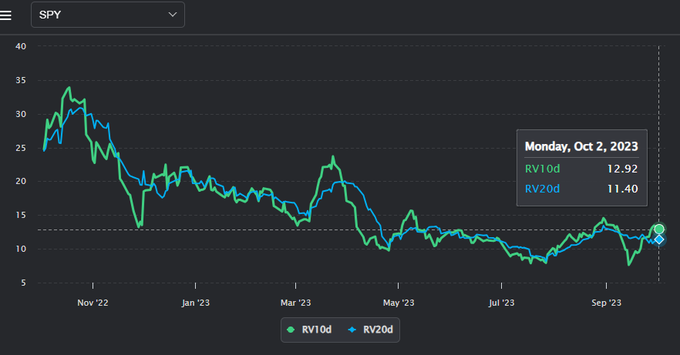

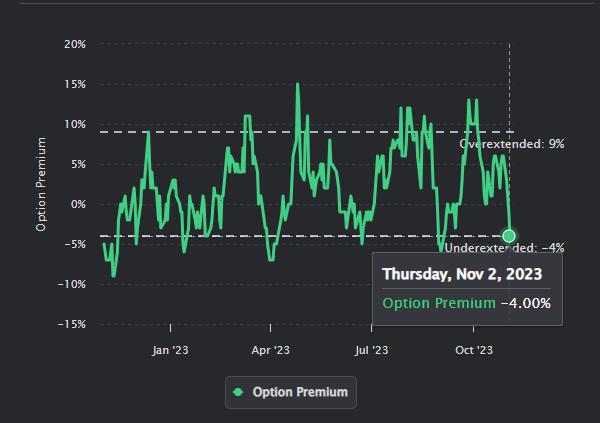

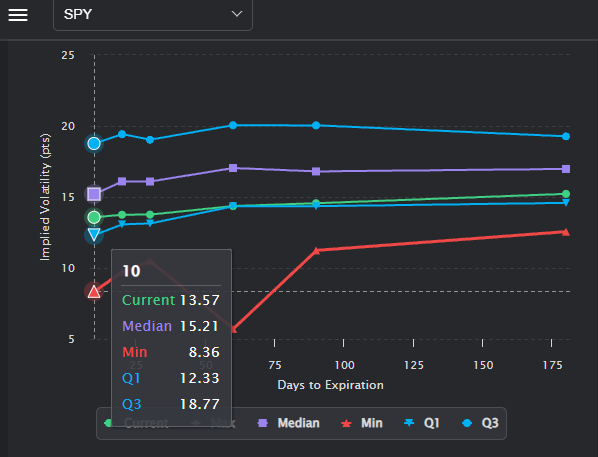

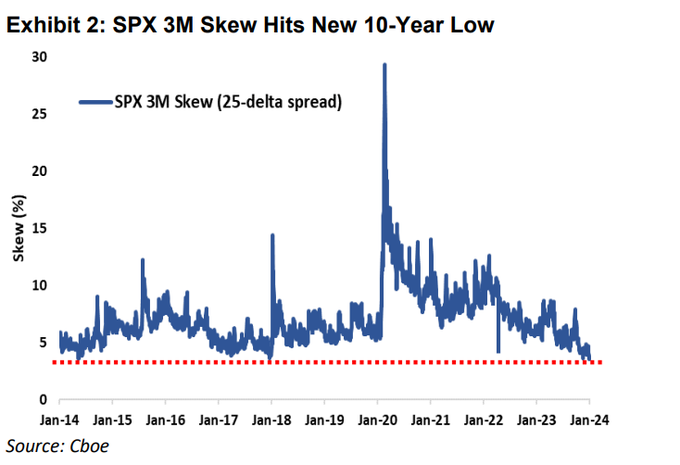

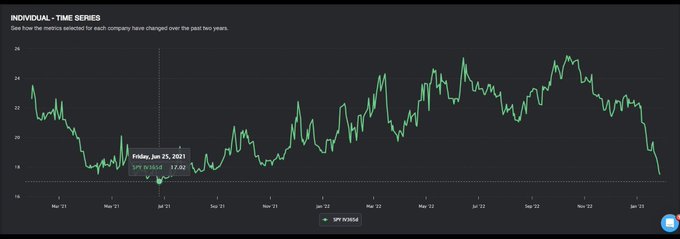

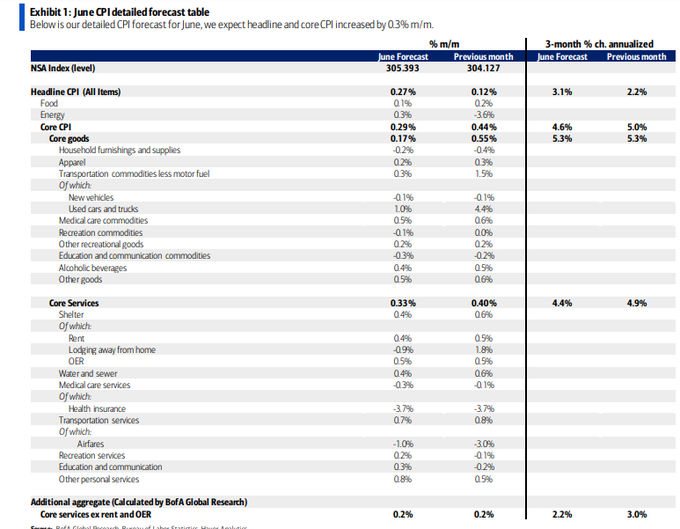

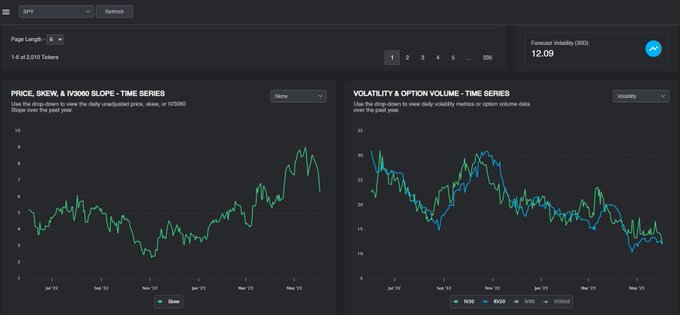

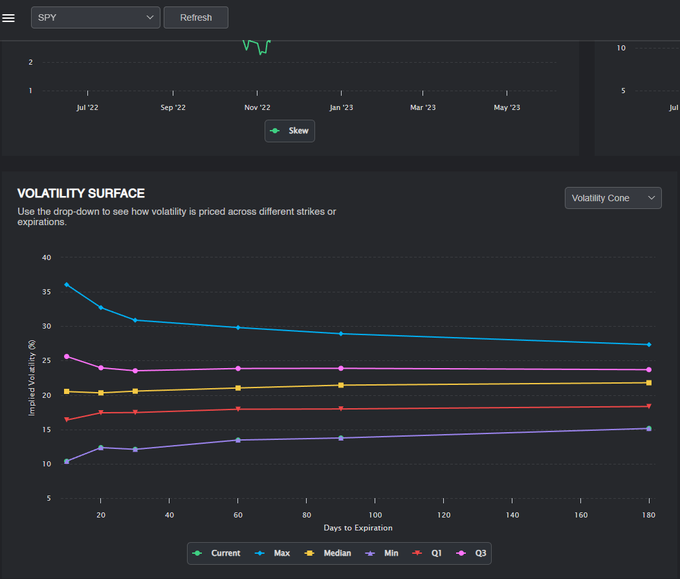

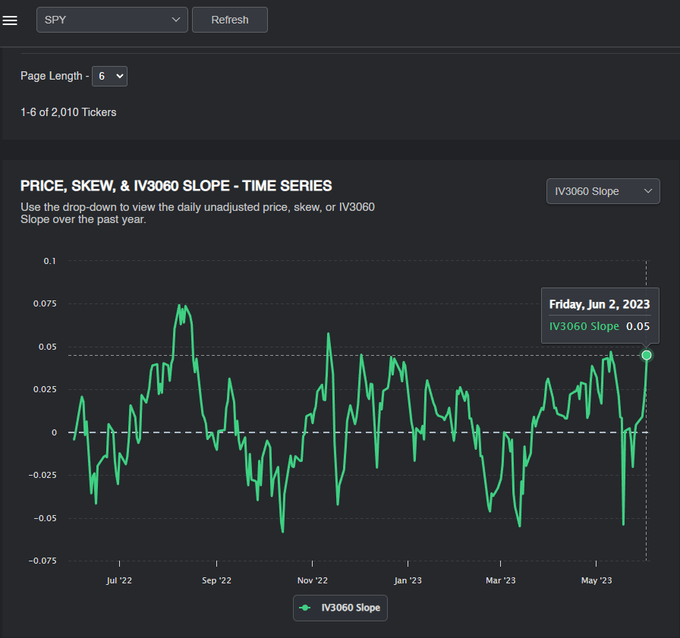

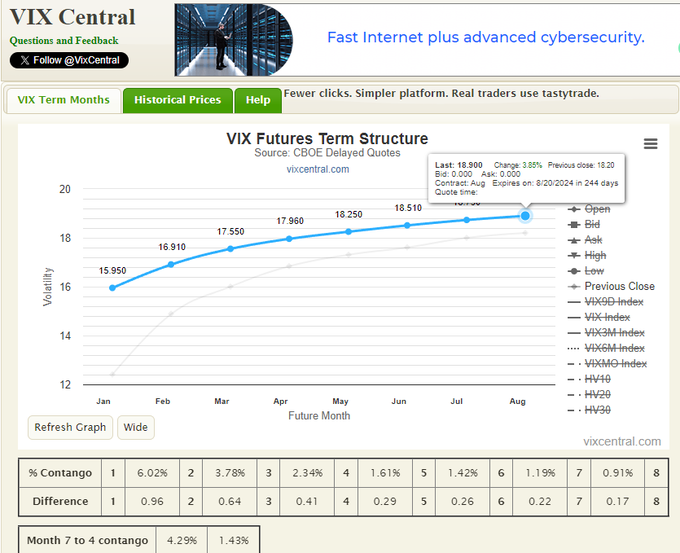

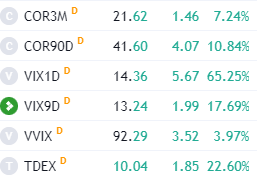

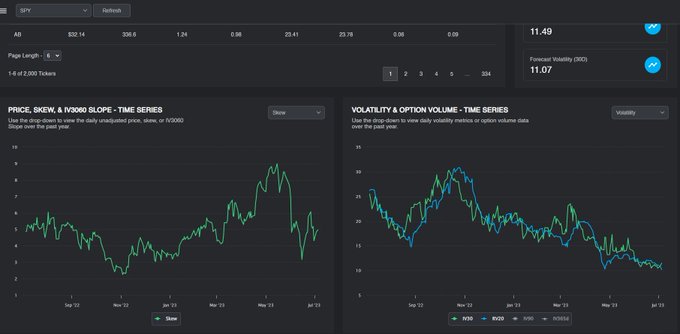

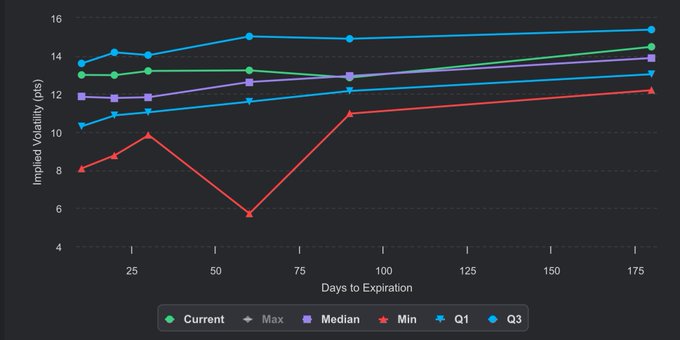

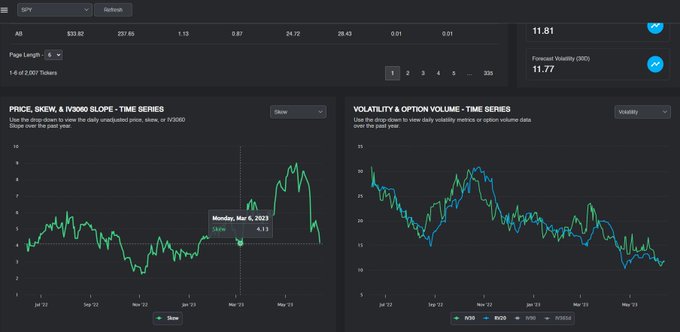

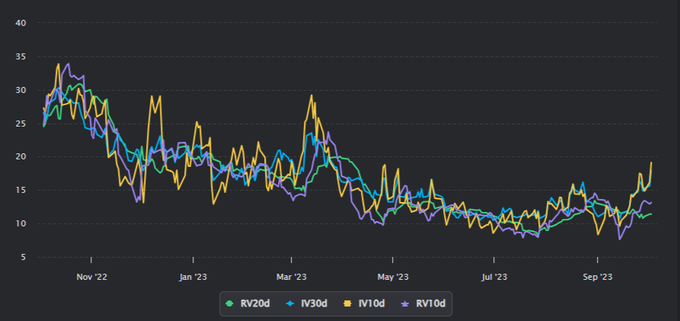

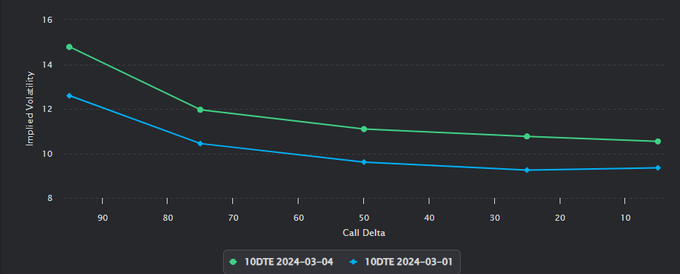

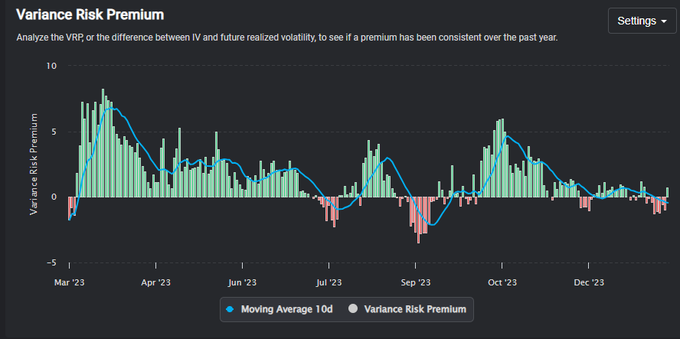

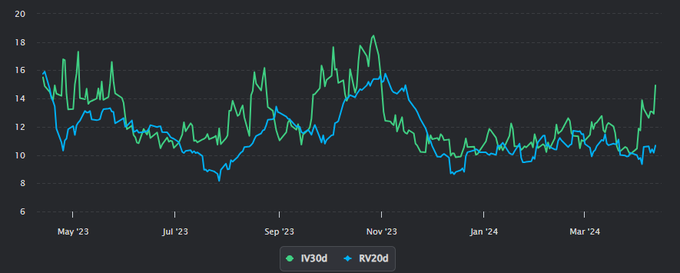

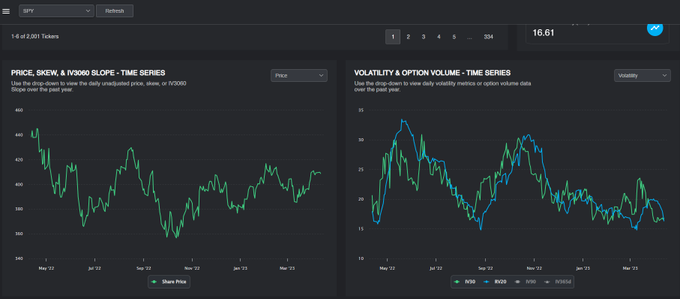

