Brad Setser

@Brad_Setser

Followers

97,638

Following

953

Media

8,842

Statuses

62,053

CFR senior fellow. Views are my own. Retweets are not endorsements. Writes on sovereign debt and capital flows.

Joined May 2016

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Davido

• 514537 Tweets

Baba

• 116859 Tweets

Valencia

• 80399 Tweets

Abeg

• 77510 Tweets

Peruzzi

• 76169 Tweets

Nancy

• 69103 Tweets

Madonna

• 59256 Tweets

Wetin

• 58105 Tweets

Francis

• 53659 Tweets

Burna

• 49641 Tweets

Lewandowski

• 49185 Tweets

Rock in Rio

• 48120 Tweets

Araujo

• 46143 Tweets

Seinfeld

• 42040 Tweets

Jesus is King

• 39713 Tweets

Katy Tur

• 30231 Tweets

#WWERaw

• 26600 Tweets

Grammy

• 25632 Tweets

Luciano

• 16755 Tweets

ANA CASTELA NO RIR

• 14944 Tweets

PRE SAVE FOI INTENSO

• 14691 Tweets

#WWEDraft

• 10555 Tweets

カレンダー通り

• 10362 Tweets

Last Seen Profiles

I am taking a leave of absence from the Council of Foreign Relations, a leave of absence from Exante data – and yes, a bit of time off from twitter too, for what I assume are obvious reasons.

230

58

2K

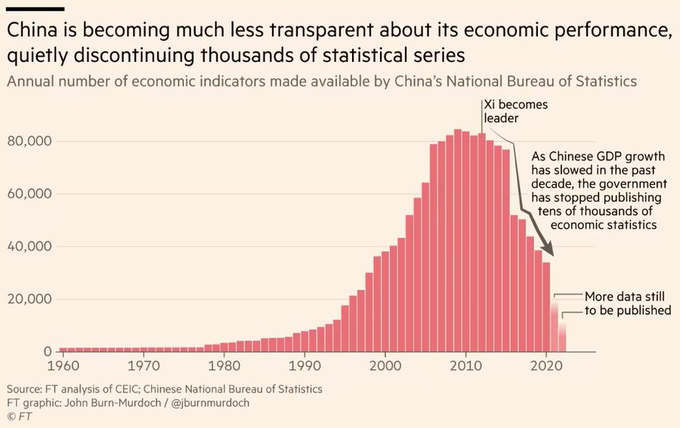

Stunning chart from

@jburnmurdoch

.

China has reduced the quantity of the economic data that it publishes over time.

There are also more and more questions about the quality of the numbers that are still (?) released.

1/x

27

346

1K

Stunning.

Spectacular, if somewhat depressing, reporting by

@Lingling_Wei

and

@yifanxie

"top leader Xi Jinping has deep-rooted philosophical objections to Western-style consumption-driven growth, people familiar with decision-making in Beijing say."

1/

108

297

1K

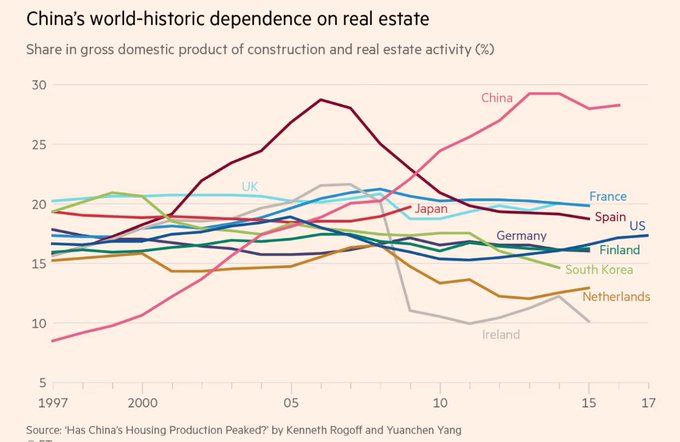

After the global financial crisis, China become a construction dependent economy.

