David Rosenberg

@EconguyRosie

Followers

261,961

Following

337

Media

603

Statuses

3,367

Founder and President of Rosenberg Research & Associates Inc. Retweets, Likes and Follows are not endorsements.

Toronto, Ontario

Joined December 2017

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Trump

• 3124809 Tweets

America

• 1025287 Tweets

Justice

• 944230 Tweets

Felon

• 633215 Tweets

New York

• 555212 Tweets

Democrats

• 489149 Tweets

Joe Biden

• 382398 Tweets

MAGA

• 361017 Tweets

Republicans

• 237748 Tweets

Luka

• 135452 Tweets

White House

• 129264 Tweets

Clinton

• 119809 Tweets

Florida

• 112827 Tweets

Dems

• 95432 Tweets

Alvin Bragg

• 92328 Tweets

Stormy Daniels

• 82465 Tweets

Neymar

• 65410 Tweets

Norita

• 64852 Tweets

renjun

• 64601 Tweets

#StateOfPlay

• 41479 Tweets

Minnesota

• 40718 Tweets

ワールド

• 37684 Tweets

Timberwolves

• 36535 Tweets

Silent Hill 2

• 33383 Tweets

#911onABC

• 29432 Tweets

Luana Piovani

• 28044 Tweets

Lively

• 25508 Tweets

Astro Bot

• 24324 Tweets

#BridgertonOcchiamin

• 22534 Tweets

ワイルズ

• 19178 Tweets

San Lorenzo

• 18661 Tweets

#النصر_الهلال

• 15388 Tweets

Borja

• 14808 Tweets

Saint MSG

• 14286 Tweets

アイルー

• 13034 Tweets

Solari

• 10892 Tweets

XCRY JAPON X KICK

• 10793 Tweets

Fonseca

• 10720 Tweets

Last Seen Profiles

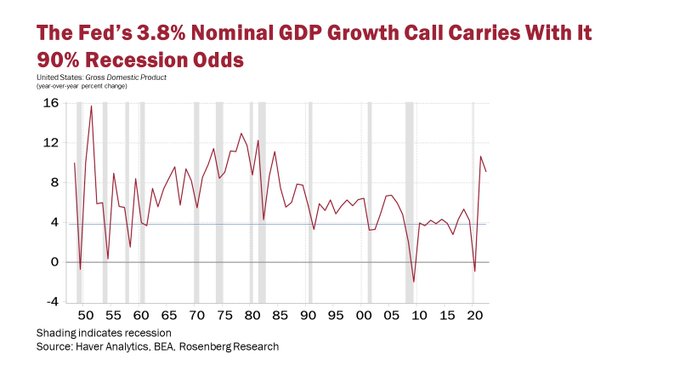

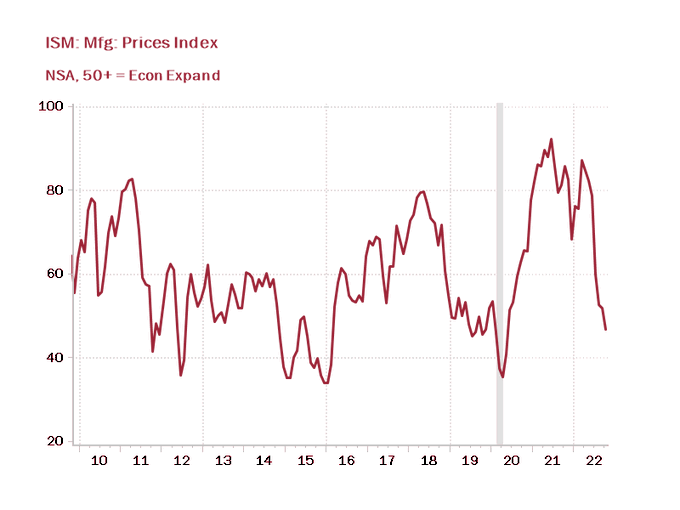