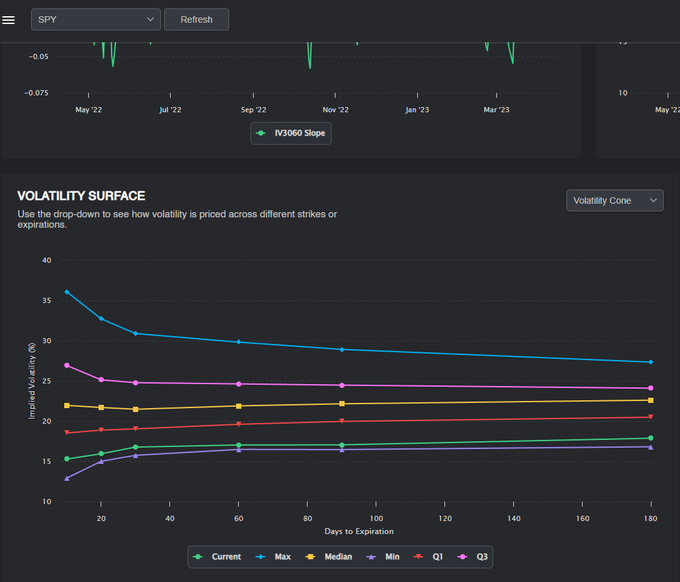

$SPY Vol risk premium gap closed. Skew back to March. Options at min IV and back in steep contango.

$COR3M Correlation at the lowest level since Volmageddon.

$COR90D (Crash risk) back to pre-banking crisis levels.

Tread carefully, full thread this weekend! 🎯

6

11

106

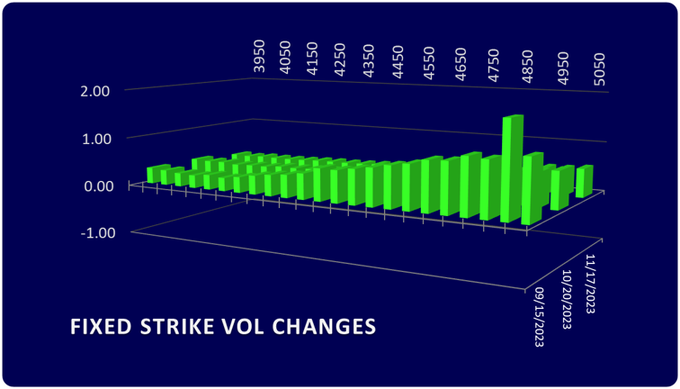

1/ No coincidence on the vol bid post VIX opex. The last 5TD has seen VX complex higher, especially 12/18, providing a warning with FSV. $VIX TS front month +27%, even back month is +3.8%. $TDEX +22%, $COR90D +11%, $VIX1D up a staggering 65%. Be very careful "IF" this continues.

5

15

105

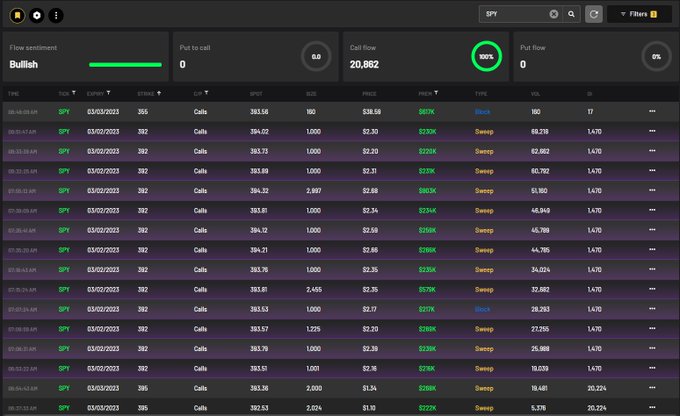

$SPY Exact same scenario. Millions worth of 0DTE call buying before Bostic talked + put selling. 