Stimpyz

@Stimpyz1

Followers

19,366

Following

25

Media

2,214

Statuses

53,291

I'm a cat, Ren

High in the Custerdome

Joined October 2018

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Galatasaray

• 110407 Tweets

Al Jazeera

• 102114 Tweets

Bernard Hill

• 86079 Tweets

Vlad

• 82440 Tweets

#GSvSVS

• 71298 Tweets

Spurs

• 66354 Tweets

Tottenham

• 62816 Tweets

West Ham

• 60174 Tweets

سعد اللذيذ

• 48917 Tweets

Theoden

• 44784 Tweets

Happy Cinco de Mayo

• 31198 Tweets

Ziyech

• 28038 Tweets

Mertens

• 26534 Tweets

Cavs

• 26258 Tweets

Anfield

• 19676 Tweets

Sivas

• 19069 Tweets

#محمد_عبده

• 18557 Tweets

Garland

• 18277 Tweets

Tim Scott

• 17319 Tweets

Paolo

• 17232 Tweets

LOSE MY BREATH MV TEASER 2

• 15482 Tweets

Emerson

• 14941 Tweets

Gakpo

• 13715 Tweets

Bülent Uygun

• 11254 Tweets

توتنهام

• 10122 Tweets

Last Seen Profiles

@SquawkCNBC

Translation: "Starwood doesn't have any earnings unless the Fed keeps money free and continues buying all the UST bonds that will otherwise crowd me out of the repo markets for my AAA CLO issuance. "

Oh, the humanity

11

23

332

@philbak1

It will be Silvergate that liquidates. At 11,600$ Saylor wont make his margin call. He will have sold 19K coins for 220M. Then the regulators will start asking why a FDIC bank is lending against imaginary collateral. Kiss the charter--and crypto credibility-- bye-bye.

19

28

314

@lisaabramowicz1

@TheTerminal

"Opted not to raise additional capital."

Like I decided not to date Giselle.

7

10

209

@LukeGromen

@FedGuy12

Our problem isnt inflation. It is growth. We dont have enough. We dont have enough because too much energy goes into USELESS finance and comes out as entropy. We can fix our problems. Just have a bonfire with Goldman Sachs as the fuel.

24

15

192

@hpalemro777

@DiMartinoBooth

@chigrl

Seizing Russian CentralBank reserves will go down in history as the greatest foreign policy mistake of the last 50 years.

20

39

184

@DiMartinoBooth

What did we learn today?

1. Fed days are invitations to squeeze the stupid short money, and

2. Equity market wont get really hurt until credit markets (high yield) demand more QE and Powell refuses.

3. Junk is currently closed to new issuance. That suggests July we gets real.

11

30

168

@lisaabramowicz1

@gamesblazer06

WAKE UP KIDS. Rates dont matter, they are a distraction. THE BALANCE SHEET MATTERS. It is going to be shrinking for YEARS. Along with your net worth if you continue to believe risk assets THIS overvalued can be bought with impunity. Easy money is gone FOREVER. Get over it.

30

26

170

@DiMartinoBooth

@BankofAmerica

Am hearing over 200 warehouse lines are closed to new loans and must liquidate by year end, facing risk weightings that are especially high under SA-CCR.

19

36

175

@DiMartinoBooth

Yellen: "We need another distraction. This bank thing is killing us in the polls."

Zients: " What about UFOs?"

Yellen: "No one cares anymore."

Zients: "OK. Let's arrest Trump."

Yellen: "That'll work."

8

30

157

@elerianm

This is idiotic. Claims are below the LT averages by a lot. Services inflation is still 6%. A pause in September is one thing, but cuts soon is just abject nonsense. Free money days are over. In retrospect, it was a disaster fro the Fed. They know it. ZIRP/QE done. Get over it.

23

13

156

@DiMartinoBooth

It is becoming increasingly clear that the Fed and ECB are depending on a substantial correction in stock, real estate and junk credit market valuations to arrest the explosion in prices. And no, Bitcoin wont be spared.

24

17

149

@lisaabramowicz1

The question I have is that if we are certain to get a Goldilocks soft-landing, why cut rates 6 times in 2024? Why cut them at all?

