Austin

@aschmidt2930

Followers

4K

Following

5K

Media

1K

Statuses

8K

Into tech and commodities. Just an enthusiast. 30% satire.

Joined November 2014

@realestatedude0 I disagree with the lens this is being viewed from. I think any objective person would agree that 6% is obscene. Cutting the commission will thin the herd of realtors. We have way too many realtors. The remaining (good) realtors, over time, should spend less time winning.

52

2

537

@Breaking911 The most astonishing part is that someone thought the anecdotal experience of a young skier is a useful input in the climate change debate. “So, uh, it snowed less on my mountain this year.”.

12

18

505

@patriciamou_ Ok. So why is the internet mostly blocked? If China is so great, what are they trying to hide?. Give me a coherent answer there and I’ll try to change my world view. Honest questions.

202

18

382

@wallstmemes Put simply: “Yeah you can’t afford enough food but you can afford about the same amount of food as last month so stop complaining.”.

3

17

332

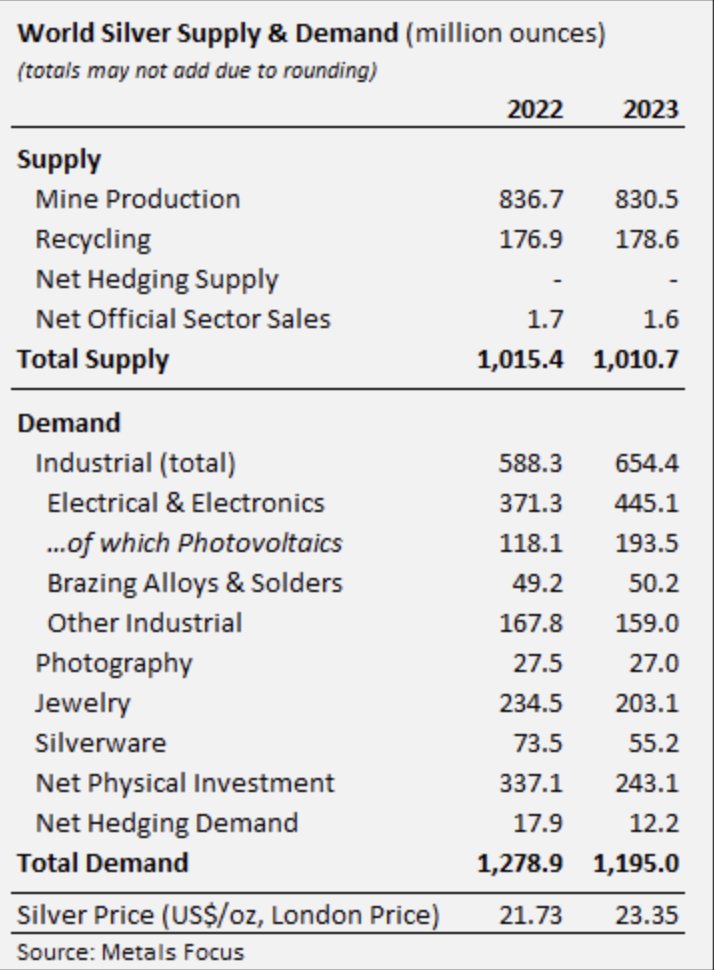

The #silver market has fundamentally changed due to the Mexican gov's anti-mining rules. First, remember that according to the @SilverInstitute, silver is already in a 24% supply deficit:

World's Top Silver Producing Country Passes Harsh Anti-Mining Rules. The Mexican Senate passes new mining law, without the opposition present:. → Duration of concessions reduced from 50 to 30 years. → State-owned companies would enjoy priority over the private mining industry.

15

78

218

#silver supply was flat with mine production falling while demand is surging. This is a supply deficit of about 22%. It will be volatile, but silver is going higher. Much higher.

@silverinstitute today released World Silver Survey 2023. All major #silver demand categories achieved record highs last year. Ag market in new era of structural deficits. Last year the silver market was in a massive 237. Moz deficit. Read more here:

12

70

210

#Gold headed to China?. A divergence of this size has created an interesting arb opportunity. Speculation, but large COMEX outflows suggest a one way ticket from New York to Shanghai 🛩️

160,000 oz of gold departs JP Morgan's vault driving the total comex vault bleed to 500,000 oz over the last 6 days. One month decline is 1.17 million oz or 5.3%:

9

50

218

Smelting is energy intensive. According to @Eurometaux, half of the EU's Zinc output has already been shut off. As Zinc's smelting process separates the Silver from the ore, this is decreasing supply. Since only 27% of Silver supply is primary,.

