Bob Elliott

@BobEUnlimited

Followers

137,106

Following

688

Media

4,178

Statuses

21,747

CIO at @UnlimitedFnds | PM of $HFND | Fmr IC @Bridgewater | Described as one of the "sane" voices on #fintwit | Comments are not investment advice

New York, NY

Joined March 2022

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

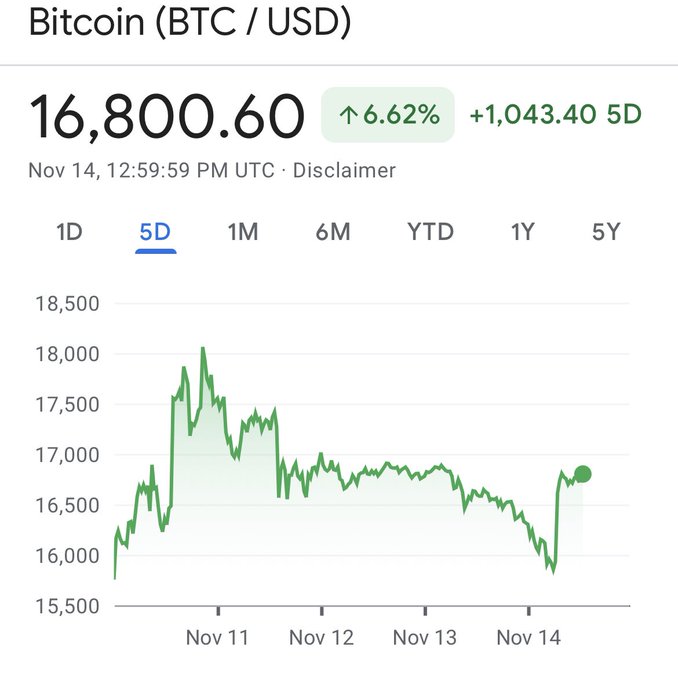

$BTC

• 479860 Tweets

renjun

• 158993 Tweets

Heat

• 120635 Tweets

Lewis

• 76432 Tweets

#SmackDown

• 72435 Tweets

#DragRace

• 70247 Tweets

Mani

• 58713 Tweets

Bulls

• 52414 Tweets

Saint Dr MSG

• 48251 Tweets

Lando

• 43916 Tweets

#FreeMillie3D

• 33736 Tweets

Ethan Hawke

• 31838 Tweets

Edmundo González Urrutia

• 29170 Tweets

Celtics

• 23416 Tweets

Role Of Police

• 20167 Tweets

Sapphira

• 19827 Tweets

Verstappen

• 16658 Tweets

#2024BAEKHYUNASIATOURinBKK

