contrarian 8888

@contrarian8888

Followers

60,619

Following

835

Media

1,696

Statuses

14,096

Former hedge fund manager of a multi billion dollar fund. Interested in commodities & startups. Nothing should be construed as investment advice

New York, NY

Joined May 2012

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

CHASING THE SUN

• 381167 Tweets

billie

• 351849 Tweets

Alito

• 275089 Tweets

Scottie

• 168343 Tweets

Crockett

• 124768 Tweets

Diddy

• 97276 Tweets

Diddy

• 97276 Tweets

Fauci

• 84169 Tweets

#النصر_الهلال

• 71575 Tweets

RPWP TRACKLIST

• 54050 Tweets

#วอลเลย์บอลหญิง

• 51147 Tweets

Juventus

• 46069 Tweets

Louisville

• 45711 Tweets

कन्हैया कुमार

• 44694 Tweets

Barron

• 43370 Tweets

NCAA

• 39808 Tweets

أبو عبيدة

• 36089 Tweets

ابو عبيده

• 35930 Tweets

#عزالدين_سليم_المفكر_الشهيد

• 30133 Tweets

Homofobia

• 29326 Tweets

ジュラシックワールド

• 29147 Tweets

Shani Louk

• 28949 Tweets

Amit Buskila

• 27306 Tweets

LOST IS COMING

• 23847 Tweets

Madden

• 17994 Tweets

Tabilo

• 17328 Tweets

المنطقه الشرقيه

• 16521 Tweets

$BASED

• 11483 Tweets

Kinds of Kindness

• 10680 Tweets

Sean Combs

• 10303 Tweets

للنصر

• 10232 Tweets

