Marc Chandler

@marcmakingsense

Followers

17,566

Following

1,983

Media

5,999

Statuses

28,621

Breaking Down and Making Sense of Global Capital Markets

Joined May 2009

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 463920 Tweets

Baba

• 114630 Tweets

Valencia

• 78158 Tweets

Abeg

• 74030 Tweets

Peruzzi

• 70346 Tweets

Nancy

• 62348 Tweets

Wetin

• 55724 Tweets

Madonna

• 55339 Tweets

Pant

• 53252 Tweets

Francis

• 51741 Tweets

Lewandowski

• 47598 Tweets

Idolo

• 46389 Tweets

Araujo

• 45231 Tweets

Rock in Rio

• 44959 Tweets

Burna

• 43844 Tweets

Seinfeld

• 39619 Tweets

Jesus is King

• 36966 Tweets

Werey

• 34098 Tweets

Farouk

• 32277 Tweets

Fermín

• 29539 Tweets

Katy Tur

• 24979 Tweets

Grammy

• 24444 Tweets

オリンピック出場

• 21114 Tweets

Ter Stegen

• 19064 Tweets

Popsy

• 14724 Tweets

Wizzy

• 13721 Tweets

ANA CASTELA NO RIR

• 11152 Tweets

PRE SAVE FOI INTENSO

• 11140 Tweets

Last Seen Profiles

@Gerashchenko_en

In my work, I draw parallels between the NATO driving east and China moving into the underbelly of the old USSR. Putin's invasion of Ukraine has turned Russia into a client state beyond what Beijing could not dream of 16 months ago.

11

39

424

In my career, I have rarely been bullish gold, but the breakout last week and my reading of the macroeconomic and geopolitical situation have turned me positive toward. Spoiler alert. It is not due to inflation expectations.

#GOLD

7

34

123

@TheStalwart

What strikes me is that rebuilding the human and capital infrastructure of the world's largest economy after years of neglect and at extremely low interest rates has become associated with left politics. It shows how far the political spectrum has shifted in America.

1

10

97

@scottlincicome

Indeed, I would argue the current administration has done more to support Russia's projection of power and weakened the alliance system more than a democrat socialist senator from Vermont.

10

0

43

@Kathleen_Tyson_

Wake me up when Saudi Arabia and UAE no longer outsource monetary policy to the Fed by pegging their currencies to the $USD. Then I will believe that the GCC could become an independent power source. Using the dirham is a bit like a stable coin tethered to the dollar, no?

2

8

48

@ericadamsfornyc

@FrancisSuarez

@Sarasti

Will NYC have to buy

#BTC

to pay the new mayor--or is he really talking about converting his paycheck into Bitcoin, which means saving his first three paychecks, not spending them. How many Americans can do that?

5

4

32

Say what you want about MMT's normative claims, but as a descriptive model of linkages, it understands how the US budget deficit in Feb that puts 12m shortfall at $932 bln a 32% y/y increase while 10-year ylds have fallen 37 bp, unlike orthodox models. POTUS does MMT?

#MMT

5

14

33

@ianbremmer

Again, why let the facts get in the way of the story you want to tell? Your own data shows Reagan's approval was lower. And he was re-elected.

1

1

34

@lisaabramowicz1

Higher inflation? The difference between -0.4% y/y and -0.8% from June is not more inflation, but less deflation. Core rate rises to 0.3% from 0.1%. Less disinflation. $Gold sell-off began at the end of last week setting wheels in motion after a record run.

0

4

32

I am not a gold bug, but a little less than two months ago, when the yellow metal rose above $1400, and given my sense of interest rate trajectory (lower for longer) and geopolitics (messy), I turned bullish and suggested target of $1700. Will discuss on

@CNBC

today ~4 pm ET.

3

7

29

@biancoresearch

I don't think Fed set up swap lines. They were a standing agreement (permanent). What they did was lower the price to OIS +25 bp (from 50bp) and offered to lengthen duration of the swap

1

2

27

@LukeGromen

Can't we agree that repos are not the same as purchases and the Fed's repo is not the same as QE? That QE and using the Fed's balance sheet is a new innovation while repos are a standard Fed tool even if not used recently. Case also here for permanent and regular repo facility.

5

2

26

@upholdreality

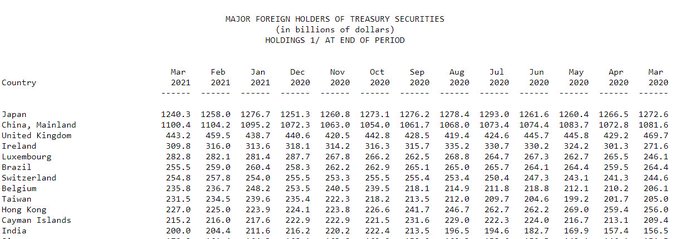

Not to confuse a great narrative but the fact of the matter is that fir several years now foreign central banks have not been accumulating US Treasuries. Reserve growth in general had leveled off with excess national savings going into sovereign wealth funds of different sorts.

