John Paul Koning

@jp_koning

Followers

27,969

Following

635

Media

3,715

Statuses

21,480

monetary economics|history of money|central banking|financial privacy|payments|gold|financial inclusion|cryptocurrency|monetary law|financial crime

Montréal, Québec

Joined November 2012

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Last Seen Profiles

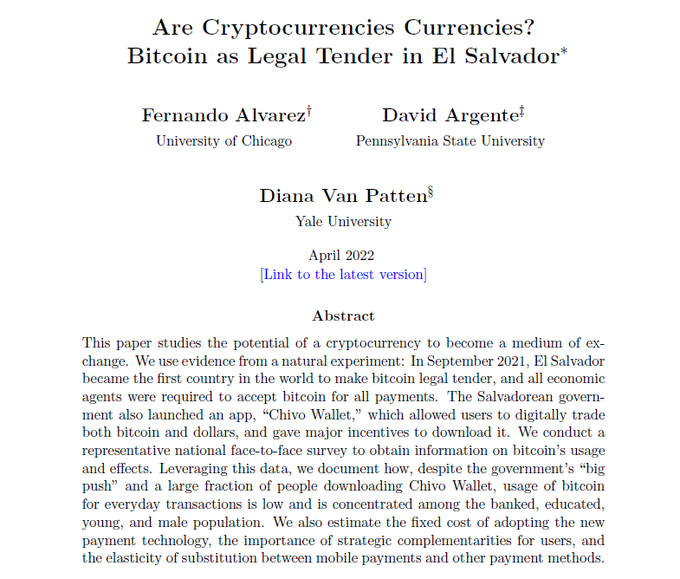

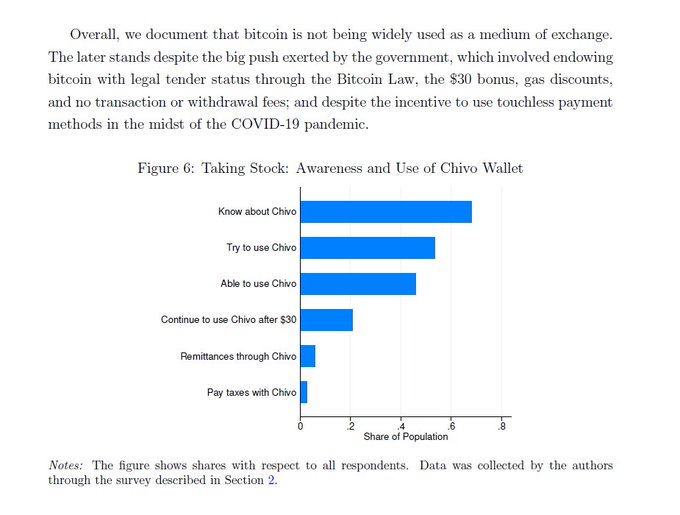

Here's the definitive study of El Salvador's bitcoin experiment. To measure bitcoin usage, the authors rely on survey data gathered from face-to-face interviews with 1,800 Salvadorean households.

ht

@alvafer64

26

179

567

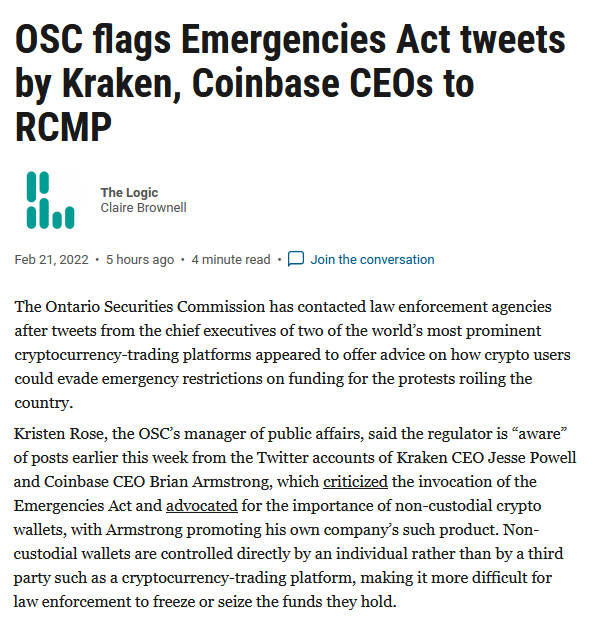

The Ontario Securities Commission recently reported crypto CEOs

@jespow

&

@brian_armstrong

to the RCMP. I don't imagine this bodes well for the ongoing process of registering Kraken/Coinbase under Canada's new regulatory framework for crypto marketplaces:

53

103

425

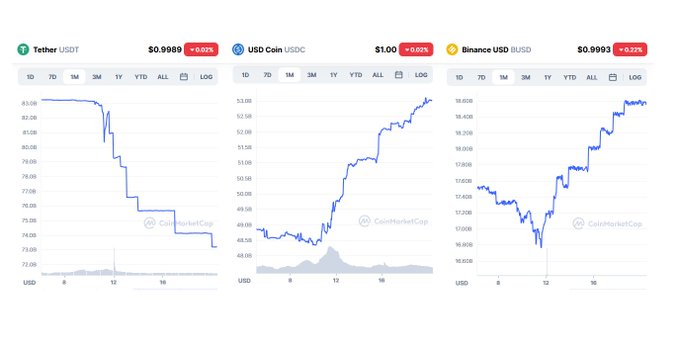

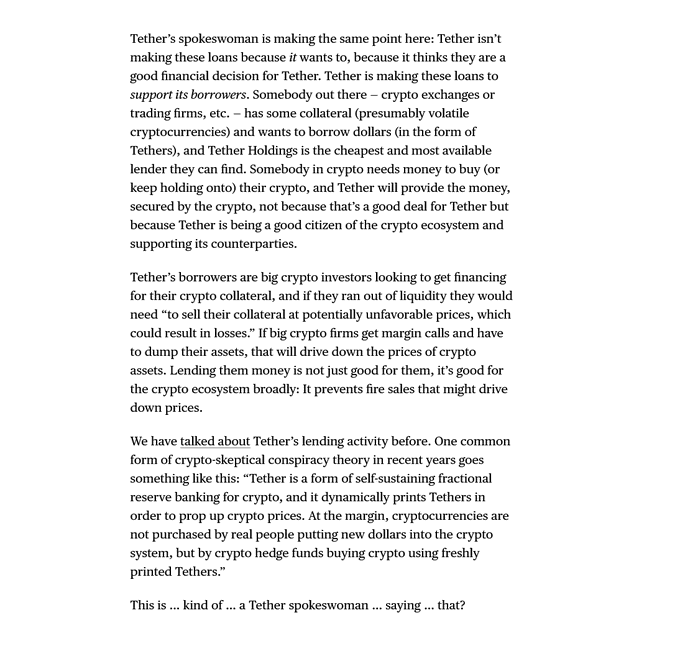

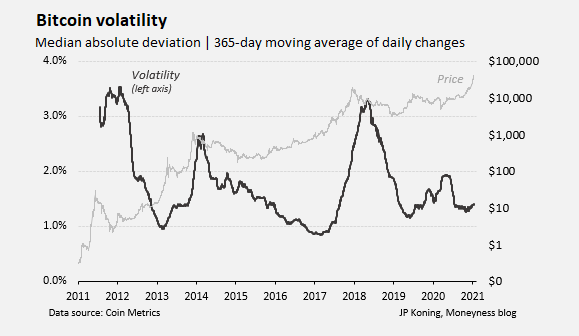

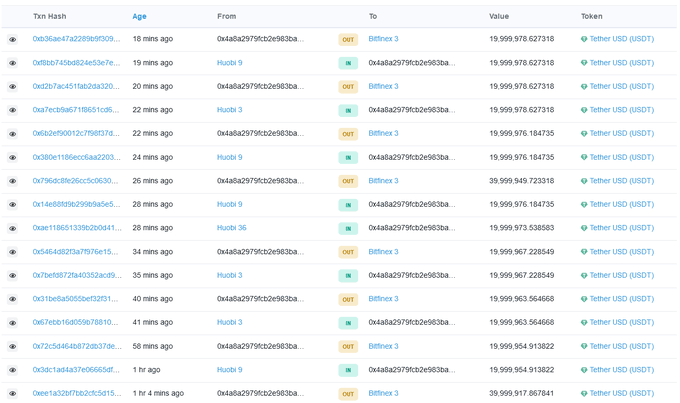

The Tether conspiracy theories weren't conspiracy theories after all? Because it sure sounds like Tether's spokesperson just admitted to them.

via

@matt_levine

37

98

403

