noodles

@crypto_noodles

Followers

11,754

Following

1,455

Media

262

Statuses

3,323

Explore trending content on Musk Viewer

NuNew 3rd Showcase

• 373606 Tweets

Cohen

• 114019 Tweets

$GME

• 89563 Tweets

#LovelyRunnerEp11

• 77426 Tweets

#キュウゴー

• 53012 Tweets

MY LOVE IS LIKE

• 44436 Tweets

GameStop

• 39150 Tweets

#CBÖğretmeneMülakatıKaldır

• 36604 Tweets

TREASURE COMEBACK

• 33124 Tweets

Aziz Yıldırım

• 28685 Tweets

LINEの新機能

• 27718 Tweets

Roaring Kitty

• 24524 Tweets

Hot Sale

• 21003 Tweets

Square Enix

• 20912 Tweets

Childish Gambino

• 19938 Tweets

Ravens

• 17538 Tweets

GET WELL SOON GYUVIN

• 16667 Tweets

Deco

• 15403 Tweets

$AMC

• 15336 Tweets

ACEITA ANITTA

• 14135 Tweets

Atiku

• 12885 Tweets

McDavid

• 12331 Tweets

Stevie Wonder

• 12015 Tweets

Qちゃん

• 10234 Tweets

Last Seen Profiles

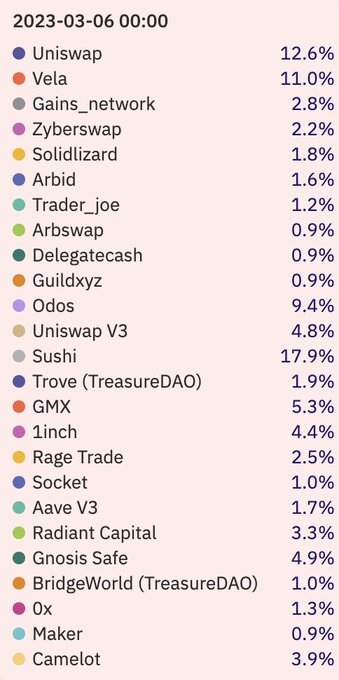

You can't talk about perps without talking about the king:

@dYdX

Wonder why $DYDX has been down only?

👇 👇 Come at the king, best not miss 👇 👇

59

141

744

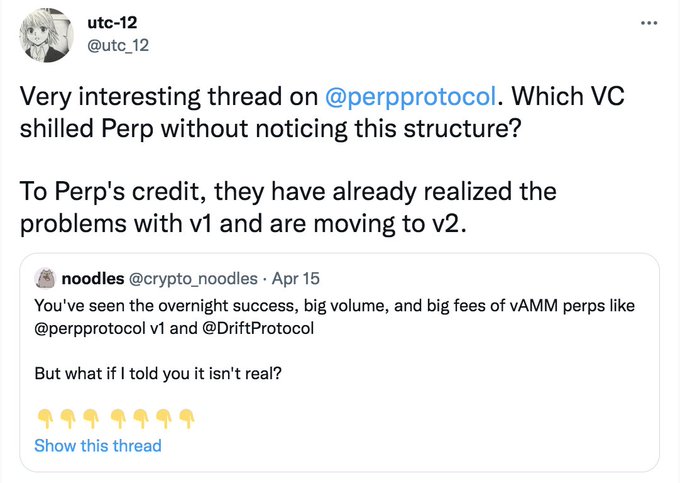

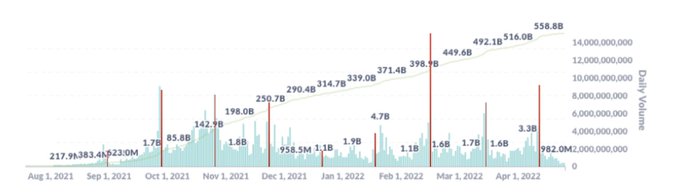

You've seen the overnight success, big volume, and big fees of vAMM perps like

@perpprotocol

v1 and

@DriftProtocol

But what if I told you it isn't real?

👇👇👇 👇👇👇👇

41

128

658

There is something special about

@arbitrum

- No VC subsidized TVL like

@solana

- More TVL than

@optimismFND

even w/o a token

- No token emissions to incentivize usage (like

@Polygon

/

@avalancheavax

)

This is why we build on

@arbitrum

@rage_trade

More will follow...

38

52

529

So your telling me that

@multicoincap

:

> Invested $5M in

@SeiNetwork

at $50M FDV

> $SEI trades at $5B FDV

> $5M investment is now $500M (vested over 4yrs)

@KyleSamani

is probably the best investor in our industry. And $ETH maxis hate to see it.