Last Seen Profiles

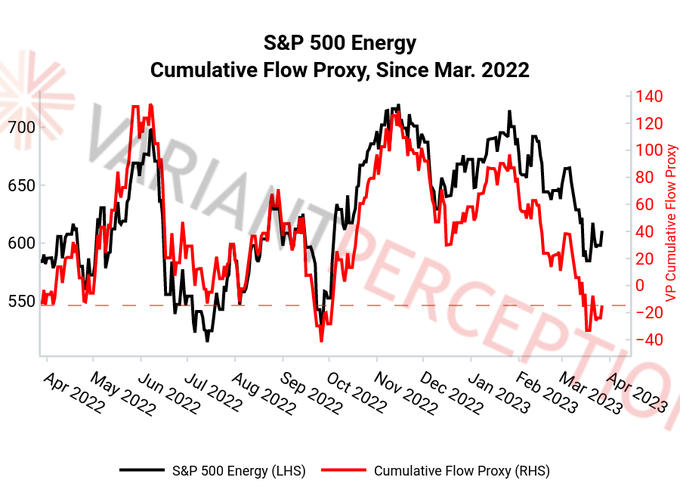

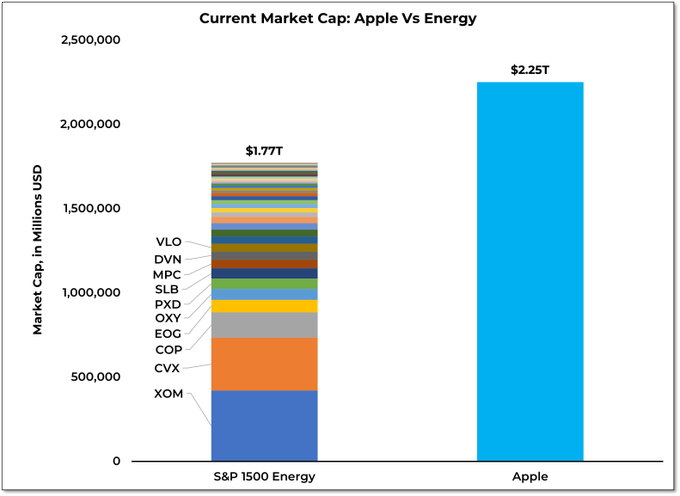

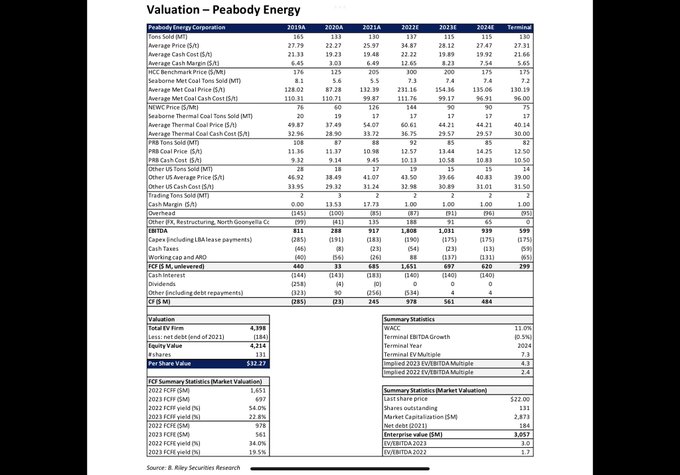

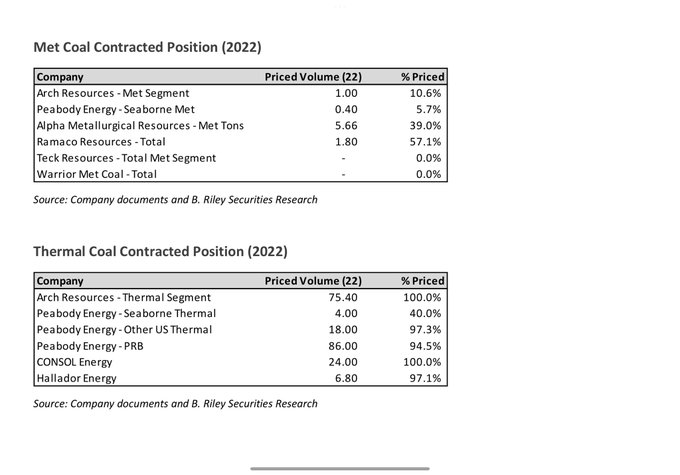

$XLE $panr $btu

#uranium

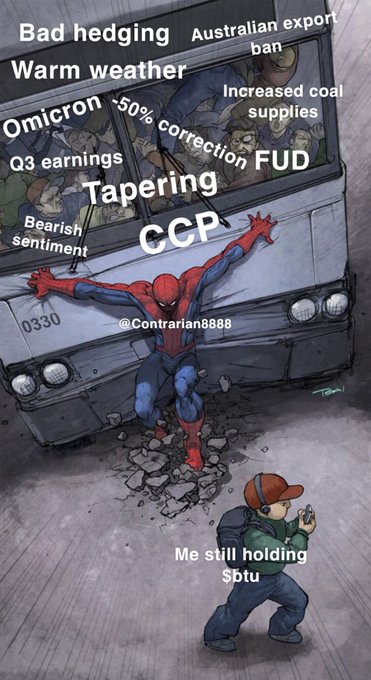

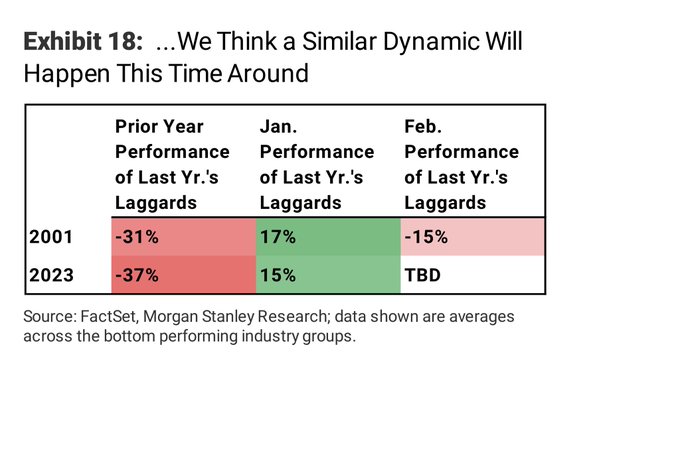

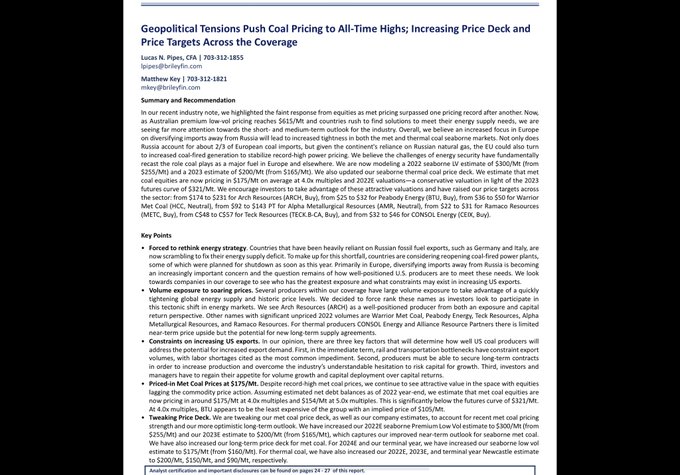

The recent fall in energy equities (doesn’t matter- oil/coal/uranium-name your pick) has been breath taking and clearly causes some deep reflection on whether one has overstayed ones welcome. This tread goes over my current thinking. Firstly credit

36

134

710

My first tweet in 3/21 on $BTU. 20 months later and it has 10 bagged and fortunately have owned every share i purchased at 3$ and much more as ive added at $8, 10$ and 20$. The power of patience and contrarian thinking. Cheers for those that have stuck with me on this journey.

@BatonRougeBorn

Investigating $btu as a Hail Mary contrarian trade.

@hkuppy

kedm mentioned it was trading at 1/3 the cash flow it made in 18 or 19. But just getting up to speed.Risk is Biden with a carbon tax. Positive is if gas goes to 4-5$ next winter u get coal/gas switching and btu goes nuts

