Explore trending content on Musk Viewer

#Mステ

• 394828 Tweets

#Mステ

• 394828 Tweets

billie

• 285835 Tweets

CHASING THE SUN

• 131835 Tweets

Scottie

• 97954 Tweets

Valhalla

• 42825 Tweets

#のらりクラり呑もうの会

• 35886 Tweets

Louisville

• 31391 Tweets

ひーくん

• 28890 Tweets

ジュラシックワールド

• 16989 Tweets

トップバッター

• 15114 Tweets

しーちゃん

• 14549 Tweets

Mリーグ

• 12843 Tweets

Go City Go

• 12792 Tweets

ベビモン

• 11446 Tweets

NEW hair

• 10988 Tweets

佐々木朗希

• 10591 Tweets

西洸人くん

• 10402 Tweets

#大倉忠義オンライン飲み会

• 10120 Tweets

BACK TO THE BEGINNING

• 10006 Tweets

Last Seen Profiles

Pinned Tweet

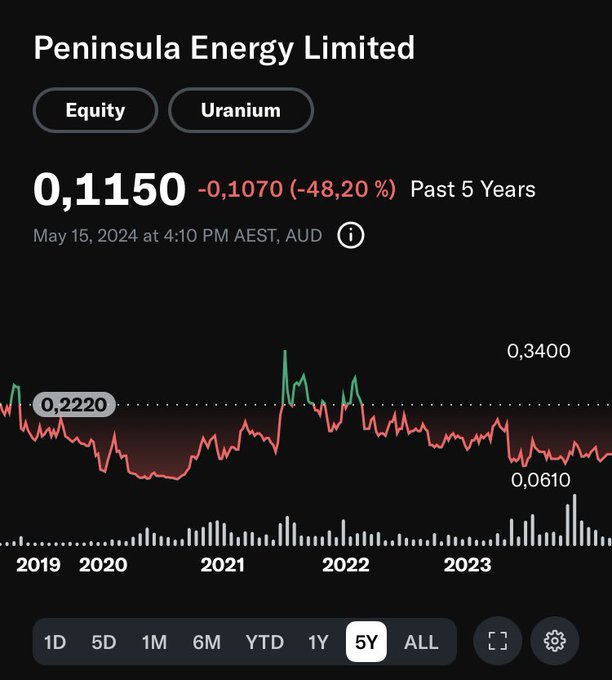

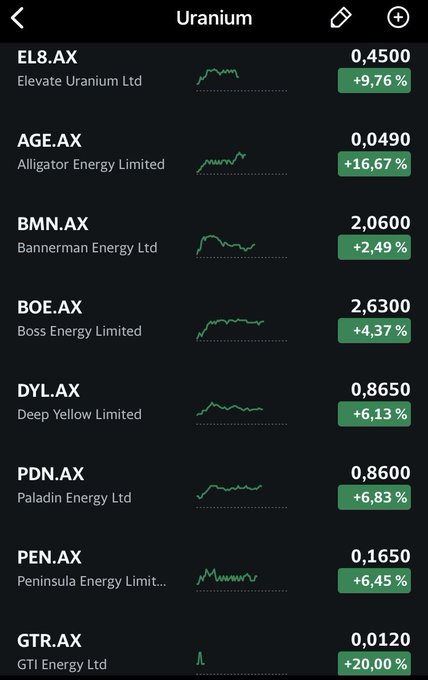

From my 5 years in the sector $PEN has been the best example of a forever cheap company:

They have been in situations where they need to raise a lot of cash, with massive dilution, at the worst time.

It does not even need to be incompetence. You do not bet on unlucky jockeys.

