SRSrocco Report

@SRSroccoReport

Followers

20K

Following

7K

Media

5K

Statuses

21K

How Energy & the Falling EROI (Energy Returned On Investment) will impact Precious metals, Mining & the Economy

Joined May 2013

The Silver Market can't deal with Total Silver Investment being higher than Industrial Demand. At some point, the LIGHT BULB will go off and demand for #silver will be like nothing we have seen before.

HOW TO BREAK THE SILVER MARKET??. When Physical #Silver Bullion & ETF demand continues to surpass Industrial Demand. That's how you BREAK the Silver Market. #SilverSqueeze @WallStreetSLVR .

10

108

290

Really appreciate the Forensic analysis on Tether. It seems as if the world now has a Ponzi nearly Double the size of Bernie Madoff's. Going to be quite interesting when the Tether-Bitcoin-Crypto Bubble Pops.

In short - Tether's bailing out a ponzi, that can in no way pay them real money for the UST they receive, hence - the ONLY logical answer left - is that those Tethers Justin got were unbacked. It proves Tether, at the very least, will accept garbage collateral. It's. A. Ponzi.

31

74

307

LOL. Average Bitcoin Mining Cost = $139,652. According to MacroMicro, the cost to produce #BTC is twice as much as the price.

66

59

288

When certain individuals and entities suggest selling U.S. Treasury gold to buy a crypto-Ponzi coin. If this doesn't shock people, then it's due to the irony each new generation has to learn the hard way of why investing in Ponzi's ends badly.

Senator Lummis just said the quiet part out loud. The United States should sell their gold and buy bitcoin.

79

36

275

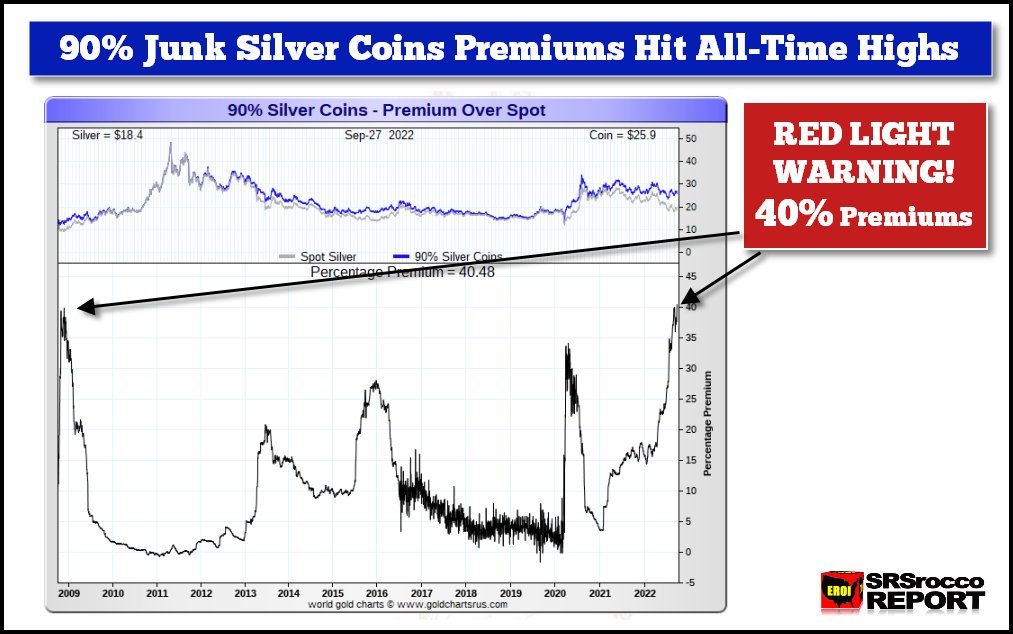

RED WARNING LIGHT. 90% Junk Silver Coins Seeing All-Time High Premiums. With Junk Silver premiums reaching 40%, the same as during the 2008-2009 Global Financial Crisis. Suggests. something BIG is happening in the #Silver Market.

7

69

225

Peru, the Second-Largest Producer of silver in the world, peaked in 2017 at 155 Moz and is down a stunning 30% at 110 Moz in 2021. Unfortunately, with Peru's #silver production down 9% YTD in 2022, the decline continues.

13

58

223

So. let me bring up the 500 ton Brontosaurs in the room. With Saylor suggesting a $20 million $BTC price in the future, that would equal a $400 trillion Market Cap. Or roughly 4X the total Top 3 Central Banks Money Supply. Have people gone completely Financially Insane?.