Does that mean a stablecoin was effectively the biggest beneficiary of the FDIC bailout? Recall that Circle said it had $3.3 billion stuck at Silicon Valley Bank going into the weekend of March 10.

32

79

336

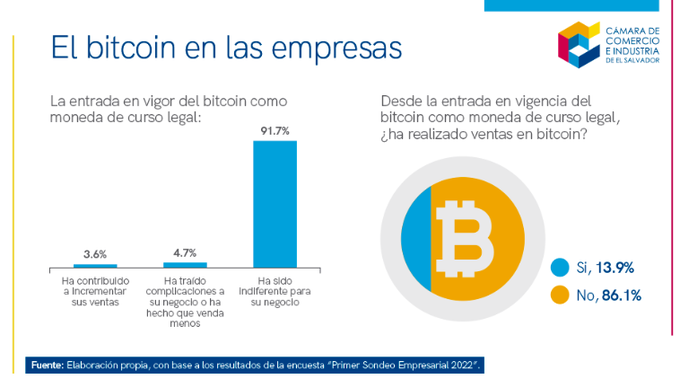

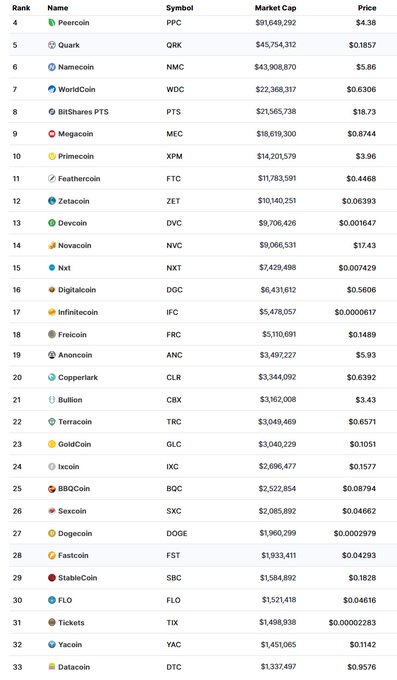

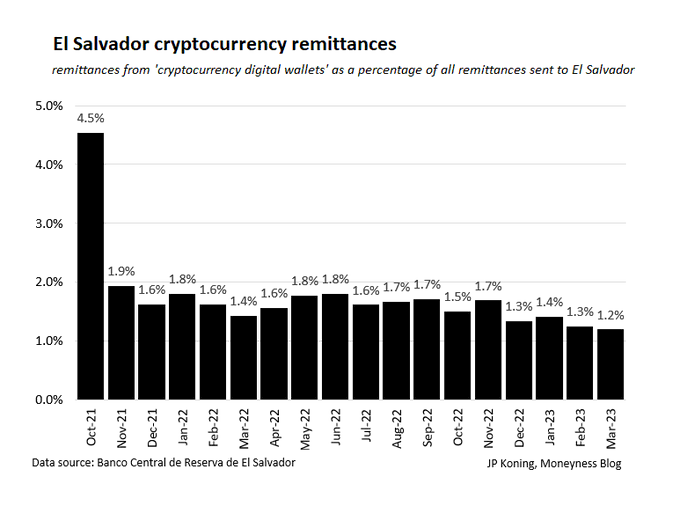

Since El Salvador adopted bitcoin, 86% of Salvadoran merchants have not processed a single bitcoin transaction:

Not surprising. Bitcoin is not a good payments medium. Even when propped up by government coercion, people avoid using it.

ht

@davidgerard

38

96

335

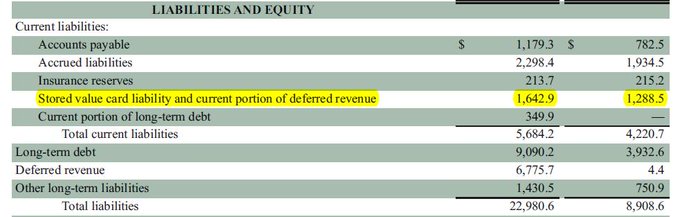

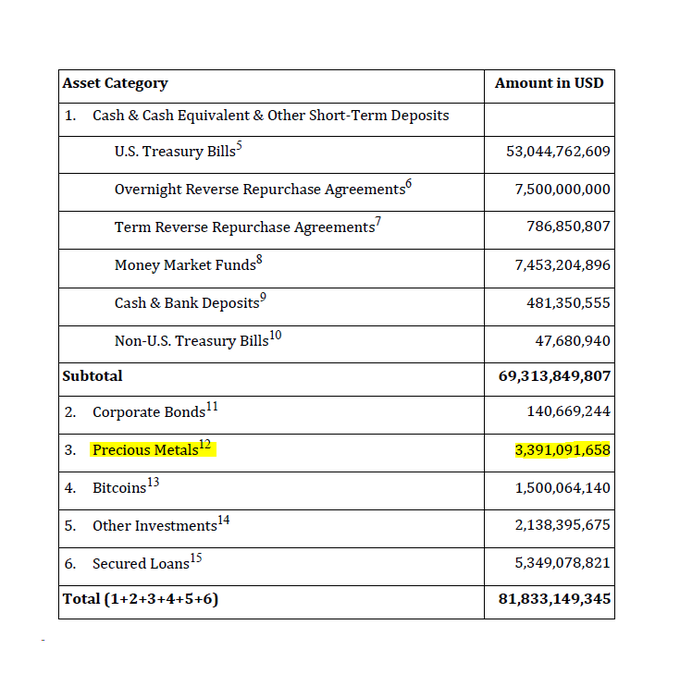

A leader should not be gambling with their country's wealth. The table below shows how

@nayibbukele

, President of El Salvador, has lost millions on bitcoin wagers.

via

45

80

284

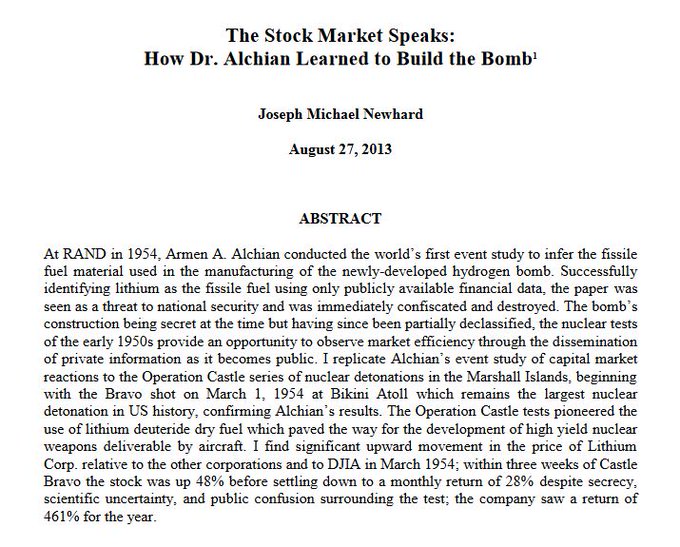

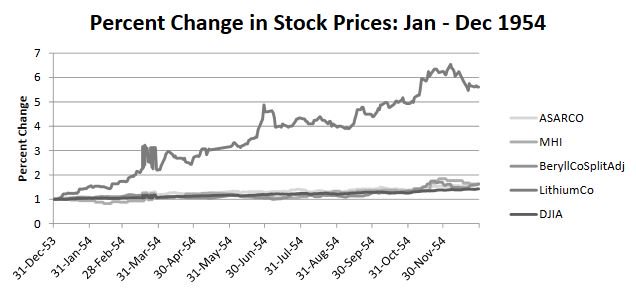

By watching stock prices, Armen Alchian correctly guessed the secret fuel used in the new H-bomb ht

@david_glasner

6

168

259

Flushed out another one.

