Aaron Klein

@Aarondklein

Followers

6,233

Following

745

Media

591

Statuses

16,757

Come for FinTech/FinReg policy. Stay for MoCo ramblings. Senior Fellow @brookingsecon Former @USTreasury @SenateBanking . Always Maryland, banned by Russia.

Silver Spring, MD

Joined January 2014

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

London

• 333330 Tweets

May the 4th

• 258653 Tweets

#WWEBacklash

• 256573 Tweets

Star Wars

• 239664 Tweets

Madonna

• 221469 Tweets

La Liga

• 147031 Tweets

Barcelona

• 127726 Tweets

어린이날

• 107603 Tweets

Girona

• 104947 Tweets

Haaland

• 88629 Tweets

Xavi

• 84883 Tweets

الوحدة

• 81614 Tweets

Hamilton

• 78553 Tweets

Wolves

• 70632 Tweets

SOUTH KOREA APOLOGIZE TO BTS

• 69790 Tweets

Man City

• 60231 Tweets

#النصر_الوحده

• 54193 Tweets

Alonso

• 40403 Tweets

#HalaMadrid

• 30947 Tweets

CAMPEONES DE LIGA

• 28477 Tweets

برشلونة

• 27713 Tweets

Bianca

• 26122 Tweets

West Midlands

• 23655 Tweets

Magnussen

• 23577 Tweets

Klaus

• 20197 Tweets

Stroll

• 18537 Tweets

Jade Cargill

• 17833 Tweets

Andy Street

• 16610 Tweets

Sergi Roberto

• 15208 Tweets

Laporta

• 13020 Tweets

علي معلول

• 12133 Tweets

Portu

• 12061 Tweets

Ter Stegen

• 10672 Tweets

الدوري الاسباني

• 10275 Tweets

تشافي

• 10160 Tweets

Tanga Loa

• 10156 Tweets

Last Seen Profiles

Pinned Tweet

By mandating real-time payments new legislation by

@ChrisVanHollen

@SenWarren

@RepPressley

will make it less expensive to be poor, saving Americansn who live paycheck to paycheck billions in overdrafts, payday loans, check cashing, late fees, interest.

17

23

105

Unlimited deposit insurance is regressive economics and a betrayal of the New Deal’s core principle: government is there to protect ordinary Americans not the wealthy. My latest in today’s

@WSJ

21

34

141

Deficits of this size with 4% unemployment and insufficient

#infrastructure

investment, yet people are talking tax cuts?

8

69

123

You’re not going to believe this but when

#CFPB

Director Cordray was nominated by President Obama, he was confirmed by the Senate on a bipartisan basis with 66 votes.

0

58

109

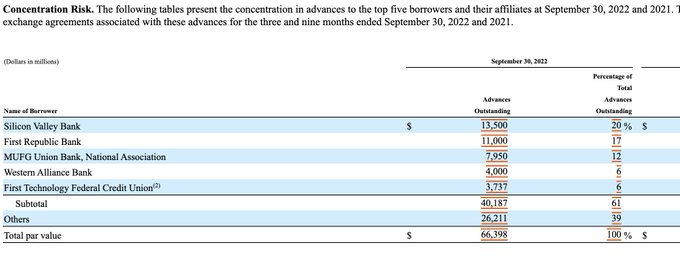

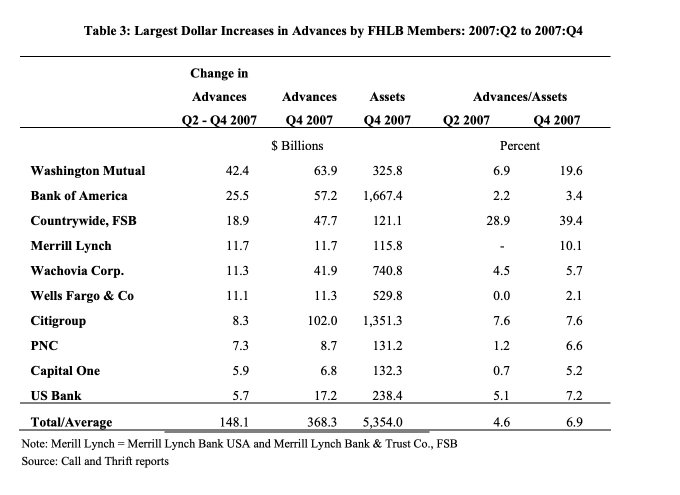

Bailing out VC and Big Tech. Identities of the 10 large companies who got hundreds of millions to billions of taxpayer bailouts when SVB failed. Kanzhun is a Chinese tech firm. Marqeta is a FinTech. IntraFi is supposed to keep customer funds fully insured — that’s intriguing.