4

0

23

31

11

532

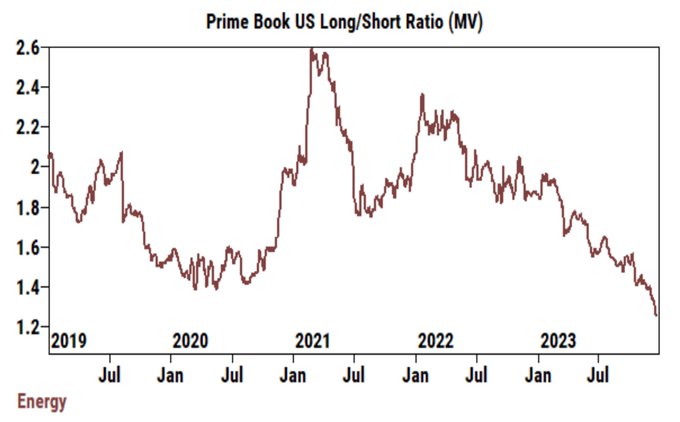

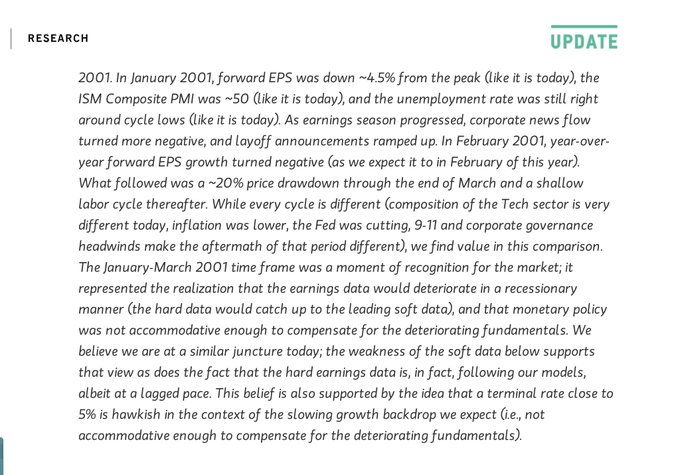

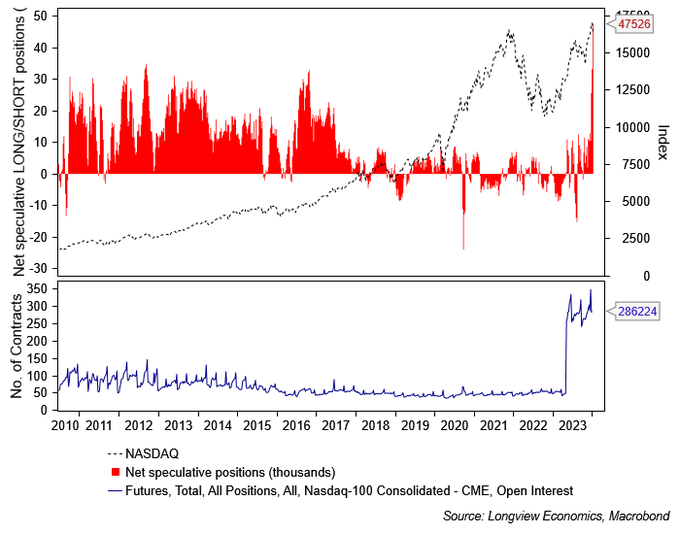

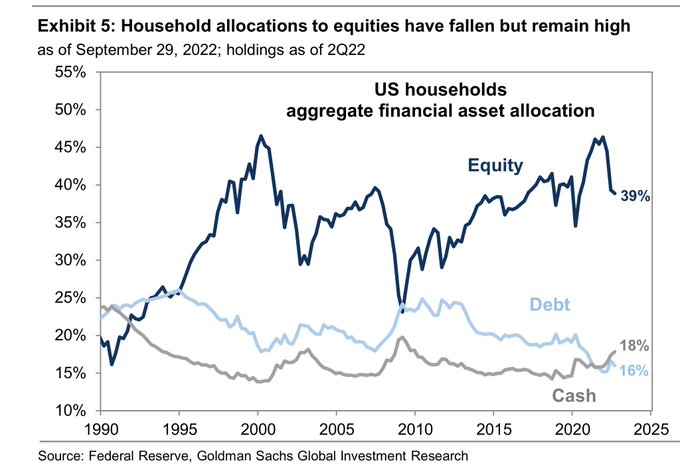

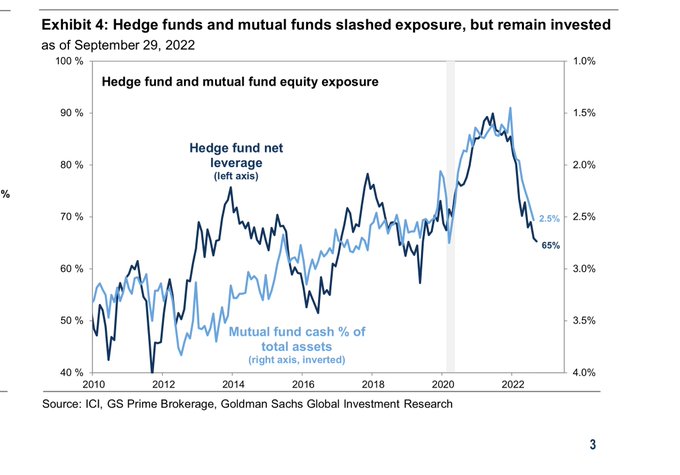

Hfs unloaded energy at the fastest pace ever and loaded up on tech just in time for opec cuts to cause energy to rip and presumably higher yields to now pressure tech 😭😭😭😭😭

26

60

513

Calling out

@hkuppy

whos had phenomenal trades for one bad trade is such poor taste. I also managed to pick $sber last Friday and saw it go down 99% in 3 trading days (and this despite picking the 3rd Best stock out of 8,571 on a 1 year basis with $btu). We all get stuff wrong.

