MEV Alpha Leaked

@mevalphaleak

Followers

14,471

Following

94

Media

10

Statuses

415

Retired searcher shit-posting when I feel like it. previously: low-level solidity optimisations / DEX arbitrage / ML / AlphaMEV / BetaRPC

EVM

Joined April 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mbappe

• 1038219 Tweets

Fauci

• 1017129 Tweets

Jadue

• 147039 Tweets

WNBA

• 144194 Tweets

Marjorie Taylor Greene

• 126973 Tweets

Acun

• 107027 Tweets

#loveIsland

• 91734 Tweets

Mimi

• 77336 Tweets

Caitlin Clark

• 77136 Tweets

Paraná

• 69998 Tweets

haechan

• 57629 Tweets

Chloe

• 39331 Tweets

marti

• 30306 Tweets

Rune

• 29584 Tweets

Jaime Caravaca

• 27090 Tweets

Angel Reese

• 26797 Tweets

AIDS

• 26645 Tweets

天安門事件

• 25218 Tweets

Marge

• 22319 Tweets

Trent

• 21791 Tweets

Epoch Times

• 21226 Tweets

#ラヴィット

• 20277 Tweets

#WWERaw

• 19229 Tweets

Rhys

• 14886 Tweets

luli

• 12884 Tweets

Pat McAfee

• 12515 Tweets

K HARUA

• 11596 Tweets

San Lorenzo

• 11556 Tweets

XCRY EN KICK

• 10644 Tweets

O Santos

• 10251 Tweets

エンバペ

• 10169 Tweets

Last Seen Profiles

@SiegeRhino2

Closed source completely centralised protocol without any audits.

People are absolutely lost their mind investing 600M into that, I don't even consider this DeFi.

0

3

52

While downfall of UST was obvious to anyone who was willing to do research, I'd love to see clone of LUSD with improved oracle model.

Something like LUSD but where oracle uses median price between ChainLink/Tellor/Uniswap TWAP(ETH-USDC) so it takes at least 2 parties to rekt you.

@HS_Preze

This one is ultimately controlled by single person which is even worse than centralised or governance control imho.

1

1

11

7

5

37

What will be stable equilibrium with bundle merging?

Ultimately all AMM trades should be routed privately so hopefully all sandwich bots will completely disappear.

Next should be oracle updates so back-runs will disappear?

Will it be old-school arbs at the beginning of new blocks

4

5

41

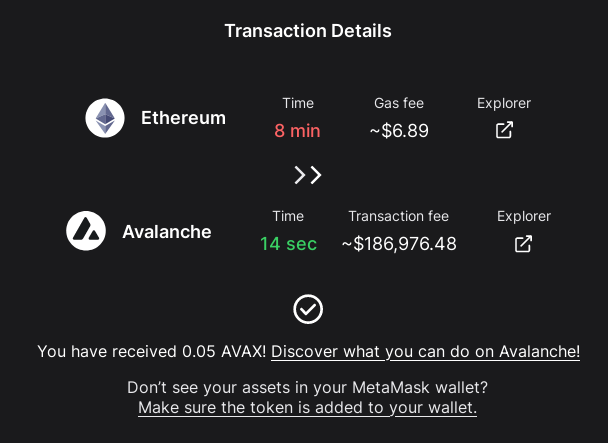

Observed some of the largest BetaRPC back-runs so far:

1) with MEV gap of 2.55 ETH

Trader got back: 93% Miner: 4% BetaRPC: 3%

2)

with MEV gap of 1.62 ETH

Trader got back: 95% Miner: 3% BetaRPC: 2%

That I consider fair distribution.

3

3

40

@SiegeRhino2

I didn't build sandwich bot for ethical reasons and they've built the most notorious one and run it for a very long time, so they clearly don't care about ethical reasons.

Outside of ethical reasons I think this sets dangerous precedent, what about gas auctions in general?