• 15723 Tweets

Yamamoto

• 11290 Tweets

Juan Soto

• 10015 Tweets

Last Seen Profiles

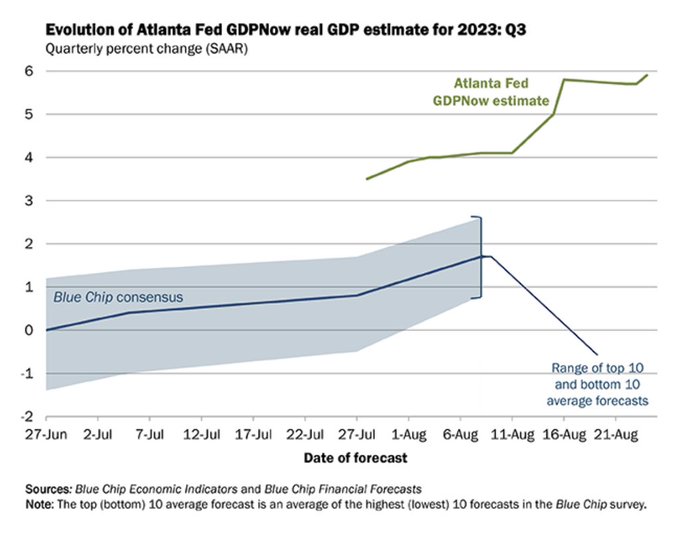

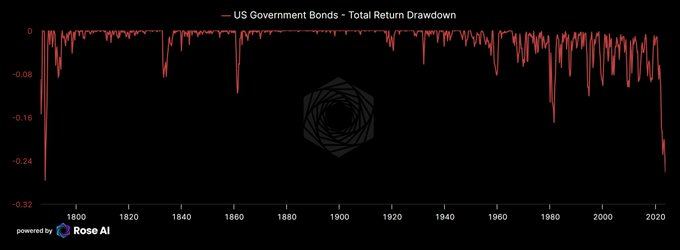

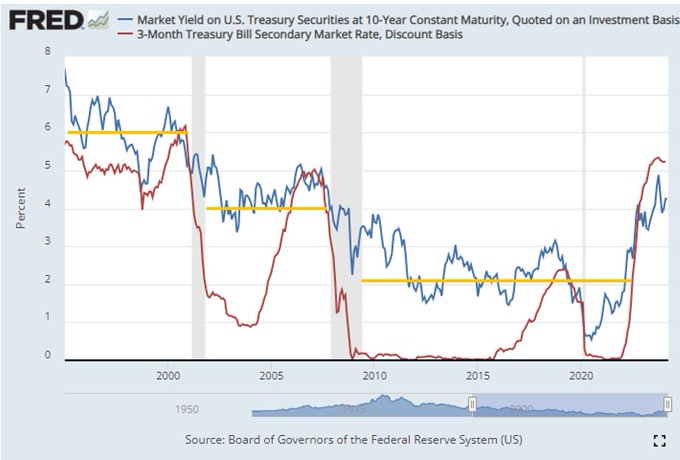

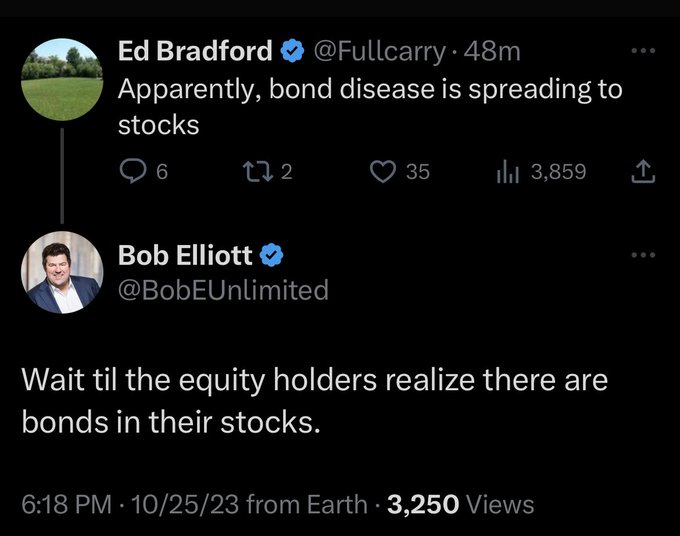

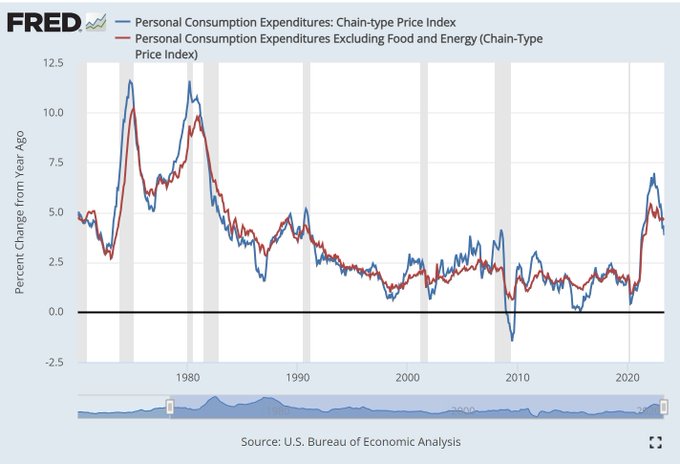

With the most recent leg down, this US bond selloff is on par with the largest ever in history.

As shown next, it's also in line the largest falls for major countries that didn't lose a world war or have hyperinflation. Some perspective from my friend

@abcampbell

on the selloff:

55

304

1K

I taught an intro macro and markets course for a decade and thought folks would enjoy it if I shared some readings inspired by that course. An updating thread:

This POW Camp reading covers nearly every topic in macro and markets in just a few pages:

68

170

859

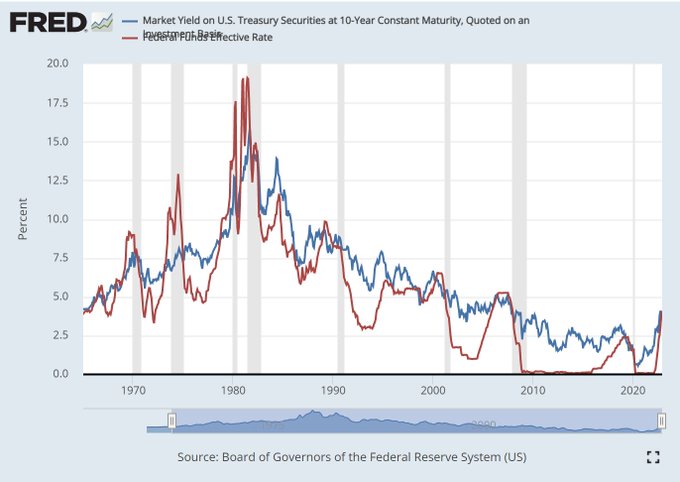

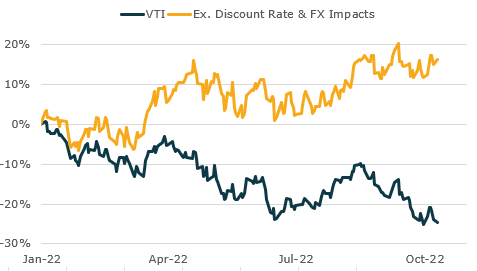

Never imagined that my first time on

@CNBC

I would be suggesting cash is the best asset out there, but these are the times we live in.

Many thanks to

@MorganLBrennan

and

@jonfortt

for having me on to get my 'cold shower' take. Check it out!

82

63

755

@Claudia_Sahm

This is disappointing. It is normal for people to have differences of opinion, but these types of unfounded personal attacks are totally unprofessional. And they stifle what could have been interesting public discussions of markets, the economy and policy.