11

38

106

Why is non-profit

#creditunion

@golden1cu

making $24 million in overdraft fees off its members who run out of money and spending it on stadium naming rights?

My latest in

@politico

finds they are not alone. Many credit unions are hooked into overdraft.

5

36

102

Celebrating my banishment from Russia with Ukrainian vodka. Cheers

@StephenAtHome

@jimmykimmel

@sethmeyers

hope you do the same.

12

7

103

When the

@federalreserve

put up $30 billion to help JMPC buy Bear Stearns there was no itemized list of toxic assets the government was buying to help JMPC.

5

18

89

To those who thought

#trump

would support

#infrastructure

:

#Budget2017

proposes to cut $1 out of every $8 for

@USDOT

6

102

85

.

@Harvard

has 250% more legacy undergrads than African Americans. Want to show change: end legacy admissions preference.

2

23

84

The Fed bailed out trillions in investments including junk bonds, juiced the housing market through trillions of mortgages and yet the argument is inflation is due to $1500 checks send to families.

7

19

82

Fact check: False. Silicon Valley Bank included $3 billion bailing out one of the world's largest stable coin issuers. We have no idea what would have happened in crypto had SVB been allowed to fail.

@GaryGensler

4️⃣ Unlike banks and the entire western financial system, crypto has never had a central bank bailout. In fact, central banks are actively conspiring against it. And yet its price is fast approaching all time highs having survived countless crises on its own

77

222

2K

10

19

81

Raising the deposit insurance limit is about the rich protecting their money at your expense.

* Mnuchin Says Deposit Insurance Should Be as Much as $25 Million

(via

@business

@johnspall247

) $KRE $XLF

42

13

81

10

12

73

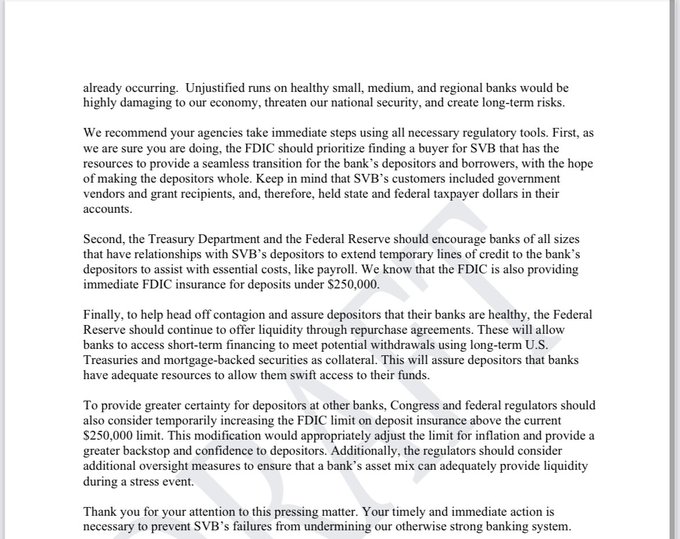

Raising deposit insurance limit from $250k to what? $1Mill? It isn’t the issue these are corporate depositors with tens to hundreds of millions. And temporary? Please if you do it once markets will expect it again.

Unless you support unlimited deposit insurance oppose this.

NEW—

@RepJoshG

is circulating this letter, which, among other things, calls on congress/regulators to raise the limit on deposit insurance.

28

34

80

9

24

71

Financial education is not the answer to student debt.

Reducing the cost of college is.

There is no good reason why college is 45% more expensive today than 10 years ago.

6

17

69

Why is

@JohnsHopkins

“unable” to be need blind in admissions with its current $3.8 billion endowment?

2

5

64

Brave take by

@PATreasury

on limits of financial literacy.

You can't budget your way out of lost income, delayed paychecks triggering overdrafts, or many more ways the system is rigged against those without money in favor of those with $$$.

