Gary Bohm

@GaryBohm5

Followers

1,213

Following

1,320

Media

338

Statuses

3,502

Founder & Host of Metals and Miners YT Podcast | Substack destination for: metals, miners, economy, consumers, A.I, more. #Gold #Silver #Copper #Uranium

Joined January 2022

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 553206 Tweets

Wizkid

• 548984 Tweets

#TheKingdomsConcert

• 216517 Tweets

#WWERaw

• 124516 Tweets

Patricia

• 58597 Tweets

Smackdown

• 31784 Tweets

Tatum

• 28868 Tweets

Derrick White

• 23783 Tweets

Saint Ram Rahim

• 21886 Tweets

Braun

• 20351 Tweets

Cause of Conspiracy

• 19623 Tweets

Luciano

• 19459 Tweets

Ghar Vapasi

• 18752 Tweets

Dario

• 17414 Tweets

Aleska

• 16270 Tweets

#DesafioXX

• 15387 Tweets

Rony

• 14611 Tweets

All To Myself D-2

• 14068 Tweets

Endrick

• 12930 Tweets

Olimpia

• 12635 Tweets

Gunther

• 12408 Tweets

Porzingis

• 11203 Tweets

Freya

• 10627 Tweets

Last Seen Profiles

Pinned Tweet

Are you ready for the coming ASSET ROTATION AND FLIP FLOP?

Hard Assets Like

#Gold

and

#Silver

To Go Way Up.

Financial Assets To Go Down Vs

#Dollar

.

Listen to Lynette Zang share in Part 2 of our interview recorded 4/24/2024

@TheLynetteZang

(~31 mins)

0

0

2

#Silver

has finally breached the $26 resistence level. I had a fantastic discussion about this and so much more with Kevin Wadsworth of Northstar Badcharts.

@NorthstarCharts

Here is a short clip from our extensive silver discussion speaking to his silver roadmap. Look for part…

8

55

160

Part 1 of the interview with David Hunter is now up on the YT channel. Discussed: thesis overview, sentiment, business cycles, meltup and more.

@DaveHcontrarian

#gold

#macro

#markets

via

@YouTube

1

6

66

PART 2 of the interview with David Hunter is now available on our YT channel. Talked: Consumer, The Bust, Trigger, Rotation, DXY, Bonds, Metals and more.

@DaveHcontrarian

#gold

#macro

#bust

4

13

64

Interviewed Rick Rule and we spoke exclusively on

#uranium

and

#gold

. Part 1 is due out tomorrow. Here is a clip from our discussion on Cameco.

@RealRickRule

@RickRuleRulz

9

11

63

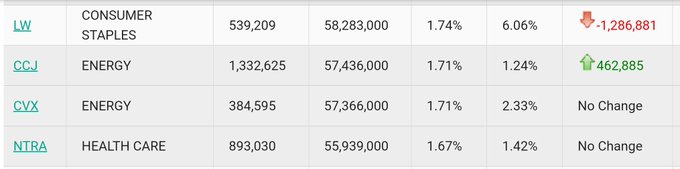

Druckenmiller upping his Cameco holdings. Interesting. 🤷♂️

#uranium

2

6

61

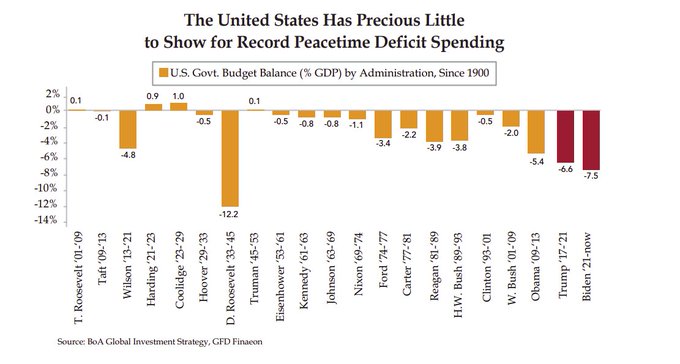

@DiMartinoBooth

exactly. Pull the $3T deficit and what does it look like then?

