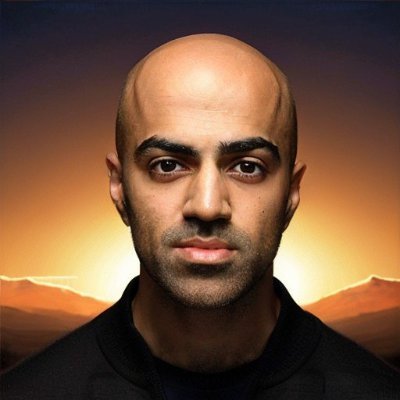

Arthur

@Arthur_0x

Followers

204K

Following

95K

Media

618

Statuses

14K

CEO & CIO @DeFianceCapital Leading Asia-based crypto investment firm across liquid and venture strategies. Fundamental driven active investing.

Onchain

Joined April 2013

1/ 🇺🇸 Today, @CAForever submitted detailed plans for the next great American city, an hour north of Silicon Valley, including: Solano Foundry, America’s largest manufacturing park, Solano Shipyard, our largest shipyard, and walkable neighborhoods for 400,000 Californians.

64

78

761

Oct 10 Crypto Massacre: Binance Edition The most important microstructure fact from the October 10th crypto massacre isn’t just “volatility was high and we had chain congestion,” it’s that the reference/pricing/quotes many desks and DEXs lean on became unreliable, exactly when

28

48

290

Best quote of the article: "It’s not about the loss itself; it’s about the lack of accountability."

3

4

46

Big news!!! FOUR Organics is officially at PopUp Grocer in NYC's West Village! Our mission has always been simple: create the cleanest lip balm possible with just FOUR organic ingredients. No compromises, no unnecessary additives—just pure, effective hydration. We're thrilled

0

0

42

We are fine, fund took some losses but not even in our top 5 PnL swing days. I am just very angry and disappointed that this event set the space back by so much especially for the altcoins market where most of the price discovery happen on offshore CEXs.

55

17

535

Long story short, Hyperliquid and Ethena did nothing wrong. Binance did many things wrong.

101

165

2K

I think over the next few days it'll become clear that Binance's poor oracle implementation is the biggest contributor to making Friday the largest crypto liquidation event ever Maybe spend less time taking shots at competitors and more time focused on your own CEX

43

39

387

Did Ethena Really Depeg? I’ve seen a lot of chatter about the Ethena depeg during the market mayhem this weekend. The story is that USDe briefly depegged to ~68c before recovering. Here’s the Binance chart everyone is quoting: But digging into the data and talking to a bunch of

While we share these suggestions privately with any partner we work with across both DeFi and CeFi, want to surface this publicly so there is zero doubt going forward on what we view as appropriate oracle design and risk management for USDe:

200

260

1K

Worst kind of ppl on this app are the TA bros who are perma-bears on the coins and have been calling for a dump for months and then yesterday happens and it’s the literal worst black swan in crypto history that had absolutely nothing to do with charts or TA and then they come on

149

19

526

While we share these suggestions privately with any partner we work with across both DeFi and CeFi, want to surface this publicly so there is zero doubt going forward on what we view as appropriate oracle design and risk management for USDe:

175

196

1K

All these CEX insurance funds are more of a marketing facade than anything real. I have never seen any of them being used in any substantial manner since 2017 after so many major liquidation events we went through to compensate users or to take on the risk of ADL and underwater

43

37

281

DeFi > CeFi when it come to the most critical part of the market, transparency and fairness. That said it will still take a while for DeFi to catch up to the distribution and userbase of CEX.

A few months ago, I shared my perspective on the market share competition between DEXs and CEXs, predicting a reversal around 2028. I believed a specific catalyst would be needed to trigger this shift. I’m now convinced that the recent system failures and opaque liquidation

19

4

80

Only four assets out of the 429 in total on Binance (spot only) are up from the pre-crash prices. Zcash - up 17% RDNT - up 15% Succinct - up 12% Morpho - up 3% The remaining 425 assets are all down

42

88

389

If the industry leaders don't step up to fix and improve the exchange infrastructure of crypto, trust in the market will be gone especially for altcoins and what follows is that there won't be many users that will participate in this market going forward.

98

32

427

i think everyone is thinking about finding a new home for their perp trading after being unfairly liquidated on binance~

How’s everyone’s life going? I’m not here to mock anyone — I just want to speak one last time about the topic of “XX Life.” Everyone’s life is full of drama and brilliance, and every exchange has its own style and philosophy. But I’ve always believed this: neutrality for a

54

21

242

Major crypto derivatives markets should have circuit breakers. Allowing a flash crash to blow up a significant percentage of your users is strictly value destructive. But if the exchange is left with bad debt which would have been liquidated if not for circuit breakers? That is

60

22

330

At this rate, the top perp exchanges need to decide if they want to level up and be an institutional exchange or remain a bucket shop forever.

38

26

282