0

9

67

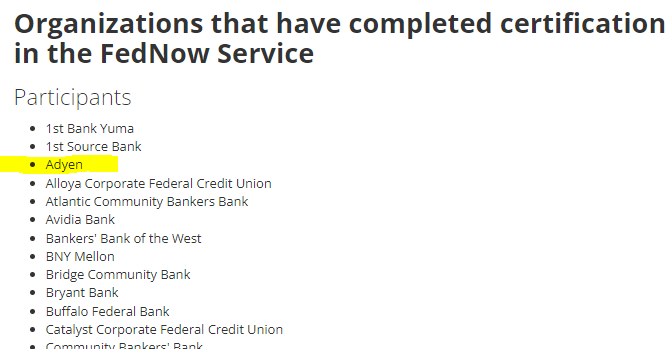

America has about 10,000 banks and credit unions. The Fed took 10+ years deciding whether to build it and then 4+ years to buildFedNow. Today it launched with…. 35 banks and credit unions.😩

@federalreserve

announces that its new system for instant payments, the FedNow® Service, is now live (1/4):

95

516

1K

5

20

63

Makes you wonder why

@federalreserve

bought $16.5 million of

@UnitedHealthGrp

corporate debt this quarter to “help stabilize the economy for working people” 🤔

1

25

63

You spent $72 Million over 4 years to build a gorgeous aquatic center with a pool just for kids that’s only open 4 hours a week because you say you can’t hire enough life guards in Feb in a county w/>1mill people and a ton of outdoor pools. 😰

@Aarondklein

@MontCoExec

Thank you for your feedback. As we continue to add staff, we plan to open up more recreation swims. We also continue to host lifeguard classes at the center to increase staffing.

1

0

3

3

1

64

Financial literacy is too often sold as a fix for problems that are rooted in variable and insufficient income.

Those living paycheck to paycheck often spend more time developing and sticking to a budget more than the wealthy.

There's a fundamental problem teaching people who don’t have enough money to fix a flat tire to save for retirement

@ConsumerFed

Investor Protection head

@BarbaraRoper1

says

@janetnovack

@dcjretiresecure

@Michael_S_Barr

@edmpirg

@Aarondklein

0

3

8

3

18

62

I did wake up dying to be asked what the real story of how the FDIC deposit insurance cap was raised to $250K.

Thank you

@NPR

@planetmoney

for asking. Now the world knows.

1

13

60

.

@Alan_Krueger

was my teacher, my supporter, my boss, and most of all my friend. His great contributions to America, economics,

@Princeton

, and his friends and family will always live on.

0

8

57

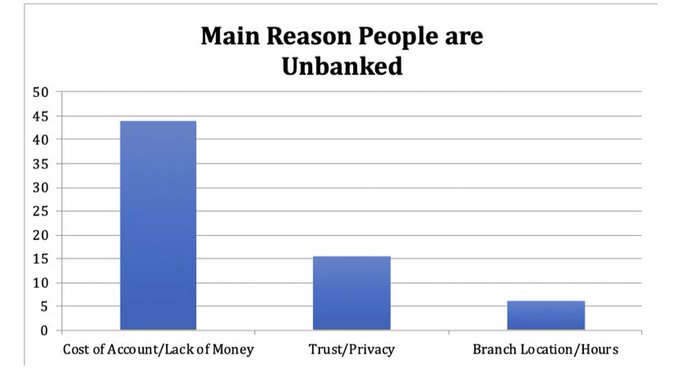

Can we please retire the trope that people are unbanked because of bank location and hours?

The

@FDICgov

asked unbanked people why they don't have accounts. The answer is simple: bank accounts are expensive if you don't have $$$. Fees not hours!

3

18

57

America’s failure to adopt real-time payments was a conscience decision by the Fed. The result is hundreds of billions taken from people living paycheck to paycheck and given to banks, payday lenders, and check cashers.

3

13

55

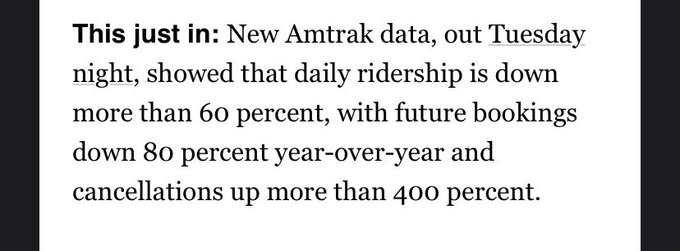

Before bailing out private airlines we should support public transit and

@Amtrak

who are taking massive losses.

1

17

56

When the Fed wants to do something, like bail outs it finds creative legal workarounds, invents shell companies called Maiden Lane, etc…

When the Fed doesn’t want to do something, like provide direct accounts to all Americans it cites legal impediments.