47

12

432

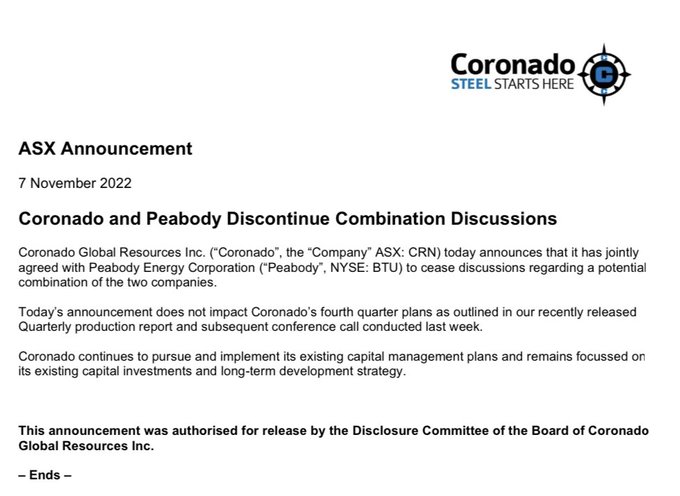

$BTU. I tweeted earlier today that Cramer was bearish $BTU. No one believed that it was a contrarian signal- well BTU and Coronado cancelled the merger discussion. CRAMER DOES IT AGAIN LOL

$BTU fans rejoice: it is over (until episode 3, anyways)

$CRN $CRN.AX

#CoalTwitter

@mfwarder

@8750Capital

13

31

194

36

32

361

$QQQ Some musings on a Saturday morning.

@kevinmuir

piece yesterday about HF continued buying of tech and selling of energy- something i had noted as well in several tweets from GS data made me think what is causing this apparent stupidity. H/t to Kevin for some of these charts

26

66

337

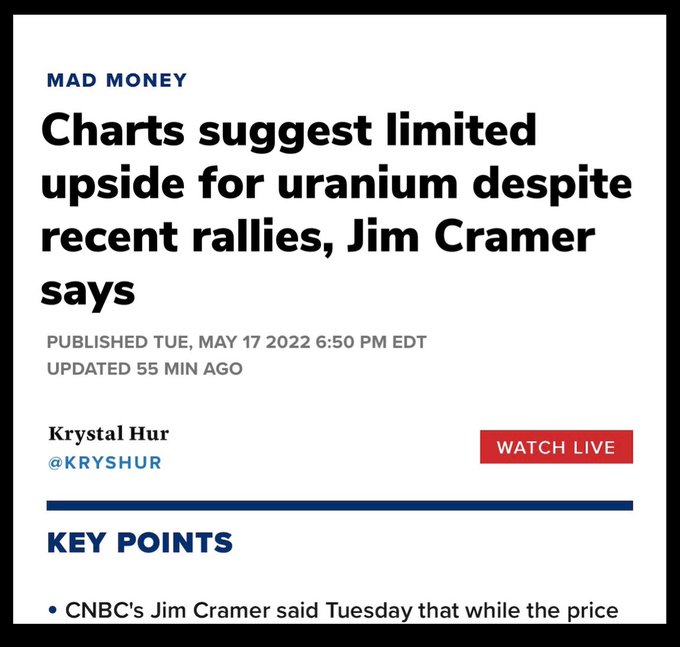

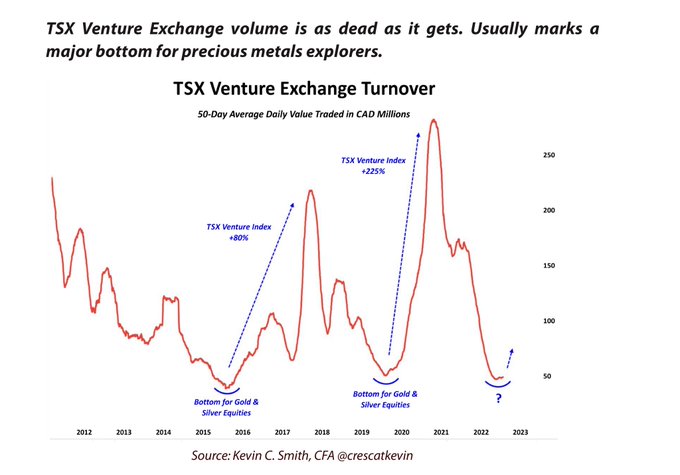

Uranium’s going to rip.

Based on technical analysis, Jim Cramer seems to think

#uranium

has limited upside 😳🚨

#InverseCramer

#Uranium

#InvestingNews

82

11

206

20

14

335

$KWEB. Yesterday i exited the remaining part of my $KWEB May $20 calls for a total 416% return on a sizeable bet. The cathartic moment when Hu was removed allowed me to triple down that Monday 10/24 and i tweeted about how this was similar to the $AR ft article claiming they