6

12

52

@NorthstarCharts

Kevin Wadsworth, of Northstar Badcharts, and I discuss whether or not a generational opportunity is at hand with

#gold

.

Clearly, gold is on the move, as it has broken through the $2000 resistence area, hit new all time highs, and continues to rise.

This short…

2

9

50

@Josh_Young_1

@WSJ

means when spr releases stop, China partially/fully reopens, and fundamentals return to normalcy (not enough investment vs today/future needs), then price shoots up to find its real s/d equilibrium

0

1

42

Amazon presses the nuclear button as they quietly acquire a nuclear powered data center. Signpost?

#uranium

1

6

41

Part 1 of my interview with Rick Rule, recorded on Feb 12th. We discuss

#uranium

and

#gold

. Uranium -Supply, Demand, Utilities, Legacy Stigma, Institutional $, SPUT and more! GREAT Interview.

@RealRickRule

@RickRuleRulz

watch --->

1

10

35

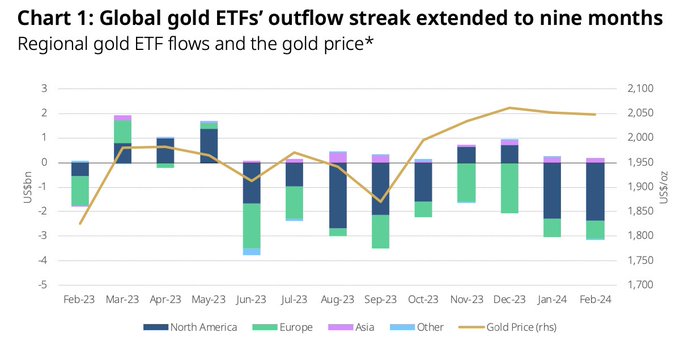

This is so important to understand. Once western investors move into gold it has no where to go but up as strong central bank and eastern countries purchasing has put a significant floor under

#gold

9 consecutive months of $Gold ETF outflows but no impact on the Gold price itself because of strong physical retail demand and central banks purchasing!

#goldprice

#gold

3

5

25

2

6

33

Had a great discussion with Tony Greer of

@TGMacro

on 4/5/2024. Below is the important points to watch for. (~31 mins)

- Market Analysis Process: Tony outlines his market analysis process that has given him an edge and why he is "killing it", which…

1

4

32

Watch Kevin Wadsworth's recent discussion with me on silver as he shares his technical analysis and why he is fully confident that preventing silver from going to $37-50 is futile.

@NorthstarCharts

SILVER - Longer term VERY bullish. Short term - is resistance futile? It's simply a question of how quickly we get to the $37-$50 target zone, not if

#Gold

#Silver

#preciousmetals

#Inflation

#Commodities

15

31

289

1

3

31

Lobo Tiggre and I discussed the state of the

#uranium

story and whether or not it was still a buy. Here is a short clip from the interview. Part 1 of the full interview will be out tomorrow.

@duediligenceguy

1

3

30

I had an incredible and detailed discussion with Kevin Wadsworth of NorthStar Badcharts, held on 4/2/2024. (~46 mins)

@NorthstarCharts

In Part 1 of this interview, Kevin shares his charting skills to share with us:

- where he believes

#Nvidia

…

4

3

22

Had a great interview discussion yesterday with

@profitsplusid

Bob Coleman and he discusses the high probability of a large silver move coming soon, as he mentions in this attached post, and why. Interview coming out soon.

0

1

22

Has

#uranium

bottomed and now headed higher?

@duediligenceguy

Lobo and I had a great discussion today talking about Uranium and where he believes it is headed. Look for that interview to come out soon!