0

0

39

Thank you everyone for participating! Grand total of 128 submissions received.

I tried my best to de-duplicate submissions by code and 23.6 ETH of rewards have now been dispersed:

Also smaller rewards were dispersed beyond top 5 for trying!

1/

1

3

33

@bertcmiller

Interestingly this person also started completely from scratch with an empty account, deploying the contract and exploiting an arb bot in the very first bundle:

There he didn't even have to create a bait.

2

7

28

I'm a boomer and don't understand value of NFTs even the rare/old ones. Fractionalised NFTs make even less sense to me.

But given I've promised some worthless NFT for winners of first competition and too bored to draw one in MS paint I've fractionalised one I won from Lido.

1/

2

2

26

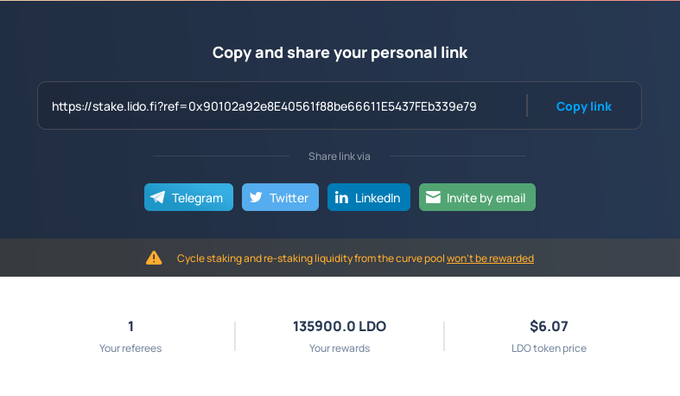

One follower told me about

@LidoFinance

referral program. Decided to check ma balance after the NFT mint transaction, not so bad from 13 ETH to 825k$

Before everyone looses their mind: yes I know that I won't get it for violating Terms of Service but fun feature anyway.

1/

1

1

23

@bertcmiller

To perform a sandwich/front-run you need to have input shit-coin available. That's why proper slippage is more important when you buy.

So to sandwich Vitalik they had to hold bag of dog coins originally which they obviously didn't

In this sense back-run was their only option.

6

2

21

Also releasing first version of front-end code for my little pet project:

3

0

18

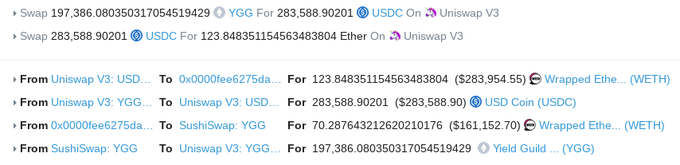

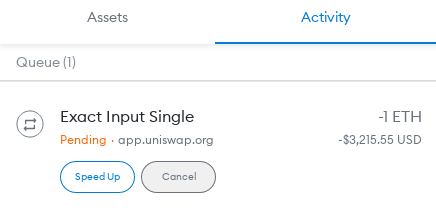

@NathanWorsley_

Found actual transactions from top

#1

place on leader-board:

1)Trade:

2)Back-run:

User received only 38% of the opportunity?

The hell is that, first route user incorrectly as "aggregator" service then return back to them only 38%?

3

1

18

1) So it seems that consensus is that 'screwing up other bots' is more ethical than other things.

I've been logging all the events which happened in the mempool for a year now. A lot of people read the 'Dark Forest' from

@danrobinson

but not many actually understand what happened

1

0

17

@SamuelShadrach4

So you buy NFT at 500k$ then donate it at "appreciated" value of 3.4M$ to claim nice fat tax deduction?

I guess I'll become something of an NFT collector myself closer to the end of the tax year.

2

1

17

@NathanWorsley_

I actually don't get it, why not route user correctly in the first place?

Like RPC endpoint can't change original transaction so can only spend gas on back-run.

That's a centralised DEX aggregator why not create optimal path in the first place?