Great Rogoff and Yang chart highlighted by

@MESandbu

today

1/

28

293

1K

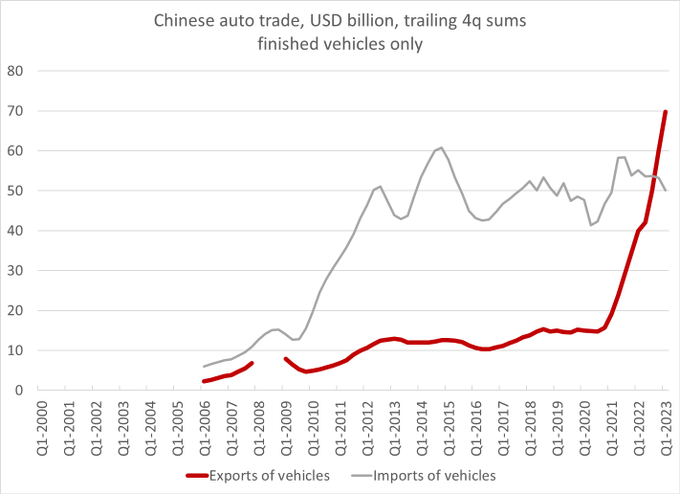

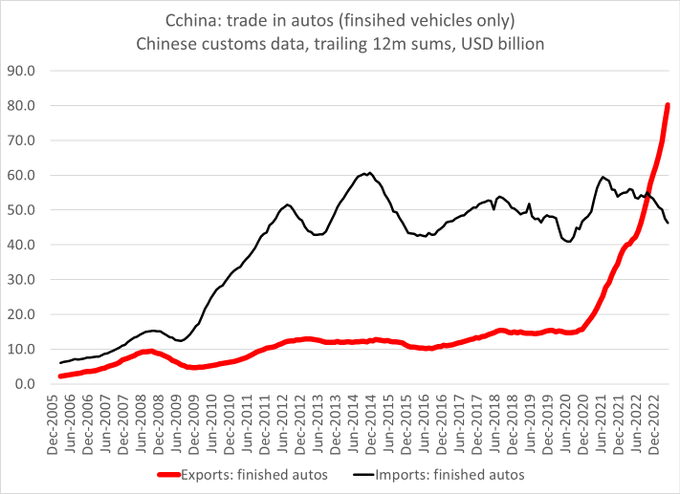

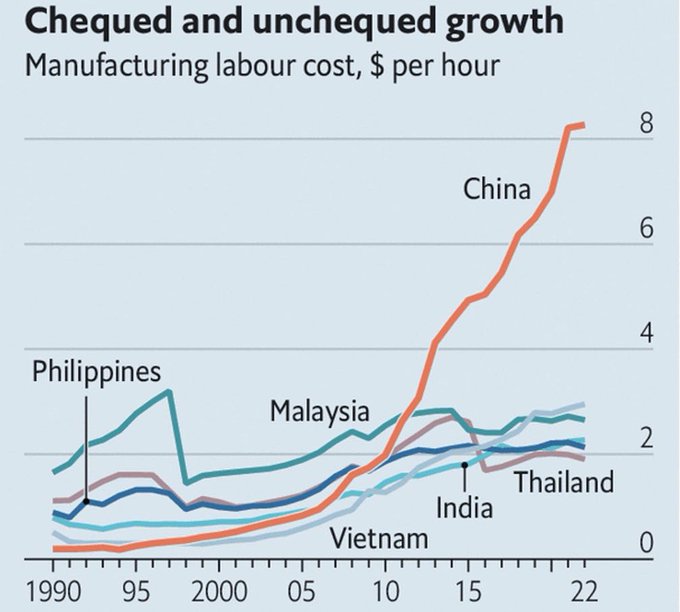