It's amazing how persistent the '27-year' myth is. People really want it to be true, so they don't bother to do any back-checking. I traced out the myth's history here:

26

54

227

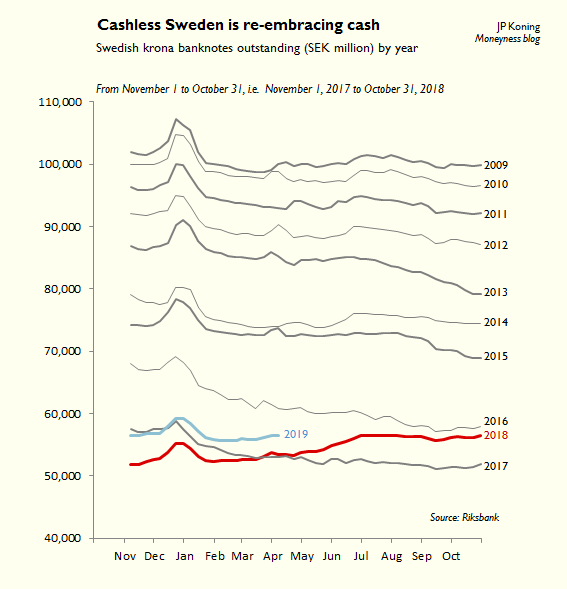

You can't blame the IMF for advising nations like Argentina to avoid copying El Salvador.

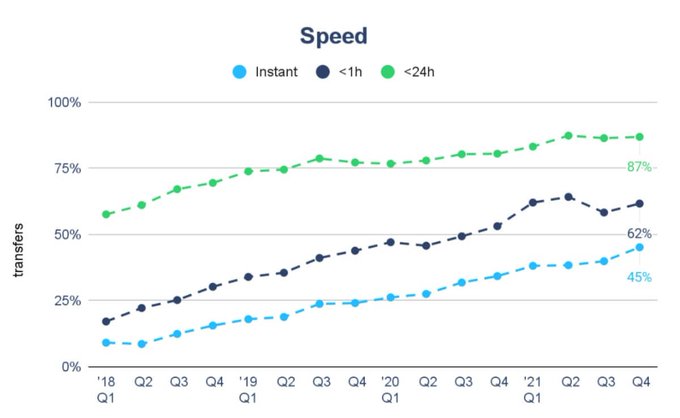

The ongoing stagnation of Salvadorean crypto-based remittance flows is a clear sign that El Salvador's

#bitcoin

-as-legal tender experiment has failed:

83

49

221

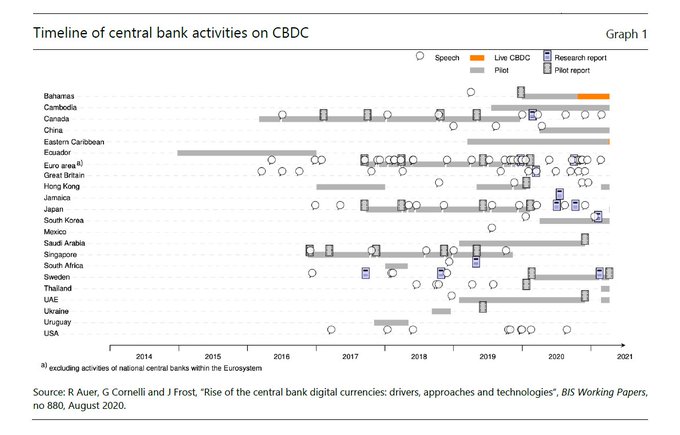

This is a dumb metaphor. There is no "space race towards digital currency." The U.S. dollar's dominance is determined by the strength of the U.S. economy and its institutions, not the medium on which it is issued.