10

2

34

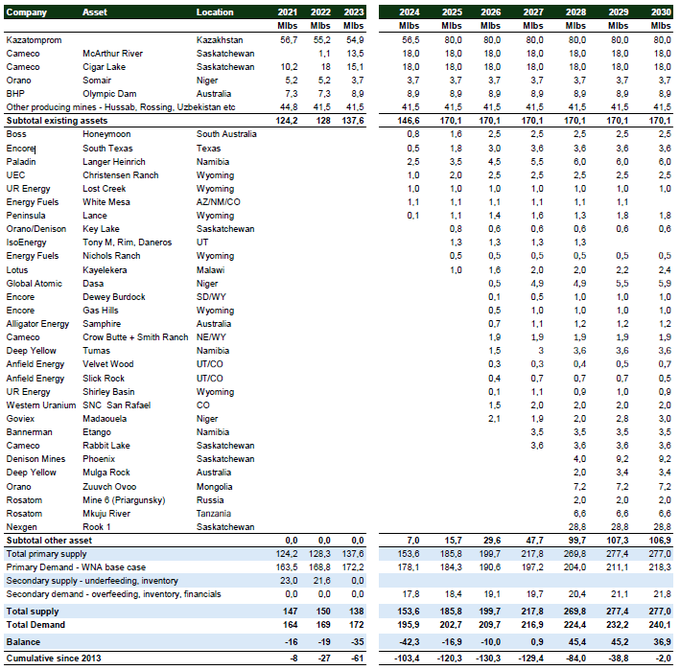

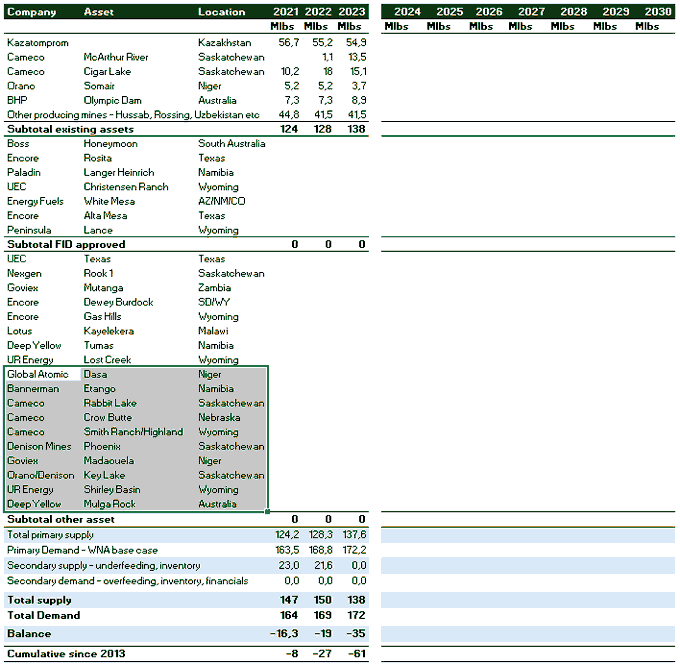

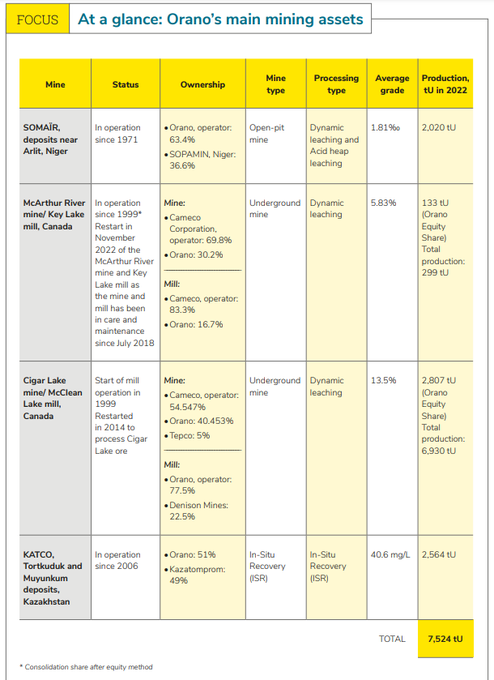

I have now added almost added all available

#uranium

production potential to the updated model (which is not realistic).

I have added 10% secondary demand from overfeeding, inventory and financials.

Still, Kazatomprom can not miss and Arrow must come online in 2028.

I am going over the numbers SCP have used in their

#uranium

supply and demand analysis, and I have several things I want to tweak:

- Using WNA base case demand assumptions.

- Adding secondary demand etc

Are there any more credible projects coming online before 2030 for supply?

9

6

47

51

60

348

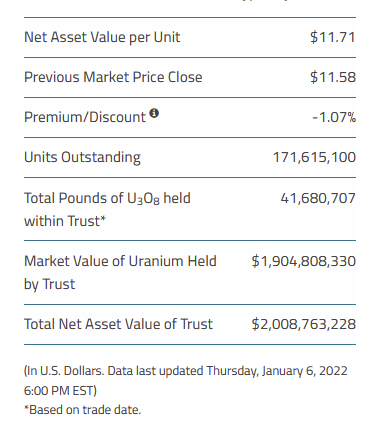

Cameco total

#uranium

production in 2023 was 1.1 Mlbs under September 2023 revised production plan.

The September 2023 revision was already down 2.7 Mlbs (100% basis) for Cigar Lake and McArthur River/Key Lake production.

13

49

280

The one thing I have taken away from the

#uranium

trade has been:

"This trade is simple, but not easy.”

It has been obvious, but it has moved slow enough that you can second guess yourself. Many have said we are wrong.

For those who have stuck with it, I tip my hat to you.

24

12

258

In today's post on

#uranium

I will comment on the recent spot market activity, defend the valuation of $PDN

@Paladin_Energy

, try to be more bearish on $GLO

@AtomicCorp

and continue my praise for $BMN

@BannermanRes

and

@brandon_munro

23

28

192

After a month break I have written a new post on

#uranium

. Based on recent events I am more optimistic for the sector than in a long time.

10

23

186

I have finally written about my

#uranium

portfolio and included my positions! $EU $UUUU $GLO $URG $NXE $GXU $DML $BMN $LAM $FMC $HURA $VMY $FCU $DYL $STND $FIND

27

22

168

My favourite thing about corrections is that I finally stop hearing people call for a correction all the time ;-)

#uranium

5

8

163

For today's post I had a hard time not using the Braveheart “Hold” meme as the main picture.

The subject for today is about why we hold our

#uranium

investments.

10

36

160

I have had this post in the back of my mind for a couple of weeks. It goes through the reasons why the market opportunity is so big in the

#uranium

sector. It is what I will refer to going forward when people ask me why I have invested in the sector.

15

31

155

It has been a while since I wrote a piece on

#uranium

and commodities. With all of the turmoil and we are experiencing now, it seems fitting to write some more.

18

19

145

New Sunday post on

#uranium

. The market as a whole has been good the last two weeks, but it can't all be positive news.

11

21

142

Sunday is here and back at my regular schedule. (I made an extra post on

#uranium

taking it on the chin on Friday). Today I look a bit closer at long-term contracts that need to be replaced, and how well stocked inventories are relative to the situation.