@profitsplusid Perhaps. But there is another side to that coin. Bitcoin might be going up because this is a new asset class. We simply don't know. Both sides are guessing, but skeptics refuse to admit that Bitcoin might have huge value.

81

28

221

@WallStreetSilv Please remove my interviews from your WSS Youtube Channel. Also, I will no longer be doing any interviews with WallStreetSilver Youtube.

19

28

214

Bitcoin is by Far the Biggest Waste of Energy compared to other industries and metals. RIOT Platforms reported that it consumed 1,117 MWh to produce one $BTC in Q3 2024. That same power could do the following in the chart.

@SRSroccoReport Doesnt it take moving 10 tones of earth to find a few grams of gold? Then move it around by truck, train and plane? Then with security, insurance etc etc? Sounds like golds got its energy issues “if” we are being honest about it.

83

53

211

Unfortunately, MSTR is a PONZI on top of a PONZI. MSTR current Market Cap = $66.4 billion. However, its total holdings as of Q3 2024 of 252,200 $BTC equates to only $22.7 billion based on $90K Bitcoin Price. When the Bitcoin-Tether Ponzi POPS. So will MSTR on leverage.

@SRSroccoReport Yeah, wouldn't recommend Bitcoin miner stocks. It's a highly competitive and difficult to predict business. Got rid of all mine in February. Stick to self-custodied Bitcoin, plus some capital gains free MicroStrategy stock held in a tax-advantaged account.

33

38

211

INDIA SILVER EXPORTS EXPLODE: Filling The Insatiable Physical Metal Demand In The West. Evidence that the SilverSqueeze in the silver market is going global can be seen by the explosion of Indian silver exports. @WallStreetSilv #Silversqueeze. READ MORE:

13

68

186

SOMETHING BIG JUST HAPPENED IN THE U.S. MINT GOLD EAGLE MARKET. Not only have #Gold Eagle sales this January surpassed last year’s total by a factor of three, but it’s also the highest figure since the 2008-2009 Financial Crisis. PUBLIC ARTICLE:

9

90

182

It isn't a surprise that BITCOIN surged after the Nov 5th election, coinciding with the Tether Market Cap PUMP. This continues today. Thus, the more Tether prints Tethers, the more liquidity, and the higher the Bitcoin-Tether-Crypto Ponzi continues. 🤡🤡

Bitcoin is now breaking out of its triangle/pennant pattern on the 4-hour intraday chart. Assuming this breakout holds, it should run to $100,000+ fairly quickly. $BTC $IBIT

30

48

182

Luke. you are SPOT ON. As the world heads over the Energy Cliff, Ponzi Finance (Treasuries & Bonds), will no longer work well. The world will transition to using physical payment for energy & goods in the future. The Global Market hasn't figured this out yet. 🤪🤪.

In part 2 of my conversation w/@menlobear, I suggest settling oil in gold is "inevitable" due to Peak Cheap Oil & sov debt bubble. Why?. Left cht is how many bbls of oil buy 1 oz of gold since 1870; right cht is how many bbls of oil 1 UST ($1,000 face value) has bought since 1975

7

29

171

Global Silver Production Continues to Grind Lower While World Gold Production Forecasted To Hit New High in 2024. Global Silver production down ~80 Moz from its peak in 2016, while World Gold Production is up 6 Moz. Got #Silver?.

19

37

177

Global Silver ETFs continue to put a SQUEEZE on LBMA's total silver inventories. APR 2019: Silver ETF's accounted for 34% of LBMA's total silver inventories. JAN 2021: Silver ETFs account for 70%. The Squeeze continues. @WallStreetSilv #SilverSqueeze.

6

45

159

Silver Will Become Like Palladium, but on STERIODS. 2020 Palladium = 98% Industrial vs 2% Invesment.2020 Silver = 52% Industrial vs 60+% Invesment.not including Jewelry & Silverware demand. Can't have too many more years with #Silver Investment at 60%. @WallStreetSLVR.

5

31

154

While Silver is being mined at 7/1 Ratio to Gold, the Market Price isn't based on that ratio. It's based on the Cost Of Production, as I have repeated many times. Barrick & Newmont Cost = $1,786.Pan American Silver Cost = $22.61. Cost Of Production Ratio = 79/1.

"The most undervalued, underappreciated, best value of anything I've ever seen in 35 years of finance." Andy Schectman of @MilesFranklinCo on the opportunity he sees right now in the silver space. Interview up TOMORROW, July 24. #silver #silverprice #preciousmetals

16

43

160

HOW TO BREAK THE SILVER MARKET??. When Physical #Silver Bullion & ETF demand continues to surpass Industrial Demand. That's how you BREAK the Silver Market. #SilverSqueeze @WallStreetSLVR .