3

11

190

@TikTokInvestors This is how people work hard for decades and have nothing. It’s just a car. Who cares?.

3

0

175

Each day, about 2.3 moz of #silver are mined globally. About 820k oz is available for investment (retail and etf) ex-industrial demand. 102k was just sold in one day, on a single website. Wild.

Yesterday's tracked #silver sales at APMEX were the highest I've ever recorded for a Saturday. Sales were 49% higher than the previous record and 322% above average! #silversqueeze

9

43

164

Silver recycling is a low-margin business. With the silver price plummeting and energy costs rising, recycled silver likely will drop meaningfully. At 180 moz/year estimated by the @SilverInstitute, this matters.

4

4

159

A hat tip in this thread to @SRSroccoReport who has been pounding the table that the energy cliff would drive investors into silver. I'll end on sentiment. Silver is HATED. Go read #silver twit. People have completely given up. Even the bulls are like "love it long term but.

3

7

154

@creativelytired @EricKlinenberg Because we’ve torn down the carbon economy faster than we’ve built the green economy and much of the world is now on the verge of starving? We need to build, but that’s hard, so we go with the easy route of “oil is evil! punish them!”.

20

7

141

@financialjuice Coming soon: trading paused until we hit 2% inflation. Wish that were 100% a joke.

5

7

148

Let's talk demand. Industrial demand is 52% of the total supply and 64% of mine supply. Which number you use depends on your view on the reliability of the recycling data, which is often debated (strong arguments by @keith_neumeyer that it's aggressive).

5

10

151

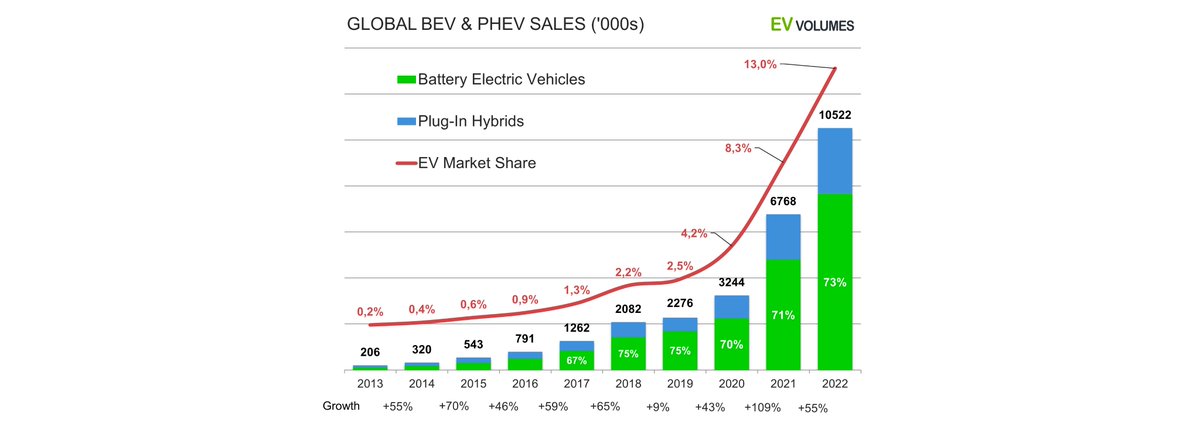

Significant implications for the #silver and #tin markets. Remember: Chinese producers have mostly switched to TopCon (30% more silver) and HJT (120% more).

