Viresh Kanabar

@VKMacro

Followers

3,724

Following

1,380

Media

2,306

Statuses

16,056

Explore trending content on Musk Viewer

Drake

• 3072749 Tweets

Kendrick

• 2757310 Tweets

madonna

• 640474 Tweets

Sant Rampal Ji Maharaj

• 292936 Tweets

Not Like Us

• 202060 Tweets

こどもの日

• 191044 Tweets

어린이날

• 180646 Tweets

#अविनाशी_परमात्मा_कबीर

• 149028 Tweets

Copacabana

• 144044 Tweets

Flamengo

• 113930 Tweets

Anitta

• 92854 Tweets

ケンタッキーダービー

• 71346 Tweets

フォーエバーヤング

• 62890 Tweets

Anthony Edwards

• 58959 Tweets

子供の日

• 55391 Tweets

Maidana

• 53071 Tweets

鯉のぼり

• 52168 Tweets

#UFC301

• 47285 Tweets

Timberwolves

• 40482 Tweets

Minnesota

• 37591 Tweets

Leafs

• 36972 Tweets

Katt Williams

• 29967 Tweets

端午の節句

• 29666 Tweets

Bruins

• 27011 Tweets

Vogue

• 25788 Tweets

カグヤ様

• 25705 Tweets

ゴージャス

• 25457 Tweets

設営完了

• 25303 Tweets

Fortaleza

• 20616 Tweets

Like a Prayer

• 20328 Tweets

Hung Up

• 19576 Tweets

テーオーパスワード

• 17606 Tweets

Isabella

• 16195 Tweets

Naz Reid

• 13980 Tweets

Live to Tell

• 11960 Tweets

Ant Man

• 11765 Tweets

Last Seen Profiles

@Halsrethink

You might find this article interesting Harald. Something you have spoken about before too.

8

23

78

@y_alibhai

@afneil

‘You have to report on all facts that I deem appropriate, or else you’re bias’

So your problem isn’t that he’s not reporting facts, but that he’s not reporting all of the facts that you’d like to be reported. Just lol.

0

4

53

@agnostoxxx

1) exports are at or close to a 7year high

2) other areas such as autos, renewables, rail all use steel and have been strong

1

1

53

@Big_Orrin

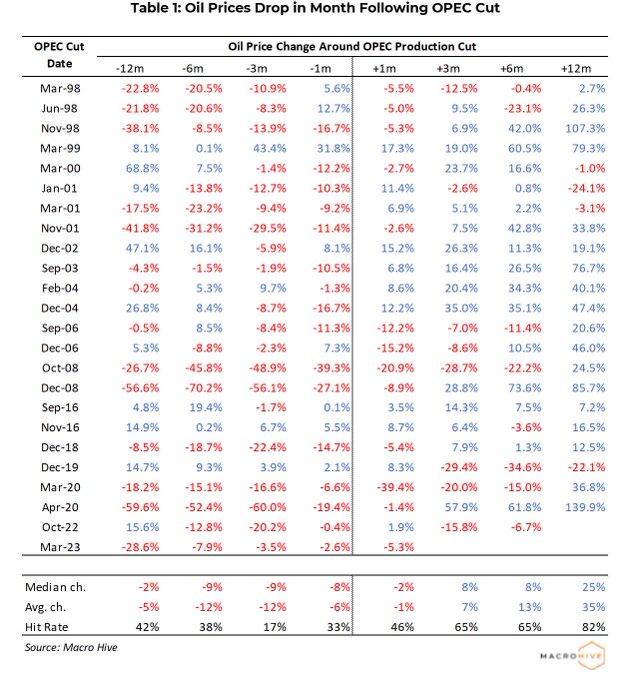

We looked at every opec cut going back to 1998 - prices are very often lower one month later

2

11

42

Bit late to this this one with

@agnostoxxx

and

@marketplunger1

. Good convo.

Takeaway is the goal is to make money, not to pontificate about being right

1

2

37

Best interview on macro I've heard recently.

@agurevich23

on Macro Huddle.

Discussions around process, decision making and r/r always trumps blue sky vision macro.

3

4

38

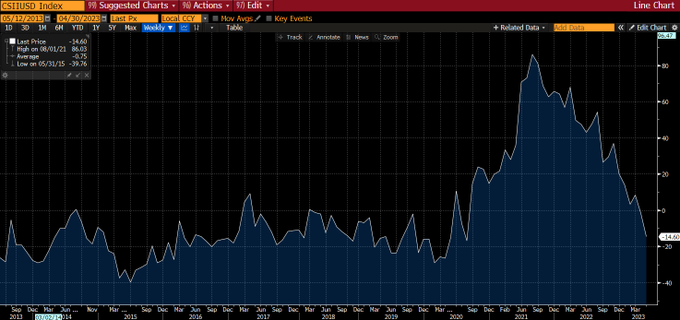

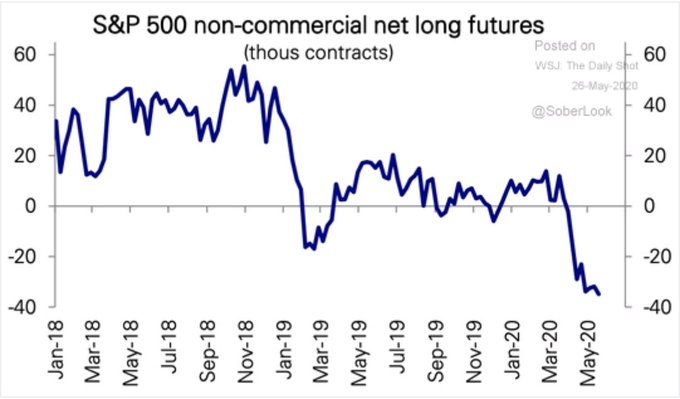

Hearing a lot of talk about speculative positioning being at records for bonds and gold etc. But very few of these actually show positions as a % of OI. Gold does look like its at extremes, but 10 year treasury’s aren’t. Ht:

@movement_cap

2

10

25

Quick shout out to

@Sunchartist

for the excellent charts/ comments he’s been sharing. Must follow imo.

