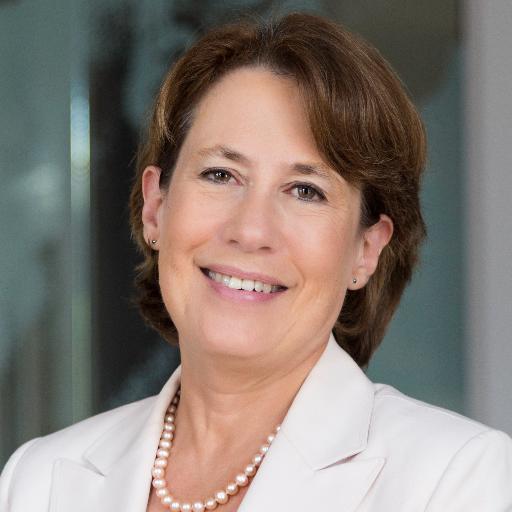

Sheila Bair

@SheilaBair2013

Followers

16,437

Following

355

Media

170

Statuses

3,247

Speaker, writer. Former College President, FDIC Chair. Author NYT best seller Bull by the Horns and Money Tales series. Committed to young people. Personal acct

Washington, DC

Joined July 2013

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

어린이날

• 557030 Tweets

こどもの日

• 530979 Tweets

#HAPPYBAEKHYUNDAY

• 122681 Tweets

#해피큥데이

• 92422 Tweets

GW最終日

• 79113 Tweets

#기다리던_민족대명절_큥탄일

• 71049 Tweets

Al Jazeera

• 67998 Tweets

Vlad

• 54968 Tweets

#HappySkyDay

• 53287 Tweets

Bernard Hill

• 51276 Tweets

Cole Palmer

• 42170 Tweets

سعد اللذيذ

• 35527 Tweets

Theoden

• 26776 Tweets

Gallagher

• 25287 Tweets

Madueke

• 23362 Tweets

Sodoma e Gomorra

• 23121 Tweets

Nicolas Jackson

• 21575 Tweets

#LIVTOT

• 20928 Tweets

D-1 to BLOSSOM

• 20407 Tweets

Happy Cinco de Mayo

• 19169 Tweets

West Ham

• 18158 Tweets

Cucurella

• 15656 Tweets

碧海くん

• 13357 Tweets

LOSE MY BREATH MV TEASER 2

• 12180 Tweets

Rohan

• 11798 Tweets

Anfield

• 11528 Tweets

Last Seen Profiles

Student debt has prevented 400,000 young Americans from buying homes, the Fed says in a paper covering 2005 to 2014 via

@WSJ

44

379

556

Once we get past this painful transition of tightening, we may find higher rates are better for growth by creating more discipline in capital allocation. via

@WSJ

71

54

363

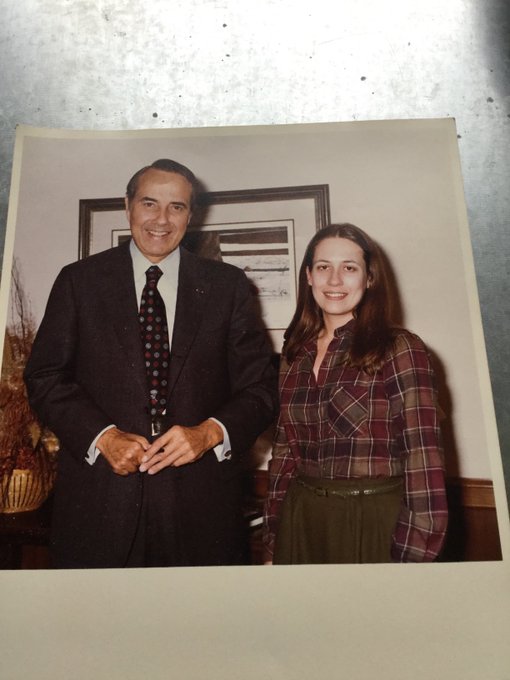

Bob Dole was one of the best dressed senators. It was not easy. Special padding in his suit coats to fill out the much-damaged part of his upper body from WWII injuries. Only one good hand to button buttons. If he could make the effort, why not John Fetterman?

#SenateDressCode

56

44

353

The Fed could have provided targeted support for primary corporate debt issuance, conditioned on no shareholder distributions. Instead, it provided massive, blanket support for corporate debt markets, no strings. This is the result. via

@financialtimes

27

149

323

With all the smart people at the Fed, why did it need to hire outside help to buy securities, and even if it did, why not hire an independent advisor with no asset management business? May well be on the up and up, but optics are terrible.

via

@WSJ

26

82

228

People, stop piling on the SEC for the hack of its X account. Seems the focus should be on X’s own security. (My account has been compromised twice.) Let’s also find out who was trading bitcoin and profited by the false post.

@sonalibasak

@BetterMarkets

@SECGov

@DianeSwonk

66

43

211

The Fed has raised short term rates by 6000% this year. In our over-leveraged economy, they need to stop and assess the impact. Opinion: Why the Fed, and Jerome Powell, should hit the pause button on rate hikes via

@YahooFinance

36

44

196

This is the person I know. Elizabeth Warren believes in a market economy. She just wants it to work for everyone, writes

@SheilaBair2013

via

@WSJ

24

78

177

#SBF

was financial illiterate. He thought effective altruism meant he could rip people off, that it was OK to use new investor money to pay the old… Another reason why we need early financial education - to help kids understand money ethics, hopefully preventing future SBF’s.

249

11

140

Reposting this piece from December. The Fed should hit pause on rate hikes to assess their full impact on the economy and financial system system stability. via

@YahooNews

20

36

138

So the Fed still hasn’t directed banks to suspend shareholder payouts and bonuses, but it keeps giving them capital relief. Big banks get the Fed's blessing to take on more leverage via

@markets

4

95

128

Our daughter Colleen graduated on Saturday from Oregon State. Here with my husband Scott and our son Preston. So proud, honey. You made it!!

@PrestonCooper93

13

1

129

Jelena McWilliams led the FDIC with grace and dignity. She was a steady hand during the pandemic when well-justified regulatory forbearance was needed to help millions of households in economic distress. We should thank her for her public service and wish her the best.

@FDICgov

2

13

127

Having a hard time reconciling big banks’ boast that they are so well capitalized they can pay dividends and still support the economy, but they refuse to take even 5% of the risk of lending to Main Street.

@HalScott_HLS

via

@WSJ

19

40

111

So what? Tech would confront profit declines from Mr. Biden’s tax plans because they hardly pay any taxes now. This is an appropriate policy result.

13

28

92

Without comment on Fed succession, I do take issue with the view that anyone who cares about financial regulation is “political”. No, they’re principled. Let’s face it. You don’t get votes or political donations arguing for tougher capital rules. via

@WSJ

7

10

83

Hell has a special place for bank lobbyists exploiting this crisis to further their deregulatory agenda. Coronavirus should not be an excuse to substantially loosen big bank rules via

@YahooFinance

4

36

85

In the debate over cryptocurrency/stablecoin regulation, let’s separate investor protection and system stability (important) from protecting large bank dominance over payments. The latter should not be the objective.

@Aarondklein

@GeorgeSelgin

@MorganRicks1

7

17

79

At last! Fed unleashes 13(3) authority to help the real economy. And new small business loan facility in the works. Thank you Jay Powell! Federal Reserve announces extensive new measures to support the economy via

@FederalReserve

6

43

77

Real estate inflation misallocates capital, serving as a drag on productivity. Common sense told us that already, but good to see empirical support. Excellent paper. Housing booms, reallocation and productivity via

@bis_org

11

10

74