Ihar Mahaniok

@mahaniok

Followers

6,504

Following

3,695

Media

50

Statuses

1,201

Managing Partner at @geek_ventures . Belarusian in NYC with passion to help immigrant founders. Seed check in @instacart , @pandadoc , @ppl_ai , @airbytehq .

New York, USA

Joined December 2007

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Arsenal

• 479509 Tweets

Flamengo

• 158384 Tweets

Tottenham

• 129609 Tweets

Spurs

• 128897 Tweets

Forest

• 107078 Tweets

Botafogo

• 87489 Tweets

Raya

• 67532 Tweets

DAVI NO DOMINGAO

• 57969 Tweets

melanie

• 50602 Tweets

Lite

• 48539 Tweets

Romero

• 35525 Tweets

Maracanã

• 25075 Tweets

Brunson

• 20954 Tweets

Gazzede SoykırımıDurdurun

• 20537 Tweets

Candace Parker

• 19659 Tweets

Türkiye Yüzyılı Maarif Modeli

• 19279 Tweets

Göztepe

• 18995 Tweets

Gabigol

• 18495 Tweets

Brest

• 14543 Tweets

Arrascaeta

• 14440 Tweets

Duhamel

• 14155 Tweets

Chris Wood

• 10060 Tweets

Last Seen Profiles

I see that as investors get famous (like

@paulg

) they get into a bubble where they only see well-connected founders that get rounds from Sequoia and like, and those founders don't need to risk their savings to start a company.

I see lots of founders that have to hustle, grind,…

@StephNass

That was pretty much true when we started YC in 2005, but fortunately it's much less true now.

Founders shouldn't have to risk their savings on a startup.

32

16

456

29

21

360

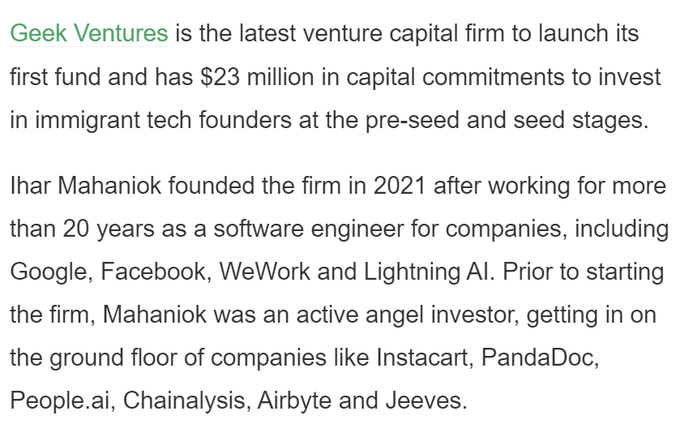

2023 in numbers

@geek_ventures

:

- 34 investments made

- 19 new companies

- 14 different countries of origin of the founders

- 1 exit

- 2 new team members

- 3 SPVs for LPs

- $23M fund closed with 70 LPs

- 7 offline events for founders in 4 cities

- 7 online events

15

0

104

So happy, proud, and humbled to see an article in Techcrunch about

@geek_ventures

.

Could I have thought 11 years ago when I was thinking whether investing hard-earned cash in

@Instacart

was a good idea that it would lead to this moment?

Today,

@geek_ventures

announces the…

21

4

89

@dvassallo

It never needed 8000 to keep barely functioning lights on. It needed way more than 550 to grow and improve and not be a Nazi haven

1

0

49

btw, if you're an immigrant to the US with zero connections, and you are building a startup, apply at and we at

@geek_ventures

will take a look. We write $100k checks.

4

10

48

@nateobrienn

which life would you prefer:

Option 1: fantasy

Option 2: real life

Everyone would prefer fantasy, but people understand that they can't choose that

3

0

37

@sweatystartup

Direct correlation is a significant overstatement.

I have been playing video games since I was 5. Played today too. It didn't prevent me from having healthy weight, family, money, success, and happiness

2

0

35

I am looking for a principal for

@geek_ventures

. The ideal candidate profile is an angel investor or a syndicate lead with some markups; alternatively, someone who made investment decisions in early stage funds or FOs. Fully remote.

DM me if you know one :)

4

5

25

Proud to announce the first exit in

@geek_ventures

portfolio!

The food robotics company Bowlton was acquired by

@ZikiKitchens

, a unique tech-focused restaurant chain that produces modular restaurants.

Congrats to

@YarikGraf

and Paul Shvets!

2

0

24

Happy to announce that we successfully transitioned to make all investment due diligence and investing decisions at

@geek_ventures

by generative AI. We are using a combination of several LLMs.

From now on, instead of analysts, we are hiring only ML engineers and prompt engineers.

8

0

23

wow! Thanks

@ChristineHall

, great article.