459K 393p traded today. Dealers bought back those shares while further call buying fueled the gamma squeeze. All off of one word from a non-voting member. "Summer pause." 1/9

15

17

100

$SPX I’m short (-delta) with slightly long vega exposure from the close. 🚩Read thread below for warning, FSV holding in/VRP gap. The rising 20SMA is the target.🐻 are on the shot clock here until EOM/BOM rebal takes place. Have a fantastic thxgiving-spread kindness! Cheers🍻

12

9

102

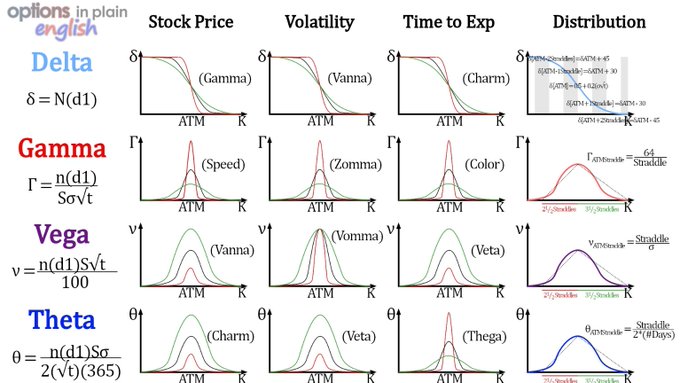

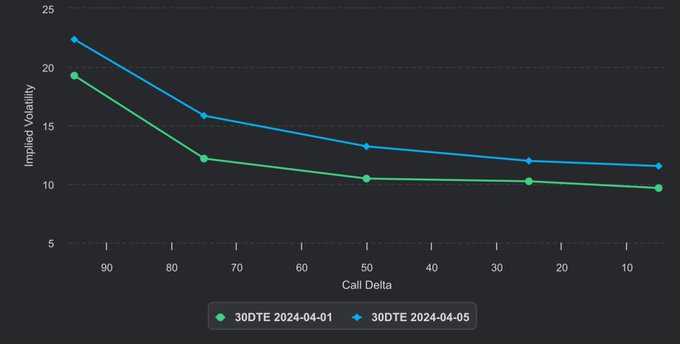

1/ Clear warning was given yesterday as vol markets did not agree with the price action. That move is being realized today. With NFP tomorrow, the only point that matters is the 20SMA. Time may catch up to price once again like on 6/26. If this happens... a massive Vanna squeeze.