0

1

19

@SloCan68

in the last U bull, how many pullbacks of more than 25% were there-7,8,9? Markets must digest, consolidate, take profits. As you said, nothing has changed!

0

1

19

In Part 2 of my interview discussion with Bob Coleman - founder of Profits Plus Capital Management and Idaho Armored Vaults, from 3/27/2024 (~45 mins)

@profitsplusid

discusses:

- the wider the base, the higher in space for

#gold

prices

- if…

0

4

18

@GRomePow

with all of the daily job layoff announcements, it feels like that next cycle is beginning

1

0

17

within 6 years, A.I.'s energy needs will grow by almost 400%! What baseload source will fill this gigantic hole? It has to be nuclear. There is no other clear option.

#uranium

1

1

17

@unctiously

@StealthQE4

this is true. however, boomers age out of homes, divorces occur & we have yet to but will probably see large job losses. houses will need to be sold. I dint forsee everyone stopping in place for 2, 3, 5 yrs because of a 3% mortgage. life still happens. I forsee inventory rising

3

0

14

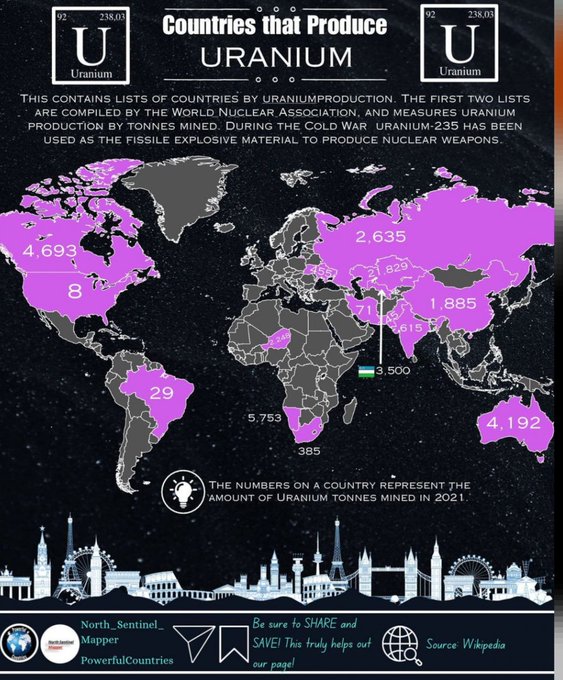

Countries that produce

#uranium

. U.S. currently produces so little, despite being so capable to produce way more. Now US wants to build stockpile and ban Russian U/Kazatom sending lots to CH and falling short of targets. 🇺🇸 production ramp soon.

0

3

13

@JohnMoser66

@RetirementRight

he probably meant housing sales not housing prices. sales/refinancing's have dropped off a cliff. many expect prices to follow.

1

0

12

Part 2 of my interview with Rick Rule will be out tomorrow morning. We complete our discussion on uranium and then pickup gold.

If you have not watched Part 1, the link is below.

@RealRickRule

@RickRuleRulz

#uranium

#gold

Part 1 of my interview with Rick Rule, recorded on Feb 12th. We discuss

#uranium

and

#gold

. Uranium -Supply, Demand, Utilities, Legacy Stigma, Institutional $, SPUT and more! GREAT Interview.

@RealRickRule

@RickRuleRulz

watch --->

1

10

35

0

0

12

@KingKong9888

the wall of worry that

@profitsplusid

spoke about in my recent interview with him. Thats why so many will miss this. interview found here:

1

3

12

This was an incredible discussion that you do not want to miss, and you need to watch the whole way through with Steve St. Angelo from

@SRSroccoReport

.

#gold

#oil

#gdp

(~34 mins)

In Part 2 of this interview, Steve makes the case for:

- why Steve…

1

3

12

I had the pleasure to sit down with BOB COLEMAN - founder of Profits Plus Capital Management and Idaho Armored Vaults and have a great discussion on 3/27/2024.