34

17

148

@LynAldenContact

"Fiscal Dominance" is about to crash into the side of a mountain. Powell is going to have to signal his willingness to help Yellen sell debt by late summer one way or the other. It doesn't matter what he does, it all amounts to the same thing. The end of the rainbow is close.

18

18

144

@DiMartinoBooth

I cannot fathom is how Bulls can talk about "soft landings" with a straight face. It's fine 2 believe the Fed will backstop stocks--that is their own fault after all. But the idea that the US economy is "strong" when continuous 7% deficits are required to conjure growth is nuts

14

28

149

@rcwhalen

@Hedgeye

@zerohedge

You cant criticize Powell and the Fed and Yellen and UST till the cows come home. But they are putting the ball where it belongs--in Congresses court. You want deposit insurance? Change the fuckin law. You want to modify the dual mandate? Change the fuckin law.

15

19

145

@DiMartinoBooth

Market would have rallied even if the headline had been hotter. Markets are testing Jay Powell. This is what QE has cost the Fed. Respect. You raise? I call. Schoolyard stuff. Like Ike slapping Tina around. Pay attention Jay, you give in and this abuse in NEVER gonna stop.

17

12

142

@DiMartinoBooth

@WSJ

OF COURSE they are going to stop accumulating USD. What did the brain trust at 1600 THINK was going to happen when they hit ctl-alt-delete on the Russian CB reserves? It will go down in history as the single dumbest foreign policy move ever.

12

14

133

@NickTimiraos

This rises to an impressive level of naïveté even for the WSJ. Powell is loving this once in a lifetime chance to change the course of runaway fiscal spending and shadow finance hostage taking once and for all. He is thinking legacy, and should be. Rushmore has room.

31

19

142

@DiMartinoBooth

Give this risk rally any more steam and they will cap. This market is so asking for it. I wouldn't take an inter-meeting 50Bp raise off the table if stonks and risk dont get the message pretty soon. Reminds me of my mom, we ignored her long enough and The Wooden Spoon came out.

20

9

133

@TaviCosta

You dont understand a word you are saying, do you? Sure emergency loans at the discount window increases the balance sheet. You think it is stimulus? That banks need cash to meet deposit outflows? Wait until they raise rates again. Cause they will. Idiocy like this guarantees it.

25

11

135

@DiMartinoBooth

Crypto credibility is hanging by a thread. At 11.5K$ Saylor will refuse to make his margin call to SilverGate, having sold his 19K coins for 220M. Then Lizzie and the regulators will start asking why an FDIC bank is loaning on imaginary collateral. There goes the neighborhood.

13

16

127

@lisaabramowicz1

@elerianm

@FerroTV

What is going to get crushed is the FINANCIAL ECONOMY. Wall Street, not Main Street. This is what Powell knows but wont discuss. CMBS and CLOs are already dark. The ABS markets are the wellspring of all profits for the tapeworms. They cannot survive years of "higher for longer."

21

28

133

@LynAldenContact

@Convertbond

Demand for UST is easy to fix. Just let the incoming credit cycle take its course with no bailouts, and watch the fraudulent manufacture of 'safe' assets out of straw known as 'securitization' go the way of all flesh. Presto: plenty of UST buyers.

5

16

132

@DiMartinoBooth

You can thank Biden for that. The decision to seize Russian assets after the Ukraine war broke out will go down in history as one of the stupidest moves ever.