@RJRCapital

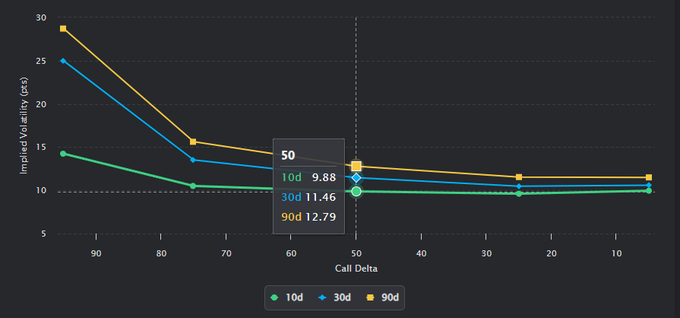

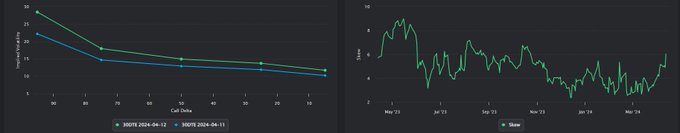

There is clearly some fear under the hood today that's not agreeing with this price action. 10D/30D OTM puts are both at the same level.

1

3

26

4

17

98

@RJRCapital

@Jedi_ant

@neildecrypt

I’m positioned as short as I’ve ever been in my entire career. I even added more today. IMO this will turn out to be the greatest bull trap in market history.

12

10

94

1/ Pay attention to what's going on under the hood.

$VIX Dealers tried to suppress Vol into OPEX this AM.

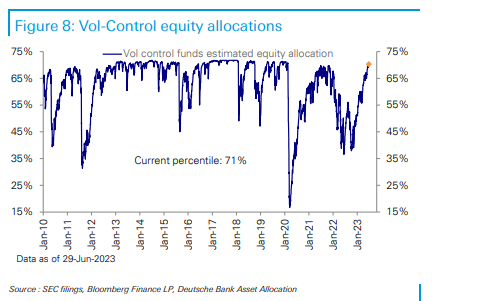

RV has moved slightly higher; forcing Vol control to sell, but there is still a variance risk premium present.

This selloff has some of the same fingerprints as June.

9

21

93

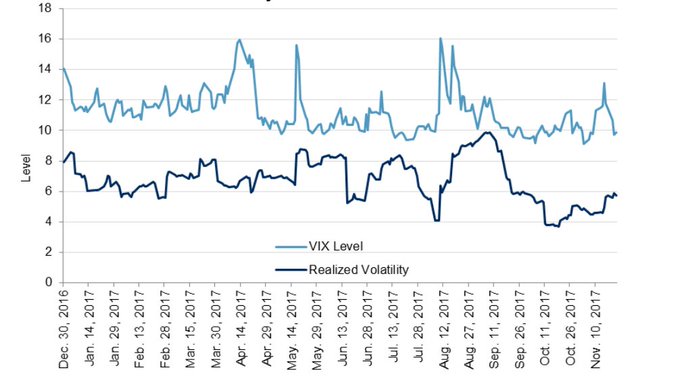

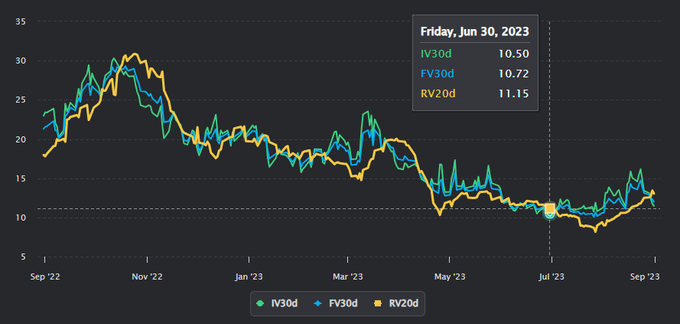

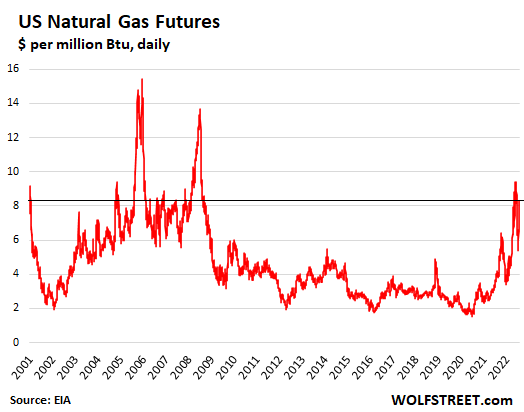

Even with $VIX now at 11, there is still room lower if $SPX continues to make ~0.70% daily moves. 1M RV has crashed to an 8 handle. It's important to remember that a low $VIX doesn't mean cheap. Before Volmaggedon in 2018, 1M RV floated around 4 and stayed under 10 for 14 months!

5

11

92

31/ The only guarantee I can give you in the markets is that all $VIX gaps will fill. The last one to fill is at 12.10, which could serve as the final bottom. Long vol buyers remember, "the market can stay rational longer than you can stay solvent."

4

12

92

Sell Oct/Buy Dec✅

I’ll say this over and over again. Volatility needs a reason to stay elevated, $SPX does not.

Today: Bonds green, Yields down, DXY red, $VIX 0.50%, correlations lower, fixed strike vol lower.

$SPX Down almost 1%. I buy when folks are scared of weekend risk.