15

21

137

My first post in well over two weeks (away on honeymoon). I have thought a bit about my exit strategy in

#uranium

, and if I should change it in light of the recent developments we have seen in the sector. I do not plan to bail on the sector anytime soon.

15

11

135

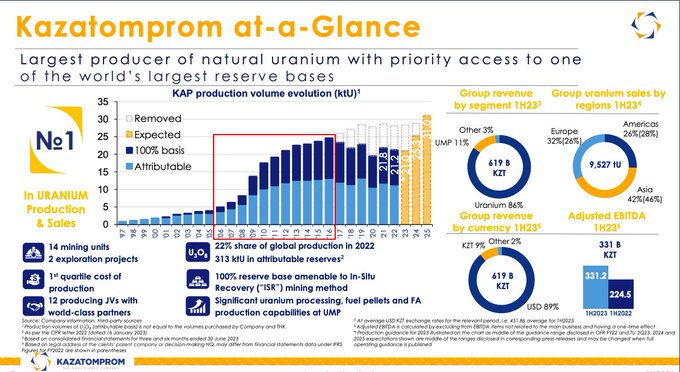

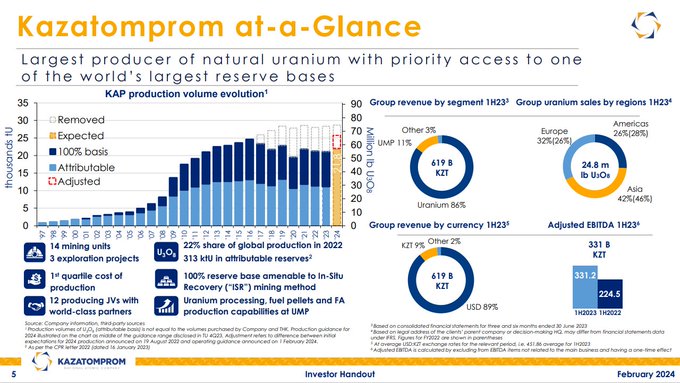

I took a look at

@NAC_Kazatomprom

´s latest 2024 presentation.

2025 expected production numbers are now missing compared to presentations they used in 2023.

How much lower than the previous target (80 mlbs/year) are they expecting for it not to be in their presentation anymore?

11

21

139

One of the biggest financial newspapers in Norway writing about

#uranium

.

This is the second portfolio manager in Norway I have seen recommending uranium. His pics are Yellow Cake, Cameco and Kazatomprom.

6

21

132

Germany agree with inclusion of nuclear in green taxonomy.

9

11

133

When it comes to

#uranium

, my risk appetite (and -tolerance) is lower today than it was in 2021. A reasonable development after almost two years of pain in the trade.

I therefore rely on my strategy, that I laid out a long time ago, before my feelings.

No chasing, no selling

11

3

128

Seeing some solid news flow from my biggest

#uranium

positions $EU, $UUUU and $GLO at the moment. Good to see in a rising price environment.

2

6

125

This has not been discussed enough. The mines who want to get into production (new and idled ones) usually do not have staff and heavy machinery on hand. This is something to take note of.

@_Gravedigger__

@Sprott

Good luck ordering equipment. Heavy machinery can take over a year just to arrive. Very soon we will see a 2 year backlog.

In many places there’s also labour shortages. There will be bottlenecks everywhere

9

6

130

9

13

124

About time to change ticker from $FIND to $FOUND?

Baselode Intersects Multiple Zones of Elevated Radioactivity in Two New Holes at Hook Uranium Project