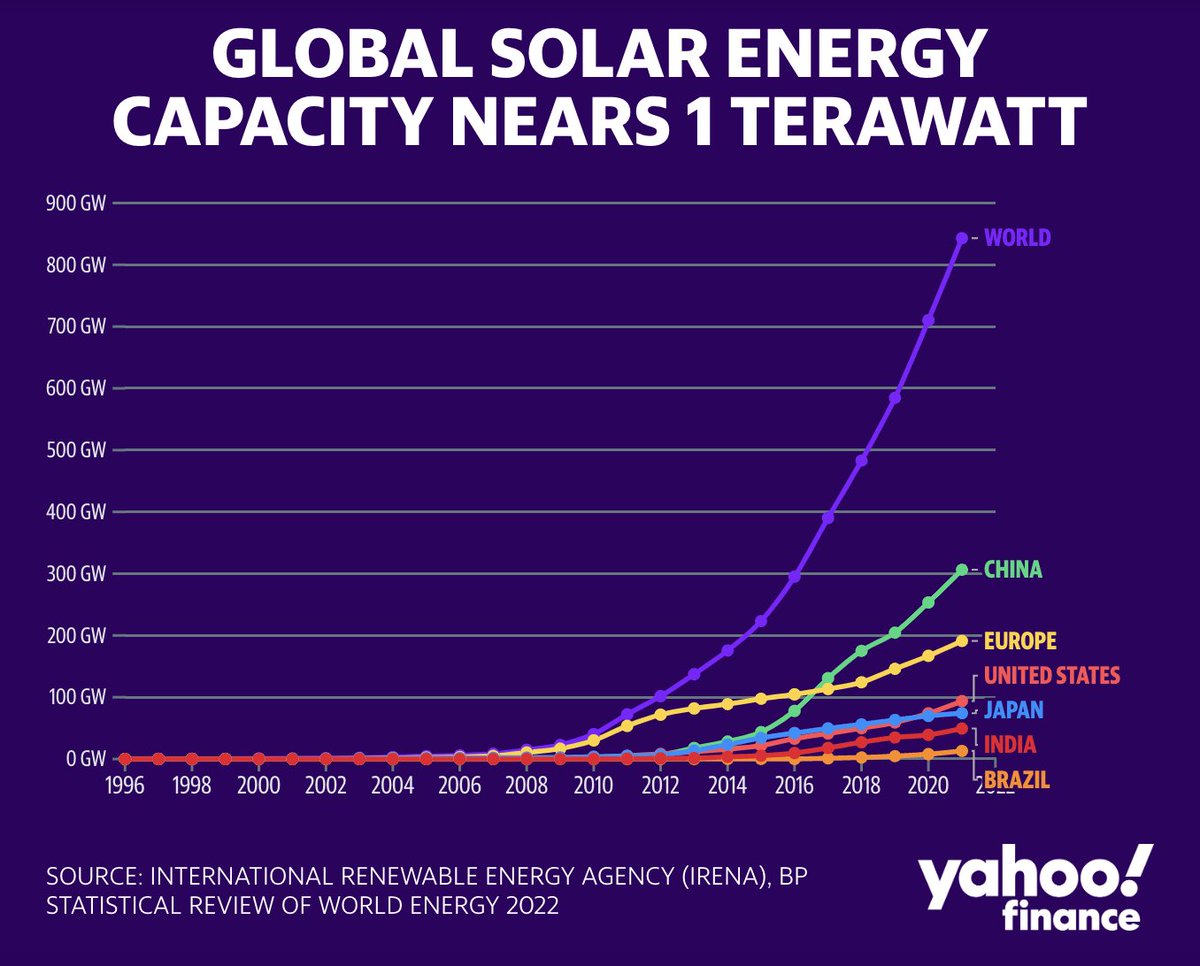

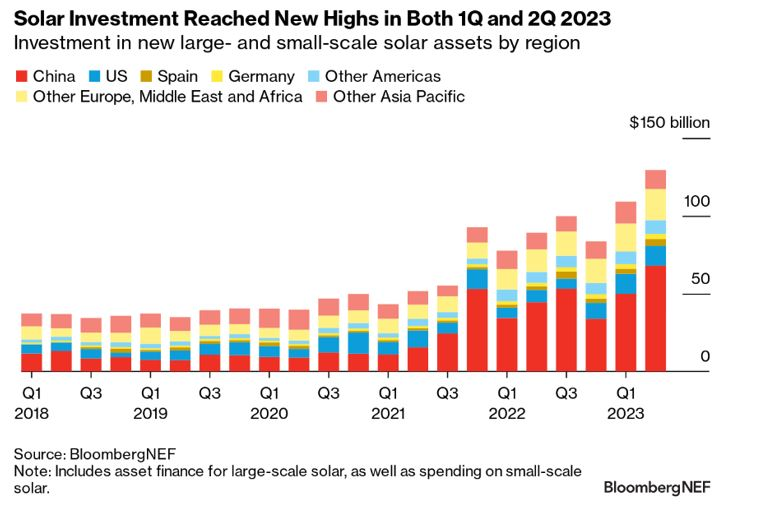

Solar deployment is now happening at a roughly $500B annualized rate. Which technology deployments were larger than this? The US's aircraft production during WWII seems to have peaked at maybe $400B (inflation-adjusted). Global datacenter construction appears to be maybe

5

41

129

this report. Could be other banks) you want to be on their side of the trade. Next, the cost to borrow SLV is skyrocketing:.