7

5

26

@georgemagnus1

@MichaelKovrig

And yet, the World Bank and ADB estimated that the Chinese economy would grow 5.2% in 2023.

Seems like a lot of smart people think it is more than fiction.

1

0

25

@BrankoMilan

This is a poor and naive assessment of China. It is not because China is not aggressive. Ask most of its neighbors about the PLA's military harassment or India. Its activities must be recognized as lower rungs in a military escalation ladder.

1

1

24

@StephanieKelton

Sorry Prof, you may be correct in the narrow sense of the facts, but miss the larger context and provide fodder for a resurgent nationalism that would seem to undermine your larger agenda. Italy's far-right makes the same claims. Are those really your allies?

10

2

24

@RobinBrooksIIF

My argument is that your calculations assume costs of Chinese goods are incurred in yuan, but that is only true of something about 35%. The reason the yuan is selling off is not because PBOC wants to offset tariff, but because Chinese macro deteriorates, and $USD strong broadly.

2

4

23

@RobertKennedyJr

Is someone who concludes that the US military is a "laughingstock" really suited to be Commander in Chief?

95

2

23

@lisaabramowicz1

Ugh. Blame others before ourselves. Strong US growth (Atlanta Fed still 4.9%, BBG median 3% for Q3), larger deficit, more supply. Why not take valuation into account? And what about PRC Agency buying?

2

2

22

@RBReich

What are the odds that the Court sticks to its 'originalism' doctrine and rules against Trump on the 14th amendment given the intention of Congress? Asking for a few friends.

6

0

21

@cullenroche

To me, this still explanation still gives a priority to trade in goods and services. I think the $USD role is much more about capital markets, which are much larger than trade. FX alone is $7.5 trillion a day. Global trade is less than $30 trillion a year.

1

1

22

@tyson_whelan

@hare_brain

Well, at least the US is going to take a principled stance against China trying to repress dissent. Thankfully, we are not like them. Dripping with irony.

0

1

19

@kennardmatt

And yet the peso and the Bolsa have rallied strongly this year, and foreign direct investment inflows are anecdotally strong. Previously, many claimed he would compromise the central bank, which has not happened. Nationalization is not always bad. See US housing market.

1

2

21

@johnauthers

@Frances_Coppola

temp exit doesn't violate rules but debt relief does? Really? Rule-based defense rings hollow.

2

36

20

Remember the St Valentine's Day Massacre of 1994? Then Japan, not China, was blamed for the US trade deficit. US Tsy Sec Bentsen threatened $USD depreciation if Japan did not open auto mkts. Now the another Asian country is being blamed for US imbalance.

#takeresponsibility

1

3

20

@RobinBrooksIIF

Sorry, Robin, we continue to see things diametrically opposed. A weaker dollar will help several large swathes of the global economy. It helps ease EM dollar-debt servicing burden and helps underpin commodity prices. It likely exerts downward pressure on global rates.

2

0

19

While I have been anticipating this $USD pullback, risk is that it is longer and deeper than I initially anticipated.

#Euro

is flirting with neckline of head and shoulders bottom pattern that projects back to mid-$1.19.

1

6

16

@TheStalwart

Keynes called this the "euthanasia of the rentier class." I think that is an important development in the evolution of capitalism. This segment of the capitalist class is finding it difficult to reproduce itself. So is the middle class.

0

2

19

@WarClandestine

I am not convinced that the two claims are mutually exclusive. The US does not support Taiwanese independence but will help defend it from an attack.

6

0

19

@steve_alarm

@carlquintanilla

@Reuters

Really? How many American households have more than $250,000 in a bank account? For the vast majority of Americans, FDIC cap is more than adequate and businesses there are numerous cash management options.

6

0

17

The $JPY has strengthened sharply in the past two sessions. Its use as a funding currency ahead of the

#BOJ

meeting later this month may be over. The trade that might express this the best is long $JPY/short $CHF as mkt finds another funding currency. 2-3% move possible.

4

4

18

@LukeGromen

It has been repeated. The Fed preannounced tomorrow's operation, which allows a rolling over of today's plus a bit more. No matter how large the repo or how often repeated, it is not ownership. These nuances matter. The repo is about providing liquidity. QE was credit easing.

2

0

17

@michaelxpettis

@LuiMiyake

Fully agree with this take and my book, Political Economy of Tomorrow explores Conant's work in depth. He worked at Brown Brothers about a century before I did and anticipates much of Keynes' insight.

0

2

18

Frontpage Financial Times story quotes a bank analyst saying: "US dollar has become one of the weakest currencies on the planet." I am a $USD bear, arguing that the 3rd big rally since the end of Bretton Woods (15 Aug 1971), but isn't

@FT

quote hyperbole?

2

7

18

I joined

@DiMartinoBooth

for a discussion of the foreign exchange market and the role of the $USD. We had a broad exchange of views, including about the Federal Reserve.

Check it out:

1

6

17

@Brad_Setser

Today officials reportedly blocked some $CNY swap transactions that implied the exchange rate was outside of the trading band--mostly appeared to involve T+0 and T+1 transactions.

3

4

18