Mark Zandi

@Markzandi

Followers

30,492

Following

144

Media

250

Statuses

1,826

Chief Economist @economics_ma . Host of Inside Economics podcast . Co-founder of . Views expressed here are my own.

Joined March 2010

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

#getoutofrafah

• 1921487 Tweets

Dortmund

• 440359 Tweets

Mbappe

• 331453 Tweets

Judge Cannon

• 121260 Tweets

Wembley

• 103900 Tweets

Reus

• 102737 Tweets

Palestino

• 89098 Tweets

iPad Pro

• 84180 Tweets

Dembele

• 81913 Tweets

Hummels

• 77475 Tweets

Grok

• 68191 Tweets

El PSG

• 65879 Tweets

YAIBA

• 49356 Tweets

باريس

• 48899 Tweets

دورتموند

• 43682 Tweets

Vitinha

• 42820 Tweets

FOURTH BE MINE 10M🩵

• 31790 Tweets

Luis Enrique

• 28777 Tweets

#WWENXT

• 27368 Tweets

DPOY

• 19486 Tweets

backnumber

• 18131 Tweets

Shota

• 15043 Tweets

flora matos

• 14712 Tweets

Last Seen Profiles

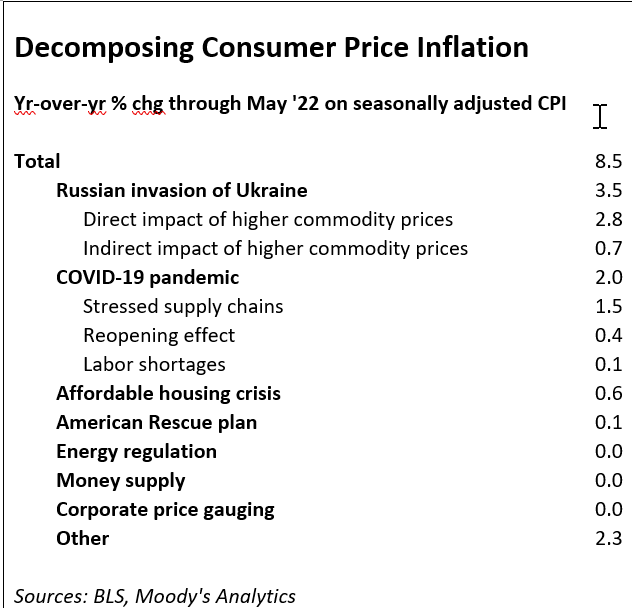

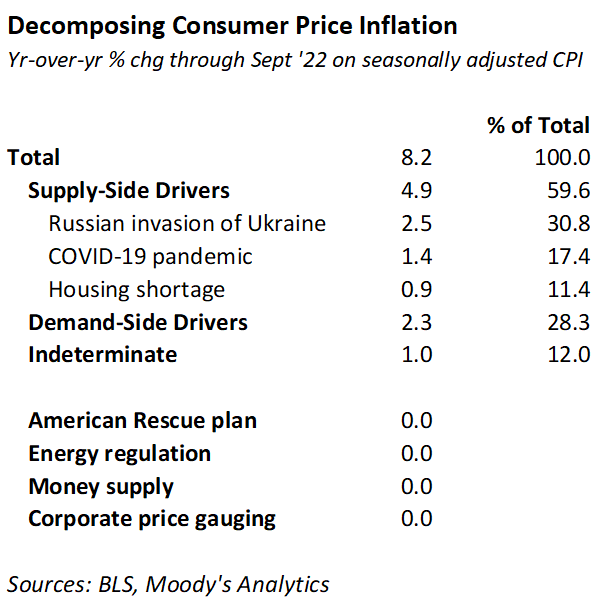

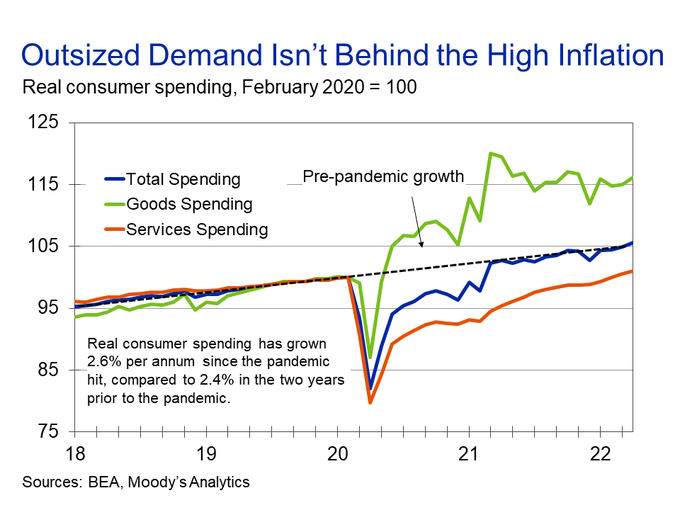

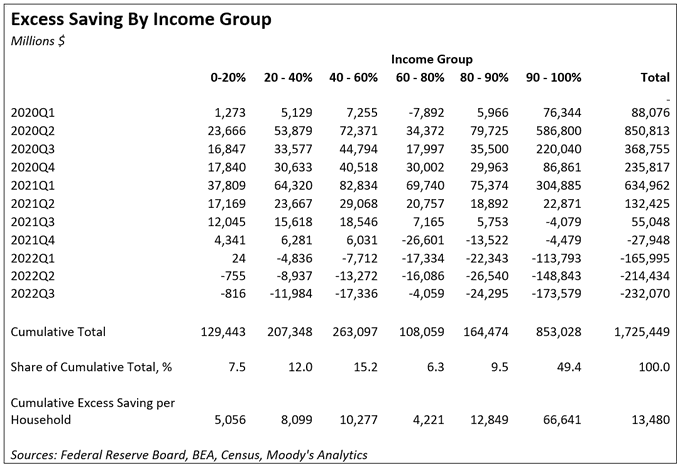

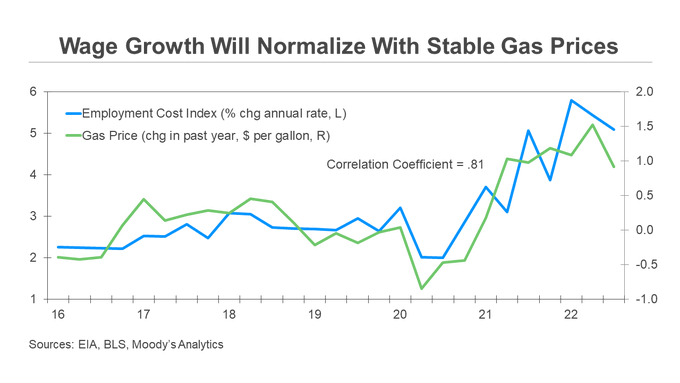

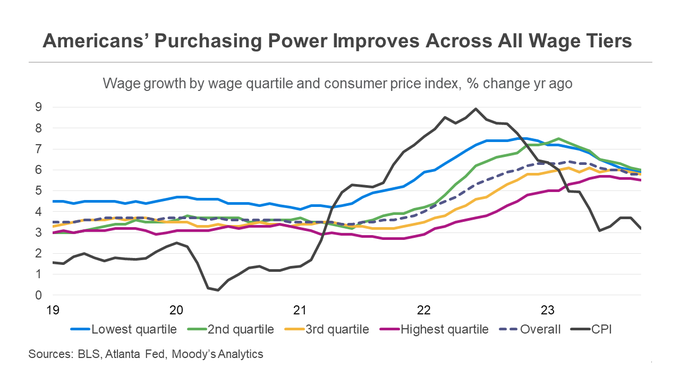

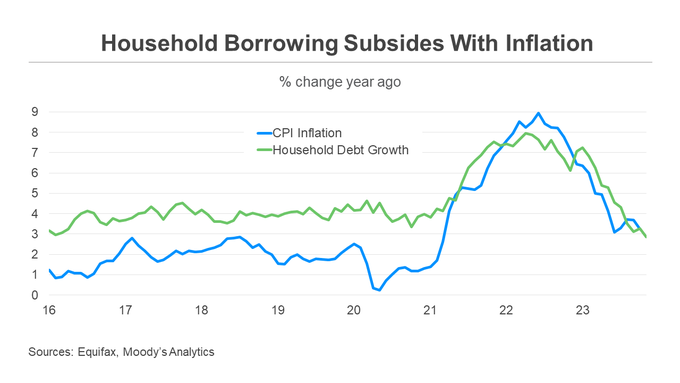

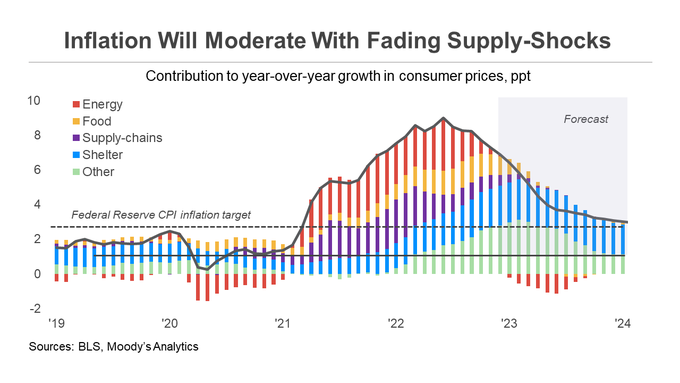

Understanding what is behind the painfully high CPI inflation is key to understanding where it is headed and when. This table should help with this. The Russian invasion and spike in oil and other commodity prices is the

#1

reason, followed by the pandemic & the housing shortage.