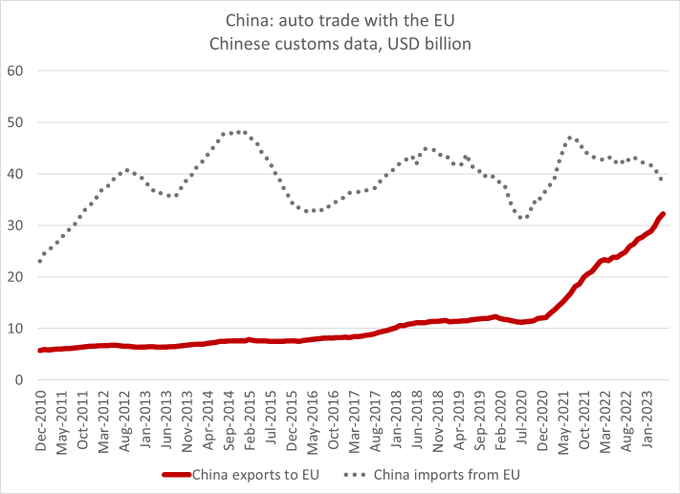

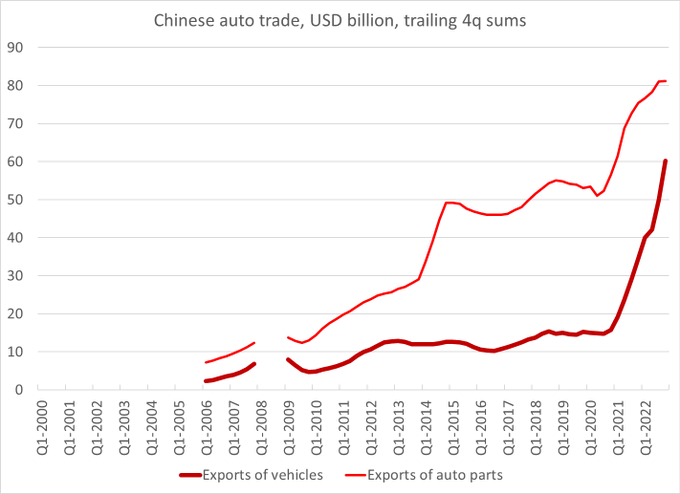

"It [China] has built enough auto factories to make every car sold in China, Europe and the United States"