15

37

143

Tethers Profits?? 🤔🤔. Tether didn't make "Profits" like Banks report profits on banking activity. Rather, Tether listed it's "Profits" as a gain of its Net Equity Value. This is totally insane, and I am amazed Tether hasn't been shut down by Regulators.

17

32

153

SILVER MARKET SHORTFALL: Explosive Potential. The #Silver Market seems to be heading for a shortfall in supply which could potentially be very explosive for the price. #silvershortsqueeze . READ MORE:

7

37

129

U.S. MINT SALES RED HOT: Silver Eagle Sales Blow Past A Cool 11 Million. Even though the premiums for #Silver Eagles are still quite high, U.S. Mint sales this month continue to be RED HOT. PUBLIC ARTICLE: #Silversqueeze @WallStreetSLVR @WallStreetSilv

2

43

127

BOB. we agree. Something BIG is about to happen in the Silver Market.

We may be seeing the beginnings of a big short squeeze in silver. The cost to borrow SLV has skyrocketed over the last 2 weeks. I went through much of this on the spaces event with @PalisadesRadio and my presentation at the Silver Symposium

5

27

133

I totally disagree with Turd on Newmont. The problem isn't Newmont. 1) The Gold Miners are competing with central banks like the Fed that can print $trillions of Treasuries at no cost. 2) The Market Psychology continues to funnel funds into Financial Assets. Unfortunately,

Fucking Newmont is such a fucking piece of shit. Down 20% YTD while gold is down 2%. New 50-year lows in price while gold is 50% higher over the same time period. A shitty business with shitty management and shitty execution. An absolute dog. When will shareholders revolt?

35

20

133

Here is an update for Barrick & Newmont's Total Cost of Production. In Q3 2022, Barrick & Newmont's total cost was $1,561 vs. the Gold Market Price of $1,728. Amazing how rising energy prices impact the Cost of Production.

You may disagree with the Gold-Energy value, but when we look at the dynamics in this chart, why did the market BID GOLD at its Cost of Production?. Why not a great deal lower??. Keith never has a good answer to this. GOD HATH A SENSE OF HUMOR. 🤪🤪

11

39

131

INDIA SLEEPING GIANT RETURNS: Silver Imports Explode. Something has seriously changed in India as the Sleeping #Silver Giant has awoken. SUBSCRIBER ARTICLE:

5

19

119

Why Silver Is One Of The Best Assets To Own In The Future?. Industrial Demand is forecasted to consume more than global mine supply by 2030. Thus, any other demand will have to be met by Scrap supply. Talk about this next week: .

Join @profitsplusid @SRSroccoReport @metalshidden and I for a round table on what is affecting the current precious metals environment

13

26

130

I have one even better. Can't produce metals without oil. The Global Oil Industry is now only replacing 1 barrel of the 5 barrels it consumes each year. Welcome to the ENERGY CLIFF. Got #Gold & #Silver?

