Citrini

@Citrini7

Followers

45,126

Following

1,863

Media

4,383

Statuses

32,825

Thematic Cross-Asset Investor. As heard on Bloomberg.

Connecticut, USA

Joined February 2021

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 544838 Tweets

#WWERaw

• 101683 Tweets

Drew

• 78878 Tweets

Madonna

• 66208 Tweets

Patricia

• 59034 Tweets

#WWEDraft

• 30088 Tweets

Tatum

• 27162 Tweets

Smackdown

• 24896 Tweets

Derrick White

• 21514 Tweets

Braun

• 19494 Tweets

Luciano

• 19302 Tweets

#4MillionHearts4Zee

• 18447 Tweets

Dario

• 16494 Tweets

Aleska

• 15725 Tweets

Saint Ram Rahim

• 15064 Tweets

D White

• 14506 Tweets

Rony

• 14349 Tweets

#DesafioXX

• 13983 Tweets

Miami Heat

• 13436 Tweets

Endrick

• 12332 Tweets

CM Punk

• 12177 Tweets

Olimpia

• 11069 Tweets

Gunther

• 10654 Tweets

Porzingis

• 10546 Tweets

Last Seen Profiles

@tolstoybb

ok but let’s lay this out right, im a paramedic and I get a call: “you have to go to the scene of an airplane crash, a pilot ejected from the plane”

there’s a big difference between showing up to the scene prepared for this guy (who seems like he probably just needed transport)…

19

20

2K

@Alfred_Lin

imagine if it was someone’s job in the process of investing in a company to determine whether or not the company was deliberately misleading and lying to their investors

what would you even call something like that lol

35

53

1K

@alex_gurevich

@FatTailCapital

@Apple

Sorry your small business relies on insanely invasive measures to be profitable. Maybe provide a service that doesn’t have to gain access to our browsing habits across applications to turn a profit.

5

11

961

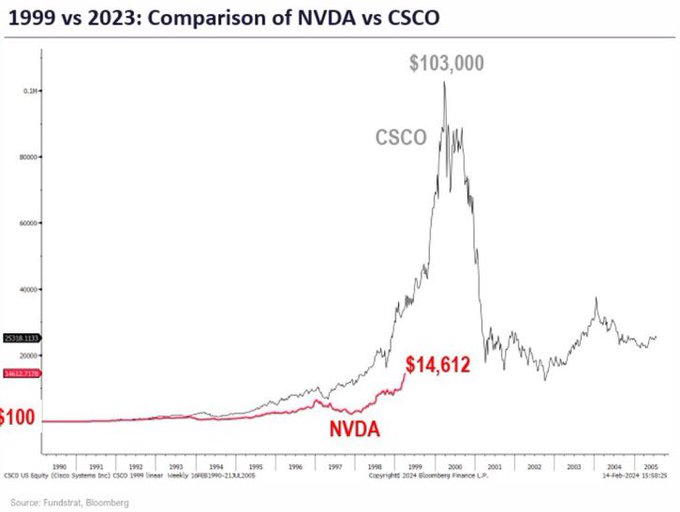

This is a pretty based chart from

@fundstrat

I am pretty sure it should be clear that Tom isn’t using this analog to suggest NVDA takes the same course as CSCO but rather that if you want to start comparing NVDA to CSCO in the dot com bubble…you better cover your fcking short.

93

99

895

Okay yeah I might short apple actually

70

68

604

@SamanthaLaDuc

@JerrBearr

@thatgirltrader

@GraphFinancials

There is just a severe lack of understanding about the incentives here from most who wish to peddle this narrative. Those who are accusing Jensen of fraud should at least take the time to understand the business model. How would you like it if someone accused you of fraud without…

74

87

579

I tweeted that

@RobertKennedyJr

raised some important questions about vaccine safety and now I am being labeled a Qanon conspiracist by some and a member of the alt-right by others.

I have long believed that incentives drive all human behavior. This gives me reason to be open…