24

15

132

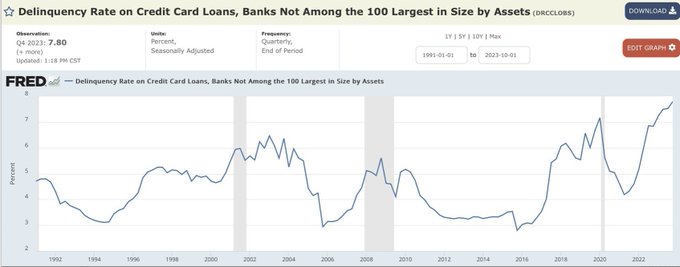

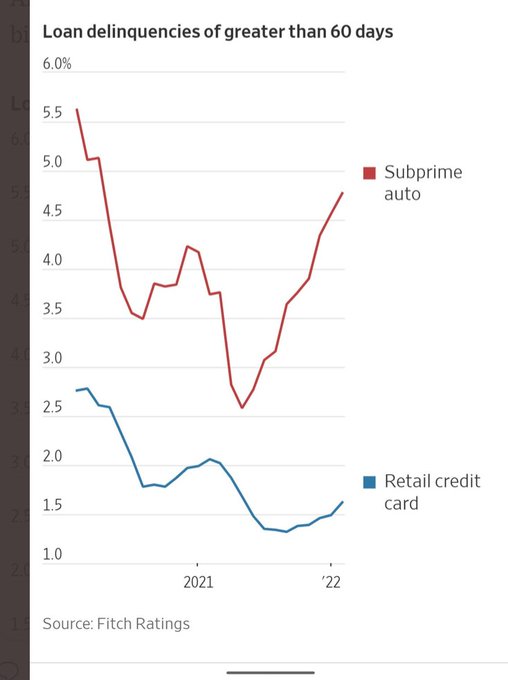

@Kens_Rant

@DiMartinoBooth

Problem loans. Credit Card delinquencies are at the highest rate in decades at the mid sized banks.

AT FULL EMPLOYMENT.

11

31

126

@DiMartinoBooth

It's more than that, Danielle. He is ready to go full on Volcker if that is what it takes. Credit is going to reprice HARD here. We are hundreds, maybe 1000's of basis points away from a pivot.

50

11

123

@bsurveillance

@apolloglobal

Or we might see the BIBLICAL write-down of PE asset fraud coming in the new year like Harvard predicts. Apollo's balance sheet is laughable. Everything (and I mean everything) is 'adjusted.' This kind of thing can't be allowed to ever happen again, and Powell gets it.

12

15

125

@DiMartinoBooth

The U.S. economy will snap like dry twig in Q1 2024. Everything that can go wrong will go wrong, all at once. Call me Deacon Blues.

23

23

123

@Altheaspinozzi

@JackFarley96

JP IMF panel chair saying out loud what all the central bankers are thinking: (If I may I paraphrase)

"If higher long term rates are driven not by tighter policy, but instead by the cost of fiscal irresponsibility--Central bankers MUST be prepared to raise rates still further."

11

20

123

@DiMartinoBooth

China is in recession

Europe is in recession

The US is in recession

We are going to have stagnant growth.

That USUALLY drives down prices

Then again, stonks have a mind of THEIR own, who is to say consumers cant be equally irrational?

19

19

119

@LukeGromen

@MarcGoldwein

@DavidBeckworth

FWIW, the SEC is going to drop a bomb in UST markets later this month with a full clearing mandate of customer trades with a short implementation timeline. The glory days of re-hypothecation are over, and de-leveraging is going to securities finance like a Mack truck.

9

30

120

@DiMartinoBooth

These "here comes pivot' rallies are to be expected 100% in a market where 95% of the opinion is vested interest in keeping the free money flowing. The problem is we have 9% inflation, and NOTHING in the data suggests anything but a chance of pause in the fall. Balance sheets...

13

11

112

@DiMartinoBooth

The only question is who they pick to give markets the bad news. It may have to be all of them one after another. If the Fed spent 10 year trying to conjure inflation with little success, why do we think they will have any better luck trying to get rid of it?

11

7

108

@JDP223

@DiMartinoBooth

@philbak1

Ok, LAST TIME. Saylor has enough coins to stay solvent down to 3000$. But at 11,500$ he will refuse to meet the Silvergate margin call. He will have sold 19K coins for 220M. THEY will own them. And liquidate them. THEY are a bank, defending loans on imaginary collateral?

7

10

106

@TheBondFreak

@lebas_janney

Nothing is trading. New issuance has slowed to a crawl. Carvana barely got done, and deals are getting pulled left and right. HYG has volmeggon written all over it. Another tantrum is coming, and if Jay refuses to back off the beatings will be savage.

13

14

110

@FedGuy12

@Evan_Ryser

Rate cuts--if they happen--will be cosmetic. ZIRP is gone forever. What markets think, and how long and hard they think it, is out Powells' control. But free money isnt coming back while he is Chair.

25

18

108

@NickTimiraos

@DiMartinoBooth

What a bunch of horse-shit. QE & QT have "asymmetric" impacts because the Fed has ZERO credibility. 2 decades of bailouts have conditioned markets that QT will ALWAYS be abandoned at the first sign of Wall Street distress. You want to stop house fires? Use deductible insurance.