#Uranium

#Discovery

3

13

62

4

7

124

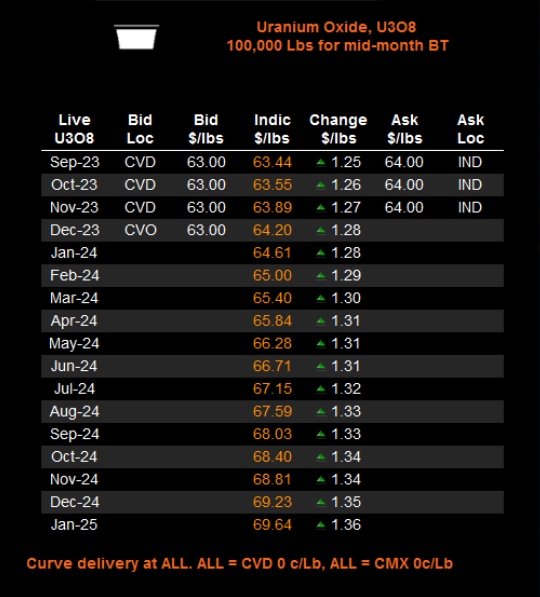

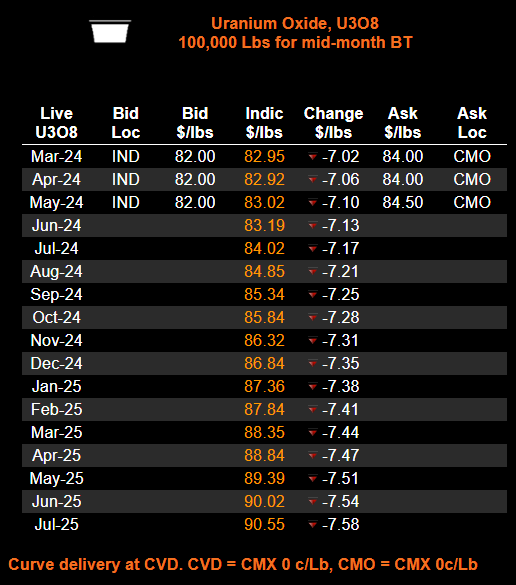

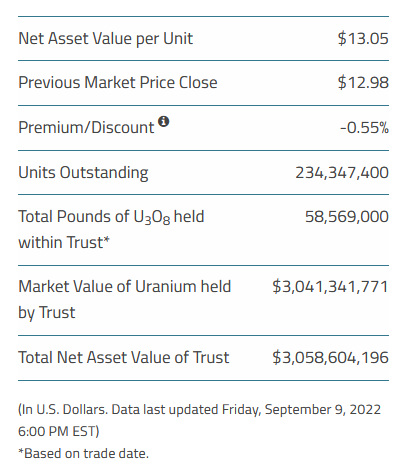

US utility inventories down to an average of 16 months, and EU down to two years. Well below their usual 2 and 3 year level. Substantial inventory drawdowns. I took advantage of the

#SPUT

rejection with another

#uranium

position today. $92E

7

8

119

Many have been talking about this might be a Cigar Lake moment in the

#uranium

sector.

For me, this is at least proof that the increase of production will be slower and harder than most analysts have expected.

We will not see a supply response as the one we saw in

#lithuim

8

8

118

I am a self professed Uranium Bug, but I am bullish on most commodities.

My latest post is about "The Big Commodity Short"

#uranium

#commodities

7

13

110

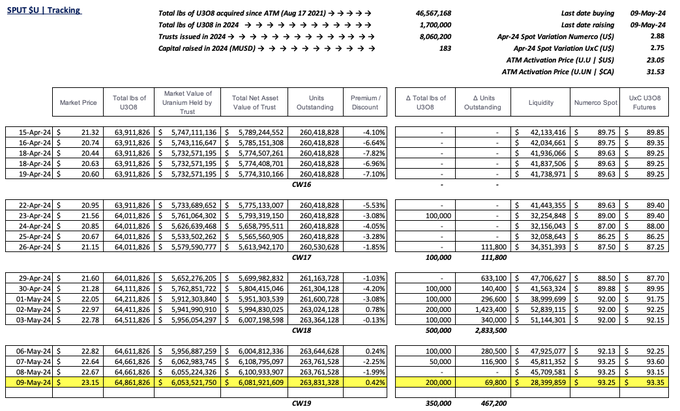

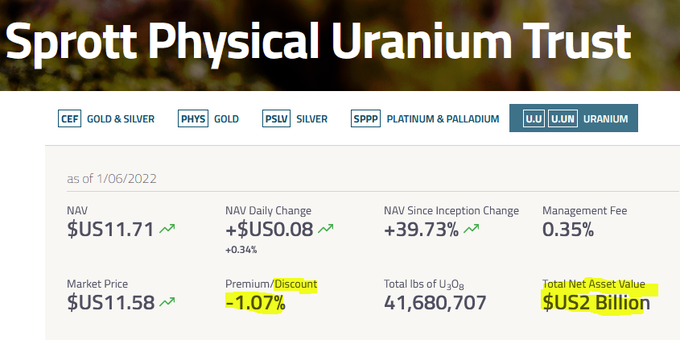

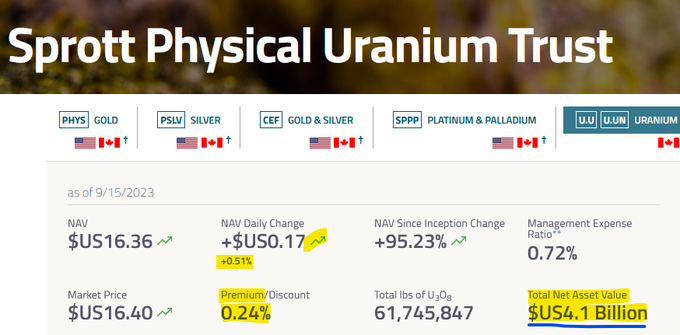

I can´t be the only one who is encouraged by

#SPUT

being able to raise cash and buy pounds almost every trading day in May. (750,000 lbs so far).

#SPUT

@Sprott

#Uranium

Trust $U.U $U.UN

#nuclear

#GreenEnergy

+0.42% premium to NAV

200k lbs gobbled

69.8k trusts issued = $1.6m raised

$28.4m in cash!

11

30

182

10

9

120

So today is the first time I write a post about

#uranium

in English. Hope you like it. I try to ad to the tactical and mental aspect to investing. (We get so much information about companies and analysis on the sector from other people on twitter already).

10

16

113

Today the returns of my

#uranium

portfolio is higher than my total value of the portfolio in March 2020. Volatility goes both ways.

8

3

113

It looks like the people that got into the

#uranium

sector on the Kazakhstan news are on the way out. (Betting on short term action with a supply shock and a spike in the uranium spot price).

The people who have invested for the supply and demand future are still here.