57

10

655

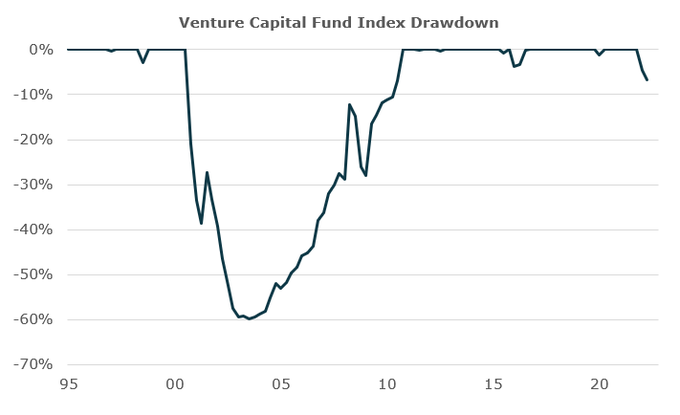

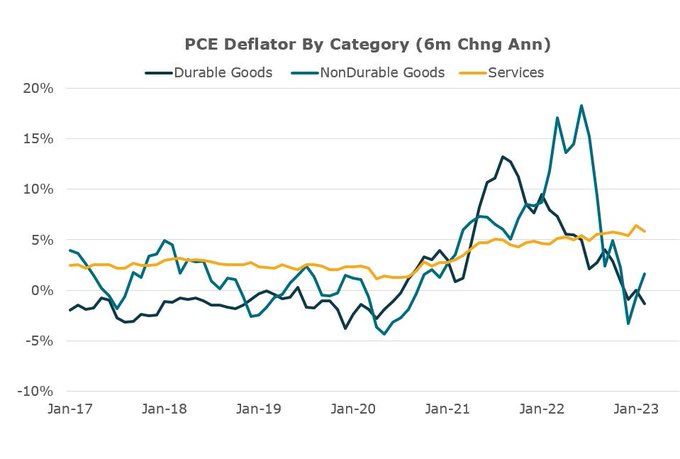

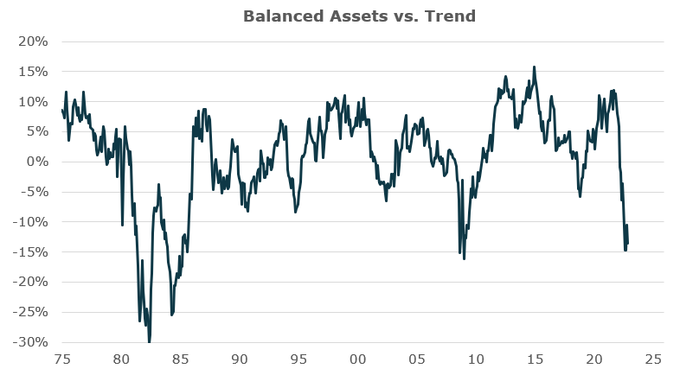

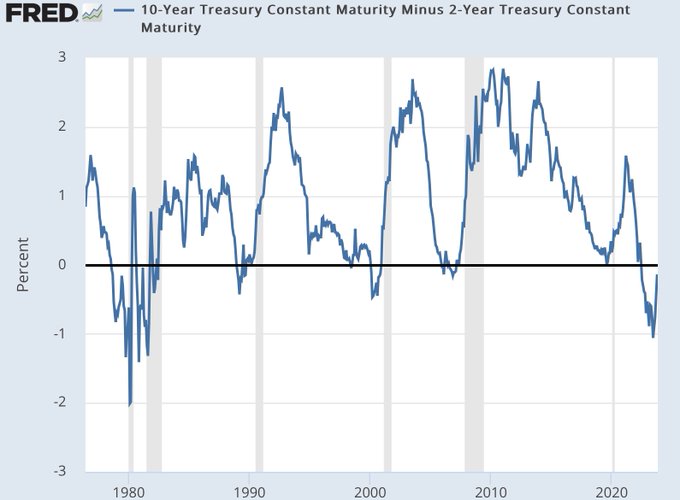

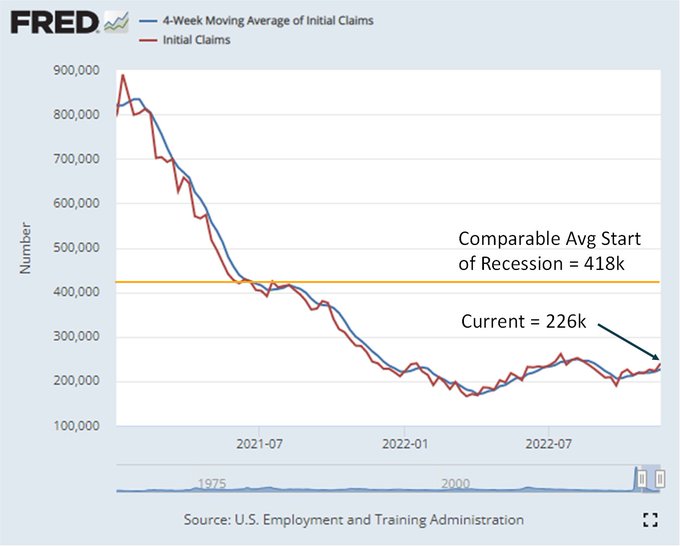

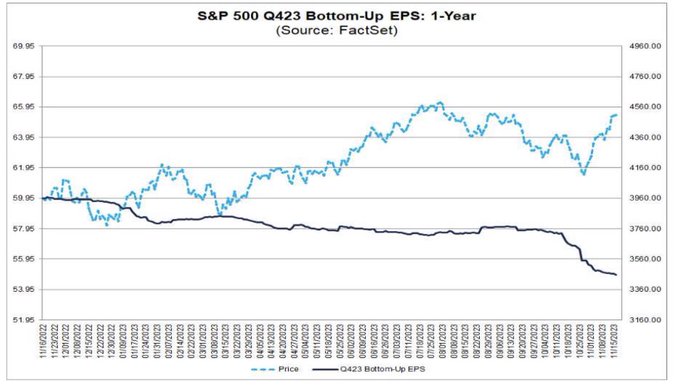

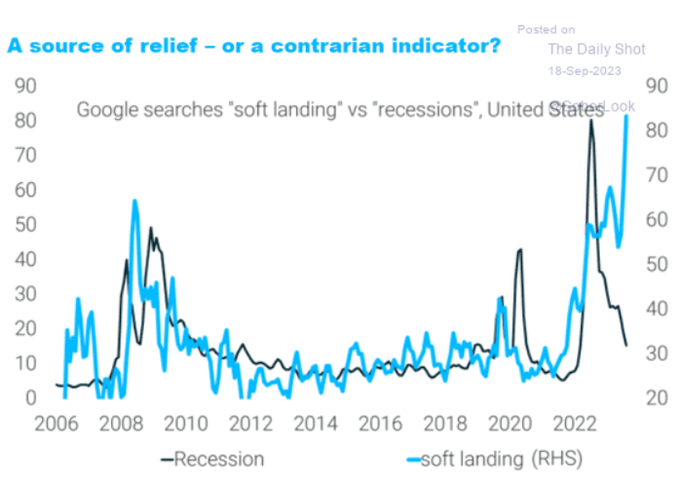

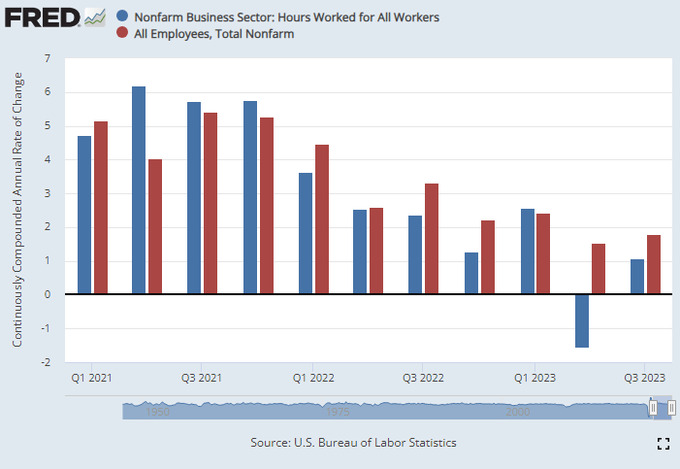

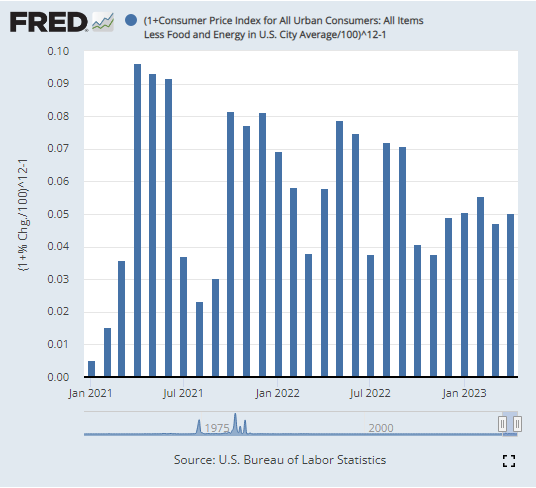