10

30

109

@NickTimiraos

Markets should not totally dismiss the possibility of a panic tightening move from the Fed. Oil is up, grains are up, now housing? The temptation to go back to 50bp moves will be tough to ignore.

32

9

103

@DiMartinoBooth

@Quillintel

@RJWholeLoans

@TheBondFreak

Never gonna give you up

Never gonna let you down

Never gonna run around, and hurt you

12

40

100

@SpeakerMcCarthy

ATTN MR SPEAKER;

This bank debacle is a warning shot on the debt ceiling. If Yellen gets a green light to re-fill the TGA with 700Bn in new Tbill sales every small bank in the Country will wobble. That money has to come from somewhere. This is a game changer for your narrative

4

22

101

@lisaabramowicz1

@TreppWire

There is no liquidity in New York City CRE Lisa. If you bothered to look up from your terminal you would see that CMBS markets have been essentially closed for a month. Banks dont HOLD CRE loans anymore, they originate and sell into ABS. Or they used to, back in the good old days

9

10

103

@DiMartinoBooth

Pivot-mongers looking for proof the Fed is deadly serious about killing the Put need look no further than the 100% write-down of AT1's in the CS deal.

9

15

103

@JackMonero

Their unstated intention is to break the put, exactly like Danielle says. The way to do that is the same way you break a wire coat hanger. Keep bending it back and forth until it snaps. They love these rallies in stonks. Its a green light to get serious.

13

9

103

@DiMartinoBooth

The Fed is going to SHRINK the monetary base? Last time they tried they broke REPO. This time REPO will be just fine. UST REPO that is. The rest of the 'collateral transformation' cluster-fuck chain is a different matter. Get out of high yield NOW. Godzilla is coming.

8

21

101

@NickTimiraos

He said more than that Nicky. He said the balance sheet reduction would be SUBSTANTIAL. And that he counting on it to tighten financial conditions further. He is gonna get his wish.

4

9

102

@rcwhalen

@MoodysInvSvc

@krollbondrating

@JoeBiden

@samjsutton

@EconomyBen

These would be the same rating agencies that rated sub-prime mortgage debt AAA in the GFC? The same ones that rate CLO mezz debt BBB by assuming NO (ZERO, NADA, ZIP) correlations across industry buckets? The ones that claimed a 1st amendment defense when they got sued?

4

12

101

@raleinerev

I am ready. I am waiting for a real estate agent in one of these absurdly overpriced mountain towns to tell sellers the truth: prices have to come down 50% to be reasonable. They doubled in 2020. Now STR bookings are collapsing, mortgage rates have doubled and WFH is history.

9

11

101

@Convertbond

Dear middle class consumers,

Learn to count. Start living within your means. Zero rates are never coming back.

Sincerely,

Jay Powell

15

8

104

@Dusseldorf29985

@DiMartinoBooth

I have said it a million times. If Powell even TRIES to print with inflation at 4% the long bond will go bid-less. How many would you want to own? I mean own--as in wear--not flip to the Fed. He will have to buy them all, which is a nonstarter.

11

17

101

@DiMartinoBooth

@phillynode

@franklupu

@BartsQuandry

The utter absurdity of pivot-babble is hard to fathom. Not a SINGLE shred of economic data currently supports even a a pause in rates, let alone a reversal of balance sheet. What you have is simply lions eating antelopes. Maybe all of them. Extinction is next. Its nature's way.

19

16

101

@macituptpt

@__ace007__

@DiMartinoBooth

Powell will be explaining this simple reality to those on the Hill who have taken the most advantage of his largess in short order. He will tell them what I am telling you. Balance the budget or no rate cuts, No QE, ever. No tickee, no washee.

23

16

101

@DiMartinoBooth

@fcolatru

@JackFarley96

JY: Jay, you need to call a timeout here

JP: We are in Blackout

JY: Just call Nick again

JP: And say what? This is what we wanted?

JY: Just hint at rate cuts, you don't have to actually do it

JP: Tomorrow maybe, if its still bad

JY: Can I tell Joe?

JP: Let's surprise him

7

11

102

@JohnBurrowsCA

He is willing to raise it again. Just not without an effort to stop bleeding future generations dry. As for work requirements, no a surprise you don't support them . You are in Congress after all, right? Nobody works there.