7

14

88

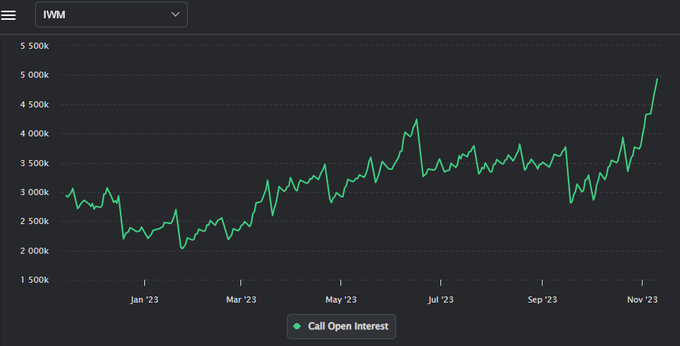

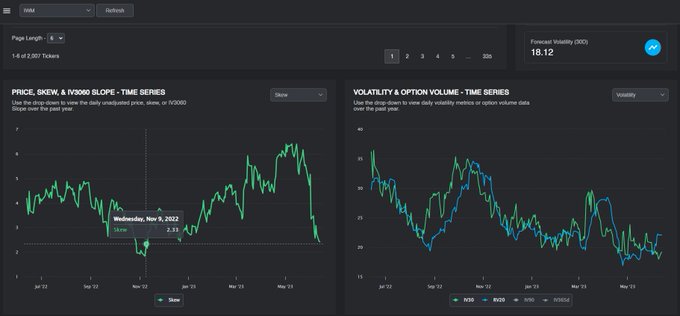

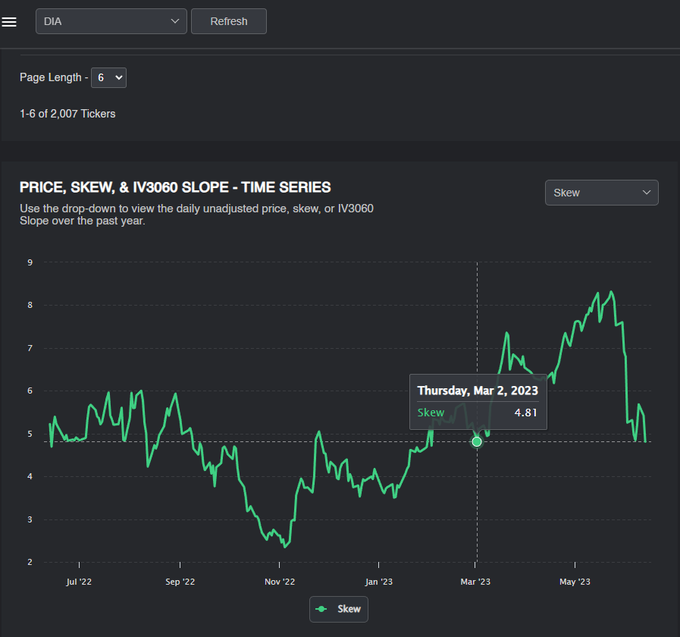

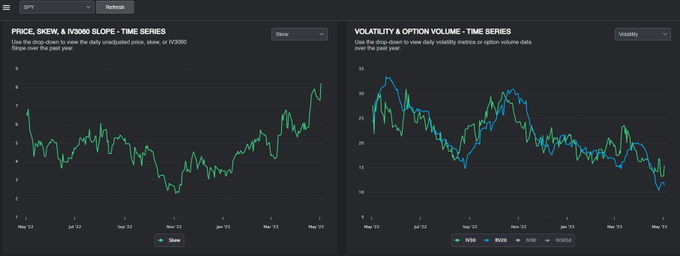

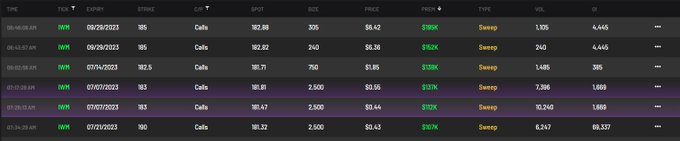

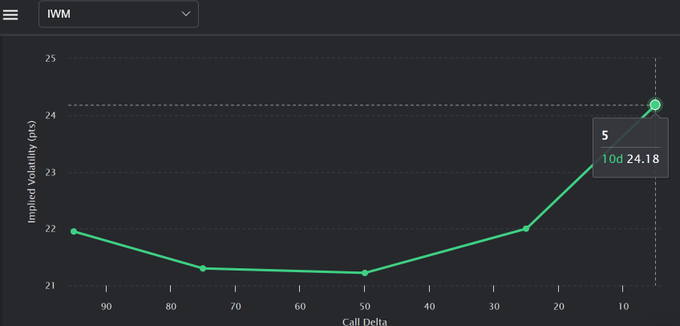

1/ $SPY Skew has now flushed out March banking crisis levels.

$QQQ Skew back to Jan 9th.

$IWM Skew now at Nov 2022 and a massive vol risk premium present.

$DIA Skew also has flushed out to March levels.

The market is pricing perfection for FOMC. Trust data not narratives🎯

7

12

83

1/ $SPY I have been adamant on waiting for a backtest before longing this market, which was reinforced in the screenshot below (give it a read). I believe we get a Vanna bid but there is ZERO reason to believe so until mid 443s confirms support.

Small update before the weekend:

6

12

79

1/ $SPY The market is down -1.5% and Skew is moving lower with fixed strike vol up a measly 1%. IV30 is at 19% but RVol is still at 11. We now have the 2nd largest Vol risk premium of the year. The market is hedged and is monetizing as we move lower.

4

7

80

1/ Humbly speaking: Called the top at $SPY 459.

FOMC plan in the quoted thread was exactly on point.

Gave a clear warning regarding BOJ.

Called the vol unwind squeeze (index higher) for this week.

Now what?

11

5

80

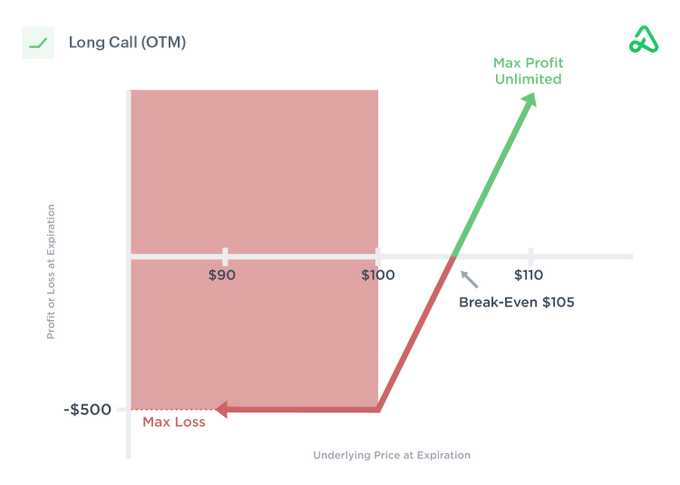

9/ “Okay Jared, what if some systematically shocking news happens, how are we supposed to know something larger is brewing?”