55

35

507

Its been a minute since I've done one of these

So here's

@rage_trade

's master plan:

"A guide to building

@arbitrum

largest stablecoin farm"

👇👇👇👇👇👇👇

22

109

454

All roads lead back to one:

-

@berachain

- BERPs

-

@Blast_L2

- NFT Perps

-

@SeiNetwork

- Parallelized -> Orderbook -> Perps

-

@monad_xyz

- Parallelized -> Orderbook -> Perps

-

@aevoxyz

- OP AppChain -> Perps

-

@HyperliquidX

- Cosmos SDK - Perps

-

@ethena_labs

- Yield -> Perps

202

196

418

A new iteration of

@TornadoCash

:

Problem: Hacked and normal funds shouldnt mix.

Solution:

- Incoming deposits are queued for 1month

- Current depositors vote to reject from queue

- Users can vote to fork/split the anonymity set if they disagree on an incoming deposit

53

45

403

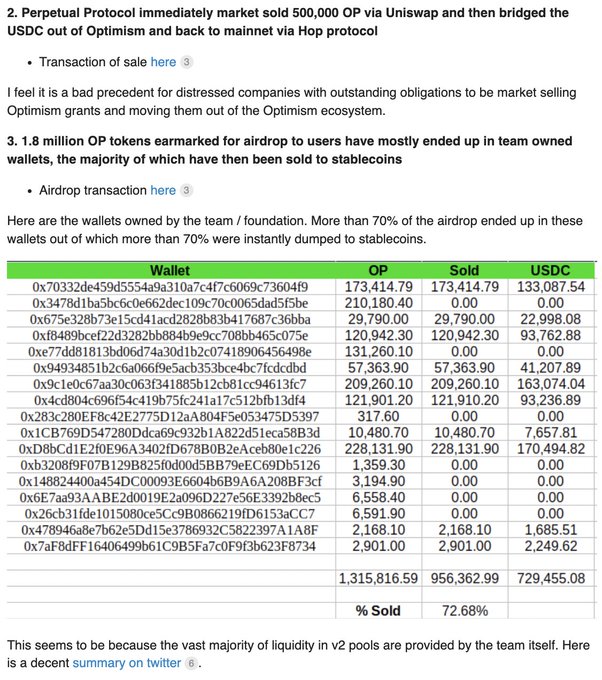

DAOs are gaming L2 airdrops

Of the 9M $OP granted to

@perpprotocol

:

- 500k was dumped by Perp's Grants DAO

- 70% of 1.8M $OP airdrop was sent to team wallets

- 70% of those addresses insta-dumped $OP

If left unchecked, DAOs will do this in future $OP airdrops too

h/t

@Gancor_

39

64

367

The

@arbitrum

team has been awfully quiet recently.

I sense something big is about to happen.

31

18

352

Okay anon, it's announcement time!

Today we are unveiling

@rage_trade

, the first liquid, composable, and omnichain ETH Perp Swap.

👇👇 So why build another perp? 👇👇

24

61

361

If your like me:

> Not big brain enough to do MEV

> Not well connected to go early VC

Then go to governance forums, its perhaps the easiest way to frontrun future price action.

Few of the best:

-

@feiprotocol

-

@fraxfinance

-

@OlympusDAO

-

@CurveFinance

-

@ribbonfinance

12

23

349

Insider alpha leak:

@Uniswap

's next *big* product is a wallet.

@MetaMask

/

@rainbowdotme

competitor

For Uni Labs, its high revenue potential

For builders/users of UNI v3, it means no v4 and continued bad LP experience

This is an opportunity for new AMMs like

@CrocSwap

@eljhfx

36

30

321

I believe most

@cosmos

AppChains are cash grabs by founders + investors.

Do we need another:

- Orderbook

- Stablecoin

- AMM

They'll dump bags on you anon.

Don't be fooled again.

39

24

319

2024 is for airdrops:

If your a whale LP:

>

@eigenlayer

>

@Blast_L2

>

@ethena_labs

If your an HFT:

>

@JupiterExchange

>

@HyperliquidX

If your 5/6 figs LP stake:

>

@CelestiaOrg

>

@cosmos

>

@osmosiszone

@rage_trade

will be the best way to earn new perp + chain tokens

20

46

293

2 years ago I created

@crypto_noodles

I simped

@tarunchitra

till he became my first follow

Over time, I made CT frens. And we got together to build

@rage_trade

.