@profitsplusid

(~32 mins)

In Part 1 of this interview, BOB discusses:

- whether he sees…

0

1

12

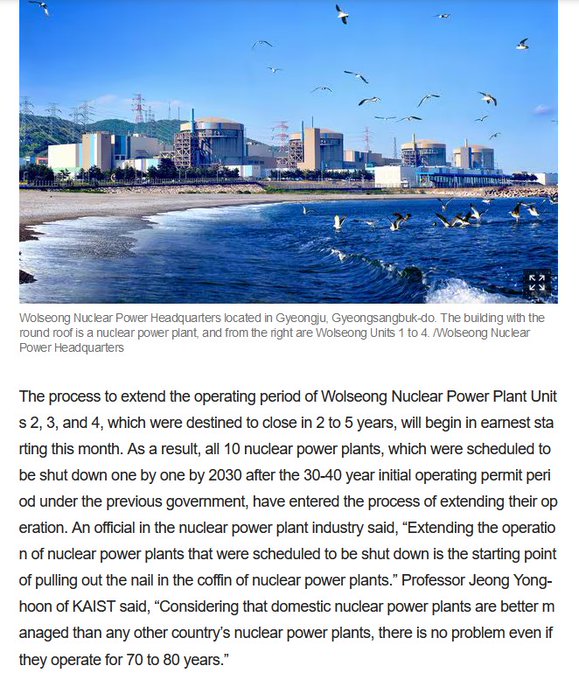

#uranium

demand continues…

💥Yee-Haw!🤠🐂 It's official!📜 10

#Nuclear

power plants that were scheduled to be shut down by 2030 by

#SouthKorea

's previous government🔟⚛️⚡️🇰🇷✖️↪️ will instead have their operating lives extended for decades to come to ensure 24/7

#NetZero

#EnergySecurity

🔟⚛️✅🌞

#Uranium

🌊🏄

5

54

329

0

2

12

Lobo was very measured and right on the

#uranium

run up and correction and will most likely be proved correct with the long term hold call as well. Supply and demand picture hasn’t changed.

I called this

#uranium

correction and I stand by my view that it's a great opportunity. Discipline pays.

Uranium Markets BPI March 11, 2024

Broker Price Index: $89.00 (-$1.00)

Spot Bid: $87.00

Spot Offer: $91.00

23

15

193

2

0

12

@Josh_Young_1

Appreciate your steadfastness, information, data, insight and perspective Josh!

0

1

11

@NorthmanTrader

another point to note: 3 times in data series it touched the upper band- 1929, 2000, 2021. Previous 2 X's- it dropped to lower band over time - both times. Its very far away from lower band currently. What will happen this time?

3

0

11

I interviewed Bob Coleman

@profitsplusid

yesterday and he speaks to this "wall of worry" issue you are touching on here. His articulation of this issue is fantastic and a must listen It illumunates a lot to what is psychologically going on here.

0

1

10

Denison Mines expecs to bring their Phoenix/Wheeler River

#uranium

production online in 2027 at production costs around $16. Current U/$LB is around $90. They will be printing $.

Denison expects to bring Phoenix/Wheeler River into production in 2027, with 8-9 million lbs annual procuction at an AISC at 16$.

Its a money printing machine 🤯💥💵

Discussion with David Cates | Denison Mines (NYSE:DNN) | Uranium via

@YouTube

8

17

99

0

3

11

@m3_melody

@TravisREMindset

The incomplete houses/neighborhoods is exactly what happened in 2008. It all just ground to a halt. We had put $ down to build, then pulled it back because things felt off. Went and looked at it each yr when visiting family for 5+ years after and it was not completed all that…

1

0

11

Central banks continue to purchase gold, regardless of price while there are outflows in the GLD etfs. It’s bifurcated and this will be one of the topics of discussion with

@SRSroccoReport

in our discussion this week. Look for it 👀

0

2

11

@Dividend_Dollar

Everyone thought G.E. would maintain its dominant

#1

position through its diversification and it fell out of top 10. Not saying Apple will fall out of top 10 but I suspect they wont be top 1 or possibly even top 3

0

0

10

@financialjuice

@TOzgokmen

so, "if it all breaks, we dont care, we are still raising rates. if we go into depression, oh well, we are still raising rates". as tought talk as this sounds, im still not buying this. if things break hard enough, they will reverse course.

