Lanre Ige

@LanrayIge

Followers

3,036

Following

777

Media

54

Statuses

5,654

Grants Lead @NeutronGrants | Consulting and Research for Digital Asset Firms | Formerly @21Shares , Menai

Joined July 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

BECKY X MAYBELLINE LIVE

• 230469 Tweets

Northern Lights

• 211450 Tweets

オーロラ

• 170154 Tweets

#Auroraborealis

• 92475 Tweets

DeNA

• 61864 Tweets

#baystars

• 61443 Tweets

THE SIGN in MANILA

• 43046 Tweets

京王杯SC

• 22051 Tweets

Fulham

• 21610 Tweets

太陽フレアのせい

• 18177 Tweets

ベイスターズ

• 18129 Tweets

ハマスタ

• 17413 Tweets

バチコン

• 16802 Tweets

ウインマーベル

• 10671 Tweets

Last Seen Profiles

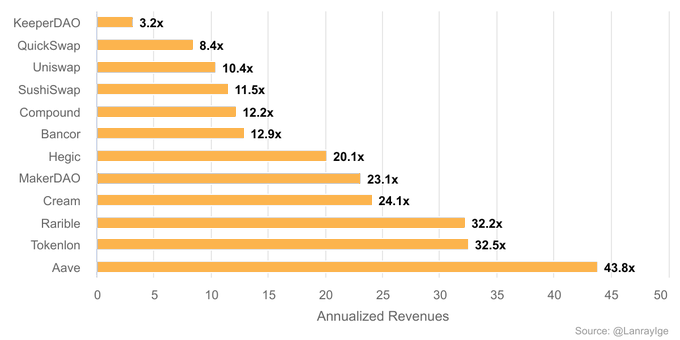

1/ I've been thinking about valuation techniques for DeFi tokens and I think most people are thinking about token revenues/fees incorrectly.

@tokenterminal

offers the best data on this. I've seen

@mgnr_io

talk about this and maybe

@Fiskantes

(???)

11

50

249

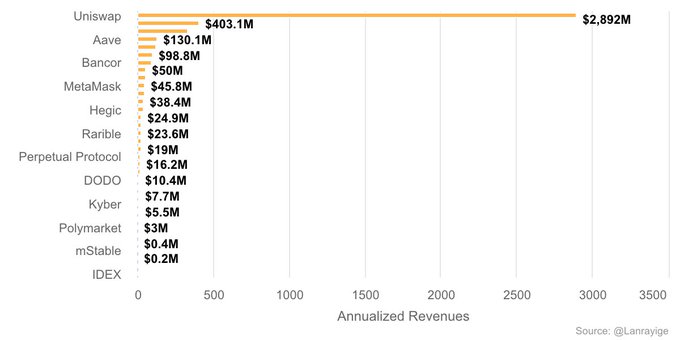

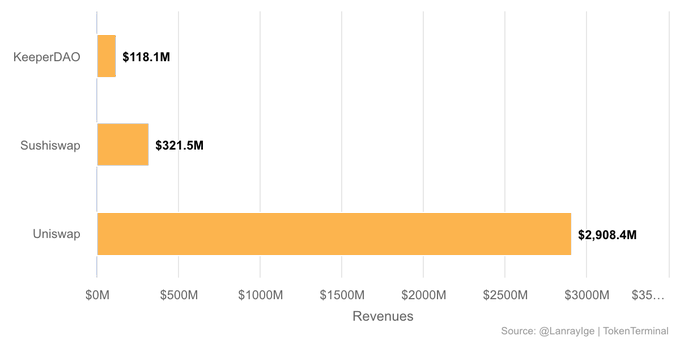

1/ Yesterday I talked about DeFi valuations and some of the issues w/ the way investors understand "revenues".

Let's take a closer look at the data w/ three projects that serve as examples of these issues:

@Uniswap

,

@SushiSwap

, and

@Keeper_DAO

1/ I've been thinking about valuation techniques for DeFi tokens and I think most people are thinking about token revenues/fees incorrectly.

@tokenterminal

offers the best data on this. I've seen

@mgnr_io

talk about this and maybe

@Fiskantes

(???)