@0xtuba

pushed me to launch faster

Today we hit our $1.5M cap in minutes

I'm grateful to CT for all the support!

47

15

273

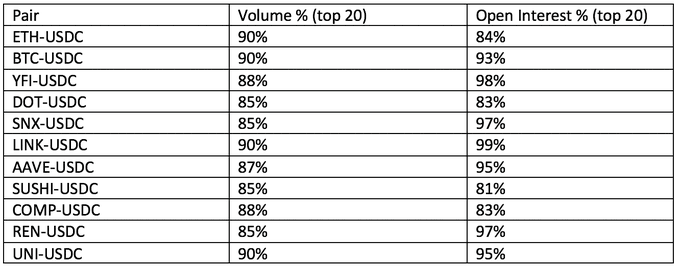

Last week we launched our DN

@GMX_IO

product.

Our $10M cap was hit in minutes!

So we spent the past week analyzing the performance. Let's have a look

👇👇👇👇

7

54

264

ETH L2s (zk/optimistic):

-

@Polygon

-

@zksync

-

@aztecnetwork

-

@Scroll_ZKP

-

@StarkWareLtd

-

@arbitrum

-

@optimismPBC

If the above succeed, they will fragment ETH liquidity in the process.

This is increasingly bullish for SOL and bearish for ETH.

81

25

251

The

@cosmos

AppChain thesis will be eaten by $ETH rollups:

-

@eigenlayer

modular trust

-

@Calderaxyz

/

@arbitrum

L3 app rollups

- Flashbot/SUAVE democratized MEV

The combination of the above will make rollups cheap, app-specific, and user friendly (w/ EIP 4337)

34

30

239

I've tried to bite my tongue because I'm bullish

@arbitrum

But each

@CamelotDEX

launchpad sale (with 1 exception) has been an absolute scam:

- Glorified landing pages

- Copy pasta code

- Down only tokens (for the most part)

Each listing is like watching a slow rug in real time

59

18

233

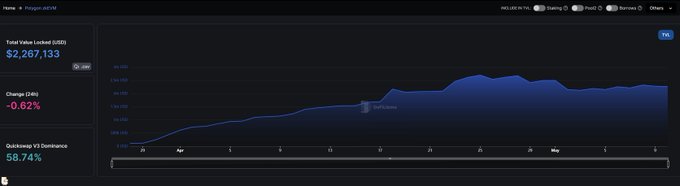

Polygon's zkEVM has $2.2M

I'd bet each member of

@0xPolygonLabs

senior management team holds more than $2.2M in crypto.

Is this what happens when there's no new token to farm?

37

24

218

With

@GMX_IO

v2 around the corner, there have been some difficult questions to answer:

- Will v2 displace v1?

- Will LPs continue to lose?

- Will Open Interest scale?

- Will GMX continue its market dominance?

👇👇 Well, let's get into it 👇👇

16

55

204

Blockspace is cheap. We no longer need AMMs.

@Uniswap

v5 will likely be an orderbook. You can already implement Uni v2 style bonding curve on

@HyperliquidX

's spot market + MMs can join over time.

Don't waste your time on LVR or mech design debates. Orderbooks will win.

42

18

214

- Sold $SOL holdings at $3.00 ($7M at todays prices)

- Passed cofounding a project that netted > $10M

- Won first $SOL hackathon, didn't continue building.

Tagging frens to share their biggest Ls:

@0xtuba

@mewn21

@0xSisyphus

@DeFiGod1

@scott_lew_is

@tarunchitra

8

8

185

So

@opyn_

is launching Squeeth today.

- ETH^2 price exposure

- Can hedge any portfolio of ETH options

- No liquidation for buyers

- And $ETH price is 3k

And if your still bearish anon... ngmi

10

23

186

The hashtag

#SeiScam

is trending.

As expected the airdrop was majorly sybil attacked leaving behind a paltry sum for the real users. And the real users were pissed.

But what do you expect from a vaporware chain?

- There is no product, there is only a token.

- There are no…

17

32

181

The most common response to our previous thread on the vAMM ponzi was:

"What about

@perpprotocol

v2?"

@0xDosa

,

@0xAthanase

, and I went digging.

And the answers will surprise you!

👇👇👇👇👇👇👇

19

33

164

A Layer 2 is only as valuable as the interesting applications built on top of it.

-

@BuildOnBase

has

@friendtech

-

@arbitrum

had

@GMX_IO

@Treasure_DAO

Layer 2's like

@Polygon

@zksync

@0xMantle

are still searching for that killer app.