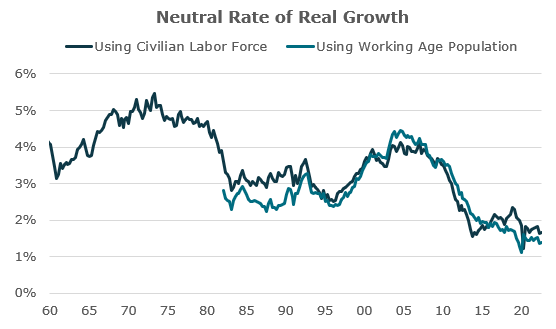

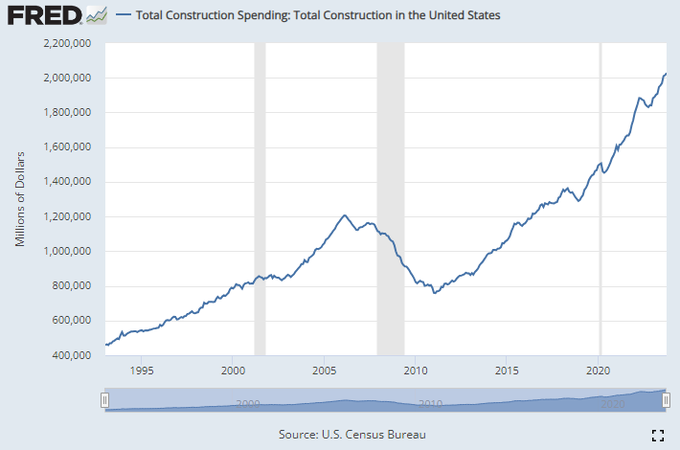

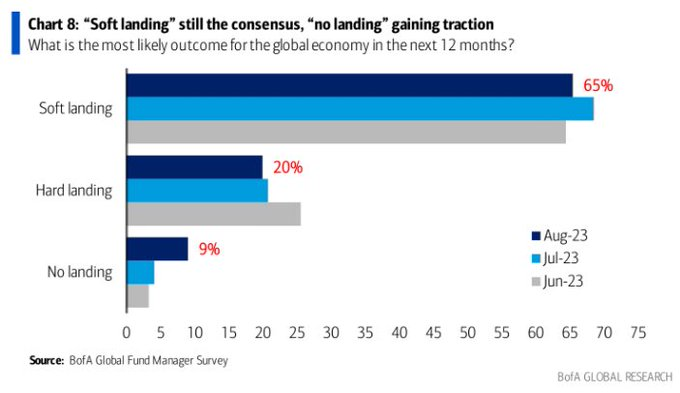

My central hypothesis is this cycle will move more slowly bc the economy is less rate sensitive than most expect.

Folks often are confused when I look at a range of indicators to test this hypothesis, particularly things are coincident/lagging. Thread.

31

91

608