3

10

49

Classic MoCo fail. Build a beautiful kids indoor swim area for a ton of money and then only have it open for 2 hours, 2 days a week. Painful to watch my kids get excited and then be cleared out at 3pm for no reason.

@MontCoExec

corruption hurting kids yet again.

14

4

55

Fannie and Freddie have been in conservatorship longer than Brittany Spears. The future of

#housingfinance

can't be like this forever?

@BrookingsEcon

will discuss

@CRLMike

's proposal and hear from a diverse panel of experts on 2/23. Click below to join:

2

22

55

Crazy story in

@FDICgov

testimony about preventing disorderly collapse of Signature Bank "was accomplished with minutes to spare before the Federal Reserve’s wire room closed."

Why does the Fed's wire room close at 4pm? Read this

@GeorgeSelg

and I wrote:

8

12

49

Correct. The Fed lent 29:1 against the subprime dreck from Bear Sterns. The Fed’s overly tight criteria for Main Street businesses and muni’s far more deleterious to economy than this move by Treasury.

2

12

49

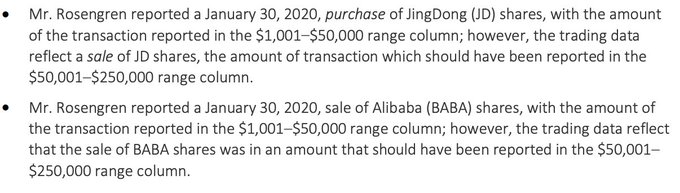

Amazing that

@federalreserve

Chair Powell has allowed

@DallasFed

@BostonFed

to not release the dates of financial trades that he is now criticizing as improper, but accepting as within the rules. Without knowing when the trades were made how can pulic faith be restored?

1

9

49

Senator Paul S. Sarbanes was the most brilliant, kind soul whose service to Maryland and the nation was pure in purpose: to help people.

It was the greatest honor and privilege of my life to work for him.

#SarbanesWay

0

4

51

PPP was a grant disguised as a loan.

TARP for banks was a loan disguised as a grant.

One was full of fraud, ran up hundreds of billions in national debt, and was tremendously popular.

The other was tightly administrated, turned a profits, and was despised by the public. 🤯

12

6

52

If only there were an entity in charge of regulating bank holding companies and their affiliated businesses from problematic tying behavior with the bank……

3

12

46

Remember when

#Republicans

had complete control of government, argued for tax simplification and left us w/7 different brackets?

2

19

47

New legislation to mandate real-time payments would reduce income inequality by empowering people through access to their own money.

Progressives should embrace this approach by

@ChrisVanHollen

@SenWarren

@AyannaPressley

@RepChuyGarcia

. Here's why:

3

16

39

No fooling, today is my 5 year anniversary

@BrookingsInst

@BrookingsEcon

. Amazing how quickly time flies when you are having fun.

2

2

49

Wonderful to see notes of kindness for Alan Krueger who would have shared in today’s Nobel Prize if alive.

Alan combined his ground breaking research with incredibly public service

@WhiteHouseCEA

@USTreasury

@USDOL

.

A man in the nation’s service and in service of humanity.

0

4

48

Dirty little secret:

@USTreasury

sent this money on Friday. But America's pathetically slow payment system run by the

@federalreserve

couldn't deliver it to people's wallets until Wednesday.

1

14

46

When idiots talk about things they know nothing about you get this video.

FedNow is an upgrade to Fed ACH which is a technological dinosaur that's why it takes 2-6 days for your check to clear. It has nothing to do with any of what this guy is talking about.

7

10

46

Taxing elite university endowments unless they let in more poor students was a good idea when

@RichardvReeves

and I proposed it a year ago.

1

14

45

Is this story was processed like a check it wouldn’t be available to read until sometime between next Monday night and Thursday — and no one could tell you exactly when it’d be there.

3

13

44

The

@bankofengland

launched a realtime payment system in 2008 after 18 months. The

@federalreserve

is in its 8th year and is still more than 18 months away. Meanwhile $100Billion + in overdraft fees have been racked up as we wait...

Shonda Clay, the Federal Reserve’s payments improvement director, recently sat down for a Q&A on the role, plans for continued engagement with stakeholders and what excites her for the year ahead. Read more:

#payments

#FederalReserve

0

1

2

2

15

44

FedNow is an upgrade to the Fed’s ancient payment system that transfers Commercial Bank Digital Currency. It is NOT Central Bank Digital Currency. Please stop spreading misinformation

@RobertKennedyJr

. Delete this post.