8

5

108

Today my post is more “out there” and a bit more quirky than usual. I hope you like it. Also I will give thanks to

@BambroughKevin

for all his education during this week in

#uranium

12

16

107

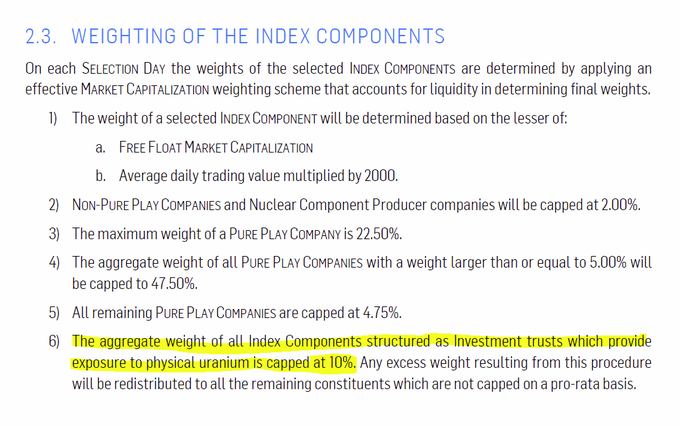

#SPUT

is not buying, and we still see spot moving up. Makes you wonder what can happen if they trade at a premium to NAV again with over $104M in cash.

7

7

107

So I finally got to listen to Oranos Conference call, and around 1:16:55 they say they produced 7,146tU of uranium in 2023 compared to 2022 production of 7,524tU. -> A reduction of 5%.

(18.6Mlbs in 2023 vs 19.6Mlbs in 2022).

Have anyone seen what they guided for 2023?

6

13

108

We are going through the first test of our conviction in the

#uranium

bull market. Today I write mostly about keeping cool. So zoom out to keep perspective.

I subscribe to some great services on uranium. I do not comment on most companies because of this

13

15

107

Interest is perking up in the

#uranium

sector. I have about 300 new followers so far in September, 2,800 in total. Rule number one: embrace the volatility, number two: avoid leverage.

I follow

@trader_ferg

for lessons and inspiration.

6

5

104

I have written a post about the movements we saw in the market on Friday. After several weeks of positive returns we got licked on Friday with -10% on most of the equities. In a

#uranium

bull market, volatility is the name of the game.

7

16

106

With the increased interest in

#uranium

I am now up to 3,000 followers. I got a lot of new followers from Norway🇳🇴 the last 24 hours, after the article about the sector in

@Finansavisen

. I write some articles myself, but I also share videos and other information I find useful.

10

4

104

1/5 Encore Energy $EU.V is my best performing, and biggest

#uranium

position to date, mostly due to me betting hard on them when they were «forgotten» in 2019 and early 2020. Their performance after that entry has been impressive.

4

6

105

The most popular internet broker in Norway (and the rest of the Nordics)

@NordnetNO

is writing about the investment case for

#uranium

.

3

17

103

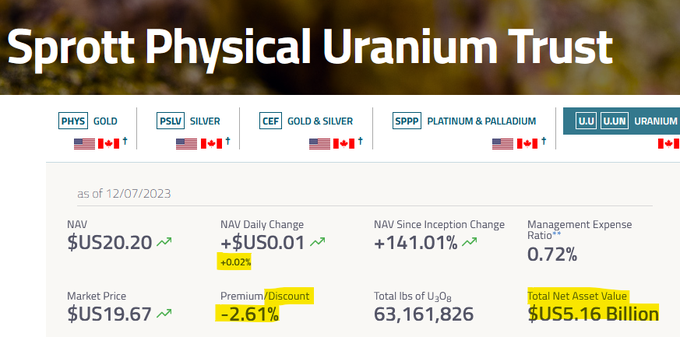

Here is my latest post. Sprott Physical

#Uranium

Trust stole the show on Friday, but I would not forget the life extensions of the Byron and Dresden nuclear plants. (If we now just get the Japanese restarts going, before a cold winter, we will be flying).

5

12

102

Might need to dust of my French dictionary🇫🇷 Something like «Hold my beer (vine) while I invigorate the nuclear sector in Europe.»

(Way outside the bull base case).

4

8

103

After taking some weeks off from following

#uranium

minute by minute I came to the conclusion that I needed to buy some more today.

I therefore bought some more $FIND shares. I am more convinced today than I was three weeks ago.

11

4

98

Back up the truck. We are gonna need more

#uranium

. Good job Illinois!

4

11

96

@JohnPolomny

has a Youtube channel everyone should follow. I have been a subscriber since 2019 and his weekly update is invaluable. I use him to keep level headed on my

#uranium

investments.

8

10

96

4,500 followers! We have seen a lot more downside volatility the last couple of months and the

#uranium

community has gotten heated at times.

However, I still find a lot of knowledge here and I am still learning something new every week. Thanks to everyone contributing.

9

3

97

Retail have a history of many being thrown off a bull market by the volatility. We are lucky to have people like

@uraniuminsider

who provide this daily service. Priceless.

2

6

95

Easing back into things with my first post on

#uranium

of 2022. I write about the three biggest positive triggers I am looking at in the coming year.

6

12

94

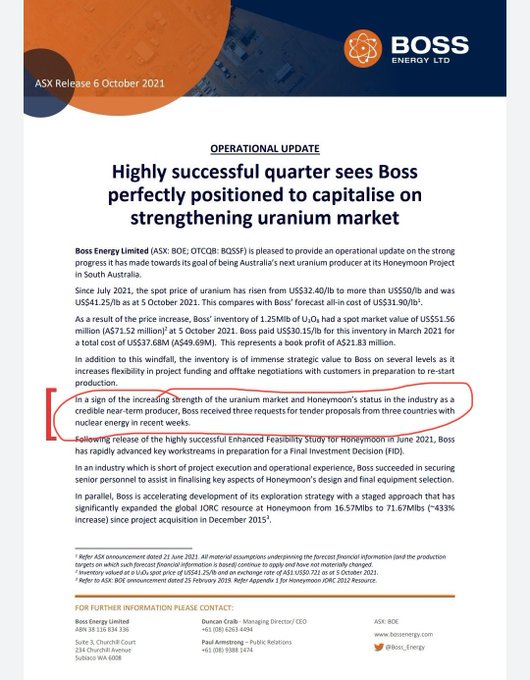

Look at the big picture for

#uranium

.