23

32

213

Krugman is wrong. Up here in Canada we place the following tariffs on US goods: 270% on milk, 245% on cheese, 238% on chicken, and 298% on butter. As a result, my family pays $100s more per year than we should. It would be nice if Trump won this particular battle.

27

101

178

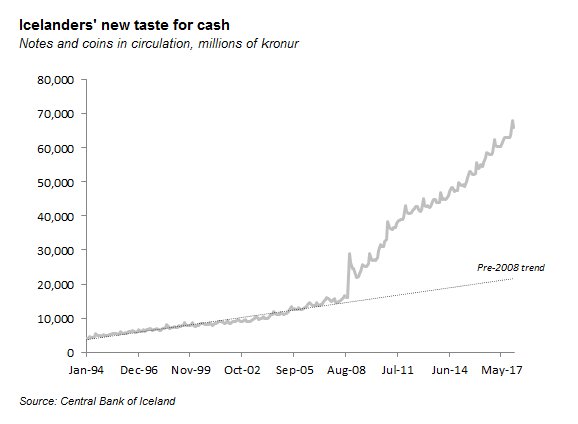

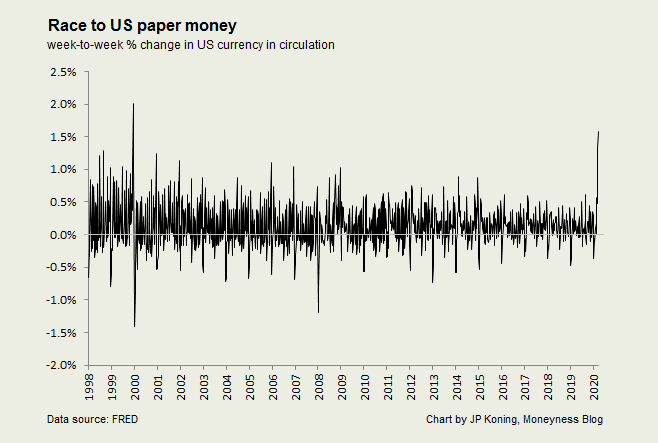

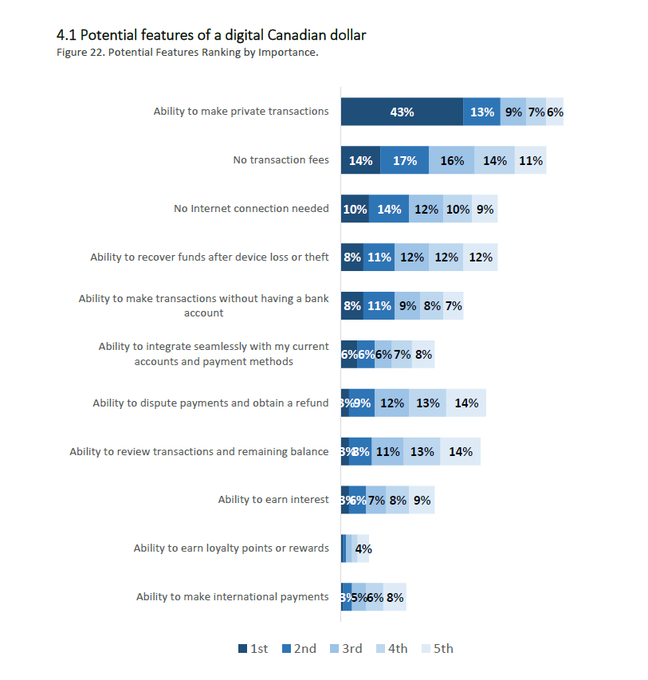

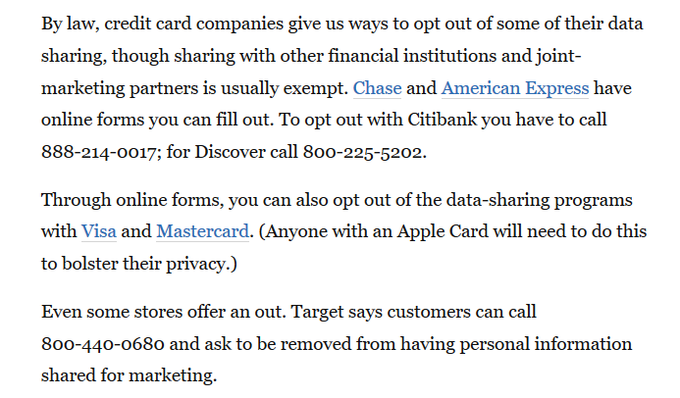

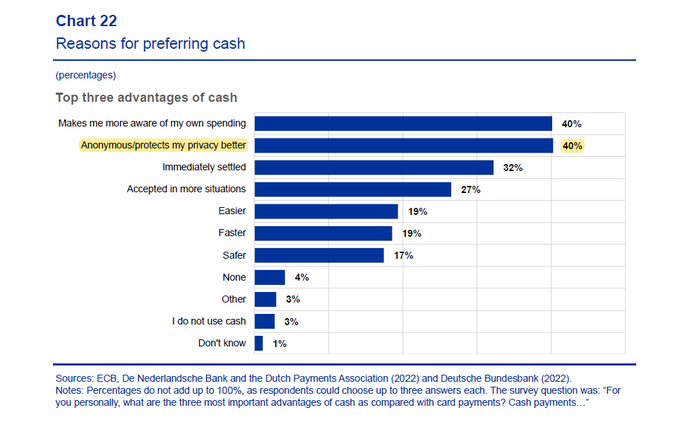

Europeans are getting more concerned about their financial privacy. The

@ECB

periodically asks citizens for their top reasons for preferring cash. In 2016, just 13% of Europeans cited privacy/anonymity. In 2022, that number rose to 40%.