Look for shorter dated tenors explode in convexity. 1 Wk/M VIX calls moving from 0.02 to 0.30 or SPX 1 delta puts moving 500% etc. I talked about it here:

3

5

75

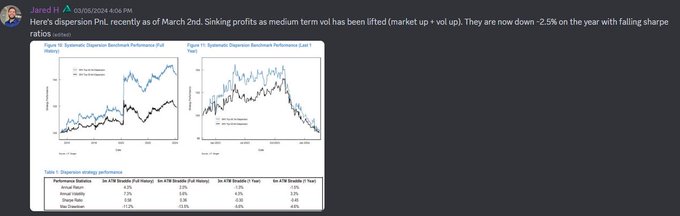

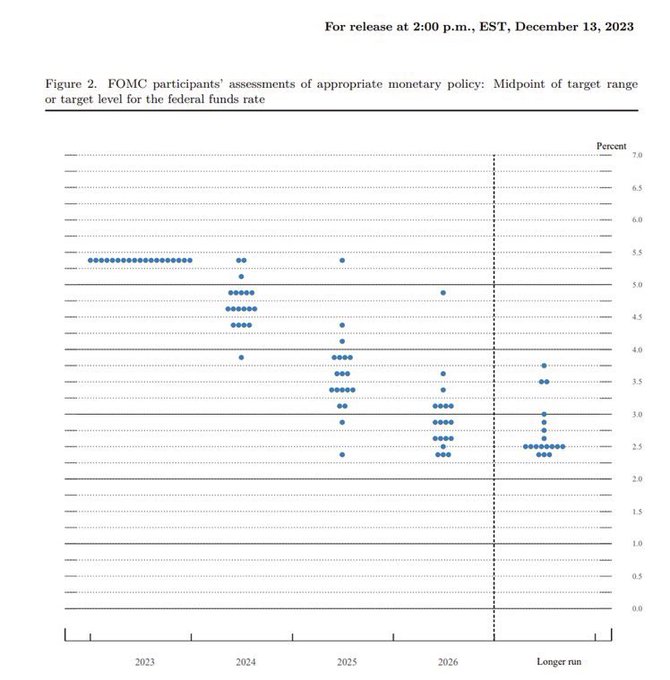

With the new Fed Dot Plot, structured products are significantly less appealing. Why settle for the once great 10% when $SPX is +23% on the year? Liquidation thereof causes the infamous market up+ vol up. Combined with the dispersion trade, this is why vol was suppressed.

@Mystral2042

@MrStudPuffin

TA points towards 4700+ after digestion. I have a near 95% probability we see SPY 464-468 before it’s truly done. Macro wise, BOJ is the black swan IMO + when the fed cuts, yield stacking products and the dispersion trade will be over. Only issue is that we looking at Q1-Q2 ‘24.

4

1

11

3

12

75

1/ It's June Opex. Time for a small update on the markets & my own account.

8

7

71

@BotFintwit

IMO we get a quick spike to 20SMA (finally), and that's your final dip long into new highs. 4850-4900. With QOPEX expiring I believe we finally see vol become unpinned. The next leg higher would be market up + vol up in a big way!

6

5

70

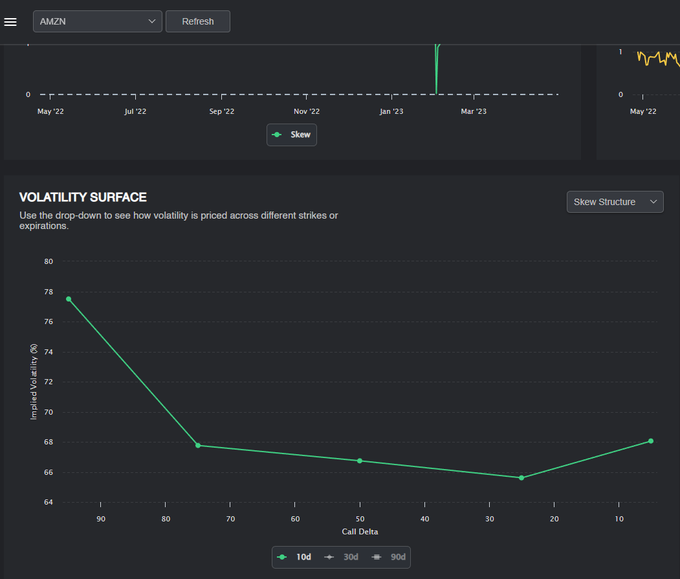

1/ $SPY Tomorrow's candle close is going to be the most important one in over a year. Hopefully you guys read this thread in full! Traders are bullish on $AMZN and here is what that means.

12

14

61

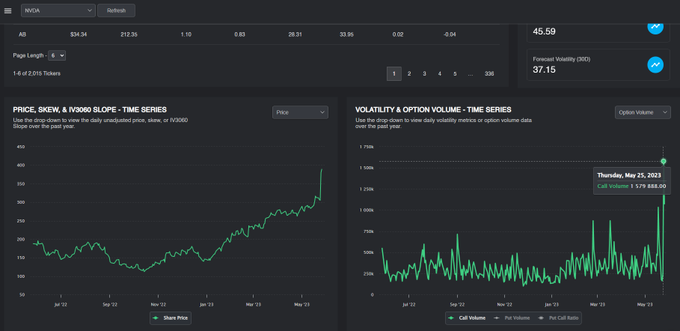

While $SPX has been grinding higher, the $COR90D index which quantifies expectations for a left-tail event (Crash), is back to March banking crisis levels. Also noteworthy, is one of the largest $VIX calls I have seen in recent times. $16M in June 26c, nearly 100k contracts.🚨

4

17

63

1/ $SPY Another $2.6B at 418.72 bringing the running total to nearly $10B within 2 days and $2 apart.

"Hedge through Tuesday." Now you can see why I said this. The majority related to post-opex but the debt deal has to be factored in.

Here is what I see moving forward:

8

12

63

@SamanthaLaDuc

They also nailed Silicon Valley Bank blowup just to name a more recent systematic event.