25

9

332

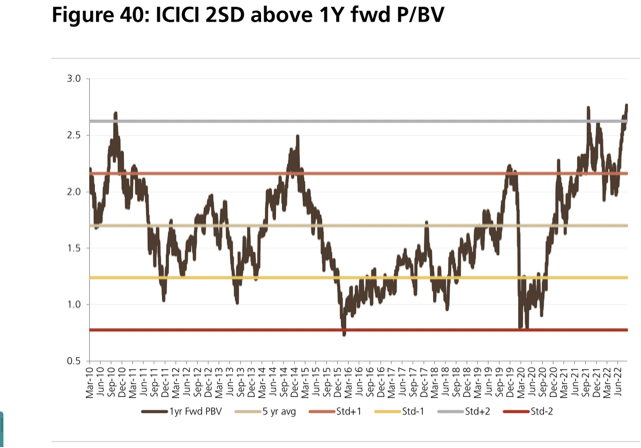

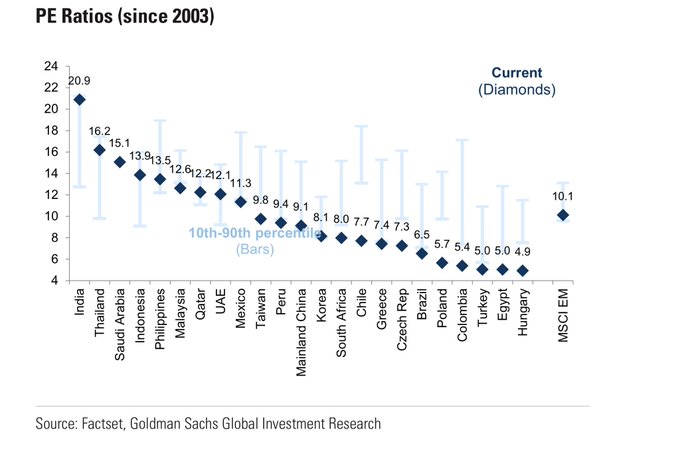

#india

$IBN I've always seeked out opportunities where the consensus is convinced of something and things may change. My questioning nasdaq in Nov 2021 and recommending $Tqqq puts got me a lot of ire with folks saying C8888 stick to something u know about like energy and not tech

29

46

318

#uranium

to the moon. !!!!! Now that most people have given it up for dead lol. Love how that happens. 4 mos ago so much utwit excitement. Outside of few folks like

@quakes99

and

@uraniuminsider

haven’t seen much news or talk.

22

19

314

Unpopular opinion but

@dailydirtnap

absolutely nailed the short term top on Uranium saying too many A$$holes in the trade. I haven’t seen any“Im a U a$$hole” memes floating around in the last few days. That being said i remain bullish and long- but kudos to Jared for calling it

21

5

309

After meeting

@hkuppy

last august for a fun filled night at Nobu, met

@PauloMacro

for a boozy evening sharing a nice bottle of Pauillac discussing, you guessed it, macro lol. Love how this platform helps you meet such amazing smart people.

8

3

294

Looks like someone who was massively short calling it ww3 two weeks ago is now net long.

Russia’s recent and notable change in tone on their requirements for a settlement are likely due to

@Ukraine

’s progress in the war. Let’s hope this can end soon without more loss of life. The more Russian losses, the sooner, it appears, that this will be resolved.

105

29

294

28

11

291

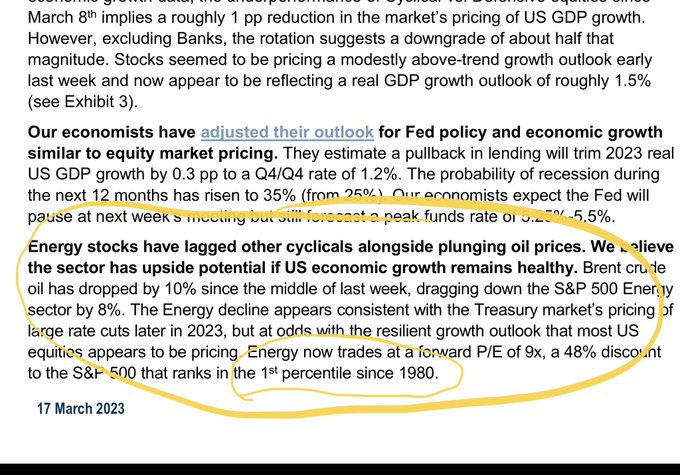

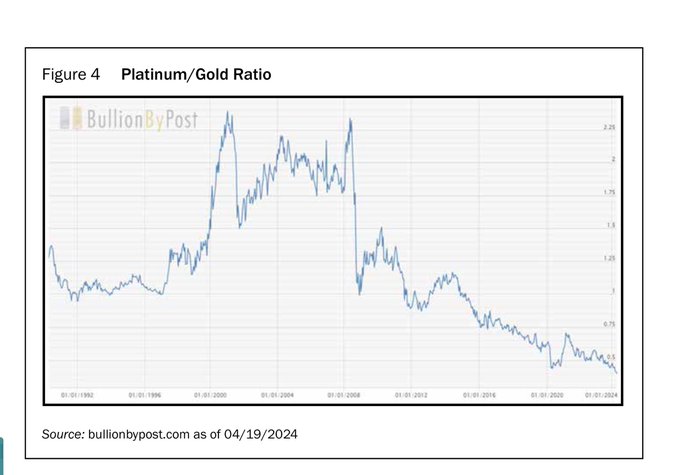

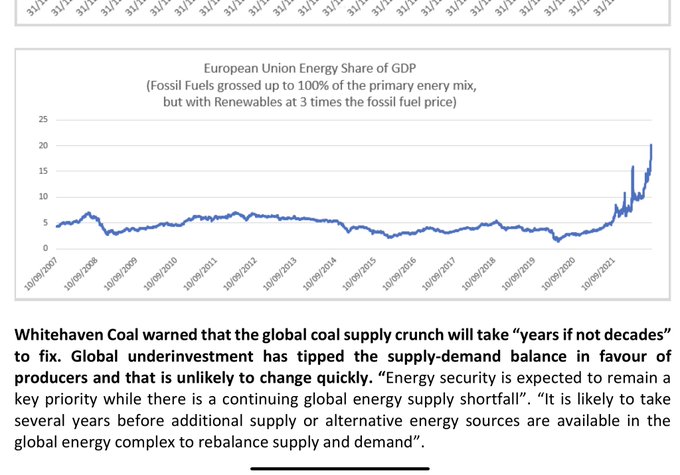

$xle. I count myself one of the very few privileged people who can pick up the phone and speak to my friend