11

50

249

2

42

180

The Cosmos reply guys were right (cc

@EffortCapital

)

In the next 12-18 months, we'll see a few other of the most successful Ethereum Dapps "vertically integrate" and launch their own chains.

Expecting

@Uniswap

@compoundfinance

(maybe)

@AaveAave

and

@opensea

(maybe)

10

18

148

.

@perpprotocol

averaging $300M over the last few days w/ no token incentives for traders (aside from small referral program).

I bet the exchange will be averaging $1B in daily volume by the end of summer.

2

5

68

@mrjasonchoi

Hmm don't fully buy this. Most of the power players in crypto still fit into the ex-ivy league/finance/big tech middle-class group.

Plus now we just have new credentials which are just as elitist i.e. ex-coinbase, funded by paradigm, etc.

4

0

59

@0xtuba

legal issues or reputational damage from the conflicts of interest from the FTX<>alameda relationship

1

1

47

@0xSisyphus

This sounds silly. Trivial to sybil and won't lead to any of the inherent issues w/ the LUNA/UST/TERRA ponzi actually being fixed.

Weird since I'm sure they all know this so idk

7

0

44

Modular Summit has been the best crypto conference I’ve been to by far.

Congrats to the

@CelestiaOrg

and

@maven11capital

teams 🫡

4

1

46

Excited to officially launch the Neutron Grants Program. Applications are open. 🥳🥳

1

4

40

@KyleSamani

"It’s clear that FTX’s risk engine is the best in the world across every asset class"

how is this clear at all lol?

3

0

41

@VitalikButerin

it's a weak justification but it holds some validity. i.e. a token having gov rights to turn on a fee switch which would generate $X cash flows should be worth more than a token that doesn't have that. Even if the fee switch is never turned on.

not the ideal val framework tho

4

2

38

What’s the argument for why a storage focused blockchain (

@ArweaveTeam

@Filecoin

) with VM capabilities doesnt become the default data layer for DA chains/rollups in the LR? Instead of Ethereum or

@CelestiaOrg

?

@musalbas

@jadler0

@epolynya

@elindinga

@TusharJain_

9

1

37

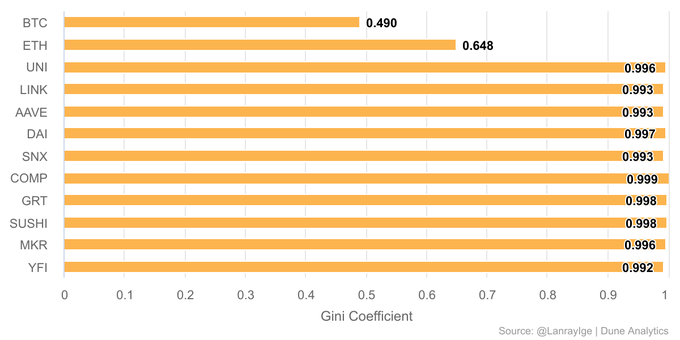

24/ Here's the data I worked with. I did this quickly so there could be a lot of errors.

@Fiskantes

@cburniske

@mgnr_io

@elindinga

@Jpyaan

let me know your thoughts :)

6

1

37

@adamscochran

I don’t think this will make any difference to the chances of an ETF application success. Let’s be serious

1

0

36

Another great episode of

@zeroknowledgefm

podcast about

@penumbrazone

. The best crypto podcast out there imho

17

9

35

11/

@Uniswap

's tokenholder revenue is zero.

@SushiSwap

's revenue should be 1/6th of the listed value. Similar adjustments should ideally be made for other assets as well.

