Cullen Roche

@cullenroche

Followers

97K

Following

43K

Media

5K

Statuses

42K

Founder & CIO @disciplinefunds 📊 | Author @pragcap 📖| PM of DSCF 💰| Defined Duration Investing ⌛| Board at Cambria ETFs 💸

Encinitas, CA

Joined February 2009

At this point I don't even see how anyone can think rate hikes didn't slow inflation given the evidence. If they'd left rates at 0% in 2022/23 shelter inflation (CPI's biggest input) wouldn't have reversed. The housing market would STILL be on fire if they hadn't nuked it with.

@McClellanOsc Bigly disagree. It's not a coincidence that inflation peaked almost exactly when they stopped QE and started raising rates. It crushed the housing market and private borrowing. If they hadn't raised rates the housing market would have been on fire and the biggest inflation

27

8

85

Two things that are true IMO:. 1) The Fed was slow to raise rates and deserves criticism for their initial "transitory" view. 2) They (finally) raised rates at a time when the rest of govt was printing up the wazoo and it helped slow inflation by offsetting what the rest of.

@FedGuy12 Agree that CB independence isn't necessary for price stability. Disagree that Fed hasn't been effective in recent years. They raised rates (yes, a little late) at a time when the rest of the govt was stimulating up the wazoo. They did exactly what an independent CB should do.

22

3

68

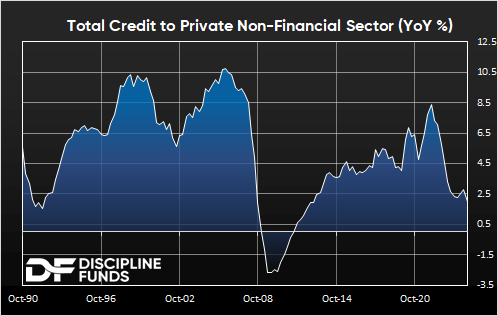

Agree with Steve here. IMO one thing a lot of people missed about recent inflation is that higher rates have a stimulative impact from the govt net financial asset level, but are highly restrictive to private net financial asset levels. This can be clearly seen in something

How should we think about the fact that interest payments comprise the vast majority of federal deficits while primary balance has shrunk and stabilized around under 2% of GDP? We are not running “recession level” primary deficits. Interest expenses shouldn’t be ignored by any

14

9

64

Btw, the @HowardMarksBook letter from this month is an absolute masterclass in valuation, price and behavioral finance. One of his best ever. Which is a bold statement since he's arguably the best living investment writer out there.

oaktreecapital.com

In his latest memo, Howard Marks sets forth the essence of value and price, as well as the critical relationship between the two.

3

1

19

Joe asks an interesting and important question in here - why has grift increased so much and why are the scammers so brazen about it?.

AI, ORALITY, AND THE GOLDEN AGE OF GRIFT. In today's newsletter, I go back to Ong-posting to try to answer the question of why grift is so out in the open these days. Why don't people feel shame and the impulse to obfuscate? Why don't other people react more judgmentally?

30

8

127

Somewhere out there is a 5-year-old boy who will date my daughter someday, and he has no idea I just bought new leg day shoes in anticipation of our first meeting. #ifykyk

12

0

28

Nah. It's the Keynesian Utopia. The value of labor will fall, but productivity will increase. And we will spend less time working because so much of it will become automated. A UBI will expand and the economy turns increasingly into the Keynesian Leisure economy. Footnote: The.

everyone I know believes we have a few years max until the value of labor totally collapses and capital accretes to owners on a runaway loop - basically marx' worst nightmare/fantasy. this is the permanent underclass thing. and everyone I know subscribes to it.

23

6

89

Good critique. Thanks Samantha. I added an adjustment for this in the NAWI Incidence scale which adds an adjusted multiplier to account for the wage earner issue and NAWI adjustment. I am being somewhat conservative with the multiplier because the cited 4.8% increase is the.

No, FICA does not work to track employment trends:. 1. "Social Security limits the amount of income subject to taxation. For 2025’s earnings, that limit is $176,100.".>MANY HIGH INCOME EARNERS NOT TRACKED. 2. "The taxable wage base is adjusted annually based on the national.

2

1

12