1

0

22

@Jason

@RandyTreibel

It takes a UPS driver about 5 minutes to unload 30-50 daily packages for our building. Quite faster than 1 package a minute

2

0

21

@Jason

@BillAckman

@joerogan

Why don't you sponsor a debate on angel investing between you and, let's say, Lauren Boebert? or may be it will make more sense to hear an "open debate" on important topic of investing between you and Charlie Sheen?

3

2

16

@umichvoter

the problem is that there will be 3rd candidate that will siphon 5-10% off Biden and that will hand victory to the felon

7

0

20

btw, happy to share that we recently closed our first deal as the lead investor on a priced round, with the first board seat for

@geek_ventures

. I'm extremely excited about the company and can't wait till the moment we can talk about that deal freely!

2

0

21

@AdamDraper

To me, a founder having an assistant is a huge green flag.

It means the founder is smart enough to find someone to take menial / smaller tasks off their plate and can focus 100% on the important stuff.

I got an assistant and it changed my life. And I recommend all my portfolio…

4

1

19

@RiverMcTasney

CEO's job at pre-seed and seed:

1. Set a vision, strategy, and culture

2. Hire best people

3. Product direction and high level product management

4. Initial sales

5. Fundraising

5

0

20

.

@geek_ventures

is looking for a principal.

If you are an early stage investor with at least 5 years of experience and track record of investment decisions, please apply!

Check out the details and how to apply at the link below.

0

6

19

This Friday,

@geek_ventures

hosts an online webinar on Generative AI with Igor Markov, a distinguished Research Scientist in the field, for founders of our portfolio companies.

We have a few seats available for top founders outside of our portfolio. If you're interested, please…

4

3

20

Just wrote a post listing some of the people who were crucial in getting

@geek_ventures

to the $23M close.

They deserve all the applause.

2

0

20

Congratulations to our portfolio company

@ShapesXR

! Raising $8.6M seed round in 2023 is no small feat :)

Glad that

@geek_ventures

has been part of their journey since 2021.

3

1

20

To fellow emerging VCs: great episode of 20vc with

@HarryStebbings

and

@robgo

on VC fundraising. Lots of insights.

2

0

19

It's happening! We at

@geek_ventures

are hosting an amazing Founders / Investors community event next Tuesday.

Great VCs on the panel. Quite a few experienced founders confirmed.

DM me if you're interested! And pls elaborate on your track record and value add to the community :)

0

1

19

I'm so excited about December! We invested in 4 companies, deployed the largest amount of money in the history of

@geek_ventures

, and are now working on an amazing deal that will close in January. Great times.

3

0

18

@Jack_Raines

@ylecun

Less than 5% of the world population. It's negligible. The phrase "pretty much no one uses it" is correct.

Also, even in the US lots of people don't use it.

2

0

17

@realCoreyEngel

VCs should be contrarian, but this is contrarian for contrarian's sake, without any logic

3

0

17

Proud to have been invited to a Belarusian podcast "Signal and noise" to talk about

@geek_ventures

and venture investing overall.

English subtitles are there!

Thanks

@Okendokenn

and

@yah0r

.

0

0

15

@jefielding

It's still 100x better than being ghosted by a VC that signed a term sheet.

This happened a few times to my portfolio founders in the exact same scenario - a VC signs a term sheet being confident that they will have capital in soon, and then LPs don't bite.

2

0

16

@taykcrane

@Betterment

of course not. It's just 10 years in which S&P 500 outperformed a more balanced diversified portfolio. Next 10 years can be reverse.

1

0

15

@paulg

@StephNass

what's happening here, I think, is that as investors get famous (like

@paulg

) they get into a bubble where they only see well-connected founders that get rounds from Sequoia and like.

I see lots of founders that have to hustle, grind, and risk before they get first $100k check

2

0

14

Carta has a PR crisis after PR crisis, and every time it's a CEO own making.

You remember how a few months ago Carta CEO reached out to everyone telling them not to believe bad press written about Carta? People didn't know there was bad press until they read that from the CEO.…

@karrisaarinen

Karri, you are free to share our conversation. What I remember is that you appreciated we made a mistake that affected you and two other companies. Thank you for understanding. 🙏 We fucked up and I’m sorry we fucked up. I hope you will forgive us.

You also acknowledged that…

223

11

107

4

2

15

Something weird is happening with

@Angellist

. I tweeted about their angel portfolio page, and suddenly I get a message about "violations of Terms of Service". I had 50+ investments on there as well as a syndicate and suddenly got locked out.

7

2

14

@StephNass

Then you're too focused on super early stage.

Yes I barely care about the product at pre-seed. But at seed and above, starting from 10M+ valuation, I care. At Series A product becomes very significant.

If product looks and feels like crap at this level, it gives zero confidence

4

2

14