While it may seem that VCs are ploughing…

12

23

149

Building/listing on

@HyperliquidX

L1 today will be like getting into the

@binance

/ BNB eco in 2019/2020.

10

17

147

If your a perp trader, you could go to:

-

@GMX_IO

for ETH/BTC

-

@synthetix_io

for top 20 cryptos

-

@GainsNetwork_io

for forex

-

@aevoxyz

for pre-launch pairs

-

@HyperliquidX

for alts w/ cross margin

-

@vertex_protocol

for $VRTX rewards

Or go to

@rage_trade

and trade on all of…

📢 Docs for Rage v2 are live!

Learn how you can trade on

@GMX_IO

v1/v2,

@synthetix_io

,

@HyperliquidX

,

@vertex_protocol

,

@ribbonfinance

, and more all in one place.

➡️

6

6

82

12

12

139

In conclusion, dydx built the most liquid perp book - but the liquidity comes at the expense of HODLers. HODLers hold the token all the way down, while MMs eat a free lunch at your expense.

Please follow

@0xAthanase

for the work that went into this!

5

2

135

If a protocol offers 60% APR on GLP, when

@GMX_IO

offers 30%... they are taking leverage:

- 2x APR

- 2x exposure to trader PnL

- 2x exposure to asset prices

- 2x profits or losses

If they only show you the APR and leave out the leverage risks, their lying to you.

17

5

133

Of the top 5

@arbitrum

protocols by TVL,

@GMX_IO

is the only arbitrum native project.

@rage_trade

will be the next arbitrum native protocol to break the top 5.

Screencap this, anon.

20

16

135

If youre building in DeFi, you gotta know hurdle rates

Hurdle Rate = Min return to justify investment

Current rates are:

- Stables: 15%

- ETH: ~7-8% (Staking + MEV Boost)

With

@eigenlayer

(re-staking ETH), DeFi ETH rates will struggle to remain competitive against staking.

13

10

123

When

@0xtuba

nerdnipes, you gotta oblige.

All credit goes to

@134dd3v

for the thorough code review.

So how is Sushi's Trident different from UNI v3?

👇👇👇

can some gigabrains who have read the univ3 codebase read the

@SushiSwap

trident concentrated liquidity pool contract and summarize what the main differences are ?

12

10

86

9

18

117

There's a team building on

@GMX_IO

that:

- Copied

@rage_trade

's mech design

- Called us 'dimwits' (after copying us)

- Tried to poach our LPs (none of our LPs listened)

- Reply guys to me for engagement

And our response?

- Build more cool shit

- Live rent free in their head

25

7

108

Perp tokens coming to market this year that will create billions of dollars of value for farmers:

>

@HyperliquidX

>

@aevoxyz

>

@DriftProtocol

>

@ZetaMarkets

>

@JupiterExchange

>

@IntentX_

Imo

@HyperliquidX

might be the biggest of em all, since theres no private investors

15

7

109

The biggest comeback story from

@terra_money

's meltdown will be

@Delphi_Digital

:

They were big investors+builders in the Terra eco.

Consequentially, they are experts in:

-

@cosmos

dev

- Mech Design

- MEV

Those skills will pay off more than their $LUNA holdings ever could.

4

9

102

For a more detailed version of this thread, read the full article:

Give

@0xDosa

a follow for all the effort that went into researching this.

Additional thanks to our peer reviews:

@0xtuba

@backbooked

@0xperp

@Jib0xD

@MLGavaudan

@rebeccadai0

13

4

104

There used to be a meme that

@synthetix_io

only had 13 users, but its far from the reality today.

With v3, Synthetix will introduce multi-asset LPs (not only $SNX stakers) and a multi-chain LP system (supported by sUSD).

I've always believed their volume was artificially…

As perp builders, we take inspiration from fellow builders. It's no secret that we've been

@GMX_IO

fans since the early days.

Tho

@synthetix_io

innovations in perp mechanism design are criminally under appreciated.