8

7

98

@SteamboatBuyNow

I got one. Prices DOUBLED in 2020, when work from home and 3% mortgages were the rage. Now the back to work whistle is blown, and mortgage rates are 7%. Why wont prices fall back AT LEAST to 2019 levels on properties that actually change hands? Please dont use the word "special"

29

12

96

@RealBurtonM

@RH2the

@schiess_j

@DiMartinoBooth

The best line in the Big Short is the S&P analyst telling Mike Baum they are rating defaulted loans AAA because otherwise the clients will just go down the street to Moodys'.

10

15

98

@DiMartinoBooth

Oil telling you things are not as rosy as the "soft landing" crowd believes.

"Knock knock:"

"Who's there?"

"Reality"

10

16

98

@BChappatta

Dear Wall Street:

The Ukraine situation makes aggressive Fed tightening MORE likely not less.

Sincerely Yours, Reality.

15

13

96

@NickTimiraos

These clueless twats just keep going from insult to injury. This kind of vacuous posturing only makes Powell's job (and the JOB of the Fed) that much harder, feeding the junk-food cravings of a market as devoid of leadership as our elected pantheons. He needs to SHUT THE FUCK UP.

8

10

94

@lisaabramowicz1

Translation: "We are starting to really worry about all the shit we bought last year."

5

6

92

@jgpuck99

@DiMartinoBooth

@EPBResearch

They will cut rates, but it will hardly move the needle. 100-200 bp is chickenfeed. The economy has had ZERO and 9T in QE for 15 years. The recession will be brutal when it gets here, and the passive bid driving stocks will reverse. You will probably be out by then. Maybe not.

11

12

96

@DiMartinoBooth

@edmunds

@business

“40 years of falling rates were the engine of financialism - optimizing the real economy around leveraged finance and asset prices. Without the ever-falling rates, financialism is over. The next 40 years can't be like the last 40. Investors are yet to see it.”

@S_Mikhailovich

10

25

92

@truflation

@DiMartinoBooth

“we don’t explode overnight. We explode in a series of explosions over the next year and a half as loans mature and people can’t pay them off…"

-Barry Sternlicht

11

19

93

@NickTimiraos

Powell is playing the markets like a Steinway. It's good to see. If you want to boil the frog, you have to let rallies happen; if only to keep Congress quiet. The balance sheet answer was particularly disingenuous. He knows the markets will take the wrong things from that answer.

8

9

94

@NickTimiraos

It's simple. Blackrock holds the Keyes. They could force the Fed to pivot the same way they forced the BOE. Refuse to price an end of day bond ETF. That is the functional equivalent of a freeze on withdrawals. Bingo: The Fed put. But then what? Hint: Larry no like.

9

18

93

@lisaabramowicz1

let's not mince words. It's about the damn deficit. And he is going to make that clear to Congress quite soon, precipitating the HEALTHIEST correction in decades.

12

8

92

@NickTimiraos

You wanna see broken, Nick? Look at the non-banks. When they discover the securitization markets are not re-opening again it will be a bloodbath

11

15

91

@FedGuy12

Love the work, but the problem isn't the debt in and of itself, it is the leverage. Even water can be toxic if you are in enough of it. LDI is even more popular here, the difference is US pensions can post securities as collateral to stay in trades. Its all about transformation.

9

4

90

@NickTimiraos

@AndrewRestuccia

@AnnieLinskey

Revisionist bullshit. LB had no real opinions on terminal rates, or anything else for that matter. She is just pure 100-proof ambition. It's the kind of "leadership" that got us into this mess in the first place.

5

9

87

@DiMartinoBooth

This stock market nonsense is a gift in a way. Jay can bring out the hammer and assume the economy will be just fine. All he has to do is hint at a pause and all is forgiven. It's a dream come true in policy, really. sort of. Maybe. Kind of.

18

4

89

@CNBCClosingBell

@steveliesman

That's all fine, Steve, but the structural problem in the banking system is the NON-BANKS. How can banks that are regulated and expected to provide social goods (tellers, ATMs) expect to compete with wild-west non-banks (2 guys and a Bloomberg) for loans? Hint: They can't.