Stunning stat from

@KeithBradsher

of the NYTimes

1/

61

329

964

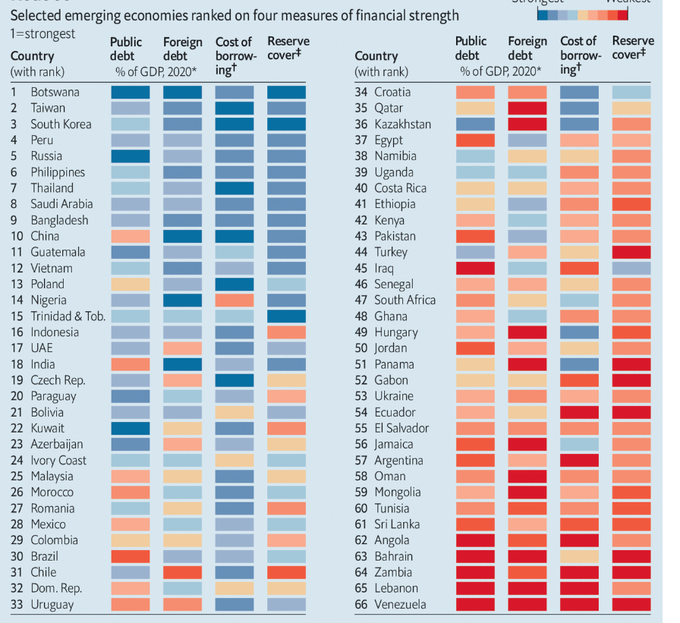

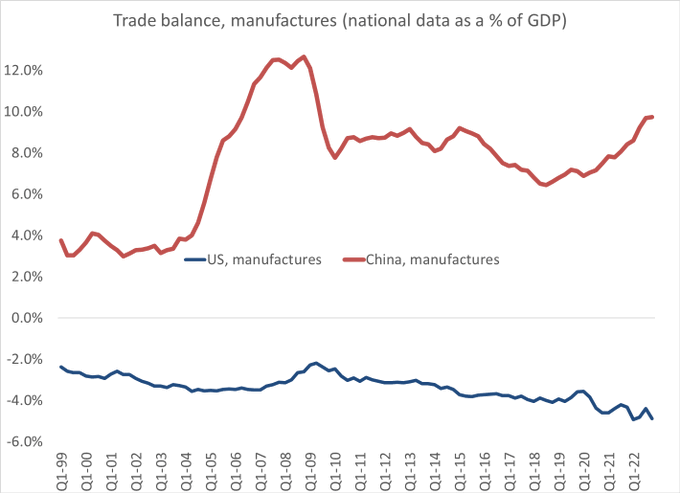

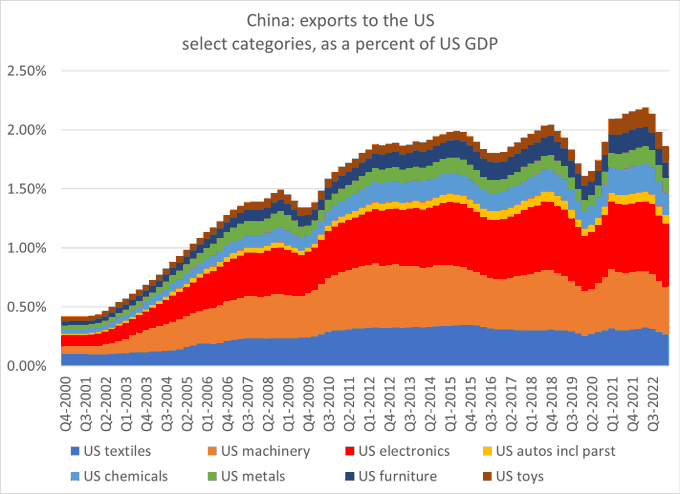

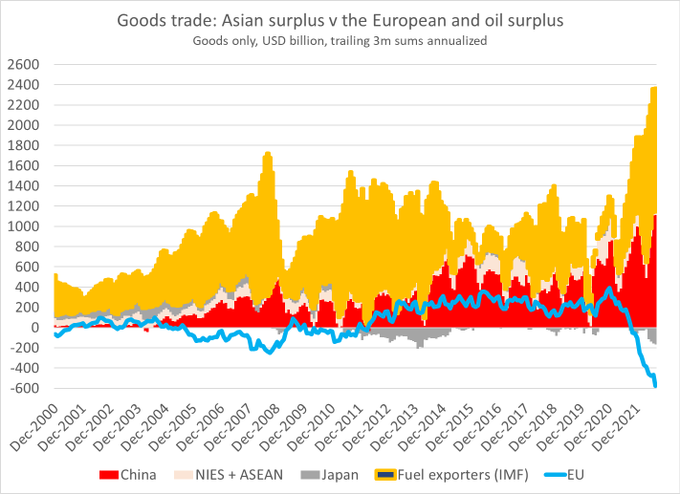

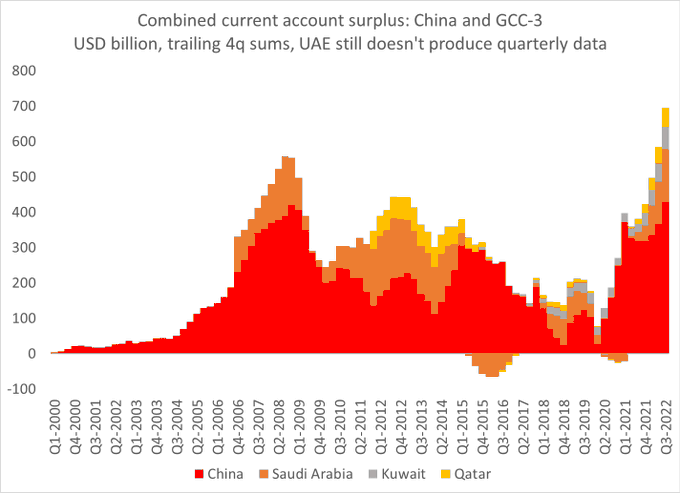

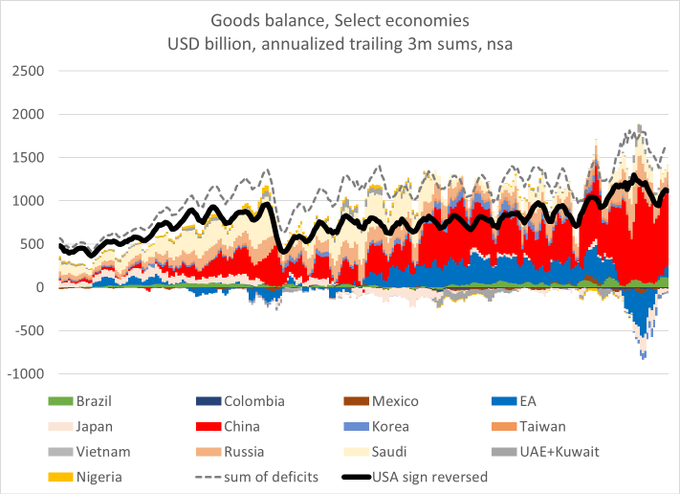

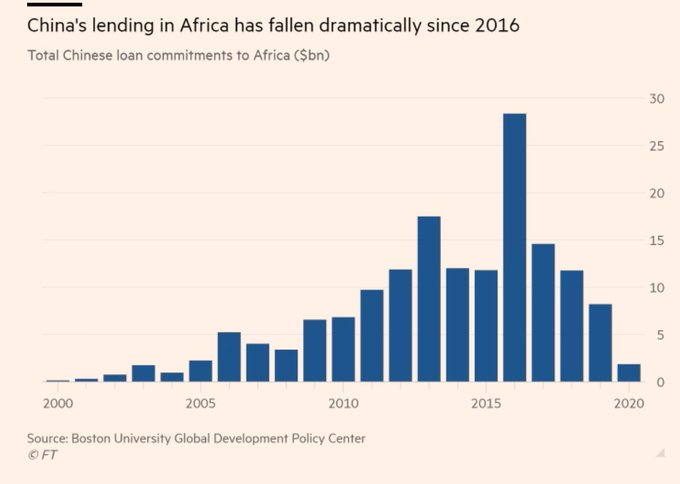

A chart that illustrates how it is fundamentally impossible for China to construct a block centered around the developing world that replaces the US/ EU ...

there is an obvious problem, namely the size of China's surplus

1/x

41

318

973

China is currently underlying going what

@adam_tooze

calls "a gearshift in what has been the most dramatic trajectory in economic history" --

And we have to try to understand it with what is by far the worst economic data produced by any of the major global economies.

1/

31

158

748

Argentina's plans to dollarize its economy should generate a lot of meetings in Beijing.

The pro-dollarization leading candidate for President may not realize that most of Argentina's remaining reserves are actually in yuan ...

1/

19

160

615

Proud to be joining

@USTradeRep

as counselor, and proud to be a part of the Biden-Harris Administration. Lots of important work to do.

70

62

602

The underlying liabilities are in yuan, not dollars -- and the central government of China has a positive net worth (per the IMF's excellent recent paper) and no shortage of fiscal capacity to backstop China's financial system.