2

0

10

Interviewed Joe Mazumdar of Exploration Insights. Had a great talk! We discussed

#uranium

#gold

#silver

#copper

@JoeMazumdar

0

1

10

India imported the entire monthly

#silver

production by themselves in February!

1

3

10

Cameco total

#uranium

production in 2023 was 1.1 Mlbs under September 2023 revised production plan.

The September 2023 revision was already down 2.7 Mlbs (100% basis) for Cigar Lake and McArthur River/Key Lake production.

13

49

281

0

0

10

@NorthstarCharts

100%. Same with

#uranium

. There were like 8 pullbacks or so in the previous bull in early 2000s that ranged from something like 17%-54%. Consolidations and profit taking along the way is to be expected. Dont get shaken out.

4

0

9

It was a pleasure to sit down with Real Estate expert MELODY WRIGHT. Her perspectives are data and site driven. How will real estate fair in 2024-25? Listen to what Melody has to say.

@m3_melody

#RealEstate

#Fed

#CRE

#Markets

0

1

9

@garysavage1

Gary, you said it would at least get down to this level and make this double bottom and it did. Wow, if it double bottoms down there.

#bloodbath

#miners

1

0

9

A.I. and Data Center energy usage is exploding. Baseload Nuclear Power is the only logical solution.

#uranium

Safe, Clean, Baseload

#Nuclear

Energy powered by

#uranium

is the only viable solution Lawrence McDonald

@Convertbond

!

1

3

30

2

1

9

SmR nuclear power for ships coming soon! The

#uranium

story keeps getting better!

1

1

9

@KingKong9888

@ASchectman

These are legitimate points. If they truly want the gold for all the reasons we believe. Why would they care about real interest rates, technical analysis, historical correlations or anything else. They just want the gold and regardless of those things they will go out and get…

1

0

9

@MarinKatusa

if you were dumping CCO shares, would you move into the metal (SPUT), American non-contract story (UEC), an etf (URNM), another play altogether or would you spread it across?

6

0

8

@AmirAdnani

Amir- US is producing virtually zero, yet is pushing for nuclear expansion through 2050. Where will lbs come from?

0

0

6

@ces921

Totally agree. It is clear the interest rate level is not properly restrictive however this may be exactly what they want for the long term based on the high debt to gdp ratio

1

1

8

Another clip from the Gordon Johnson interview.

@GordonJohnson19

is a must listen to! He understands the Fed and understands the impact policy is having on the markets and inflation. In Gordon's words, "if they don't rates higher, they aren't going to break something in the…

0

2

7

Part 2 of this discussion with Lobo Tiggre was incredible and you do not want to miss.

@duediligenceguy

(~38 mins)

In Part 2 of this interview, LOBO makes the case for:

- why

#NUCLEAR

/

#URANIUM

is the only choice moving forward to meet the…

0

3

8

@Brien_Lundin

Sentiment so low, no one believes it can/will rally and will disbelieve as it climbs that wall of worry. Then realizing (too late) it’s for real, they will pile into silver and boom

0

0

7

Only thing that has changed is fear. Nothing goes up in a straight line. Currently in the microwave society- want it now. No cycle moves that fast, it takes time- years.