The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny.

While cash transactions are anonymous, a

#CBDC

will allow the government to surveil all our private…

4K

27K

60K

3

7

43

The

@federalreserve

failed to regulate SVB or apply stronger standards to First Republic.

The Fed failed to write regulation over subprime mortgages even when Congress required it to in 1994.

Time to rethink whether the Fed should regulate banks.

13

10

43

"When I first got into politics, I quickly recognized two different kinds of politicians. There were justice politicians and there were power politicians, and Sen. Paul Sarbanes, to me, epitomized what it meant to be a justice politician."

@RepRaskin

captures truth.

0

5

43

Debating overdraft fees

@SenWarren

is correct that

@jpmorgan

generated 7x

@Citibank

in overdraft fees per account in 2019.

A handful of small banks generate way more in overdraft fees per account that JPMC. Here's whoe they are:

0

6

43

Great points by

@SheilaBair2013

in

@FT

those bailed out at SVB included big tech, VCS, and other sophisticated companies. The

@FDICgov

could have made 60%+ of money available to make payroll. Read her great take here:

4

18

42

The story shouldn't end here. Why did the General Counsels of both Regional Fed Banks permit the trading in the first place? Where was the Board of Gov oversight to allow this? Stopping bad behavior voluntarily only after public outcry is not a path to structural accountability.

Eric Rosengren and Robert Kaplan, the heads of the Boston and Dallas Federal Reserve banks, will sell their individual stock holdings by Sept. 30 via

@markets

@catarinasaraiva

0

2

3

4

12

42

Great thread by

@CaitlinLong_

. The more you dig on Fed Master Accounts the more it’s clear the system is ad hoc and deeply broken.

@ProfJulieHill

has proven this too in her work.

4

10

41

Making all checks clear within 1 day would reduce demand for check cashers by 55% among the 70% of check cashing customers with bank accounts -- great new paper by

@aaronsojourner

makes clear the importance of faster payments.

2

10

40

While government shut down drives people to payday loans,

@CFPB

eliminating rule that requires borrowers to be able to repay them. Making America Predatory Again.

3

27

39

Trump has learned the key lesson in life: inherit well. Job growth began under Obama when he rescued America’s economy from the collapse under Bush.

#SOTU

0

23

39

Trump’s tax bill instituted a tiny tax on wealthy university endowments. It should be increased and directed to incentivizing lower cost of college as

@RichardvReeves

and I proposed:

1

3

39

About to jump on

@CNBC

talking Silicon Valley Bank. This was HUGE failure of bank supervision by the

@federalreserve

.

As

@PeterContiBrown

brilliantly points out supervision is very different than regulation.

9

9

39

Key policy called for by

@JoeBiden

in today's speech: real-time payments: "Instead of waiting days for checks to clear, low-income people will have instant access to money they are owed, ending an existing, costly burden to cash-constrained families."

5

5

41

This would be a game changer for people living paycheck to paycheck. Save them billions from overdrafts, check cashiers, payday lenders...

Have you ever deposited a check—then had to wait days for it to hit your bank account? My bill with Rep.

@AyannaPressley

will help eliminate that wait time and make a huge difference for Americans with bills to pay.

1K

4K

27K

1

8

40

Fun times on

@MeetThePress

as I asked where was the

@federalreserve

in supervising Silicon Valley Bank?

5

3

39

I’m old enough to remember when the banking industry said

#DoddFrank

would make banking unprofitable.

3

10

38

The strength to capture the magic of your child in light of this tragedy.

@RepRaskin

and Sarah Bloom are tremendous parents and the world is a better place for Tommy having shared it with us.

0

3

38

“Politics is a team sport ... There is a point, though, at which that expectation turns from a mix of loyalty and pragmatism into something more sinister, a blind devotion that serves to enable criminal conduct.”

Must read by

@JWVerret

in

@TheAtlantic

3

19

37

None of the thirty-five most African American cities in America meets the Fed’s criteria for direct municipal assistance.

@CamilleBusette

and I share some solutions the

@federalreserve

can implement to fix this:

2

18

37

No fooling, today marks 8 years

@BrookingsEcon

. So thankful to all my excellent colleagues who make

@BrookingsInst

an amazing place to work.

2

0

38