@Boss_Energy

getting RFP´s from 3 different countries. Thanks for the heads up

@casperj33081634

5

8

95

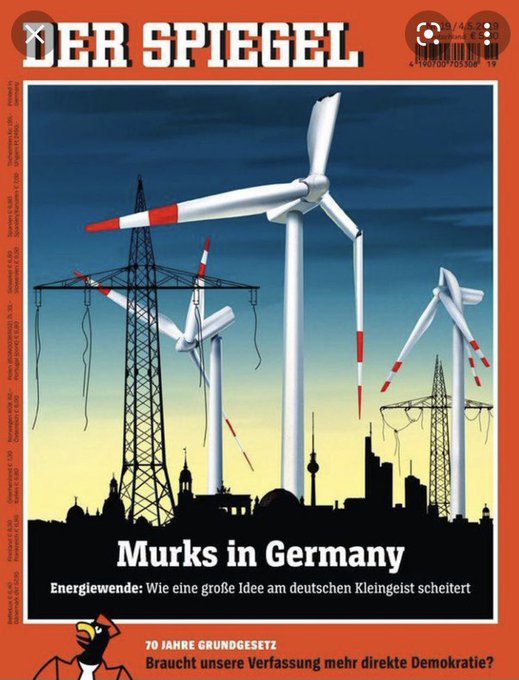

If nuclear power utilities are price sensitive because of competition from cheap natural gas and subsidized renewables, would it help if natural gas prices went up and people take notice of how unreliable renewables are?

#uranium

3

13

91

When many of my shares are having a 10%+ day, I get a lot of crazy (or stupid) ideas goes into my head. (Tilt portfolio to higher risk, use leverage, go all in

#uranium

). I always have Han Solo in the back of my head telling me not to get cocky.

13

4

93

1/3 We are soon 2 months from the last big bottom in the

#uranium

sector in mid August. Many companies doubled within the next weeks, and we are now experiencing a correction. I see many being frustrated, but I have a feeling we are soon back to only the people with real...

7

9

92

1/5 If you are frustrated about

#uranium

seasonality not showing up take a minute to assess the situation first:

If you focus on the uranium sector alone now you are doing yourself a disservice by not zooming out. When there is a risk off event in the markets everyone runs...

6

11

91

So far in 2023 we have seen

#SPUT

stack just under 4M lbs. The spot price has gone from $48.63 to $81.88, up 68.4% during the same time.

During 2022 they stacked a little under 18M lbs. The spot price went from $42.13 to $48.63, up 15.4%.

2022 and 2023 are not the same.

1

10

93

I agree that $NXE should have done this earlier, but still. Buying 2.7 Mlbs of

#uranium

is still a lot.

$150 spot is closer then we think

NexGen Announces Strategic Purchase of 2.7 Million Pounds of Uranium with Issuance of US$250 Million Convertible Debenture

$nxe

#uranium

#nuclearenergy

44

38

270

7

5

94

#SPUT

trying to remind us of what it is capable of. It would need raise less cash than it raised during Fall 2021 to reach new highs in the spot price. (There are less pounds available now). Only thing holding it back is the general market and the sentiment.

3

9

92

1/2

With corrections like the one we are experiencing now in

#uranium

I have done the following:

1. Checked my account less. (If I do not plan to buy or sell, I do not need to see what people offer at all times)

2. Added to some of my positions with available cash

3

9

92

1/x

I always try to learn from other peoples success and failures. I therefore have an anecdote I will apply to

#uranium

:

One time one of my friends was in Las Vegas playing in a poker tournament. He did very well for a long time before he blew up. When we asked him later…