#Uranium

For

#FridayFun

🤹 let's play "Spot the Difference"🖼️🖼️👀 between the

#Uranium

supply gap that will drive

#U3O8

prices higher for the rest of this decade📈 in a global

#Nuclear

resurgence🌄⚛️🏗️ as determined BEFORE Cameco's Q4/2023 Results and AFTER.👯 Do U see what's changed?🤔😉

11

13

110

0

1

8

@nickgerli1

good thread Nick. the economic storm that is still before us will be unlike anything anyone of us have ever experienced in our lifetimes. Preparation the best we can is all we can do. The rest is out of our hands.

0

0

7

@spomboy

spot on. seems that they have 2 choices: let economy deflate into debt doom loop depressoin or print trillions to generate temporary artificial growth that creates new asset bubbles that will pop and start all over again.

3

0

7

Fantastic Part 1 interview discussion with Bob Coleman of Profits Plus Capital Management. Part 2 will be out tomorrow.

@profitsplusid

I had the pleasure to sit down with BOB COLEMAN - founder of Profits Plus Capital Management and Idaho Armored Vaults and have a great discussion on 3/27/2024.

@profitsplusid

(~32 mins)

In Part 1 of this interview, BOB discusses:

- whether he sees…

0

1

12

0

1

7

Part 2 of my interview with Kevin Wadsworth of NorthStar BadCharts is now up.

@NorthstarCharts

(~54 mins)

This is a must watch as Kevin shares on:

- why this

#gold

breakout is historic and for real

- gold's

#cupandhandle

structure and why gold…

1

1

7

#uranium

supply and demand story has not changed

U-R-A-N-I-U-M...Don't take your eyes off it. The long term roadmap remains in force and we're ready for the next leg

#Uranium

#Commodities

#Gold

#Silver

#preciousmetals

#Inflation

19

55

366

0

0

7

@StealthQE4

totally agree. once sellers in a "comp" area capitulate and sell below, other sellers will follow suit and the buyers will inherently understand the new paradigm. realtors are blindly hopeful this won't happen....until it does

1

0

7

I had the pleasure to sit down with Steve St. Angelo - founder of The

@SRSroccoReport

and discuss The coming ENERGY CLIFF will Propel

#Gold

and

#Silver

Higher Than 1970s or 2000s. (~31 mins)

This was an incredible discussion that you do not want to miss,…

1

2

7

@menlobear

bringing clarity to financial sectors during historically uncertain times through Q&A sessions with some of the brightest economists and financial minds around

0

0

7

Parts 1 and 2 of this detailed Rick Rule Interview recorded on 1/12/24 have been well watched and very well received. Thankyou for all the positivity and for watching !

@RealRickRule

@RickRuleRulz

Part 1 of my interview with Rick Rule, recorded on Feb 12th. We discuss

#uranium

and

#gold

. Uranium -Supply, Demand, Utilities, Legacy Stigma, Institutional $, SPUT and more! GREAT Interview.

@RealRickRule

@RickRuleRulz

watch --->

1

10

35

0

0

7

@GRomePow

there's this little doohicky thingy they might have to worry about in the process...

1

0

6

@GRomePow

overwhelming majority are leveraged up to their eyballs with little to no savings. 34% of those who earn $250K+ are living paycheck to paycheck. No one learns.

0

0

7

How far do uranium miners have to run? Looks like the red line is resistance. Levels go back to 2011 - Fukishima event. Get above it and its game on. Stay below and have avg gains from here.

#uranium

#miners

Just how far do

#uranium

miners have to run?

Chart below is $URA/UX1! (the relative valuation of uranium miners to physical uranium).

Only 3 times in the last 15 years has the ratio been this low: Jan 2016, March 2020 and right now.