12

10

85

@Hrmn220

@DiMartinoBooth

Biden WANTS a war. It changes the narrative from his current approval rating hell, and lets him play peace-maker and statesman. Oil going to 100. God help us.

19

8

81

@ScottFagan12

@DiMartinoBooth

@chris_robb1

Inflation is about to teach a bipartisan lesson that will go well beyond progressive dreams of UBI. Taxes will rise, spending will be cut, and once great fortunes built on leverage will collapse. Remember that when the kissing stops.

5

22

89

@DiMartinoBooth

Only on CNBC:

"A former Wells Fargo head of retail banking has plead guilty to fraud in the account opening scandal."

Now back to the show

Our guest is Dick Kovasovich, former Wells CEO to tell us why the banking system is safe.

Classic shit

7

13

85

@DiMartinoBooth

@t1alpha

Counting the number of times "rate cuts" are mentioned at CNBC. From 9-10 am it was 48 times.

15

20

88

@DiMartinoBooth

@SantanderUSA

@Citi

@business

Santander could be toast next. We are at the point where every day will bring another failure from a company that should have been gone yrs ago. Each will conjure expectations of a pivot, until finally they do not. Then the Fed will pivot.

14

15

84

@DiMartinoBooth

The Chinese dont want the Yuan to replace the USD. They want the USD to BE replaced, but if it is the Yuan alone they will be stuck absorbing the excess production globally.

11

9

85

@lisaabramowicz1

@BloombergTV

It has to go further. Central banks must stop giving Wall Street a pass to embed leverage in anything that moves as a tradable claim. No more asset securitization. NO more CDS. Rate swaps must deleverage, along with repo, which must be sovereign only with no rehypothecation.

15

10

83

@Convertbond

@BeckyQuick

The Fed isnt going to pivot, Larry. Touch the stove, you get burned. No more baiilouts. Inflation would go berserk.

18

6

83

@DiMartinoBooth

@SantanderUSA

@Citi

@business

There is no securitization market for anything away from conforming mortgages at this point in time. Wew will soon be at the point where any announcement, scheduled or otherwise, from UST, Fed or WH will be seen as evidence of an incoming PIVOT. This is how you boil the frog.

8

16

82

@Convertbond

Be careful with this idea. Is a 25 or 50bp cut out of the question? No, but it is unlikely, and QT will continue balance sheet rolloff. But ZIRP isn't coming back, neither is QE. Not unless we see a Cretaceous extinction event.

16

9

84

@lisaabramowicz1

Here comes the sell side whining. "Financial stability, blah, blah blah." The whole Wall Street business model has been built around taking hostages that are "too big to fail." Time to shoot your way in.

4

5

81

@lisaabramowicz1

Coming next: "Why cigarettes are good for you," from the folks at Phillip Morris.

3

6

86

@NickTimiraos

Meanwhile markets are hyper-sensitive to the near term data, and are already pricing in a full blown pivot with core inflation at 6 1/2%. This is why Wall Street is overpaid.

8

15

80

@SenSherrodBrown

Senator. After the DISGRACEFUL letter you sent Jay Powell meddling in things that are none of your concern for abjectly political gain I dont want to hear ONE WORD about January 6 out of you or your party again. Ever.

6

7

82

@DiMartinoBooth

The situation in Florida with condo pricing in LITERAL free fall could actually be large enough to spark national contagion. The Condominium Act of 2022 mandates that all long term maintenance be capitalized on an annual basis= HOA fees larger than payments. Let that sink in

13

23

84

@MacroAlf

All this mess and the Fed hasn't even STARTED taking balance sheet away from the carry traders who finance the whole ABS market. Same with FX swaps, which will send the USD parabolic. Credit is a HUGE accident waiting to happen, and the Fed doesn't care. They cant afford to.

7

11

81

@DiMartinoBooth

@t1alpha

Wall Street as we currently understand it must be destroyed. Talking 2 in the head. It is maximum entropy. "The eater of worlds," as Oppenheimer said. It consumes energy & defecates negative productivity. We simply cant afford it anymore. The Fed knows this now. We learn it next

12

11

80

@DiMartinoBooth

What he really means is he doesn't know how rates need to go (given contemporaneous balance sheet reduction) before high yield credit markets close, junk ETFs begin to fail, and private equity and securitization markets have an aneurysm.

12

10

79