Synthetix/

@Kwenta_io

v2 fixed scalability and LP payoff issues…

13

22

159

8

15

103

I think

@GMX_IO

solves

@maplefinance

's problems

On Maple:

- Lenders earn 6-8%

- MMs move funds to CEXs

- MMs provide liquidity on CEXs (earn >20%)

On GMX:

- LPs earn trader fees (>20%)

- LPs provide liquidity at oracle price

- LPs = onchain MMs

Onchain MM >> Offchain MM

11

16

89

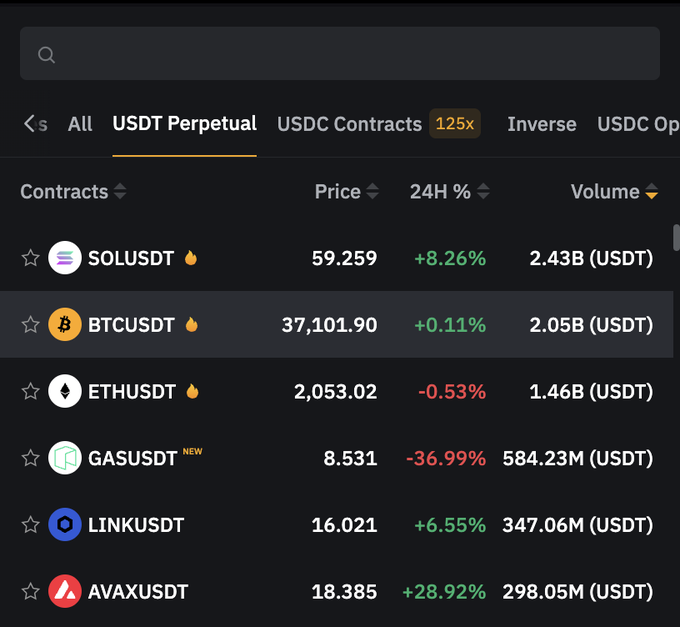

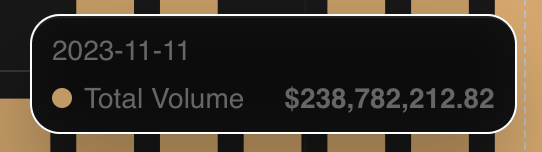

So:

>

@Bybit_Official

did $7B volume across top 6 perps

>

@GMX_IO

did $181M across v1/v2

>

@synthetix_io

did $238M

This is your reminder that onchain perps have another 30-50x ahead of us. It'll come from:

> UX (

@rage_trade

@infinex_app

)

> Aggressive user acquisition

6

14

95

As traders go DeFi post-FTX, heres a trick to open levered shorts on Aave

$100 ETH short w/ $50 margin (~2x):

- Flash-borrow $100 ETH

- Sell ETH for $100

- Add $100 in Aave

- Add $50 more for health factor

- Borrow ETH + repay loan

@rage_trade

use this to hedge

@GMX_IO

's GLP!

5

8

84

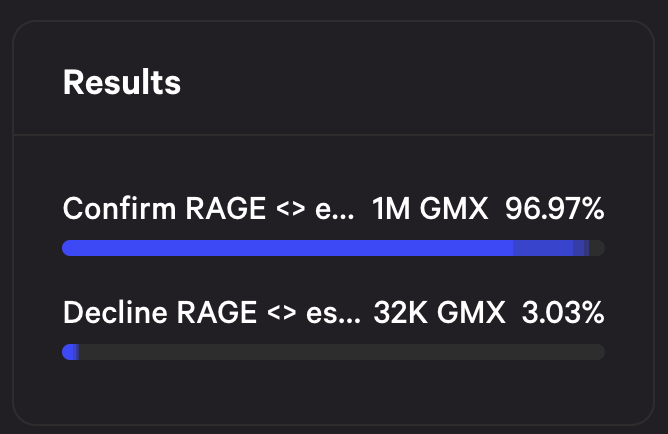

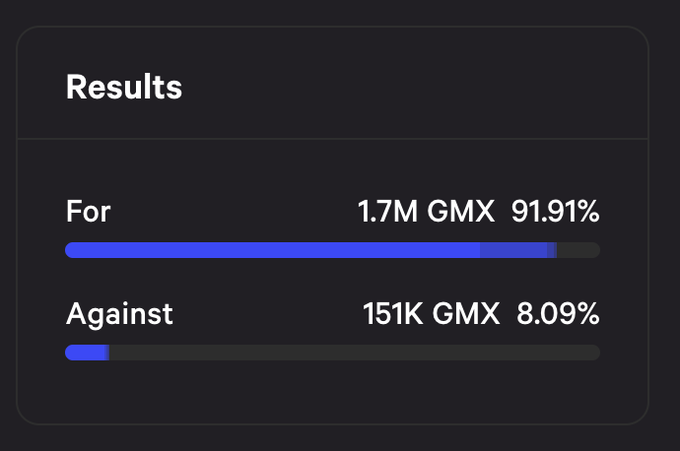

It's crazy to think that $40M of

@GMX_IO

voted in

@rage_trade

's favor

This was more bipartisan than the 'FTX Listing' vote:

- 96.9% voted for Rage's treasury swap

- 91.9% voted to list on FTX

Delta neutral GLP could grow TVL by $100M+

Long live the blueberries!