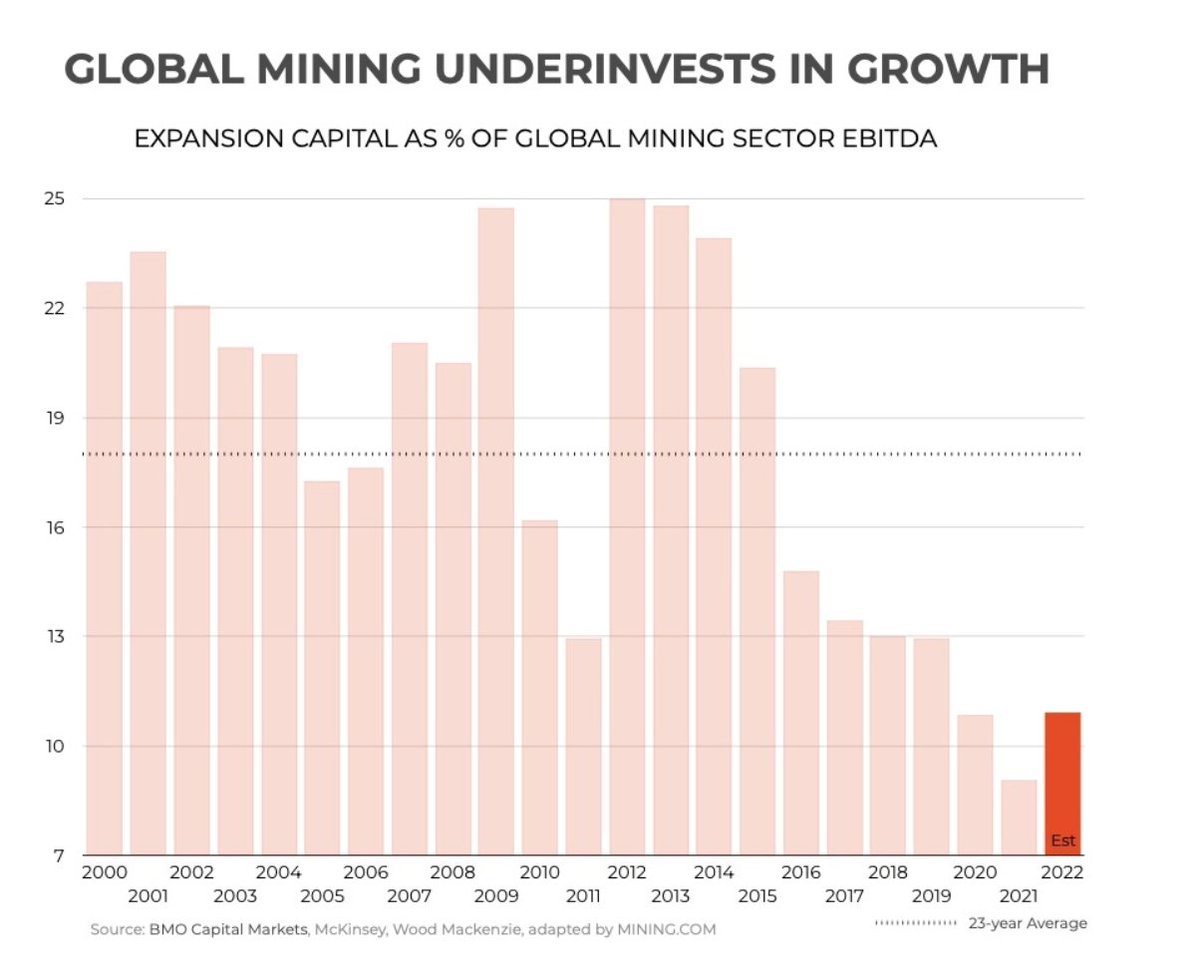

Demand is soaring, but global mining is not expanding ."near universal agreement that in the coming decades demand for metals and minerals will boom".👀THIS CHART 👀

5

40

125

We Wish the #SLV Shorts all the BEST as the price continues to SURGE HIGHER. The cost to Borrow SLV ETF Shares jumped to an amazing 4.6% yesterday versus 0.18% in July. Will the Shorts win this battle with the Commercials now NET LONG?.

4

23

121

Global Silver Production Peak Likely Occurred in 2016 at 900 Moz, while the verdict is still out for Gold Production, which hit a high of 117 Moz in 2018. In 2021, the Silver-to-Gold Production ratio fell to a low of 7.1/1. Again, #Silver is one of the most undervalued assets.

6

37

117

U.S. Mint Silver Eagle Sales Continue To Be Strong In March While The SLV ETF Sheds More Silver. the U.S. Mint has sold 70 times more $Silver Eagles than Gold Eagles in the first eight days of March. @WallStreetSLVR #SilverSqueeze. PUBLIC ARTICLE:

7

30

108

THE COMING EXPLODING SILVER PRICE: Will Behave Like Palladium On Steroids. The #silver price is setting up the same fundamentals that pushed the palladium price up by five times over the past several years. PUBLIC VIDEO: @WallStreetSLVR #SilverSqueeze

8

34

117

When Senators are pushing Bitcoin to reduce U.S. Govt Debt. You know the END IS NEAR. As Corruption, Fraud & Speculative Bubbles have replaced sound investing.

🇺🇸 SENATOR LUMMIS JUST SAID LIVE ON BLOOMBERG THAT “#BITCOIN IS GOING TO INCREASE DRAMATICALLY”. IT’S COMING!!!

35

16

114

U.S. Mint Silver Eagle Sales Start Off Strong In April. With the most recent update from the U.S. Mint, Silver Eagle sales are on track to surpass Jan-Apr 2020 figures by a wide margin. PUBLIC ARTICLE READ MORE: #Silversqueeze @WallStreetSilv

3

28

110

JP MORGAN iShares SLV ETF Inventories. Now you see it. Now you don't. JP Morgan borrows nearly 16 million of silver from Loomis International UK for a DAY and then returns it. How to CAP the #SLV PRICE. LOL

10

39

109