Otavio (Tavi) Costa

@TaviCosta

Followers

260K

Following

10K

Media

3K

Statuses

10K

Macro thinker, history student, value-oriented investor. Native of Sao Paulo, Brazil 🇧https://t.co/YApL3RfM1A

Denver, CO

Joined June 2014

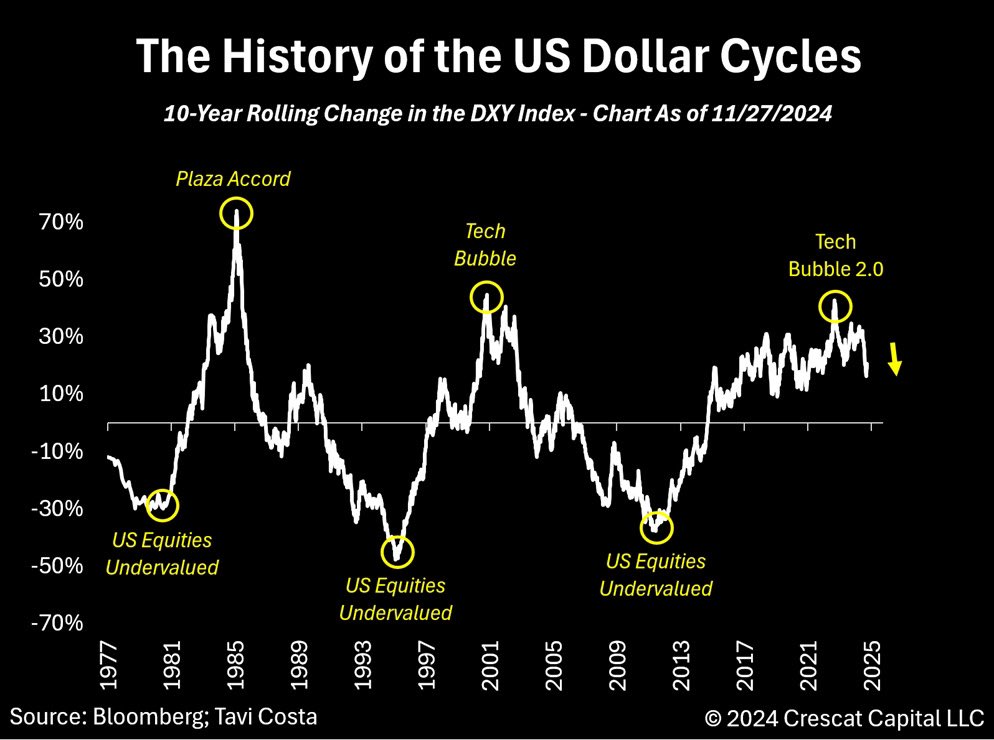

Today, a new set of structural pressures has brought the US dollar to a critical juncture. Thread 👇👇👇