9

8

87

A few influencoors have been FUDing

@GMX_IO

But have they done the math?

GLP Returns = ETH Rewards + Trader PnL

GLP's returns over last 2 months:

Sep 29 - Nov 28 = +$11.7M

Oct 29 - Nov 28 = +$4.17M

Nov 14 - Nov 28 = +$60k

14

8

81

We spent months working on our

@GMX_IO

DN Vaults

In that time, we have:

- Done a treasury swap w/

@GMX_IO

- Been audited + $10M insured by

@sherlockdefi

- Partnered w/

@MIM_Spell

@UXDProtocol

@SushiSwap

@sentimentxyz

(enabling leverage + liquidity)

Mark your calendars, anon!

4

10

75

I'm so excited to work with one of the biggest brain teams on

@arbitrum

!

@dopex_io

is one of the few projects that has been pushing the bar for DeFi derivatives.

I hope

@rage_trade

can match their energy.

@rage_trade

❤️

@dopex_io

HUGE announcement Rage Army! 🚨

Team

@dopex_io

has OFFICIALLY invested in

@rage_trade

💎🤝😈

Special thanks to all of these individual contributors ⬇️

@mariodigital_

@0xsaitama_

@chutoro_au

@Cryptobean36

@Bigbazuso_

@ZoomBie255

@psytama7

@witherblock

@tztokchad

(1/2)

14

37

129

9

4

77

Months of building, and now Rage v2 is finally in beta!

We’ve spent about 2 years building / iterating on perp products and all those learning have culminated in v2. I think this can be our mark on the onchain perp space.

Ironically in late 2021 (when we got together) nobody…

The Rage v2 Public Beta is live!

• Aggregate

@GMX_IO

v1/v2 +

@synthetix_io

• Soon

@HyperliquidX

,

@aevoxyz

,

@dYdX

& more

• 100% rebates on GMX v2

• Best funding/prices

• New perp strategies

• No moving gas b/w chains

Join Discord for invite 👇

8

53

210

24

20

68

One of the cool aspects of DeFi is that a single instrument (for ex: options) can have many different flavors.

Let's talk about 4 different flavors of options in DeFi

(

@opyn_

,

@HegicOptions

,

@PrimitiveFi

,

@CharmFinance

)

5

9

73

There is some irony to the fact that

@FTX_Official

creditors may be made solvent from the

@AnthropicAI

investment.

If one AI investment can fill the hole left by 100s of crypto investments, we all need to take a hard look at ourselves.

8

5

67

Both

@Blast_L2

and

@berachain

have been around long enough to study the

@arbitrum

and

@Optimism

playbook.

> Incentivize builders

> Builders make apps / memes

> Apps / memes bring users

> Builders + users = community

4

4

72

In todays science experiment, we will put $30B at stake to test out a multi-agent sybil attack.

Our players:

- foreign advesaries

- local politicians

- polarized right + left groups

Lets see who wins.

4

6

68

I am running for the

@synthetix_io

Spartan Council.

I think Synthetix v3 has one of the most ambitious visions for making decentralized perps multichain, scalable, and easy to use.

There are a few core ideas behind v3:

1. Separate liquidity provision from trading infra

2.…

10

8

68

Are MMs earning $DYDX risk free?

Yes, MMs are fully hedged:

- Provide liquidity in CLOB

- Trade against their own liquidity

- Hedge position on CEX

Risk free profit, then sell $DYDX

@EOSIO

+ FCoin ran similar token sale / trade mining operations

Both ended badly for HODLers

3

8

72

The day came and we were ready. We'd finished building.

Excitedly, I DM'd

@SBF_FTX

to let him know the app was ready. And within minutes he responded/tested it and gave us good feedback.

What kind of billionaire has that response time?!?

1

1

64

Yesterday, we posted a proposal to

@GMX_IO

governance. Of the 13 negative responses:

- 53% (7 of 13) accts were created in the last 24hrs

- 77% (10 of 13) posted on only 1 other topic

Separating noise from signal is the hardest job!