1/2

39

116

561

Excited to join

@USTradeRep

and the Biden Administration.

This change of course means I will no longer be writing a blog for

@CFR_org

. I want to thank all those who followed my blog -- and joined in the discussion of its key themes here.

56

35

560

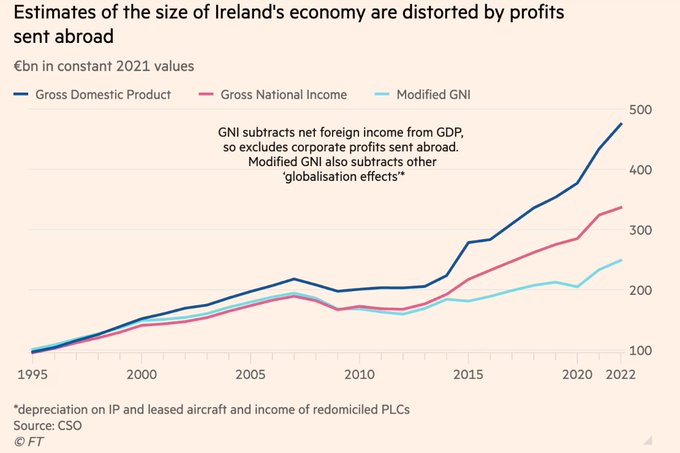

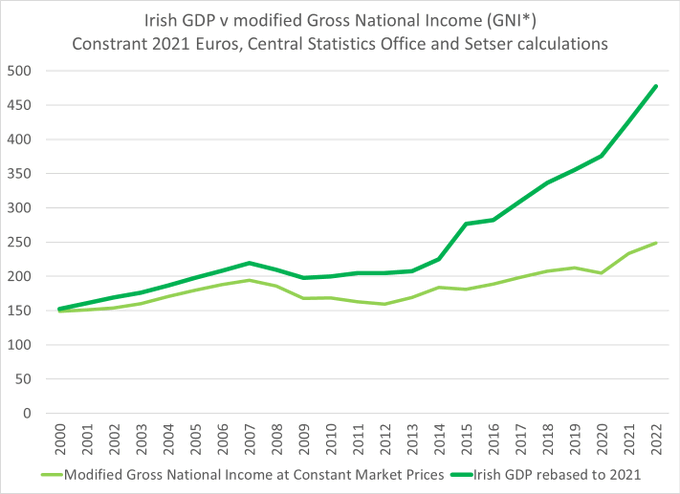

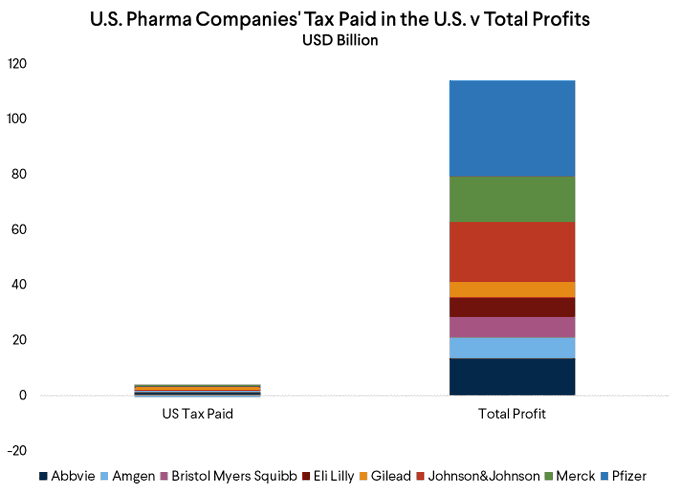

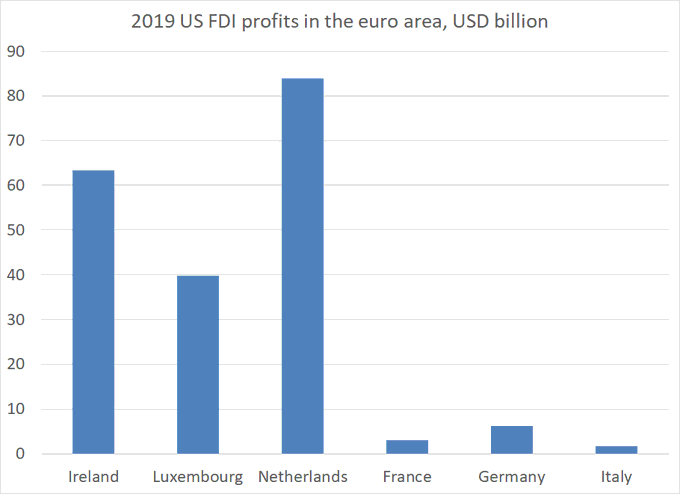

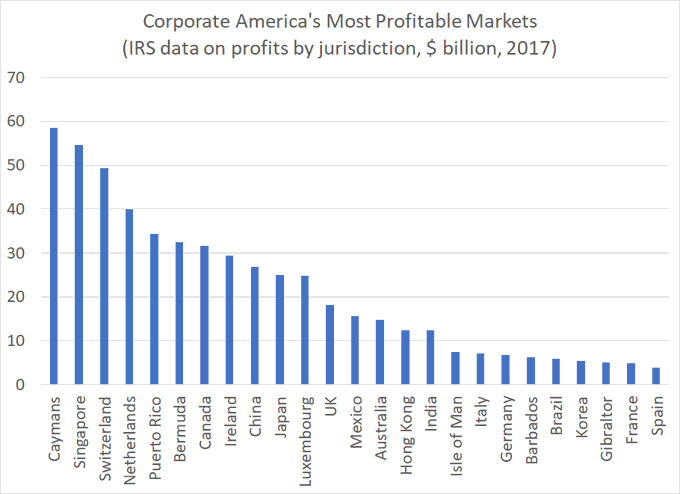

Me, in the

@nytimes

(a first), with a simple message:

The offshoring of U.S. corporate profits is a real problem, and Trump's tax reform if anything made the problem worse.

39