4

0

17

1/ Why not today harmful MEV which comes from ArcherDAO relay?

Block from your mining pool where searchers leaves trader 0.55 ETH worse off with the help of your relay.

Overall this and are great steps in the right direction.

Today, harmful MEV comes from FlashBots Searchers and Miners working together to abuse transactions. 🤖😈

We used the same MEV toolkit to create Archer Swap (

@Archer_DAO

), which gives normal traders super powers and protects them with zero-slippage, zero failure cost swaps. 💪

5

10

57

3

5

17

Can anyone please explain to me why would

@sparkpool_eth

uncle its own blocks?

Example:

It's a block by SparkPool which contains uncle at block 13055372 which is also from SparkPool.

Are BeePool and SparkPool controlled by single entity?

3

1

16

New hackathon from one of participants in AlphaMEV contest.

I think it's a pretty interesting task to optimise for, though given limited evaluation time-frame my hunch that confidence intervals would be very large and winner will be likely the person to over-fit/gamble a bit.

Thrilled to announce our very first hackathon!! Focusing on

@Uniswap

v3 🦄, developers will compete to provide the optimal LP strategy wtih concentrated liquidity.

Details:

1

7

21

4

2

14

@angela_walch

In case of DeFi unless transaction is routed via private pools it's public information so doesn't seem the same as TradFi.

But better education is necessary as there're hundreds of options to avoid it as ETH user: mistX, taiChi network, , Archer...

1

1

13

@SamuelShadrach4

"Within an Eden block, transactions are ordered by the sender’s relative stake of EDEN tokens."

There's nothing about "fair" sequencing and seems like another pathetic attempt to shoe-horn unnecessary token with broken economics.

1

1

14

@HS_Preze

This one is ultimately controlled by single person which is even worse than centralised or governance control imho.

1

1

11

@bertcmiller

What makes you think that some searchers don't continue doing so? It's all fake money anyway.

Also gold farming bots in Diablo 3 before bugs and insane inflation.

1

0

11

Sad to see but I guess expected, I'm running 3 geth archive nodes myself for back-testing/training + 1 backup and after 1.10.4 it was a downhill road, first broken snapshot logic for archive nodes() and now this.

Guess

@ErigonEth

soon be only viable client.

Who will miss archive mode support from Geth? We're trying to figure out where to go with it, as it's not meaningfully sustainable, especially as we're pushing the gas limits higher and higher.

#Ethereum

39

13

105

0

0

11

@zzp45_eth

@bertcmiller

You should start a twitch stream I see you're trying to drain 0x00000000003b3cc22af3ae1eac0440bcee416b40 in real-time again :)

It's always pleasing to see sandwich bot operators getting rekt.

1

0

11

@SiegeRhino2

But what exactly can you double check as a user?

Decode hex number on minReturn field and verify it's high enough? No-one got time for that.

Wallets should be responsible for that and perform some sanity checks on transactions and warn users before releasing signed transactions.

1

0

10

@SiegeRhino2

@SiegeRhino2

if you participate I'll personally draw an NFT for you in Microsoft Paint. What kind of money can be more valuable than that?

0

0

9

@CryptoDragonite

@FrankResearcher

Good luck explaining to your bank/tax adviser how you've received 14 billion$ airdrop and now have to pay taxes on it :)

4

0

10

@fradamt

@SiegeRhino2

@NathanWorsley_

@MEVprotection

Back-running is always way less efficient than routing because you pay exchange fee twice(user in one direction, bot in another) on top of wasting additional gas and paying for it so it won't be "competitive".

2

0

10

@_someone_els

@LidoFinance

I've made minus 13 ETH in this "arb" so don't recommend copying it.

Though important part is friends you make along the way :)

1

0

10

@foldfinance

I'm not back really, don't do MEV anymore.

Just shit-posting my thoughts as anon :)

5

0

9