226

997

2K

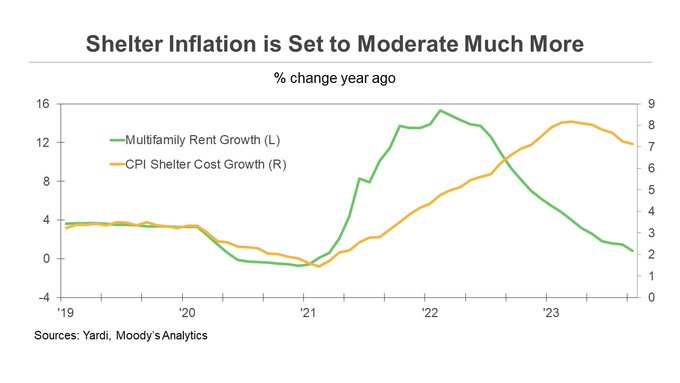

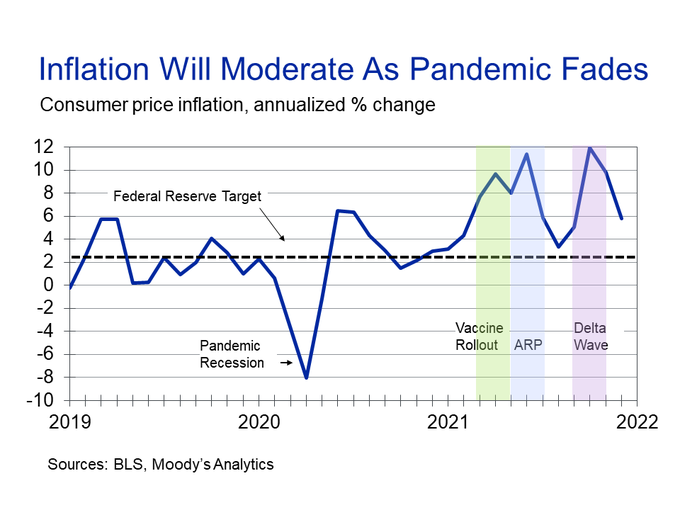

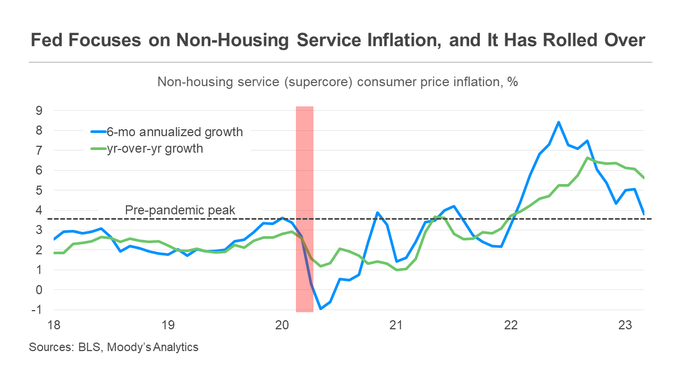

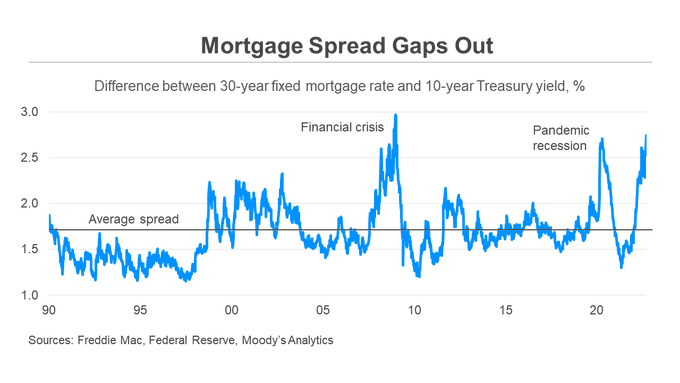

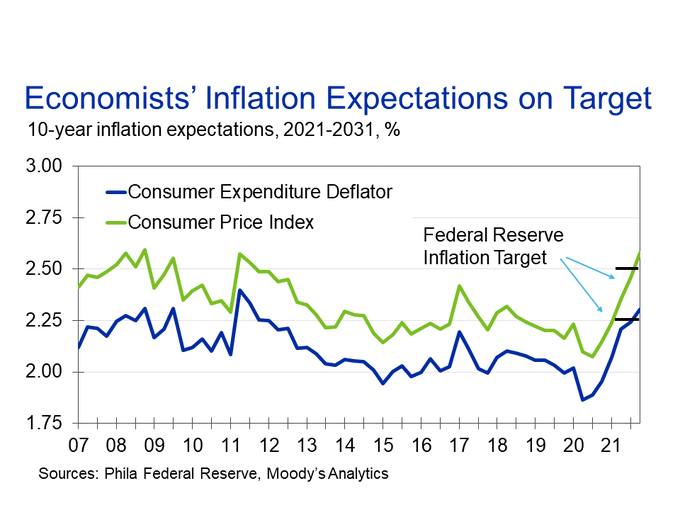

The Fed should pause its rate hikes. Now. The

#1

priority is rightly inflation, but it looks increasingly for sure headed back to target. Vehicle prices are set to fall, the growth in the cost of housing services has peaked, and even non-housing service inflation has rolled over.

49

102

448

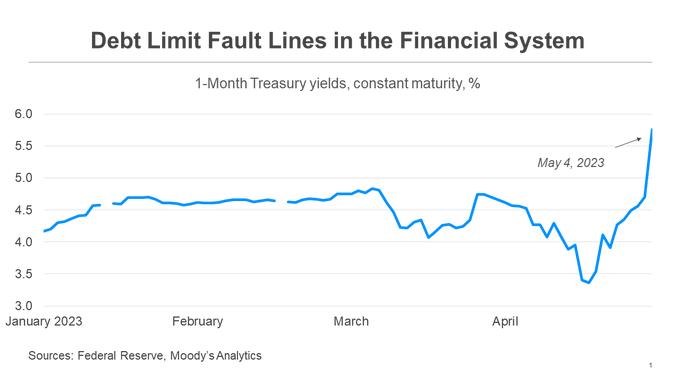

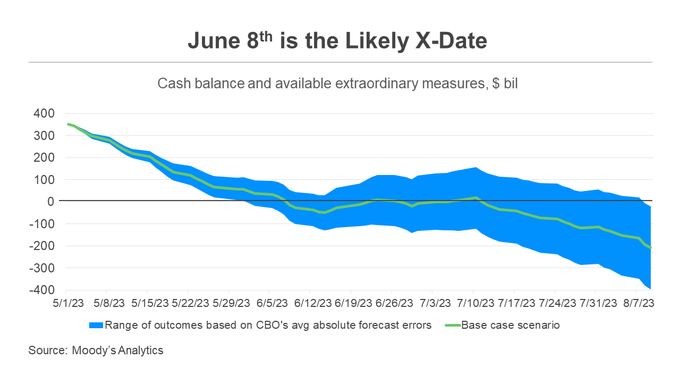