3

1

33

@AutismCapital

This is confirmed in the Sequoia article. At least that he lives in a very expensive Penthouse in the most expensive place in the Bahamas

3

1

33

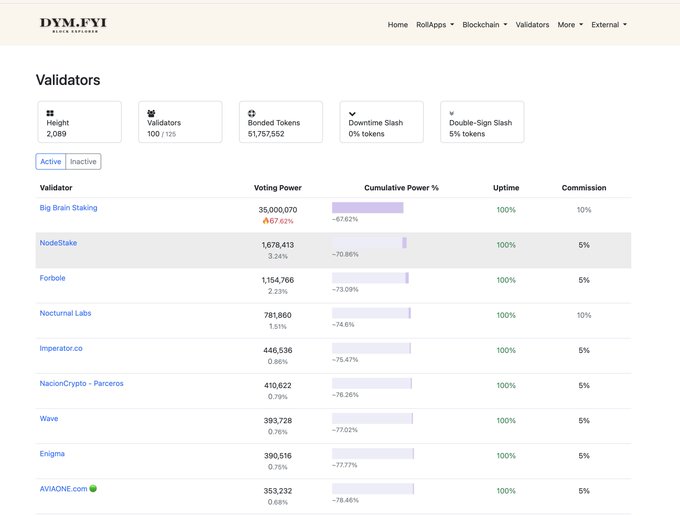

According to , a single validator has more than 67% of stake on

@dymension

at the moment. Not sure but guessing this is the validator of

@BigBrainVC

Not a great idea for investors to just stake to their own validators on day 1 w/o thinking about stake…

3

4

31

@martypartymusic

@RestaurantWill

@BlackRock

This is just false. It’s a passive vehicle. Not sure what this is/haven’t looked properly but it’s just probably something to do with the create/redeem process or the initial seeding of the fund.

3

1

30

Excited to officially start work on the

@Neutron_org

Grants Program with

@EffortCapital

@xxxxpark

and

@emir0x

as Prop-14 passes and successfully executes today.

We'll soon share more details about the program's launch date and strategy 🥳

4

5

32

@icebergy_

Tbh it's a solid biz decision. The % of Twitter users who are willing to spend $10,000s on JPEGs are more than willing to spend a few dollars on Twitter Blue so they can more effectively clout chase

1

1

28

Have the

@cosmoshub

development teams thought about doing a public all-core devs every other week/monthly like

@ethereum

does?

Could be quite helpful in better disseminating information about protocol changes + opening the discussions more in productive ways

1

5

27

We are proud to publish the draft proposal for the

@Neutron_org

Grants Program!

Those in the

@Neutron_org

and wider

@cosmos

community please have a read and provide any relevant feedback.

2

0

27

@MaxResnick1

@aeyakovenko

@gakonst

@tzhen

@0x94305

@GwartyGwart

Excellent list but why did you list

@GwartyGwart

twice?

0

1

26

Increasingly convinced we'll look back at all crypto games which aren't fully on-chain in the same way we now look back at the "Security Tokens" trend in 17-19.

Excited to see more games like

@darkforest_eth

@zkdungeon

Conquest.eth

1

3

25

One thing i worry about is whether all the apps which decide to launch their own chains just end up being generalized smart contract chains eventually — especially given market seems to incentivize this.

Seen similar w/ Sei and Injective but not LR good idea

10

0

25

12/ In most cases very little, if no, revenues or cashflow actually accrue to tokenholders. This isn't a problem now because the numbers still go 🔼. This will change one day CC:

@mgnr_io

2

0

22

@mevalphaleak

@phildaian

Awesome work. Now all you have to do is introduce a token that makes everything 99% worse and this will go viral.

0

1

25

@cmsholdings

@AlexanderGerko

"Stablecoins are generally the most convenient way to move money around "

It's so interesting how heavily one's views on stablecoins (and their convenience) are shaped by whether they live in Europe or the US.

Have you thought of moving to Europe lol

10

0

23

Noting a lot more great content (and breaking news) coming out of

@Blockworks_

as of late, especially on a lot of niche but important topics ... Always good to have more competition in crypto news

3

3

23

@arjunbhuptani

I really don't see this happening. a lot of alt-L1s would rather fade into obscurity than become rollups and many stakeholders (i.e. original founders, stakers) have very strong incentives for not wanting this to happen.

1

0

23

16/ The other important thing is that ideally fees should be adjusted for token inflation. Tokens like

@SushiSwap

and

@Keeper_DAO

(both of which I hold and I'm big fans of) generate a lot of their tokenholder revenue as a direct result of token rewards.