We may be seeing the beginnings of a big short squeeze in silver. The cost to borrow SLV has skyrocketed over the last 2 weeks. I went through much of this on the spaces event with @PalisadesRadio and my presentation at the Silver Symposium

2

8

125

What happens next? @contrarian8888 puts it well: . @mikesay98 reports exchange inventory volumes often. Silver is leaving the vaults - and fast:.

#Silver continues to be drained from Comex & LBMA vaults, with August withdrawals coming in at around 44.5M oz. Here's a chart detailing the monthly changes in their combined holdings. Notice that in 2021, shortly after #silversqueeze began, there was a huge pattern shift.

1

9

121

@HomosexualMan1 I like Green. But in general, folks who focus on the macro tend to underperform. The reason, imho, is that if you’re deep in the macro, all you see is risk rather than opportunity. That becomes dangerous as the measuring stick (USD) consistently depreciates and there are a lot.

17

10

127

Day after day after day. This is what a structural supply deficit looks like. There isn’t enough #silver. Eventually, this thing will mimic 2018 Palladium. I’d guess we aren’t too far off.

COMEX #SILVER VAULT TOTALS DROP 524K OZ - STILL LOWEST LEVEL SINCE NOVEMBER 7, 2018.- Registered vaults were down 154K ounces (needs to go below 29.15M oz. to break April 26, 2017 low). - Open Interest is now equal to 237% of all vaulted silver and 2,146% of Registered silver.

9

16

115

Let's start with the CoT report:. Historically, this is bullish. Why? Commercial banks have an enormous amount of. "influence" in the Silver market. JP Morgan is the largest holder of physical silver in the world. If they are long (I assume from.

Latest #COT report, Managed money increasing more short exposure as commercials are net long #Silver futures

6

4

109

Short term moves in #silver are tough. I won’t pretend to know what Monday brings. But JFC if you are short $SLV you may be about to have a religious experience if this goes against you. Short carefully ✌️.

LOL. You Got To See This. Shorts hold 99.94% of ALL the Total SLV ETF Shares In the Securities Lending Market. A HIGH Short Interest Utilization Rate is over 10%. Something BIG is about to happen in the Silver Market. LOL.

4

20

103

This is what a structural supply deficit looks like. #silver will continue to disappear. It won’t matter until it matters. But when it does (nobody knows) this market is going to pull a Palladium.

【Breaking: 144,256kg of silver was delivered today from SFE silver vaults】 After a slight increase in inventory yesterday, a big outflow of 144,256kg was seen from SFE silver vaults today. This is the largest single day outflow in the 10 years since the silver was listed.

6

14

105

@zerohedge If you don’t own gold, you should go buy gold. Unsure how much more obvious it can be.

11

2

97

@scottdavisCRE @realestatedude0 $500k house at 6% = $15k for each agent. Average of 40 hours spent per house = $375 an hour . Do you think the average realtor’s value is $375 an hour?. I don’t.

16

2

96

Time for an update on how the energy crisis is driving a new #silver bull market. For the full story, check out my original thread below. Let's start with the supply side 👇.

1

20

91

2023 #silver supply demand data from the @SilverInstitute is out. Key notes:. - Mine and total supply is down.- Industrial demand rose a scorching 11%, well ahead of the prior estimate of 4%.- Solar demand rose 64% YoY compared to a prior estimate of 15%. S/o to @HoPla_Invest who

13

25

86

@scottdavisCRE @realestatedude0 Realtors are a dime a dozen. Plumbers are scarce relative to demand. Not a relevant analogy, imho.

4

0

82

@zerohedge Reality - “gets laid off, opens an Etsy store, does 3 Uber rides.”. Bls - “2 JOBS!”.

2

3

81

@PauloMacro There’s an unconfirmed rumor going around that @contrarian8888 rolled 1% of $aapl put profits into $slv. Will report back as the story develops.

8

2

81

@amitisinvesting A factory shutdown is a wild excuse with an inventory build like that. They had plenty of cars to sell. People just don’t want them.