5

2

59

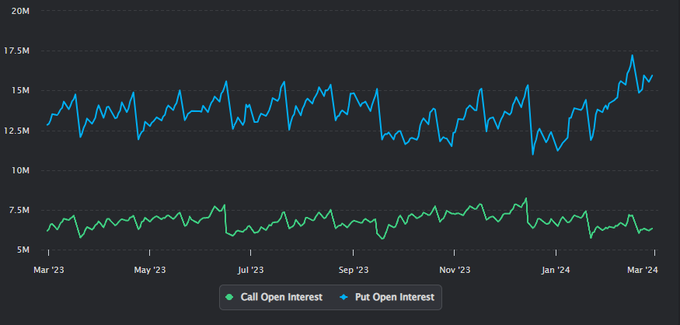

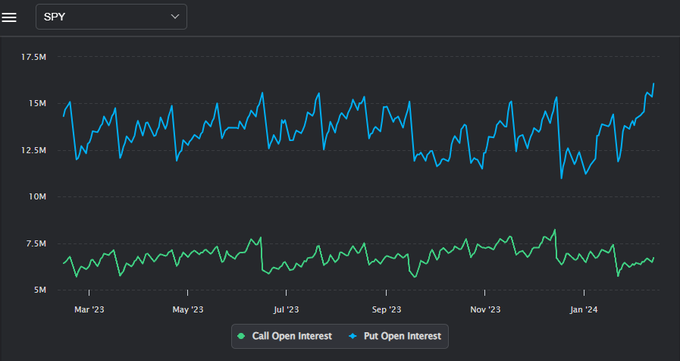

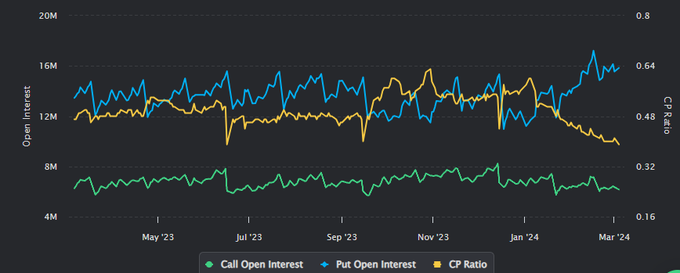

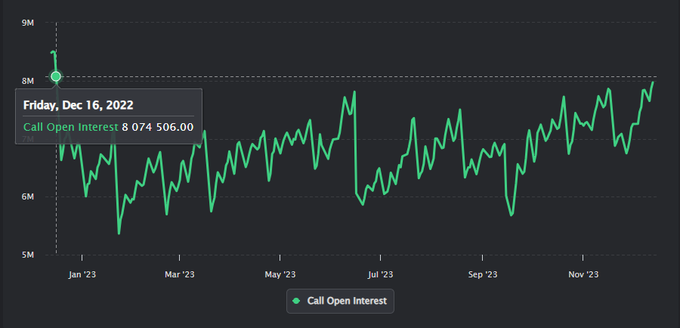

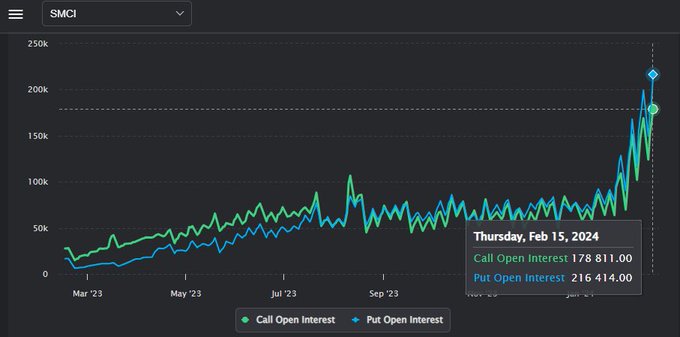

Market is pricing in 5 cuts for 2024. Meanwhile, $SPY call OI has reached 1YR highs and $IWM has a completely abnormal 10d call skew structure. Total index skews, $QQQ $IWM $SPY $DIA, have all collapsed to lows. $SPX is 2StdDev above 20d. Talk about asymmetrical risk to reward...

5

5

56

@JustinRyu10

@HardenChandler

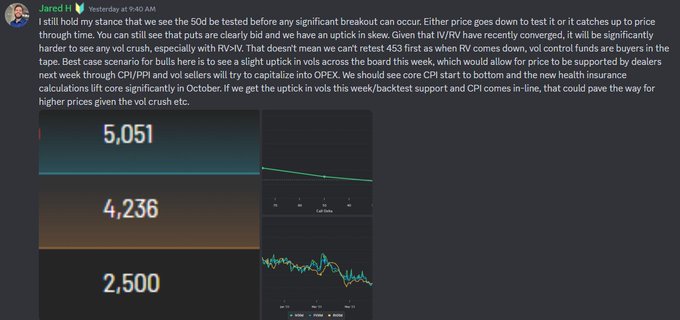

I'm short from 5195, no July entry yet but trading the expected pullback for now.

@Curious6789

@JustinRyu10

@HardenChandler

When the 20SMA is likely tested by mid week then watch for what the reaction is, not price, but under the hood metrics like momentum/FSV. I don’t see a scenario where I wouldn’t take July vol by 5/13 after hours - 5/14 an hourish after the open. Larger participants are well aware

4

0

21

4

1

58

1/ Bulls, you've got to ask yourself one question... Do I feel lucky?

It's do or die time.

5

8

54

1/ Some interesting vol dynamics after today's CPI. Let's take a look at $SPY, $QQQ, $VIX, and $IWM.

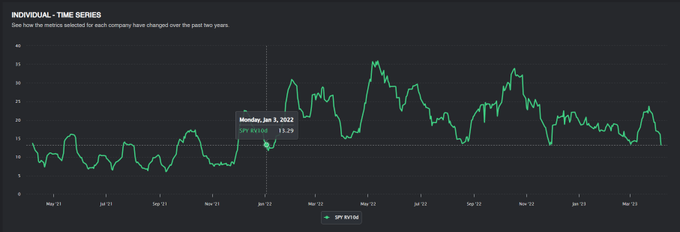

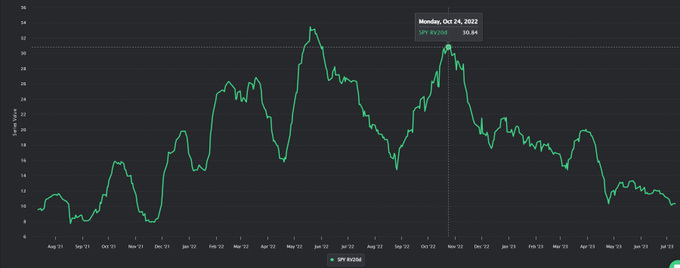

$SPY The VRP (Volatility Risk Premium) gap was closed, RV has just been crushed. RV10 now dates back to Nov 2021. Options still trading near min levels.

1

19

52

@jam_croissant

Thought I would give my $0.02 for whatever it's worth. The most expected decline in what feels like forever is "supposed" to start tomorrow. Vol markets are reflexive. I'm seeing no reach for downside in higher delta strikes and calls remain well bid as of this AM.