7

17

89

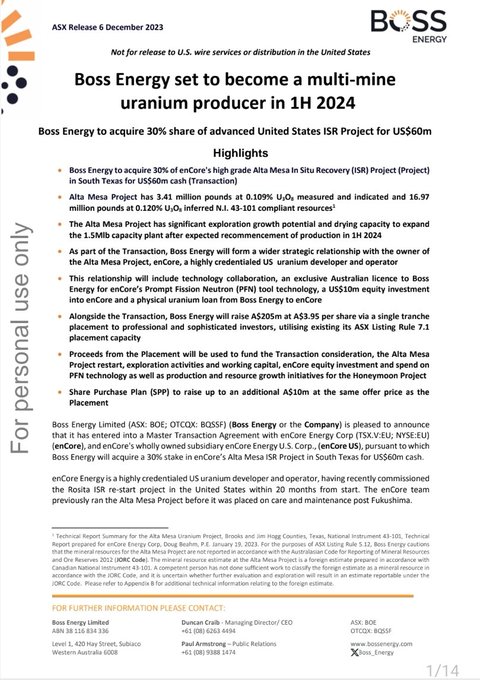

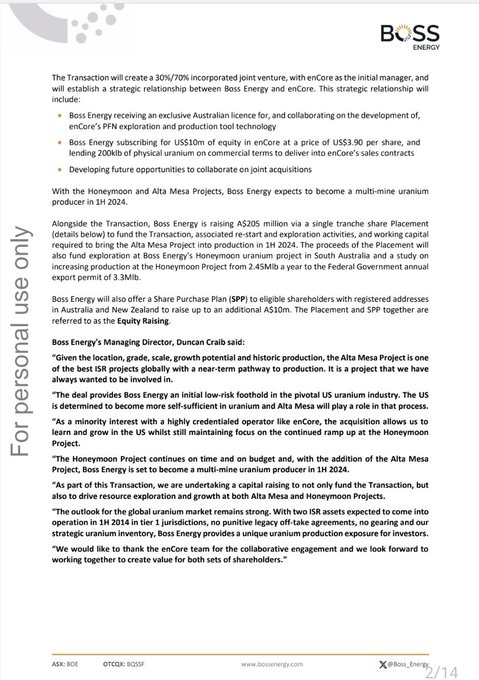

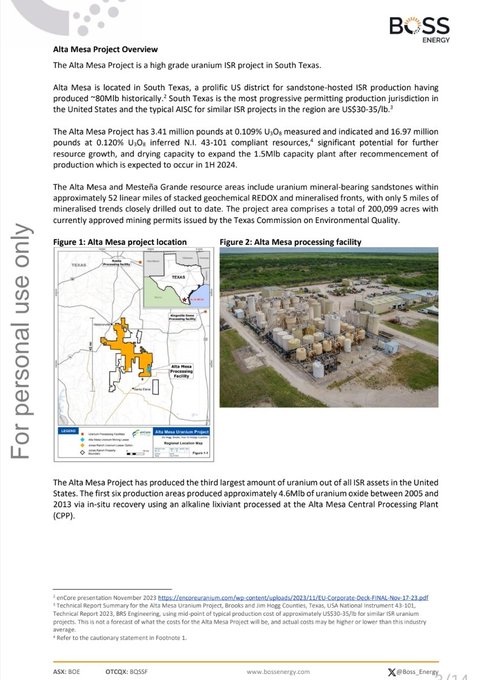

So

@enCoreEnergy_EU

bougth 100% of Alta Mesa for $120M.

@Boss_Energy

is now buying 30% of it for 60M, valuing the project at $200M, and becomes a strategic partner. Interesting🤔

@patrickadownes

Just announced. Boss acquiring

30% of EnCore's Alta Mesa asset. Strategic relationship moving ahead. 14 page release. Only 3 included here.

10

10

89

6

10

92

I am now working my way through the

#Uranium

Conference 3.0 hosted by Bloor Street Capital. A lot to dig into for new and old investors. Thank you

@JamesConnor1999

for a great job!

3

7

86

Looks like the fears of Sprott running out of money can be left behind after raising about $30M this week. Now holding $43.4M and tracking the

#uranium

spot price a lot closer.

Maybe Sprott should try to purchase 100,00 pounds next week?

7

7

89

I have seen very few

#uranium

companies that are moving their project towards production as steadily as Global Atomic $GLO the last four years.

7

9

86

Very happy to see Norwegian fund Sissener Canopus invested in the

#uranium

sector and has a position in $CCJ.

Get Google Translate out and read for yourself. (Norway has historically been very anti-nuclear so a lot of education remains).

2

14

86

Looks like

@GoviExUranium

have listened to shareholders and are showing more of what they are working on. I like it.

GoviEx CEO, $GXU $GVXXF Daniel Major, in Niger at the Miriam deposit provides an update on drilling

#uranium

4

11

95

4

5

84

The plot thickens. $KAP announces investment in physical uranium fund.

We have another significant

#uranium

buyer. It’s getting very real!

@BambroughKevin

@quakes99

@gjermundgroven

etc...!

JSC NAC Kazatomprom - KAP announces investment in physical uranium fund

#KAP

#voxmarkets

#investing

#shares

#RNS

via

@voxmarkets

1

0

26

3

5

86

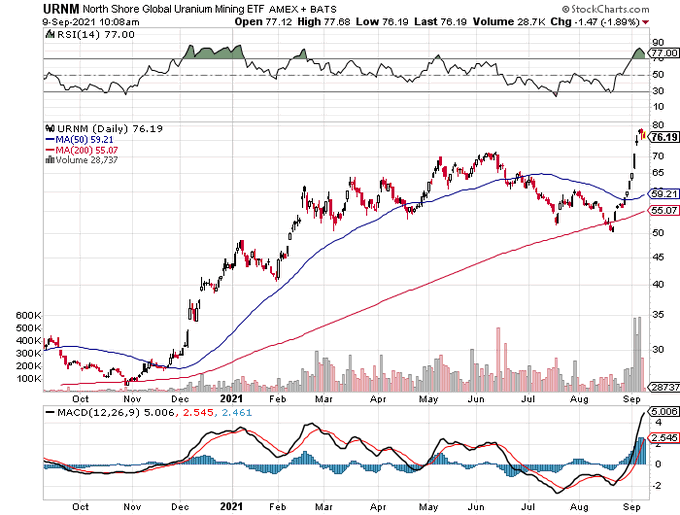

Volatility is the price you pay for playing the

#uranium

game. Less than a month ago $URNM was under its 200 day moving average at about $50. We are now just under $76, down from over $78 a couple of days ago.

Zoom out and look to all the positive triggers for the sector.

2

9

86

New post on

#uranium

and the moves we have seen the last week. For some of the newer entrants to the sector this was your first drawdown of note.

If bull markets were a medical condition I would say "this is perfectly normal and nothing to worry about."