282

499

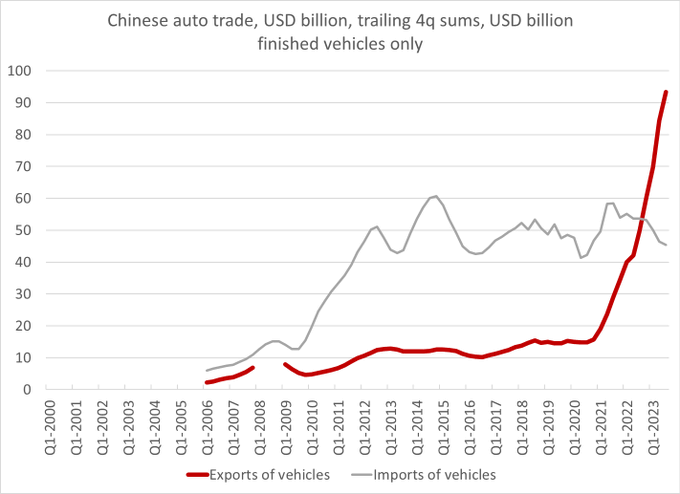

The "deglobalization" of the world's auto industry continues.

Chart from the WSJ, h/t

@scienceisstrat1

1/

28

144

510

Novo Nordisk:

a) pays income tax at the Danish corporate tax rate -- an effective tax rate of 20% v the 22% headline rate ...

b) pays the bulk of its global income tax in its home country (Denmark)

1/x

Two gold stars for Denmark:

🌟for the highest capital gains tax rate in Europe according to this

@taxfoundation

compilation

🌟for being the home to Europe's largest, most valuable company (Novo Nordisk)

Taxes are not at odds with innovation and growth. They actually support it.

