Danielle Park

@kdaniellepark

Followers

3,033

Following

205

Media

129

Statuses

11,688

Financial Analyst, Portfolio Manager, President of Venable Park Investment Counsel Inc., attorney, author, speaker, blogger, http://t.co/yzQz9xlONC

Canada

Joined June 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#يوم_عرفه

• 448440 Tweets

7Days Left Kabir Prakat Diwas

• 116424 Tweets

UNCONDITIONAL LOVE BLANK

• 93708 Tweets

#東京タワー

• 80965 Tweets

Switzerland

• 57604 Tweets

Hungary

• 54259 Tweets

Kevin Campbell

• 53242 Tweets

Hollande

• 46859 Tweets

Kominfo

• 42879 Tweets

オロロジャイア

• 38076 Tweets

اليوم الفضيل

• 32972 Tweets

اليوم العظيم

• 30112 Tweets

Hungría

• 28333 Tweets

اليوم المبارك

• 27590 Tweets

Finidi

• 24684 Tweets

Swiss

• 24011 Tweets

グリフィン

• 22662 Tweets

#SixTONESANN

• 21769 Tweets

Osimhen

• 21697 Tweets

WANDEE FIRST KISS

• 17702 Tweets

ロジャー

• 15951 Tweets

#Venue101

• 15312 Tweets

Page of Lambda

• 13953 Tweets

にじGTA

• 12028 Tweets

詩史さん

• 10956 Tweets

ル・マン

• 10240 Tweets

Last Seen Profiles

Pinned Tweet

Always a pleasure chatting with Thoughtful Money's Adam Taggart

@menlobear

and p.s. Stocks typically fall when the Fed is cutting rates... via

@YouTube

5

4

39

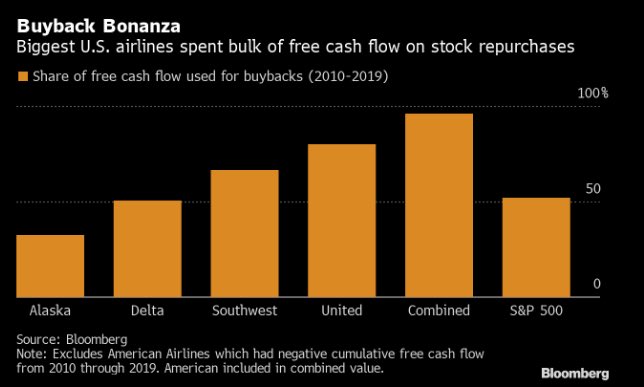

stock buybacks need to be banned as market manipulation and a condition of any gov't bailout.

Even as airline stocks halted for trading, we have to stomach this

@markets

headline “The biggest U.S. airlines spent 96% of free cash flow last decade buying back their own shares” Kind of gets under your skin given the magnitude of coming bailout.

ht

@pboockvar

131

356

924

26

71

281

ugh...time to be innovative Canada, need to think beyond real estate and fossil fuels.

18

1

81

so key, so little acknowledged.

🇺🇸 Returns

When the real S&P 500 index is very extended from its exponential growth trend line, it can take a long time to recover from a bear market, despite the Fed's interventions

👉

h/t

@LanceRoberts

#markets

#sp500

$spx

#spx

#returns

#investing

3

73

206

8

17

68

SEC commissioner's report reveals a 'very troubling' pattern in stock buybacks and insider selling via

@YahooFinance

9

20

50

Such a pleasure to share the stage with some first-class critical thinkers at the always-excellent VCRI with

@JayMartinBC

,

@DiMartinoBooth

,

@SantiagoAuFund

, and

@menlobear

. And now, day two!

Had a fantastic conversation with Danielle

@DiMartinoBooth

&

@kdaniellepark

in the green room after our panel together at VRIC

Punchline: Canada’s economy is in trouble. And it likely is giving a preview of what’s soon to come to the US

33

19

348

4

7

51

Predatory, self-enriching choices from institutions supposed to be fiduciaries leading integrity is a failure that should have consequences for decision-makers.

To boost its college rankings (now

#2

in US News), Columbia took $1 billion in med center patient care spending and self-reported as spending on students.

Lots more cheating detailed in this report.

American higher education is rotten to the core.

13

73

339

2

8

40

Central bank scourge to get even worse. The choice of Christine Lagarde as head of the ECB confirms that central bankers are taking on a more political role via

@WSJ

2

12

26

financial asset selling set to accelerate as home prices drop and owners hit by liquidity crunch and rising unemployment.

0

2

15

Yes but saying it was trash at the peak of the everything bubble was dumb and reckless and no doubt caused some to believe your shortsighted assessment to their detriment. You, sir are a great disappointment.

4

0

13

Most extreme relative overvaluation for large caps since 2000 doesn't mean small caps offer good value. RUT "outperformance" March 2000 to March 2003 was a 37% decline, versus -50% for SPY and -80% for QQQ.

🇺🇸 Valuation

For long-term investors looking to diversify their investment portfolios, small-caps may be an attractive option as they offer relatively cheaper valuations compared to large-caps

👉

h/t

@BofAML

#valuation

#equities

$rut

#smallcaps

#stocks

0

16

47

1

2

11

In a word? credit

What causes booms & busts in the real estate

#housingmarket

? With the

@Realosophy

team listening to insightful talks by

@TomDavidoff

, Lu Han,

@cynthiaholmes

in cities across Canada and worldwide.

#toronto

#realestate

#supply

#demand

#informedrealestate

0

2

4

3

0

10

Good day to be talking about capital preservation with

@JayMartinBC

and

@EconguyRosie

.

0

0

9

Great to see 30 something realtors who have never seen a downturn so confident: via @

@SimcoeNews

BDAR president and Re/Max Hallmark Chay Realty broker Luc Bouillon calls the seven-digit price tag a new “benchmark” that won’t be receding.

3

2

8

Not just MSM sadly…finance runs most content

1

0

7

@coreyhogan

very true, but I wish other producing countries like Canada had been so proactive as to set aside spoils for after the oil rush.

1

1

6

This is what productive investment looks like.

BOOM!

World's largest wind turbines to be built off British coast

"New generation turbines – built by GE

#RenewableEnergy

– will make up a windfarm capable of generating enough

#renewableelectricity

to power 4.5m homes"

#EnergyTransition

@mzjacobson

16

224

401

2

3

7