8

12

84

For people who do not want to do the math:

Cameco - 40.1M lbs contract

Encore Energy - 0.65M lbs contract

Paladin Energy - 3.4M lbs contract

Total 44.15M lbs YTD

52 of 365 days a year gives > 309M lbs pace

Have probably missed some companies.

Contracting begets contracting.

10

15

84

Uranium continues its strong trend on news of lower production from

@NAC_Kazatomprom

in 2023.

As usual, the fear is that this is short lived and the FED will put an end to this run. I have no opinion on FED action, but long term the sector fundamentals are strong.

5

9

84

I have to admit one thing I was wrong about: I did not think the supply of

#uranium

in the spot market, from inventories and production, would be as high as it has been. I did also not expect Sprott taking over UPC creating

#SPUT

, cancelling out my mistake 😉

#SPUTTracker

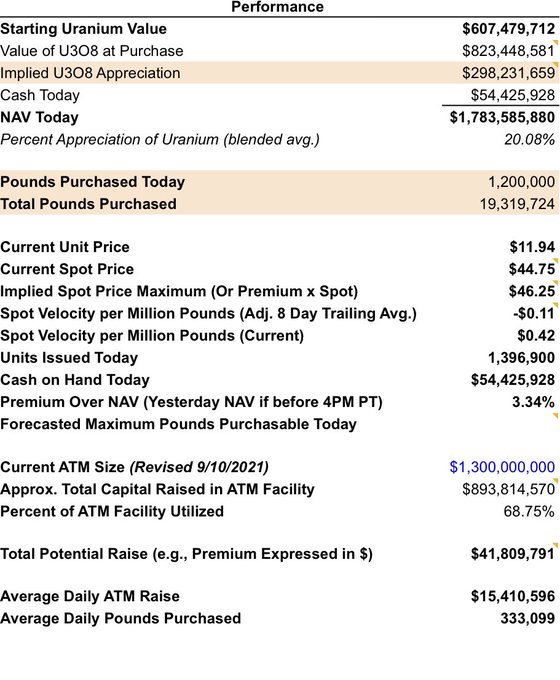

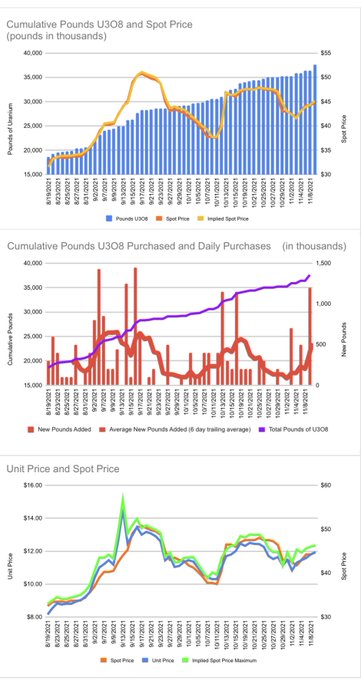

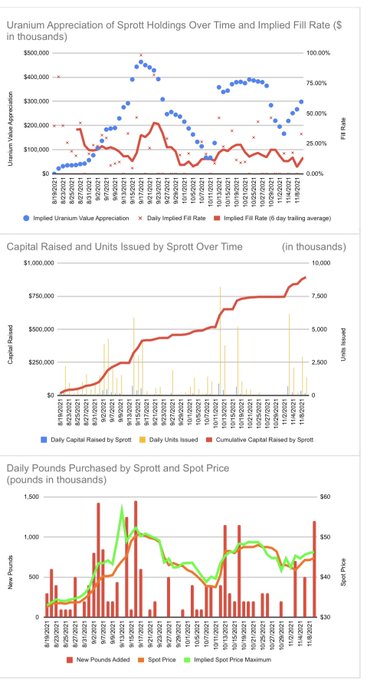

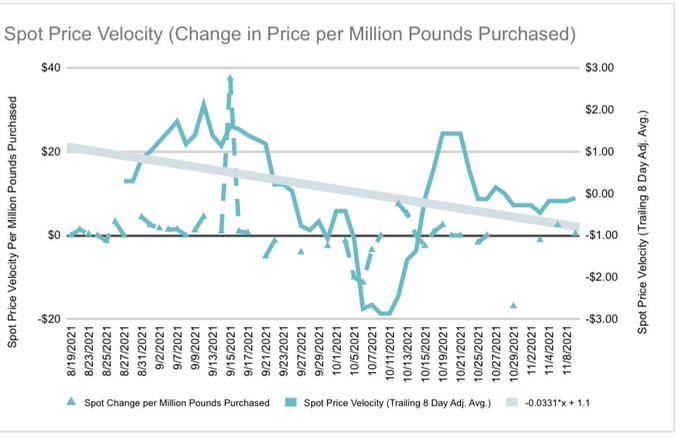

Updated: 1,200K pounds purchased for a total of 19.3M. 1.4M units issued and $54.4M cash on hand. Spot closed at $44.75 per pound (per

@numerco

). Sprott can afford $46.25 per pound.

#uranium

,

#esg

, $sruuf,

@quakes99

@sprott

@uraniuminsider

15

17

180

7

5

81

For every round number like $60, $70 and upwards I think we will see some selling from people taking profits, and scaling out based on spot price targets for

#uranium

. I will try to not do exit around round numbers when some of my targets are reached.

12

3

81

After several weeks where most of the

#uranium

investors have been tested, Sprott has finally come to the rescue with their ATM financing.

6

10

81