6

17

46

13

106

465

China likely lost its chance to stop the US from pivoting towards a policy that tries to compete with Chinese subsidies in key sectors (rather than get out of the way and exit) when it didn't accept real constraints on its subsidies during the negotiations with Lighthizer

26

91

457

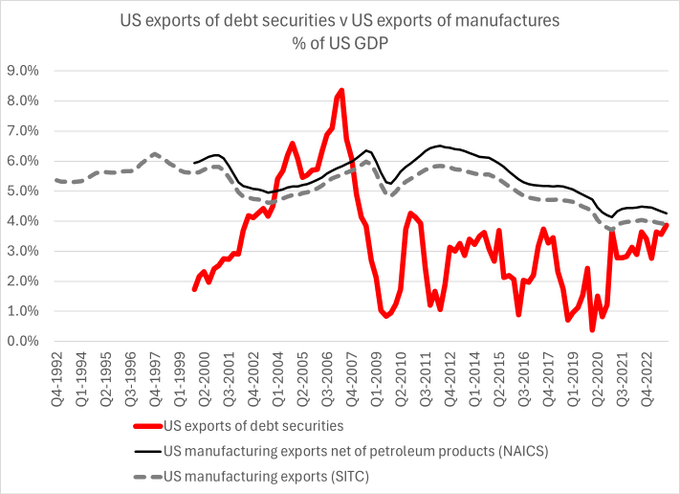

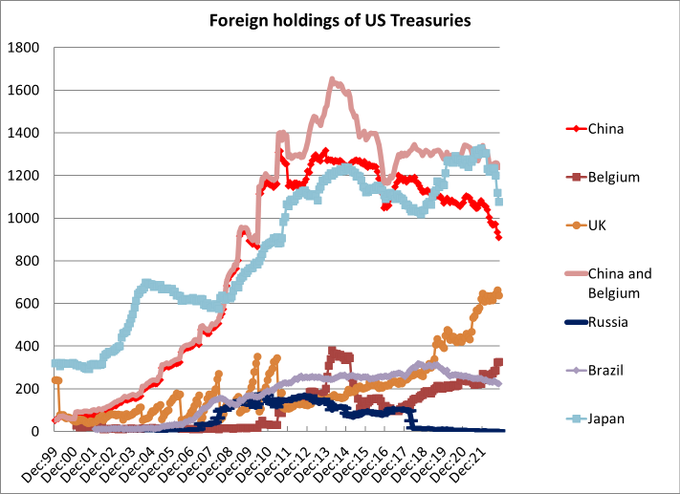

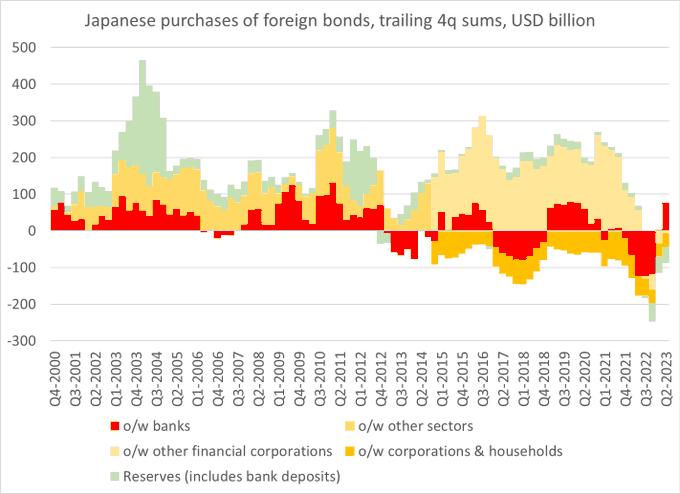

I agree with Pettis.

Pozsar gets this one wrong. The US to my knowledge has never asked for countries to run bigger trade surpluses, to engage in more currency manipulation and as a result to buy more Treasuries.

39

62

458