@PauloMacro

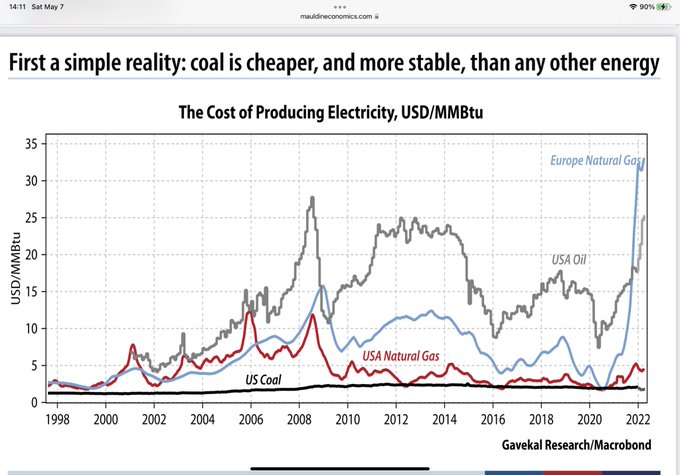

& in todays one hour call Paulo said something absolutely brilliant amongst the energy and commodity carnage. But before I get there GAVEKAL had some charts

14

34

287

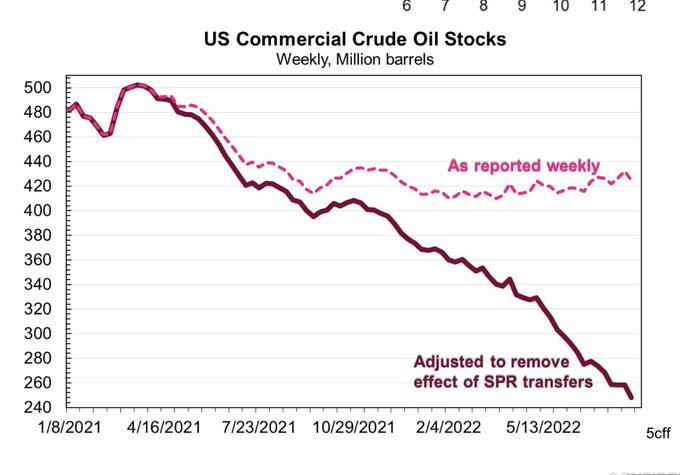

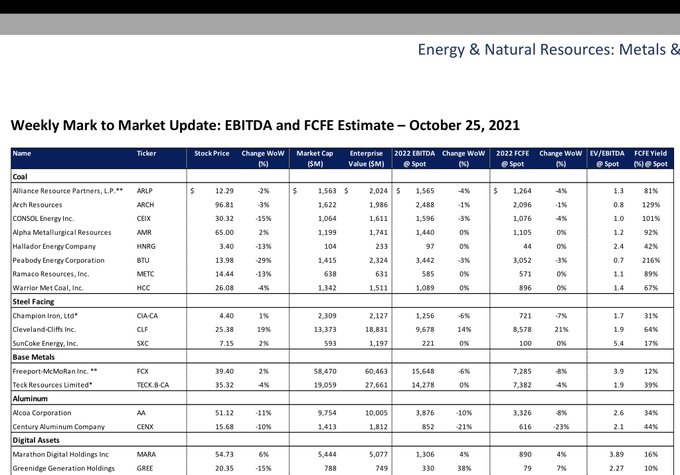

$xle $xlk This is an update on my thoughts that i penned on June 23 on the sector. At that time i mentioned i was constructive on the energy sector and was adding aggressively to names

$XLE $panr $btu

#uranium

The recent fall in energy equities (doesn’t matter- oil/coal/uranium-name your pick) has been breath taking and clearly causes some deep reflection on whether one has overstayed ones welcome. This tread goes over my current thinking. Firstly credit

36

134

710

23

58

282

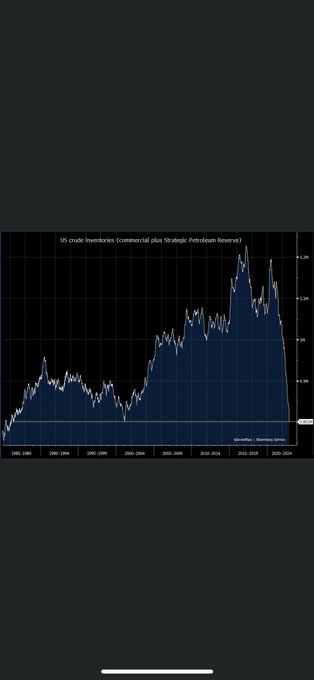

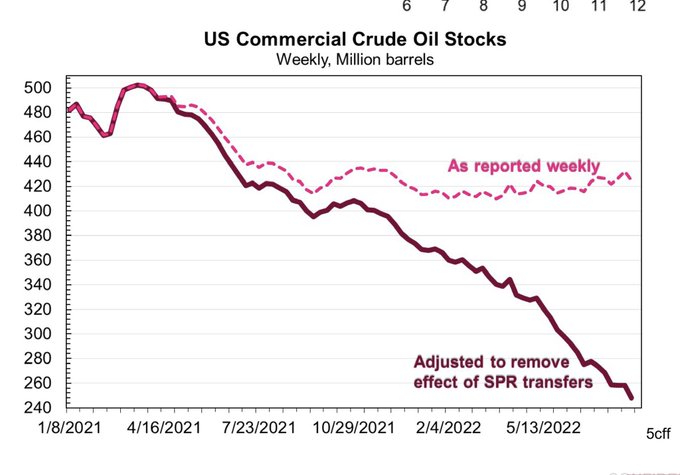

Listen to

@hkuppy

! 1. Hedge Funds who have been wrong all year long are massively short. Do i want to be on the same side as them? Nah. 2.