1

0

21

21/ I imagine the situation here will get better as time goes on especially w/ data providers like

@DuneAnalytics

,

@MessariCrypto

, and

@tokenterminal

getting better consistently.

1

0

22

@mrjasonchoi

Also calls into question, it’s ability to protect against authoritarian regimes lol so traceability is definitively a double-edged sword

3

2

20

14/ How easy will it be for

@Uniswap

governance to actually accrue sizeable revenue to tokenholders? To what extent are other actors in a defi app willing to accept rent seeking from token holders to justify valuations? I'm not sure

1

0

19

Excited that

@CelestiaOrg

has actually intentionally thought about blockchain governance, especially given all the issues with tightly-coupled on-chain governance we've seen w/ Cosmos chains and elsewhere.

Hopefully more chains decide to experiment around what actually makes…

0

2

19

@SplitCapital

This guy has a history of saying rogue racist things IN PUBLIC. It’s disappointing that he’s still so accepted in crypto given that fact. Industry’s standards are way to low

2

1

20

Isn’t

@cosmoshub

interchain security essentially a block size increase? And how are people thinking about this in terms of what consumer chains make sense w/o decentralization sacrifices?

3

1

20

17/ I can see certain niches of DAOs doing decently, such as investment DAOs (maybe

@SyndicateDAO

) but I'm not convinced this is a killer use case in any way. Social investing will be a thing but you don't need a DAO for that — see

@prysm_xyz

2

5

17

As expected, we’ll start to see a trend of dapps/chains redeploying to the Cosmos-SDK due to the strong infra + benefits of launching one’s own chain.

Fully expect either Aave or Compound to announce something similar in the next 12 months.

1/ We’re so excited to announce that

@KYVENetwork

has launched a

@cosmos

SDK-based chain, making KYVE its own layer 1! 🎉🥳

Why did we make this switch & what does this mean for the KYVE community? Let’s take a closer look ⬇️🧵

42

525

1K

3

4

21

It’s obvious though that Polygon’s LR strategy isn’t to “scale $ETH”, that’s just its SR growth strategy before increasingly positioning itself as an independent chain/DA layer.

This is why credible definitions of L1s/L2s + bridges is important. It’s not just marketing.

2

3

21

@CryptoMessiah

Long overdue. Going to do a thread today talking about the MEV microstructure is likely to play out in the LR. There’s a lot of misunderstanding on the TL atm

0

0

20

6/ For example,

@tokenterminal

counts

@Uniswap

's revenue as being all fees that go towards LPs. While

@Keeper_DAO

's revenue is counted as revenue which has accrued directly to the DAO's treasury.

2

0

16

.

@EspressoSys

had the best merch by far at

@modular_summit

but trying to explain what their t-shirt meant to someone with no context about the rollup/L2 Twitter debates proved difficult …

1

1

20

@testinprodcap

It made a slight dent during the day but yea. Testament to how liquid majors are nowadays + how good their trading algos are lol.

Though a market order on bitstamp would’ve been fun

0

0

19

Interestingly the launch of

@CelestiaOrg

, which reduces the current DA bottleneck for L2 innovation on Ethereum, is likely very positive for ETH as it is used as the default currency on a wider range of execution environments.

Introducing M2 with Celestia underneath

M2 is the first Move-based Ethereum L2 scaled using

@CelestiaOrg

’s modular data availability layer, accelerating the creation of high-performance consumer apps.

175

467

1K

0

3

19

@crypto_noodles

@cosmos

This is nothing app chain specific ? Most new tokens are cash grabs? It’s irrelevant if it’s a new chain or just a new application on an existing chain

1

0

17

@blknoiz06

I think way less but difficult to confirm for sure since I don’t think exchanges are always honest about their liq. data

0

1

19

On-chain gaming (Autonomous World) efforts led by

@0xPARC

are by far the most interesting new thing in crypto at the moment.

Surprised that

@VitalikButerin

only mentioned them in passing in the footnotes of his "Ethereum application ecosystem" article.