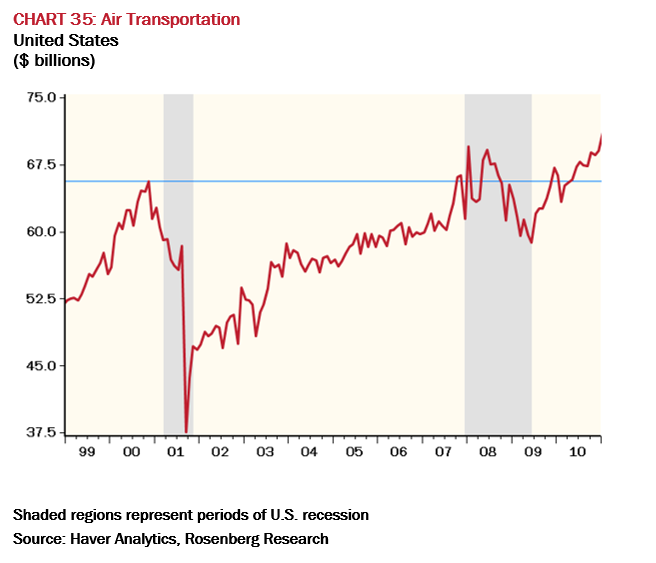

Some nifty math. When you strip out of the CPI all the items that are linked to energy (air fares, moving/freight, rental cars, delivery services, new and used vehicles), the core was +0.36% and the YoY steadied near 4%. The truth beneath the veneer.

#RosenbergResearch

607

502

3K

We've had 8% inflation before. Been a while, but we've had it. What we've never had before was the Fed hiking rates into an official bear market. Brand spanking new. More downside coming.

#RosenbergResearch

116

352

3K

I saw a chilling stat today that 20% of Canadian mortgages were taken on when rates were at the 1.5% floor. With mortgage rates at 5%+, and 40% of this debt rolling over, the hit to consumer spending promises to be spectacular.

#RosenbergResearch

158

335

2K

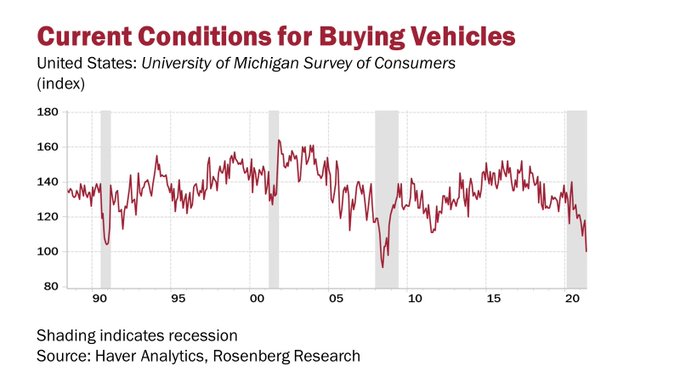

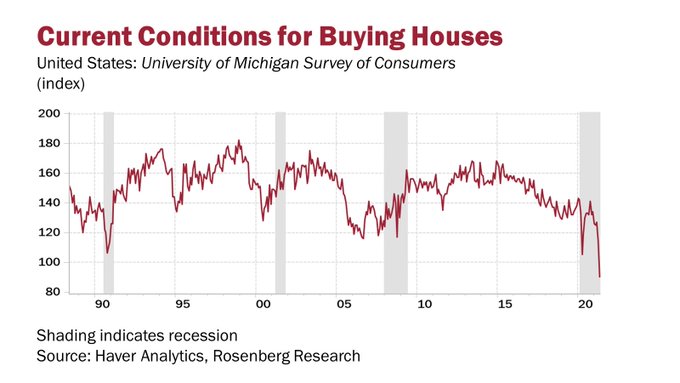

You don't need the yield curve to know a recession is imminent. The homebuilders, home furnishings, auto parts and specialty retailing stocks collectively are in a deep bear market and that is a near-perfect signal right there.

#RosenbergResearch

82

283

2K

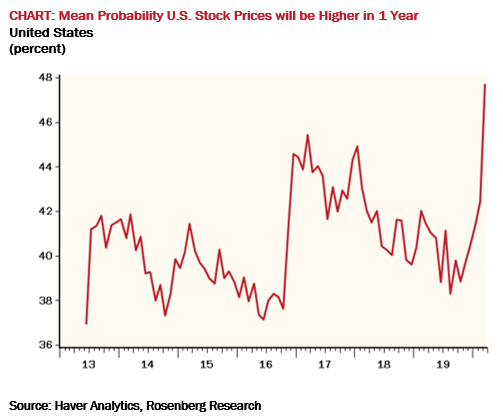

In the past 50 years, every 18% slump in the stock market over a four-month-or-longer period foreshadowed a recession. And recessions, on average, see the market slide 30%. So, no – we're not “there” yet.