It’s time for lawmakers to end the drama and come to terms and increase the debt limit. There has been little economic fallout from the political back and forth so far. But that is set to change quickly.

"Everyone is going to get hurt."

"Everyone?"

"Everyone. Just matter of degree."

@Markzandi

says the economy will sink into recession if the U.S. defaults on its debt:

57

120

259

265

117

439

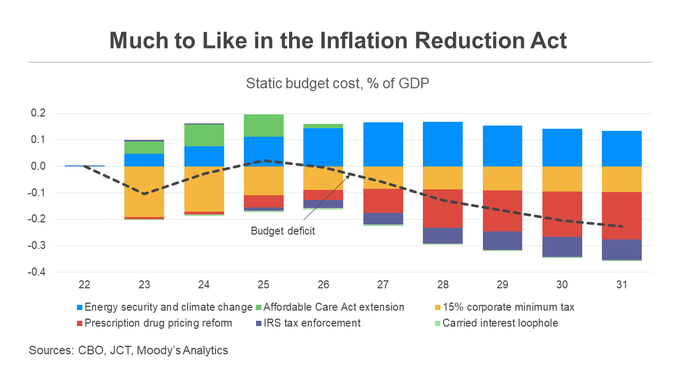

There is still hope

#BBB

in some form will become law, but if so, it will surely be a shadow of what was being negotiated. What a shame. It puts the economic recovery at some risk in the near-term and will diminish the economy longer-run. And what about climate change?

14

88

334