@JavierBlas

chart on inventories is stunning- yes we may have a recession but with china opening up, and supply tight (and probably getting

19

29

276

$BTU

#coal

. At the Mauldin SIC conference it was incredible to see the incredibly well regarded Louis Gavekal give a speech on energy and mention that countries that are going to win will be those that return to coal faster. Thousands of fund managers hearing about how coal will

10

41

268

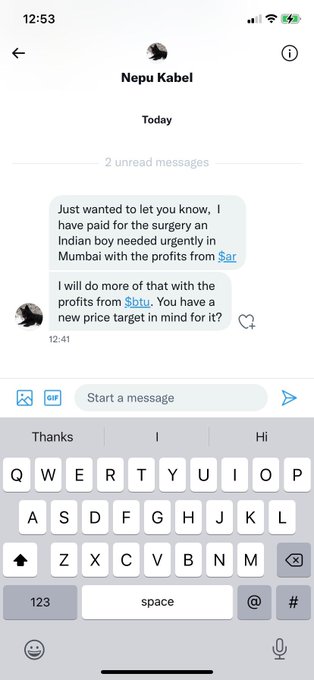

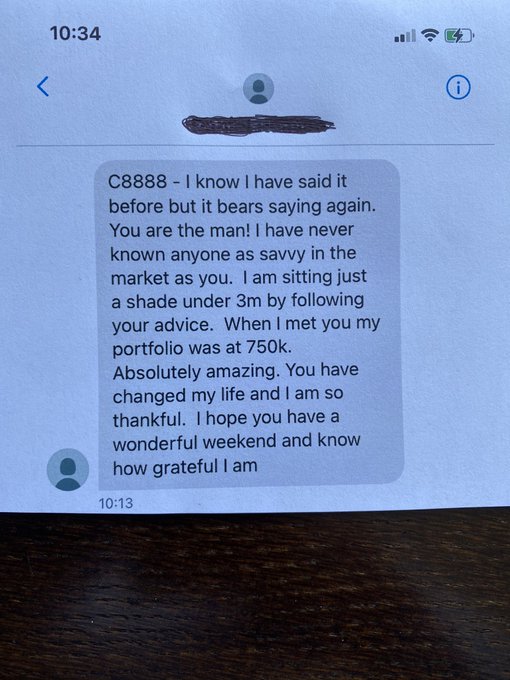

$btu. Being on social media you have to deal with a lot of crap. But every so often you get messages like this that make it all worthwhile. Glad to know being out there and visible with ideas can change lives.

#charlatan

lol

@contrarian8888

The trade that changed my life forever and allowed me to quit my job. Forever grateful. Thank you for always sharing selflessly. Ready to ride with team

#charlatan

with $Rig and $Panr.

6

1

107

16

4

272

Some News. I alluded earlier this week that i have noticed a much reduced traction rate. Post that tweet a # of followers mentioned that about a month ago I stopped showing up on their timelines. I suspect some ambitious Twitter engineer, to prove their worth to Elon, decided to

24

67

253

The issue is -nature of getting assymetric trades is you will occasionally get stuff wrong.

@hkuppy

myself and many others share our research and our ideas for free with no expectations of anything in return. If we are going to shamelessly be ridiculed for a bad call we could all

8

0

261

I agree 100% and I’d add pls stop dm me or tweeting me about what I think about some random name. I know what I know and honestly am not going to do the work to figure out a name ure interested in.

12

3

253

There is a reason I’ve been so aggressively short tech and long Vix - to allow me to have balls to aggressively add

#uranium

tonite. Scooping up $pdn from the pukers today after a painful 2 days !

23

9

251

On hitting 10K followers I want to thank all my followers for bearing with all my controversial ideas and joining me on this interesting ride. Although i joined twitter in ‘12, it wasn’t until Dec 2017 that i actually started tweeting & ill never forget the kindness of

@quakes99

27

8

249

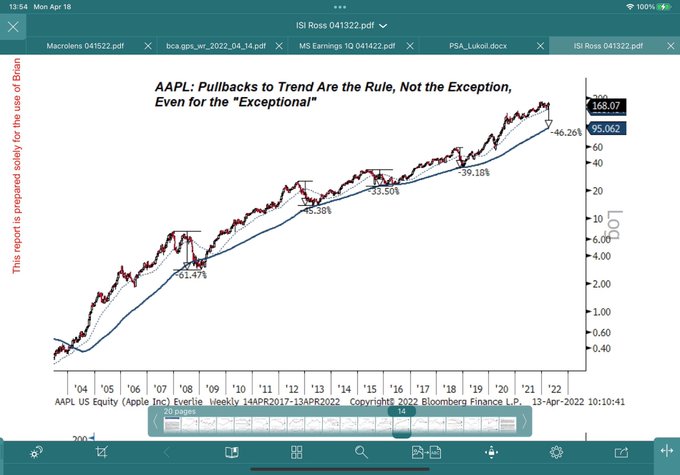

Who listened ??? Shorting aapl and buying Btu ?