20

6

64

In our effort to remain transparent, we've launched a stats page for our DN

@GMX_IO

vaults that covers daily/cumulative values for:

- Risk On/Off Returns

- Hedge Costs (Uniswap, GLP mint/redeem)

- Realized/Unrealized Trader PnL

👇👇 Let's dive in 👇👇

6

16

62

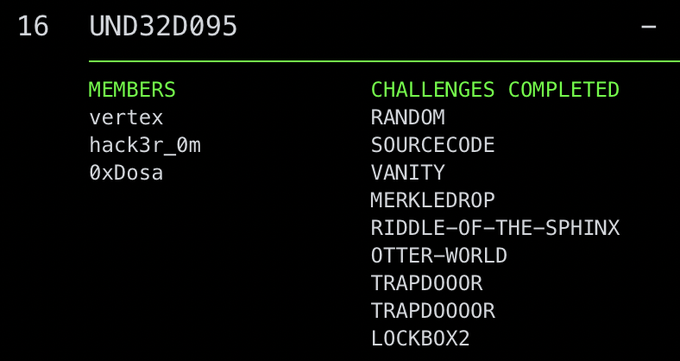

As a protocol builder, most days you're putting out fires and working across timezones.

But somedays, everything works so smooth.

-

@peckshield

Audits ✅

- Top 20

@paradigm

CTF ✅

-

@dopex_io

investment ✅

-

@rage_trade

<>

@GMX_IO

vault ✅

Week so far at Rage:

- Devs spent weekend on

@paradigm

's CTF

- Rank

#16

among top auditors/hackers

-

@peckshield

returns audit report... no high severity vulnerabilities (

@GMX_IO

vault coming soon)

How's your week going anon?

7

11

53

4

8

62

Real yield is built on real demand.

3 biggest sources of demand:

- Leverage (Perps, Options, Lending)

- NFTs

- Blockspace (L2s, AppChains, MEV)

@ribbonfinance

vertically integrated from options yield to owning blockspace

Kudos to

@aevoxyz

,

@rage_trade

is watching closely!

3

8

61

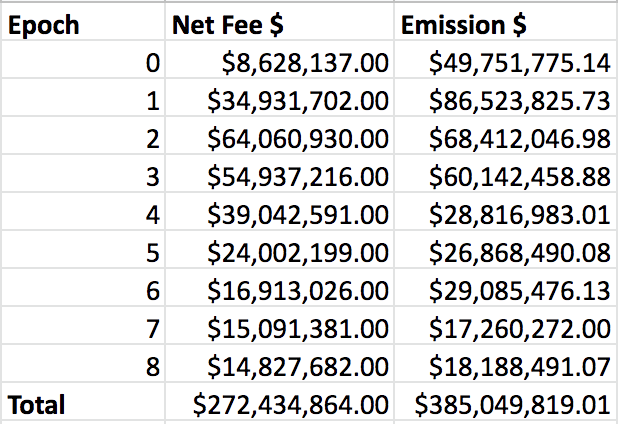

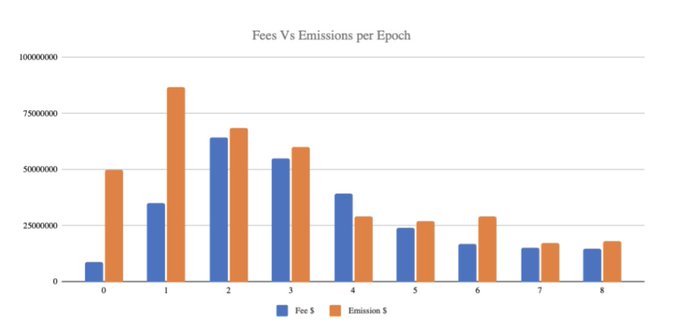

How is

@dYdX

a stablecoin farm?

MMs earn risk free profit.

Like any stable farm, excess profits are short term:

- MMs dump $dYdX

- $dYdX down only

- MMs yield compresses

You can see the yield compress by comparing trading fees vs $dYdX emissions each epoch.

2

1

62

Let me restate that once more.

@SBF_FTX

responded to us in minutes. Keep in mind, I am a dog LARPing as a cat LARPing as a rust developer.

What kind of world do we live in?

1

3

58

Unconsciously, I was so jaded by coins like $EOS, $ADA, and $XRP that I really didn't believe

@rajgokal

@aeyakovenko

would be any different.

I was wrong. They were genuine builders who were working their ass off to make this thing a success.

1

2

55

One of the consequences of MMs pulling out from

@binance

and other CEXs is the popularization of MM operated vaults.

It's still early days, but its happening:

-

@GMX_IO

GLP

-

@synthetix_io

SNX stakers

-

@HyperliquidX

HLP

Its a win-win:

- Retail gets yield

- MMs get liquidity

10

5

58

In conclusion,

@DriftProtocol

and

@perpprotocol

have designed one of the most elegant PvP ponzis Ive ever seen. But with every PvP ponzi game comes blowup risk.