#RosenbergResearch

72

275

2K

For the first time on record, the Fed is embarking on its first tightening campaign with the Dow, SPX, Nasdaq and Russell 2000 all trading below their 200-day trendlines. And the rates cycle hasn't even started yet. Good luck to long-only equity investors.

#RosenbergResearch

123

234

2K

Hard to believe we have hit the bottom with Cathie Wood still being interviewed on CNBC. When Jeremy Grantham gets the same airtime, you’ll know the lows are in.

#RosenbergResearch

90

144

2K

If households are stuffed with so much "excess savings" and with such strong balance sheets, why have they blown their brains out on credit card debt (at a 15% interest rate) these past four months -- a record $66 billion or +20% annualized!

#RosenbergResearch

#Economy

109

245

1K

Watch the Fed abandon forward guidance and rate commitments and embrace data-dependency. This cycle of hikes ends at 2 pm tomorrow. Buy bonds.

#RosenbergResearch

206

199

1K

If Putin really wanted to invade, he would have done it already. He knows better than blow up the Russian economy. Diplomacy will win out and he's going to end up getting what he wants. Best not to make investment decisions around this file.

#RosenbergResearch

151

175

1K

Why doesn’t Jay Powell save us all the time and just say “we don’t want the stock market to go up” and call it a day?

#RosenbergResearch

139

102

1K

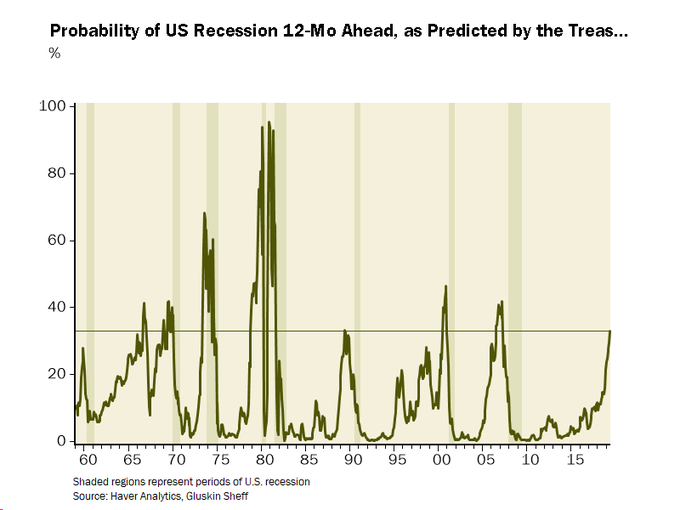

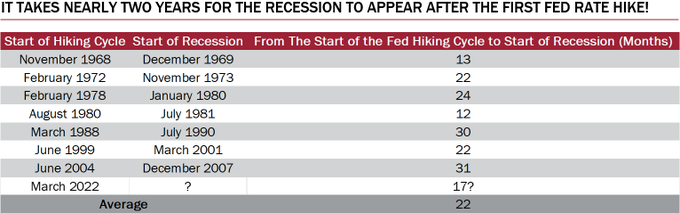

The 2s/10s yield curve has now inverted to over -80 bps. Last time here? Try April 1981. And the double-dip recession was three months away. Different this time? Bloomberg recession model now at 100% for 2023, so I somehow doubt it.

#RosenbergResearch

63

266

1K

The “everything rally.” Bonds. Credit. Copper. Oil. Bitcoin. Equities. Maybe the Fed has to go 50 at the next meeting.

#RosenbergResearch

123

94

1K

Who knew that all the global markets needed all along was for the BoE to tackle a 10% inflation rate by monetizing a debt-financed tax cut!

#RosenbergResearch

62

112

1K

Bob Farrell’s Market Rule

#8

: Bear markets have three stages – sharp down, reflexive rebound, and a drawn-out fundamental downtrend. We just moved into the third stage.

65

174

1K

Back-to-back GDP contractions may not be the official definition of recession, but the reality is that whenever it's happened in the past, the economy was in recession. Go figure!

#RosenbergResearch

50

158

1K