31

4

249

Hf went long at the top. Shorted the lows. And are buying the peak again. They have become in aggregate the new “dumb money”

11

17

249

#india

$inda $ibn. Range of P/E ratios going back 19 years. India has NEVER BEEN HIGHER. Good luck convincing me this time is different. And all the Indians tweeting me about this and that ~ I heard same theories in 2007 before india got SMOKED in 08

29

35

247

$KWEB. Up 74% fricking % from the Hu catharsis low. (Something i tweeted about that Monday morning). AND YES IM A PROUD FOUNDING MEMBER OF THE CHARLATAN CLUB lol.

#charlatans

17

3

244

Congrats

@PauloMacro

on reaching 50k followers. I had the pleasure of first discovering u at 4k, dm you shortly after & then getting tipsy together on pauillac at a spot near where we live. Here’s to the amazing friendships twitter has afforded us and here’s to seeing u at 500k

7

1

237

The 2 biggest bubbles that need to blow up- and im on the other side of both. 1 the invincibility or outright belief that the Fed knows what its doing and will save us- Long precious metals (

#silver

in mongo size) is my hedge. And # 2 is ELON. Am short $TSLA in size.

16

13

236

$BTU gonna go to the Moon.

@8750Capital

u better buy back what you sold lol.

+++BREAKING+++

JIM CRAMER IS BEARISH ON $BTU, SAID:

"SANTA CAN'T AFFORD THAT COAL, ITS GOING UP TOO MUCH"

@contrarian8888

@GoForGrubes2

@agnostoxxx

@8750Capital

@stokdog

@James56487175

8

11

98

14

11

235

I have to thank

@trader_ferg

for introducing me to Lyall Taylor & his blog. This piece on climate change and the hypocrisy of the science purported by the ESG crowd is brilliant.

11

27

234

As much as people complain about social media i have to say it has allowed me to meet some amazing people like

@hkuppy

@PauloMacro

and today both Paulo and I had the pleasure of meeting, for the first time,

@kevinmuir

who is one of the nicest guys you can ever meet.Only regret is

8

2

231

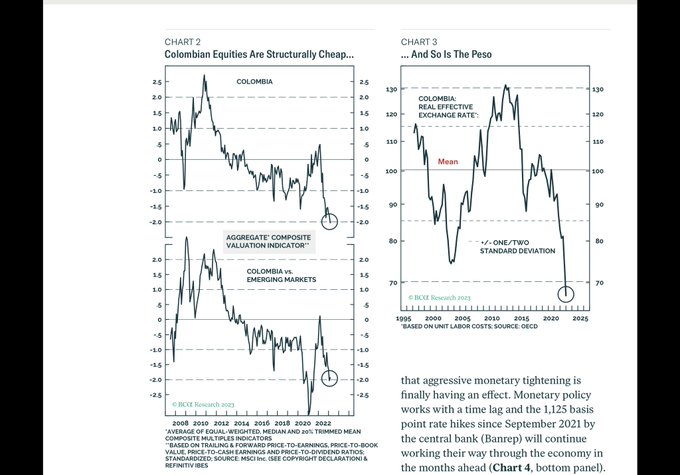

$EC. According to BCA, not only is Columbia 2 standard deviations cheap, its 2 SD cheap relative to EM and the Colombian peso is also 2 SD cheap as well. With a 25% dividend yield whats not to love about $EC

@calvinfroedge

15

20

230

Finally the Germans wake up and smell the coffee

13

12

226

$XLE $BTU. Fantastic article by

@OpenSquareCap

and i’d underscore 2 key points 1. Even with china lockdown oil draws are flat- what do you think happens when China finally opens up? 2.ESG funds are finagling their way into Energy stocks so the floodgates in terms of $ will be

Is the Ice Age Thawing for Oil Companies?

We check-in on inventory levels today & JP Morgan's interesting call.

@HFI_Research

and

@OpenSquareCap

#oil

#OOTT

#EFT

#COM

#Commodities

1

14

62

8

32

222

Best news all day !!

16

6

221

$btu. Once the debt is paid off I would expect to be swimming in so many dividends from btu. After all thanks to ESG no mgmt teams is going to want to reinvest aggressively in the biz. This is the tobacco sector trade ( tobacco sector last 20 years o/p every other sector

16

12

223

We don’t bottom until the week $arkk gets inundated with redemptions and freezes redemptions

24

14

220

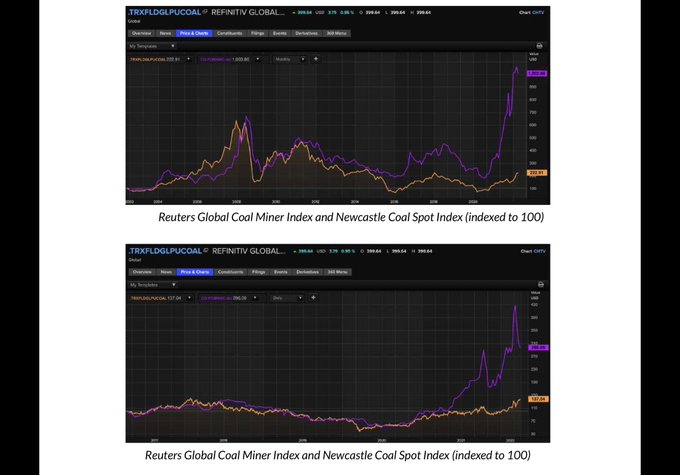

$BTU $SNOW Anyone who bot BTU at $3 has probably got vertigo given how well its done but zoom out to the longer term charts- h/t

@capitalistexp

for these amazing charts on coal. Firstly coal stocks have massively lagged the move in the commodity px- perhaps given everyone thinks

14

19

224