2K

4K

23K

24

35

530

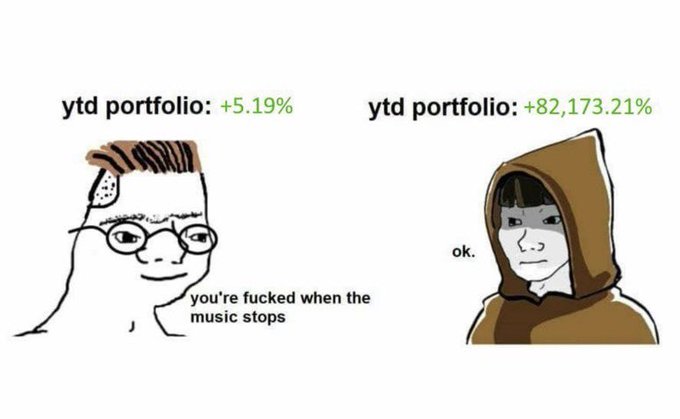

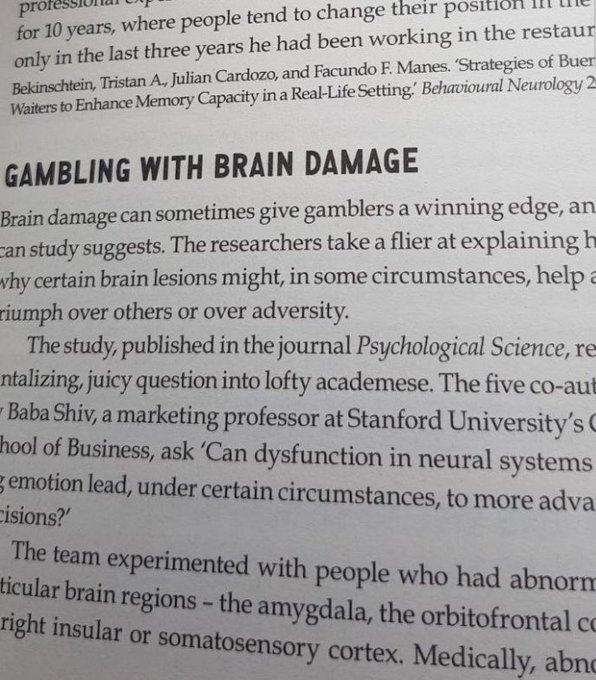

Everyone sees this and doesn’t notice the nearly 5M drawdown a month in that would make most normies soil themselves and quit.

Whoever this guy is, he isn’t lucky. He’s got balls of steel and bets more.

Lessons there.

36

26

488

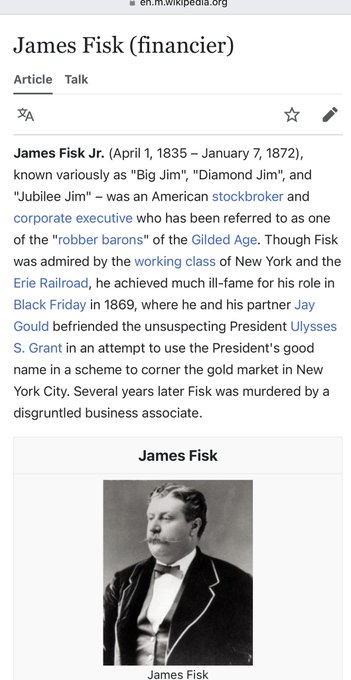

“Wall Street has ruined me, and Wall Street will pay.”

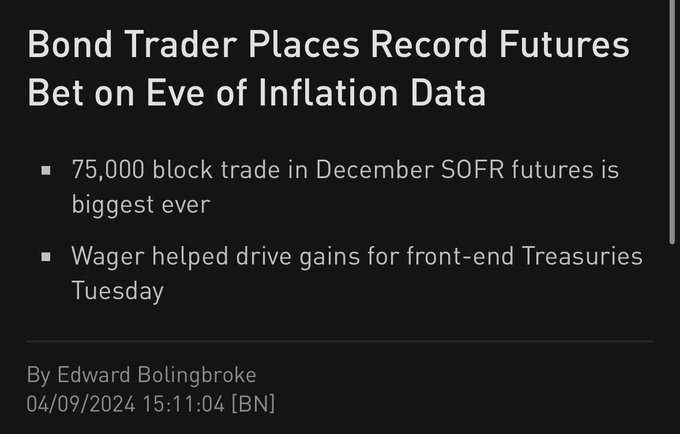

Jim Fisk’s confederate bond short is one of the greats, with much more pizzazz than Rothschild’s informational edge on the gilt market after the outcome of Waterloo, but not many are aware of the story.

14

74

486

I guarantee you that 95% of you who try managing your own money will underperform the index.

And I guarantee you that 98% of you who outperform the index will do so with a worse sharpe.

And we’re still here, trying, because we are idiots and/or because we love it.

26

20

449

Is it normal to just stop blinking once you’ve won as much as Ken has?

The SEC has made it less attractive for companies to be public, Citadel CEO Ken Griffin told

@SquawkStreet

, calling it a "tragic mistake." Watch CNBC's full interview with Griffin.

59

25

132

77

19

421

@GoodsCapital

So many things.

1) taxes (as a US citizen you’re gonna get about 30k on that 47, depending on income tax bracket)

2) nobody wants to live where you can live for 30k a year

3) they can bring the Fed funds rate back to zero and then you’re screwed

36

3

384

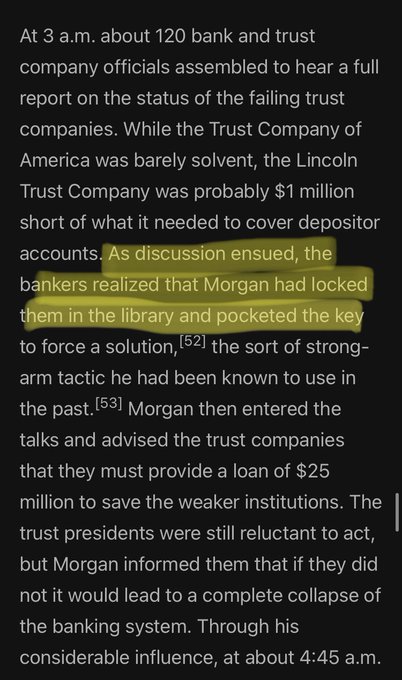

This in the library, in his house (a city block in Manhattan) that JP Morgan locked the bankers in during the panic of 1907.

As a country, the quality of our wealthiest has declined from such heights into such unbelievable depths.

16

18

371

Citrini Research cited in the Economist

2/ But a lot of info is still embedded in what assets do and don't get pushed around by political shifts. And some really do -- the basket below from

@Citrini7

pulls many of these together.

Lots of examples in the piece, but one that stuck with me was European defence stocks.

2

1

21

31

8

356

Legitimately some people don’t understand risk and just expect you to consistently double down.

What happened to my MSTR short? It was stopped out. Why am I not talking about it? Because it was stopped out.

Anyone who just doubles down and is like “oh no it’ll drop eventually”…

37

14

354