13

57

166

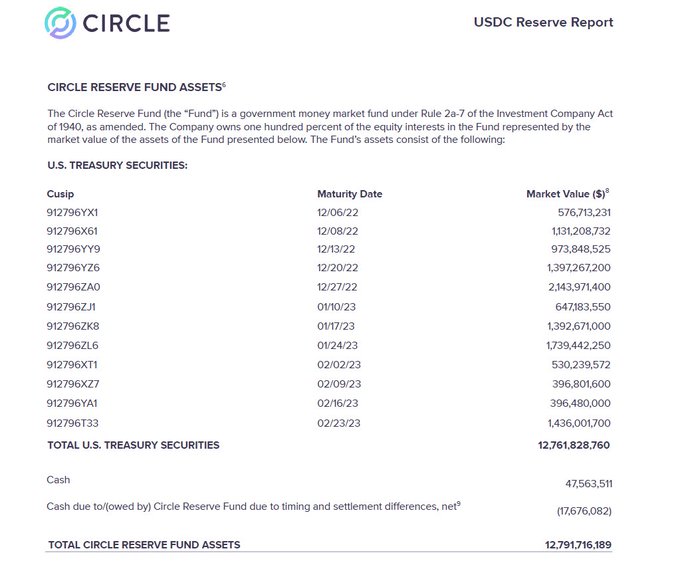

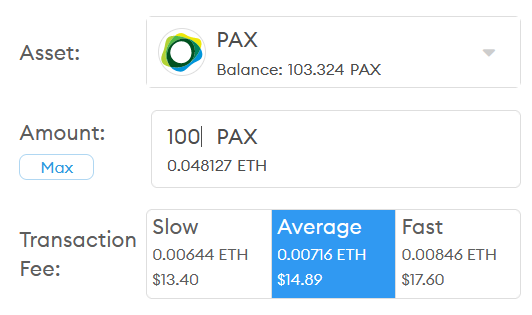

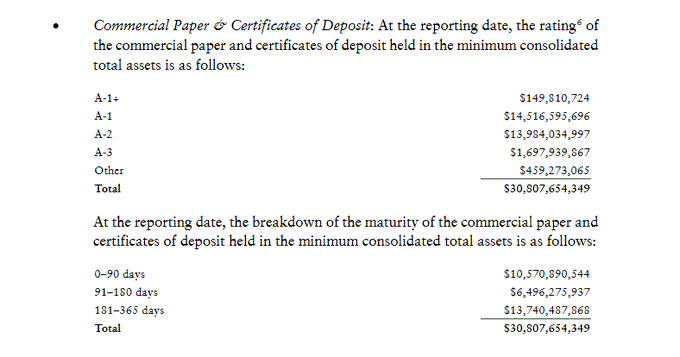

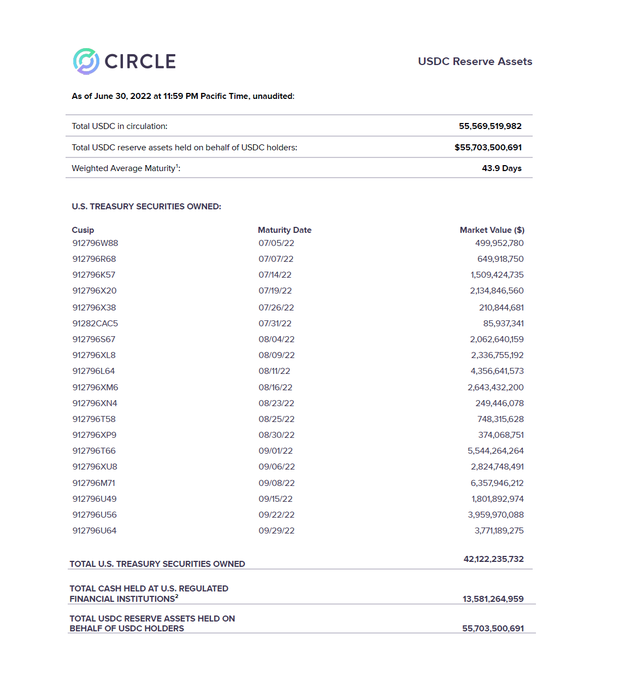

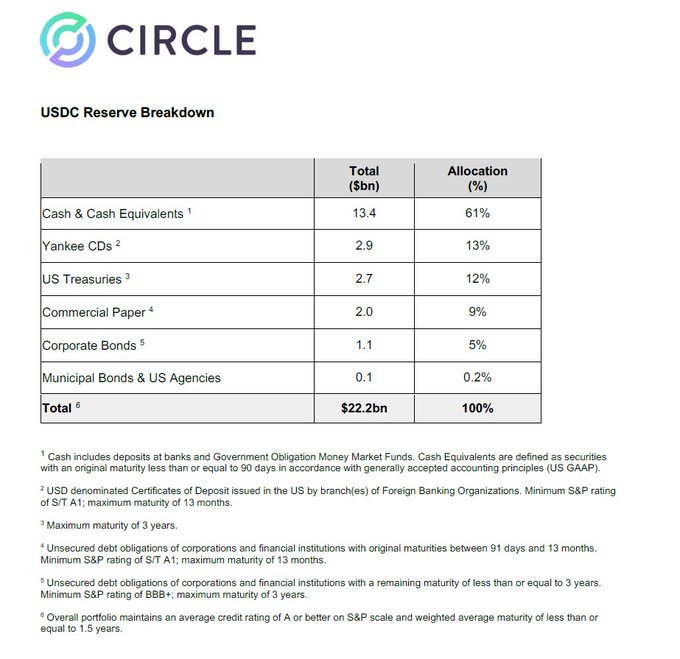

Circle is now publishing a list of all securities that back USDC as well as the names of the banks that hold its cash:

With Paxos already making this information public,

@Tether_to

is now the laggard. Any plans to disclose this data,

@paoloardoino

?

13

24

152