15

0

64

@Rothmus I request my friends do the civilized thing and post the TikTok to Twitter then send me the Twitter link.

1

2

67

As we get reports that another 46 moz was drawn off the LBMA in Sept and German nat gas is being used too quickly, my confidence level grows. Physical #silver is going to the heavens this winter. Many refineries are likely to get shut down. Miners more hit and miss.

Next, let's talk refining. 12 of the top 16 #gold and silver refineries in the world are based in Europe. 70% of production comes out of Switzerland alone 🤯.

4

17

68

@MacroAlf Good thread. While it drives me insane, any argument on the Fed isn’t complete (IMHO) without mentioning politics. They were never going to (intentionally) crash markets ahead of midterms, even if inflation is resilient. After? Perhaps.

5

2

66

@leadlagreport Agree. It’s incredibly bearish stocks as it suggests what we’ve all suspected:. CBs have lost control and have no idea what they’re doing. Gold looks good here.

5

1

63

@realestatedude0 Source? Pretty much every data set I can find says commissions, after negotiations, average 5.5%.

17

0

59

@LukeGromen And this, ladies and gentlemen, is why negative real rates and high inflation are the new normal.

1

0

62

First slowly, and then all at once. This is being driven by an accelerating supply/demand imbalance. The #silver run is close.

🚨 COMEX REGISTERED #SILVER DROPS 5.5% TO 36 MILLION OUNCES - LOWEST LEVEL SINCE JUNE 29, 2017 🚨.- Vault totals at lowest level since June 14, 2019. - Open Interest now equal to 228% of all vaulted silver and 1,917% of Registered silver.

4

5

61

Like clockwork. Price gets slammed, huge volumes of #silver leave the exchange. Where is it going? My guess is China to build solar panels.

COMEX VAULTS DROP OVER 3.1 MILLION OUNCES - TOTALS REACH LOWEST LEVEL SINCE MAY 2018.- This was the largest one-day withdrawal since July 2022. - Registered dropped. 27 oz. - Open Interest is now equal to 277% of all vaulted silver and 2,319% of Registered silver.

6

6

59

@0xgaut Airbnb for $250 a night and a $200 cleaning fee. Also, the guest cleans the gutters and mows.

0

2

60

The #silver supply situation is horrendous. Eventually, this is going to be resolved through much higher prices. Patience.

Peru's silver production is currently at the same levels as it was two decades ago, excluding the pandemic lockdowns period. That is the third largest producer of the metal in the world. Keep in mind:. Mexico, by far the largest silver producer globally, is experiencing a

5

4

58

The LBMA continued to shed #silver in October. This is what a structural supply deficit looks like. And by the LBMA’s own words…. “These figures provide an important insight into London’s ability to underpin the physical OTC market.”. 🍿

1

11

52

@KimDotcom Saying that Russia wants good relations with Europe (as defined by current borders) is a really interesting take on history. My take: they want Eastern Europe.

5

0

46

@goldseek With Mexico’s dominance in silver (especially primary silver mines) a modest investment drop will have a massive supply impact. We may see this in the financial markets soon. Industrial users will front run and buy out further than usual. Smart shorts will close. Bullish.

5

13

50

50% YoY solar growth, led by 94% growth in China, where the new generation of panels (TopCon and HJT) use 30-120% more #silver. And if China wants to do infrastructure stimulus but cannot build much real estate due to falling prices, what will they do? Probably more solar.

5

8

50

@zerohedge 15% higher than Berkshire? Yet, Apple’s market cap is 4x higher. While 22% of Berkshire’s market cap is Apple stock. Wut.

2

1

48

@WallStreetSilv Line your driveway with 10 oz bars and you’ll never need to shovel snow again. Maybe not a perfect plan.

1

0

42

@leadlagreport It’s wild how people can watch the Treasury meltdown then pile into long duration assets. On second thought, I suppose they aren’t watching.

3

3

43

@petedivine I did hear Chen present this. It would be a massive shift in this market. Considering that a majority of the cost of solar is installation, I do think it’s likely that the winning tech of the future still uses silver, despite the recent copper plating hype.

0

1

44

I follow 312 people. It’s ridiculous I have to go directly to many of their profiles to see their tweets when I’m filtering for posts from people I follow. Just show every tweet from those 312 please, @elonmusk @TwitterSupport.

6

3

45