131

338

1K

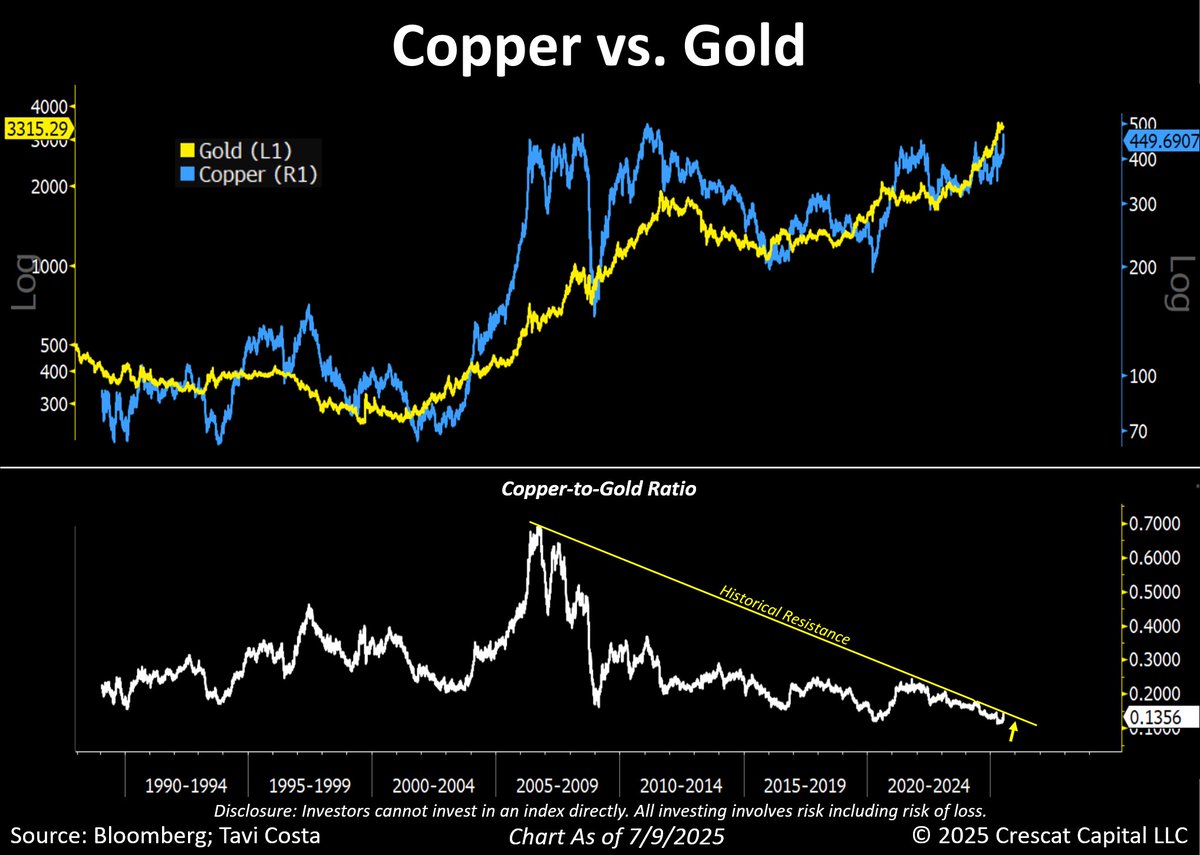

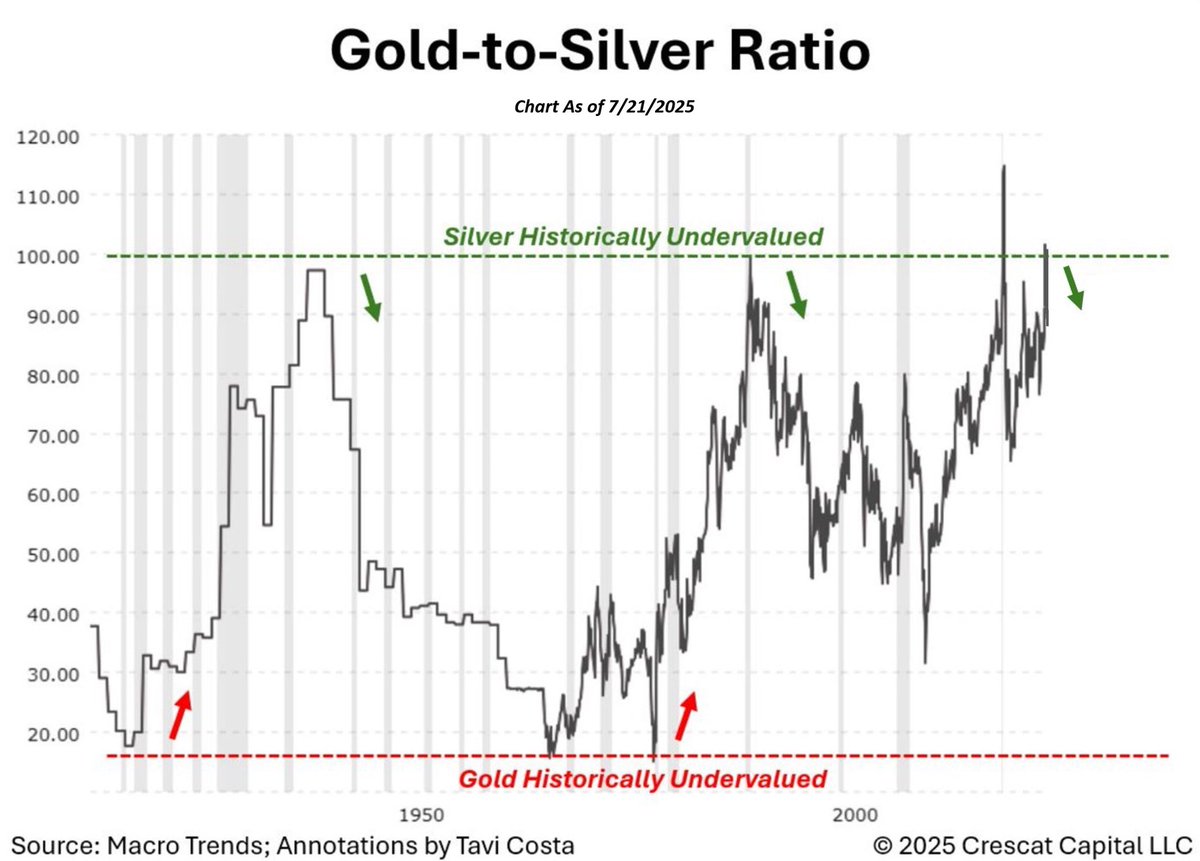

Indeed. Metals!.

Large US Grid Lacks Capacity for New Data Centers, Watchdog Says. The biggest US grid has no spare supply for new data centers, meaning project developers will need to build their own power plants, according to the system’s independent watchdog. “There is simply no new capacity.

11

10

92

RT @SteveBarton101: Oil, Copper, Zinc: Tavi’s Top 3 ‘No-Brainer’ Hard Asset Bets!. 👉 Watch the Full Episode: .👉 Joi….

0

10

0

RT @SteveBarton101: What metal could become the backbone of tomorrow's electrified world?. Copper. With energy demands rising, infrastructu….

0

11

0

RT @forexanalytix: Special thanks to❤️:. Andrew @realpristinecap. Pan @panpalobar. Steve @askslim. Tavi @tavicosta. #FOREX #TRADING @ForexS….

0

4

0