David Beckworth

@DavidBeckworth

Followers

29K

Following

9K

Media

3K

Statuses

41K

Senior Research Fellow @mercatus || Podcast Host at http://https://t.co/3pQ4uoYU7S || Former U.S. Treasury Economist || Micah 6:8, John 3:16

DC, Nashville

Joined January 2012

New working paper with @Pat_Horan92 where we provide a new decomposition of the inflation surge. Using a New Keynesian model, we show most of the inflation was caused by aggregate demand shocks. We also do a @jasonfurman decomposition with similar results (1/3) @JohnHCochrane

23

71

286

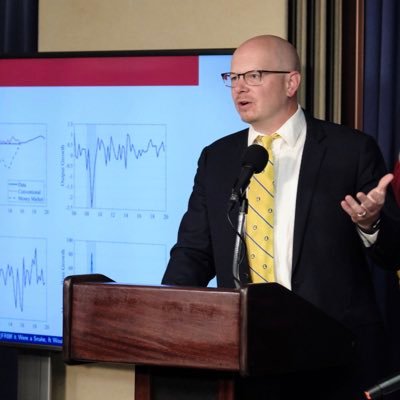

This morning I spoke about regulatory dominance of the Fed’s balance sheet. For all the talk about fiscal dominance, the truth is the Fed is forced to take actions on the balance sheet due to the regulatory framework binding banks.

federalreserve.gov

Thank you for the opportunity to speak to you today. 1 The Federal Reserve is actively revising its banking regulations, a project that I strongly suppor

23

40

391

Is the U.S. economy in a non-Ricardian state?

In case you missed it! @LukaszRachel and @DavidBeckworth question whether the US is in a non-Ricardian fiscal policy world.

1

0

10

New data shows the number of international college students enrolling in American schools for the first time decreased by 17% this fall. These students pay tuition that subsidizes American students, and many stay in the US afterward to work as scientists and engineers. Policies

79

93

435

Illegal Immigrants Didn’t Break the Housing Market; Bad Policy Did

marginalrevolution.com

In an interview, JD Vance claimed: [H]ousing is way too expensive….because we flooded the country with 30 million illegal immigrants who were taking houses that ought by right go to American citize...

0

10

27

Friedman predicting the return of price controls

11

69

612

New episode! Lukasz Rachel on Non-Ricardian Macroeconomic Policy and Its Implications for Inflation @LukaszRachel explains to @DavidBeckworth what would the counterfactual world have looked like in 2019 if we had entered a world of secular stagnation?

2

4

13

This x100 @jasonfurman

The most important fact about global inequality is that it has fallen sharply since 2000. Erasing more than a century of increase. Probably not a coincidence that this was the era of hyper globalization.

2

3

19

Such a fun conversation with two of the best trade scholars and best partners in the fight for freedom. Listen up and share widely. We talked about the trade war, the Supreme Court case and lots of economics.

Check out this new @aier #podcast, featuring @cato's @scottlincicome and Donald J. Boudreaux of @CafeHayek, hosted by @mercatus's @veroderugy, on #tariffs and the future of executive power in #America: https://t.co/pyugbEP2hj

1

5

18

4/ My own view: there has been some tariff inflation but less than expected because of inventory stocking & elevated post pandemic margins allowed business to absorb tariffs, & offsets from shelter, oil. Negative demand effect has been offset by AI, wealth.

2

4

34

If you read the Fed study, it says that tariffs lead to lower inflation because they also cause higher unemployment, i.e. they hurt aggregate demand. This does not sound supportive of Trump's policy. /1 ...

Fed Study Vindicates Trump Trade Policy: 150 Years of Evidence Shows Tariffs Lower Inflation https://t.co/We6UqxsZsJ

23

52

283

How many times do we have to do this? https://t.co/LG9Xkm0Qjs

30

111

808

President Bostic recently came on the podcast. Among other things, we got the chance to chat about our shared hobby, birding. Here is a video clip of us discussing birding. (1/2)

NEW: Atlanta Fed President Raphael Bostic will retire when his term ends in February, effectively choosing not to seek reappointment. Bostic, who became the central bank's first African American and openly gay bank president in 2017, had faced scrutiny over financial disclosure

1

1

10

𝗪𝗵𝗮𝘁 𝗶𝗳 𝗺𝗮𝗰𝗿𝗼𝗲𝗰𝗼𝗻𝗼𝗺𝗶𝘀𝘁𝘀 𝗰𝗼𝘂𝗹𝗱 𝗳𝗶𝗻𝗮𝗹𝗹𝘆 𝗿𝘂𝗻 𝗲𝘅𝗽𝗲𝗿𝗶𝗺𝗲𝗻𝘁𝘀? That is, what if we could simulate the dynamic, interpersonal, and politicized policy decisions and their impact on the economy? It is now possible with AI.

8

21

72

We also got to talk about his idea of the Fed targeting a range target instead of point target. Here is my write up of his proposal (2/2) https://t.co/bUMBUEuI25

1

0

3

President Bostic recently came on the podcast. Among other things, we got the chance to chat about our shared hobby, birding. Here is a video clip of us discussing birding. (1/2)

NEW: Atlanta Fed President Raphael Bostic will retire when his term ends in February, effectively choosing not to seek reappointment. Bostic, who became the central bank's first African American and openly gay bank president in 2017, had faced scrutiny over financial disclosure

1

1

10

When a central bank has fully functional and widely used ceiling tools, then QT--or Quantitative Normalisation (QN) in ECB's case--does not get sidelined by worries of interest rate control! Who knew?

In our demand-driven framework, there is no direct link between the pace of QN and interest rate control. In the euro area, a rise in repo rates would not lead to a slowdown in QN. We expect our monetary policy bond portfolios to be run down completely. 8/15

1

1

7

I asked AI to create an image for this week's podcast and this is what it gave me. Kind of dark, but wow!

Meet Sim Powell and his LLM Fed colleagues that argue, cajole, and dissent like the real FOMC. Amazing discussion with @TaraSinc on her work with @SophiaKazinnik to replicate and experiment with the FOMC via LLMs of each Fed official! (1/2)

2

4

24

This is from @Isabel_Schnabel recent speech on the future of the ECB's balance sheet and its implications for its operating system.

What should the Eurosystem balance sheet look like in the future? At our @ecb money market conference, I reflected about #QuantitativeNormalisation, the benefits of a demand-driven operational framework and the sequencing of operations. 1/15

0

0

2

When a central bank has fully functional and widely used ceiling tools, then QT--or Quantitative Normalisation (QN) in ECB's case--does not get sidelined by worries of interest rate control! Who knew?

In our demand-driven framework, there is no direct link between the pace of QN and interest rate control. In the euro area, a rise in repo rates would not lead to a slowdown in QN. We expect our monetary policy bond portfolios to be run down completely. 8/15

1

1

7