5

4

50

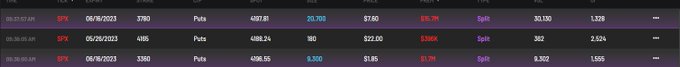

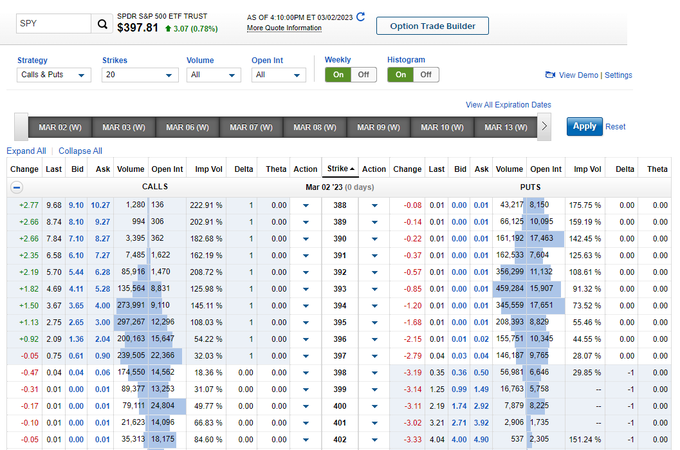

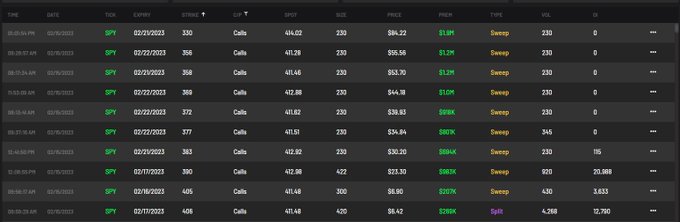

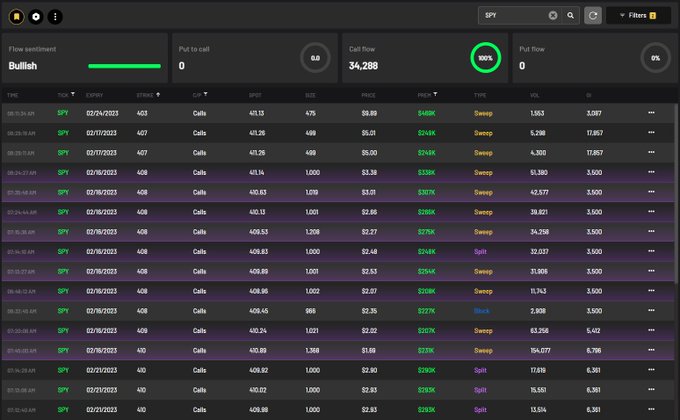

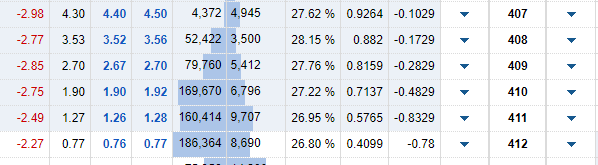

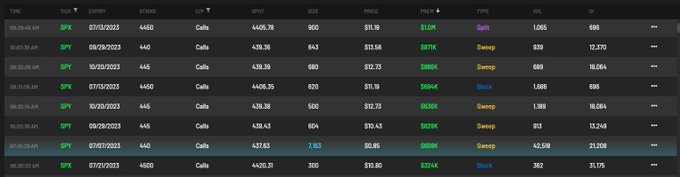

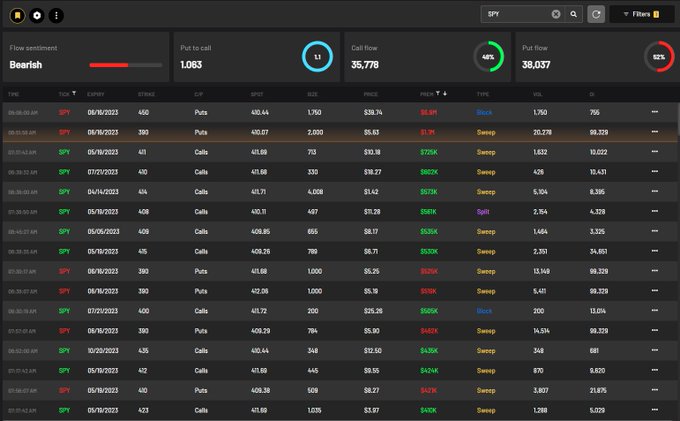

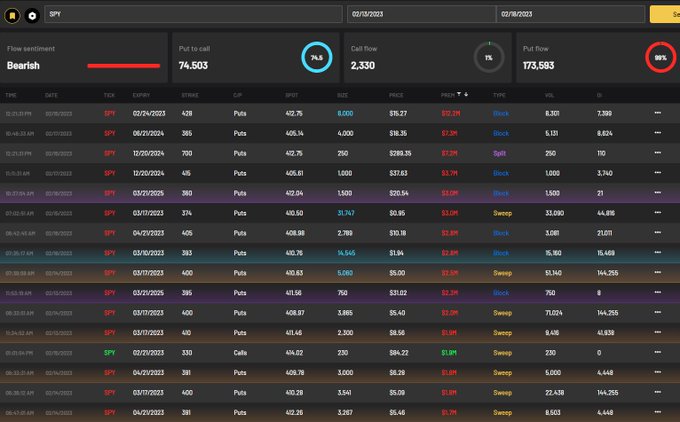

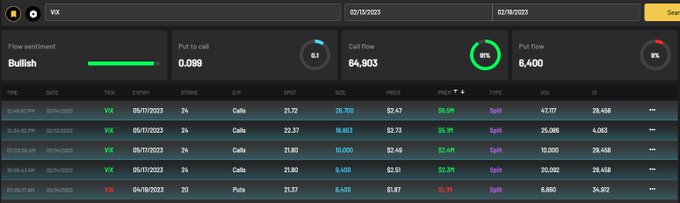

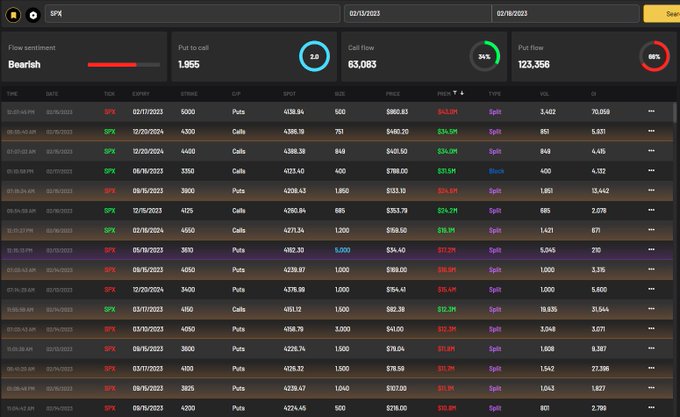

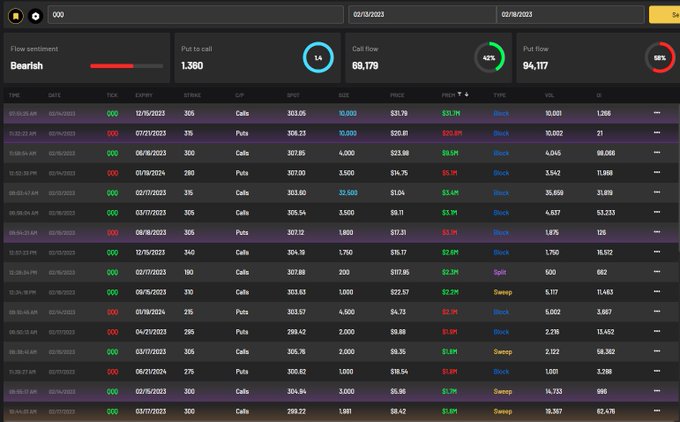

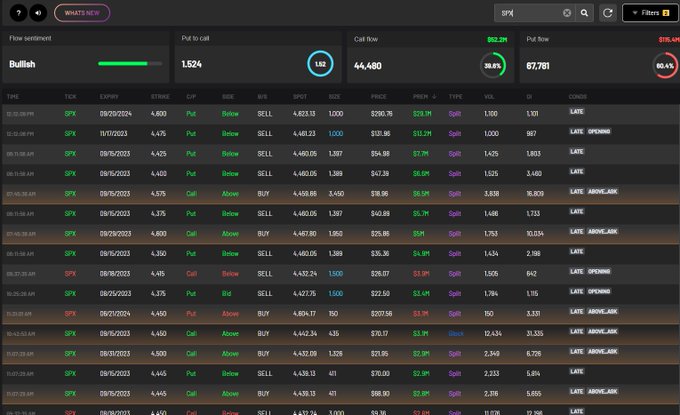

Let's see how institutions are positioned this week.

@CheddarFlow

$SPY, $SPX, $VIX, $QQQ

Filter: $1M+

3

7

48

@Jedi_ant

I don’t expect you to read this all but I make the case for a tad bit higher, a convincingly enough pullback to get 4100-4200 puts closed, and then one more leg up. IMO after that is when the “true” move comes into an unhedged market.

5

5

50