11

17

102

0

0

7

@jelle881

@MacleodFinance

I agree with this assessment. I do believe the eventual snap back will be stronger than anything we've ever seen, including 2000 and 2008 bull runs. when? who knows. but with each passing rate increase, we get closer

0

0

6

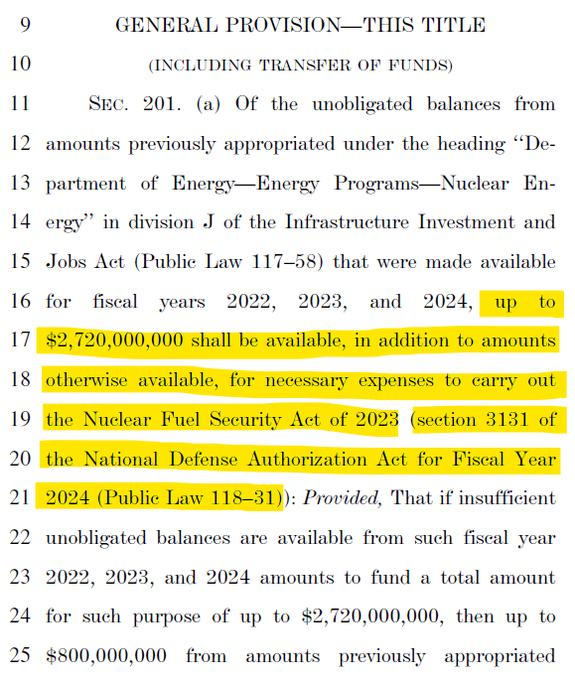

⚡️New $118B Emergency National Security Supplemental Bill released by US Senate yesterday includes $2.72 Billion to boost enrichment of domestic Uranium for LEU & HALEU and fund the expanded US strategic

#Uranium

Reserve under the American Assured Fuel Supply Program⚛️⛏️🛒🇺🇸 that…

10

34

270

0

0

6

Good uranium production chart. Of course delays and underperformance have to be taken into account.

#uranium

@PraiseKek

Someone shared this helpful slide with me a few weeks ago to see the new uranium scheduled to come online in ‘24.

3

3

22

2

0

6

@contrarian8888

2+T market cap when in early 2019 (before massive printing) it was around $700B. are they truly 3-4x more valuable today??

1

0

5

This is an outstanding read on

#gold

and what happened after the collapse of Bretton Woods. Great history here. Well done

@JanGold_

0

1

6

@anasalhajji

with the global population continuing to grow and more people coming into middle class around world, i would have to 100% agree

0

0

5

0

0

6

@TravisREMindset

@m3_melody

Melody, every interview you give is amazing! Thank you for all you do!

1

0

4

Eight Capital is rerating their targets for U stocks much higher! Read more here.

#uranium

URANIUM: The Triple Digit Uranium Guide to Trading U Equities

0

1

6

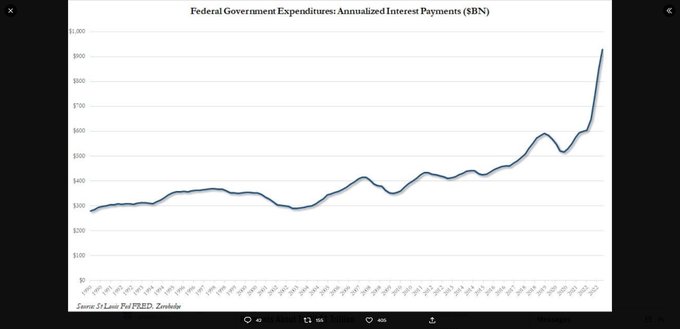

@Brien_Lundin

@TOzgokmen

as we were discussing earlier. soon approaching equality with defense, then s.s. then

#1

all by itself, while we start from a $1T plus deficit AND head into a lower tax receipt recession/depression. Iceburg right ahead!

1

0

6

If you didn't have a chance to wacth this interview with Steve St. Angelo of

@SRSroccoReport

- it is a must watch.

This was an incredible discussion that you do not want to miss, and you need to watch the whole way through with Steve St. Angelo from

@SRSroccoReport

.

#gold

#oil

#gdp

(~34 mins)

In Part 2 of this interview, Steve makes the case for:

- why Steve…

1

3

12

0

1

5