1

1

18

I did a naive (not removing exchanges, custodians, or contracts) Gini Coefficient for holders of

#BTC

, ETH, and the top DeFi tokens.

The higher the number, the greater the degree of wealth inequality among token holders.

4

2

18

Probably the highest ROI grant any Cosmos-focused program could fund.

Surprised

@dYdX

isn’t involved cc:

@AntonioMJuliano

seems like a metamask, walletconnect, web3 modal integration with dydx v4 is a non-negotiatiable?

We are delighted to announce that Atom Accelerator DAO and

@OsmosisGrants

will jointly be funding Mystic labs to work on

@MetaMask

Snaps. Snaps is due to go live in September and this work will enable users to sign

@cosmos

txs using their metamask wallet.

31

78

308

2

2

16

@cmsholdings

I mean the second they took more than a few million in VC funding, they implicitly agreed to launching a token.

A $150M raise 100% guarantees one probably sometime soon imho

0

0

16

@mgnr_io

It'll be this way until the playbook stops working and the VCs stop funding it.

Hard for founders to even imagine solving problems when the industry collectively solves very little in the first place, outside of "making it easier for people to speculate".

1

0

16

We are excited to have our on-chain proposal for the

@Neutron_org

Grants Program go live!

Please vote at:

Excited to hopefully start work soon with the rest of the team

@EffortCapital

@xxxxpark

@emir0x

0

1

17

@aeyakovenko

@worldcoin

I think the perception of Worldcoin would be so much better if the Orb was a local device that users could own as opposed to essentially a very trusted third party. It’s the reason why people are very comfortable with Apple devices holding their biometric info

3

2

15

@convexdegen

there's been talk about building zkps into IBC and improve some of the trust assumptions of light client based bridging.

similarly

@nil_foundation

are working on zkp-based bridging between chains

1

0

16

@zhusu

@mdudas

@pourteaux

@novogratz

Su, I don't think there's any research or evidence that body positivity leads to child obesity this is just a non-serious claim.

+ you can be body positive (i.e. not let young people be depressed over how their body looks) while still promoting healthy lifestyles

1

0

17

@NorthRockLP

yea it's insane, there's been a lot of money to have been made just by listening into the acd + consensus calls over the last few months + understanding a few basic terms.

100-200 people listening in to the future of a $200B network on decisions that can cause substantial swings

1

2

16

@AdamNeumannsCoS

@zebulgar

They’re definitely way more valuable (employees) and the risk they take (their career, having a job) is much more than the marginal financial risk LPs take on a single company.

1

0

17

Question for the trading shops active on dYdX: how much do you actually think about the security assurances of a rollup-based chain like

@dydxprotocol

vs a ”sidechain like xDAI.

Would a factor like that noticeably impact your willingness to put on risk at a given DeFi venue ?

4

0

16

@Galois_Capital

I think they’re leaving a contentious fork very late at this point so I don’t see one getting off the ground. There’s basically a 0% chance that any noticeable institution supports a POW new fork either imo

0

0

15

@Arthur_0x

I don't think anyone can argue that token-based governance has been more effective than public market governance at the moment. So it's a totally reasonable decision from OpenSea

1

0

16

Modularity opens a lot of avenue for really cool research into how to design better blockchains. Glad to collaborate on this article by

@EclipseFND

1

2

16

#DeFi

has grown a lot in the last three years, from a total value locked of less than $50M to over $10B today.

The visual shows how much movement there is among the top DeFi market leaders.

@UniswapProtocol

@AaveAave

@iearnfinance

@compoundfinance

0

4

14

@dymension

@BigBrainVC

So afaik Big Brain could halt the chain (obviously) and double spend ?

1

0

16

Bridging into Cosmos can actually be quite seamless and cheap but a big issue is lack of education about optimal paths + too many solutions are confusing compared to the “canonical bridge” paradigm common in other ecosystems

Trying to fix this with

@NeutronGrants

1

1

15

@zhusu

Similarly, it pains me to think about how many untold millions were spilled in PGA auctions for minimal MEV profits.

Competition is for losers. $ROOK

@Keeper_DAO

1

0

14