Despite this, I see no reason why a token cannot backstop it for a long time.

5

1

53

Question for founders + tweetooors:

I am really excited about our upcoming product.

I can't stop telling people about it.

How do I share it better without being a shill?

Fwiw I think

@statelayer

@boredGenius

and

@sudoswap

team are p good at this!

16

1

55

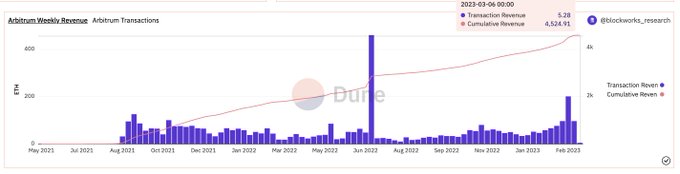

So

@arbitrum

did:

- 4.5k ETH ($7M) profit (from gas)

- 135M txns

- $0.051 profit per txn

OTOH:

-

@Uniswap

/

@SushiSwap

do 10%-20% of arbi txns

- $0.7M - $1.4M in arbi profit each

I see 1 of 2 outcomes:

- Rollups share profits w/ protocols

- Protocols deploy sovereign rollup

4

4

54

I keep thinking about

@opensea

existence through the last bear market.

Nobody:

- Gave a fuck

- Wanted to give them money

- Use their product

It makes me boolish because there's probably an OpenSea among us today.

It might even be your favourite shitcoin anon.

6

1

49

In the last cycle, there were a few (fixed for floating) yield swap protocols that raised large sums.

Only

@pendle_fi

survived long enough to capitalize on the demand for LRTs like

@KelpDAO

@RenzoProtocol

@EtherFi

.

@pendle_fi

's an overnight success, years in the making.

4

5

49

@ivangbi_

@multicoincap

@SeiNetwork

@KyleSamani

Anon these are hardly illiquid investments, look at the volume / orderbooks on some of these.

Tbf I dont think it wouldve been hard for any CT influenza to invest in these coins a year ago.

Very few had the courage while number was going down.

5

0

26

So last month I got into a debate on this with

@wireless_anon

on

@DriftProtocol

and

@perpprotocol

v1 mech design

Soon after

@0xtuba

nersnipped me and

@0xDosa

into digging through the data.

1

1

46

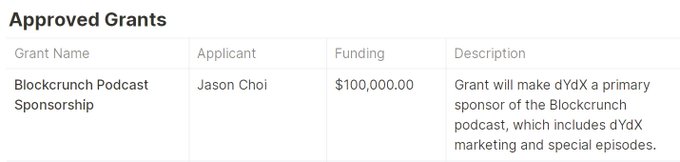

DeFi projects would be wildly more successful if they invested in customer acquisition like their centralized counterparts.

By way of example,

@Stake

:

- Generated $2.6B in 2022

- Sponsored

@Drake

and the

@ufc

- Launched a

@Twitch

competitor (

@KickStreaming

) after it banned…

10

7

44

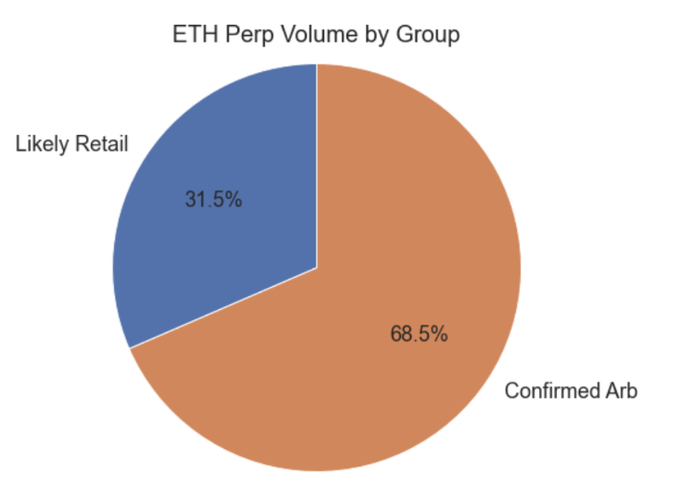

Where does all the LP revenue come from?

Approx ~80% from margin trading.

Who is margin trading:

1. Arbitrageurs (68.5%)

2. Retail trading (31.5%)

@GMX_IO

has the highest retail volume of all the defi perps we analyzed (likely due to concentrated liquidity)!

3

2

47