Melody Wright

@m3_melody

Followers

37K

Following

52K

Media

2K

Statuses

19K

Strategist, Writer, Technologist, GFC 1 Survivor. Tweets about housing, mortgage finance, commercial real estate, macro and technology. Not investment advice.

Joined February 2021

June Redfin results are out, and things have taken quite a turn under the hood. Will Wednesday be NAR’s last stand for the COVID cycle?. @DiMartinoBooth .@RudyHavenstein .@VladTheInflator .@KennyCap_Phd .@MrAwsumb .@Johncomiskey77 . 👇.

14

24

157

RT @gnoble79: INCREDIBLE OFFER JUST GOT BETTER. JULY 30 BEST STOCK IDEAS SUMMIT. Looking for cutting edge, actionable stock ideas?. Sohn co….

0

3

0

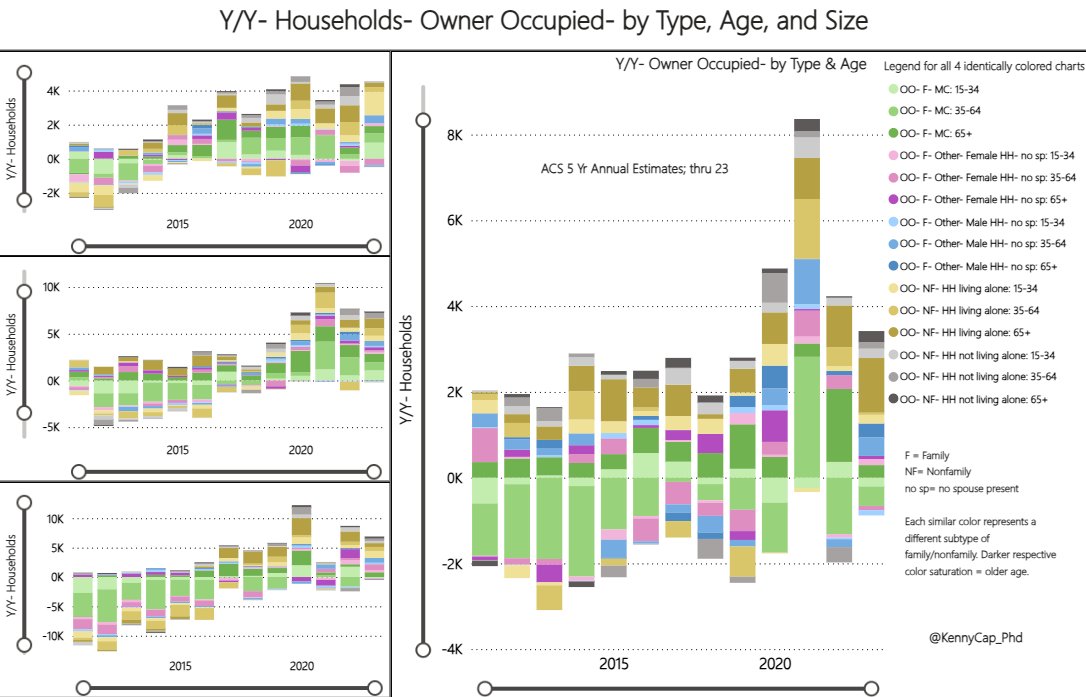

"Understand there are so many friggin’ household metrics. you could almost reasonably predict what color socks your neighbor Cindy is going to wear on a Tuesday. If more people knew all this data existed. we wouldn’t even be debating this idea of a so called “housing shortage”.

So nonfamily household growth is a common theme across markets regardless of geography. Below are 4 separate counties (that I'm not giving away) as an example. There is no evidence of a structural housing shortage.@m3_melody @MrAwsumb .

10

12

95

Day 10 TX . We are grounded at the fire station due to flash flood warnings. The rain is coming down hard, and we worry about impact to recovery efforts as well as the potential need for swift water rescue. One of our dog handlers already stuck in town. Situation developing

Day 9/10 TX. It’s hard to explain just how much respect I have for these first responders from all over TX as well as the bad-a## chainsaw team from Mexico City. Yesterday was bittersweet as effective recovery efforts persist. The prayers will be needed for their healing

11

9

78

And this is where I talked about Denver…. December 2023.

Denver is now one of the worst homebuilder markets in the country. Comment from a local builder in our survey this month sums it up: . “Home sales [per community] are ~70% of 2023-2024. Financing incentives are still playing a big part, but not moving the sales needle much.”.

5

14

83

Thank you ❤️.

The work is never done for the selfless. A few have asked if funding is still needed. The answer is yes. Please. And from the bottom of my heart on behalf of @m3_melody @TravisREMindset & Steelcroft, thank you and bless you.

3

5

39

Day 8 TX. The sun blazes and the search goes on…teams who drove over 24 hours to be here pushing to their absolute limit, trudging through muck so deep we’ve had people stuck . And then, we help the community remember . The work is never done . @DiMartinoBooth .@TravisREMindset

12

14

151

RT @CoffeeandaMike: Big Beautiful Bill, Buy Now Pay Later, SNAP, Medicaid- Laks Ganapathi. She talks the Big Beautiful Bill, Medicaid/SNAP….

0

6

0

Thank you for the prayers. Much appreciated. Half the team got to the site first thing this morning and has been searching, identifying several potential hits. This work is brutal, and I’m so proud of the team’s dedication to bring closure to those who have lost loved ones.

My vigil of non-engagement continues. My heart won’t make room for anything other than praying for @m3_melody & other angels recovering those who’ve passed to give their loved ones closure. 161 people missing in Kerr County,12 in other parts of TX

11

20

221

Enroute to TX. Prayers needed. @DiMartinoBooth .@RudyHavenstein .@VladTheInflator .@KennyCap_Phd .@MrAwsumb .@CoffeeandaMike .

20

12

230

Feed lots, active train tracks, cow pastures, middle-of-nowhere and 12 miles from a gas station, next to condemned buildings and dilapidated trailer parks…. You name it, they did it. #bullishbulldozers. H/T: @jpastaman.

New $600k - $800k homes in rural Rathdrum, Idaho (about 12 minutes away from Coeur d’ Alene) built on tiny lots on farmland alongside a very active railroad 🤡🤡🤡. Another clear harbinger of an imminent real estate correction/crash.@VladTheInflator

48

35

323

RT @DiMartinoBooth: For days, since learning of the tragic events in Kerr County, I’ve been off of this platform. All I can ask is that you….

0

38

0

♥️Thank you so much. And shoutout indeed. As usual, she put out an incredible piece. Thank you to you both. 👇.

@m3_melody @TravisREMindset Prayers! Donated. Shoutout @DiMartinoBooth for including this in The Daily Feather. 🫶.

4

7

82

Just received intel from boots on the ground. worse than Erwin flooding. If you don't know Erwin it's 10 miles away from me, the highway is still one-lane and the site is full of debris - 9 months later.

🚨Headed to Kerrville, TX with @TravisREMindset . And a Search and Rescue/Recovery (SAR) team I trust and met during Helene. Needs for this Deployment:. 4 Dry Suits/Waders.4 SAR Helmets.Jet Drive Motor.Fuel/Gas Cards.3 Tents.Water & Food Supplies.

8

13

121