3

2

24

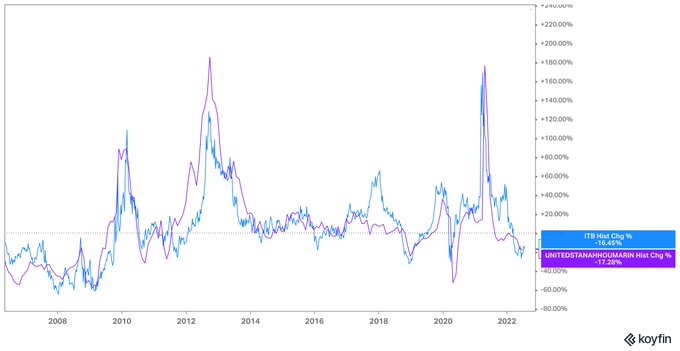

@MacroAlf

@SrivatsPrakash

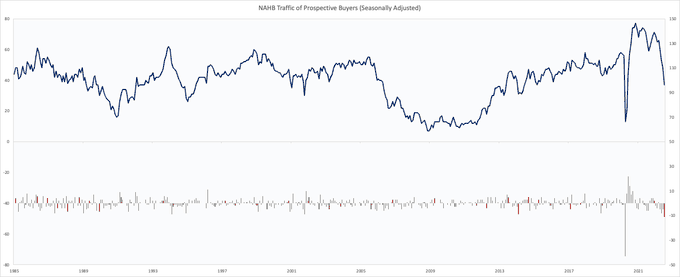

Here's $ITB YoY vs. NAHB YoY. Naturally, they track each other, so question is if you incrementally believe the housing market continues to deteriorate, $ITB should continue to fall on a YoY basis.

2

1

24

@TheStalwart

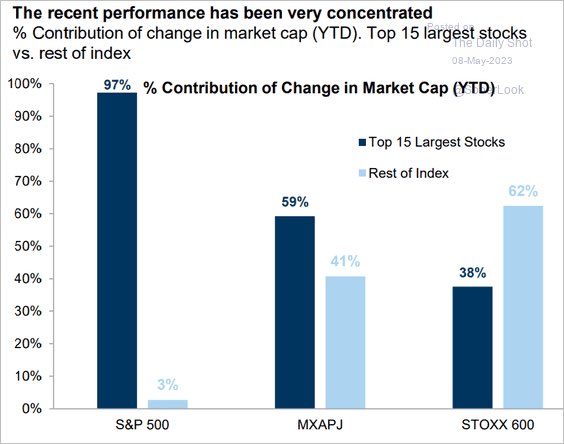

More fiscal --> higher growth --> higher yields + broader investment opportunities are helping to take excess out of the market. Who knew!

1

7

18

Just wanted to re-share this chartbook by

@Jesse_Livermore

which gives a great history of US large and smid caps

0

3

17

Jensen's comments are always worth reading in full, but this from

@TheTranscript_

is interesting!

1

5

16

This is been a wild year and a great one for both for performance but more importantly to continue my learning. As always thanks is due to all fintwit, esp..

@mark_dow

@lhamtil

@jturek18

@borrowed_ideas

@MacroOps

@jsmian

@marketplunger1

@teasri

@profplum99

@ballmatthew

5

0

15

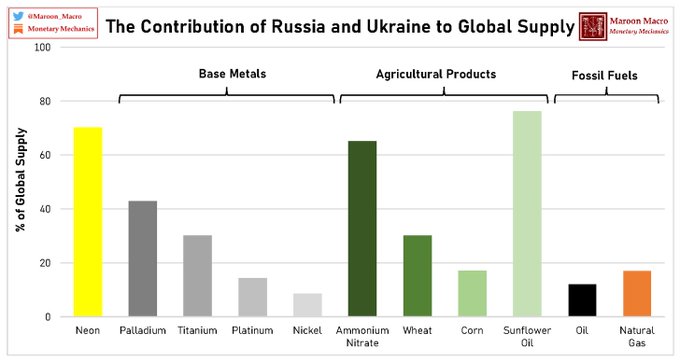

Great chart from

@Maroon_Macro

looking at combined contribution from Ukraine and Russia to supply

Monetary Mechanics Issue

#44

out now!

There have been a lot of requests for me to cover the impact of the Russia-Ukraine conflict on financial markets and the global economy.

This is part 1/2, focusing on global supply chains and commodities markets.

1

10

36

1

4

13

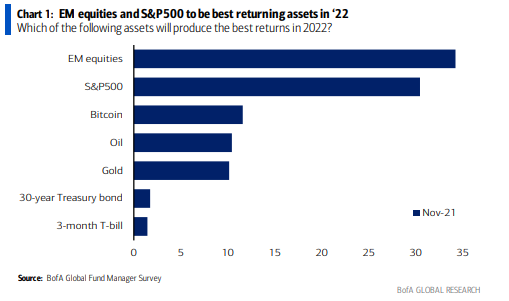

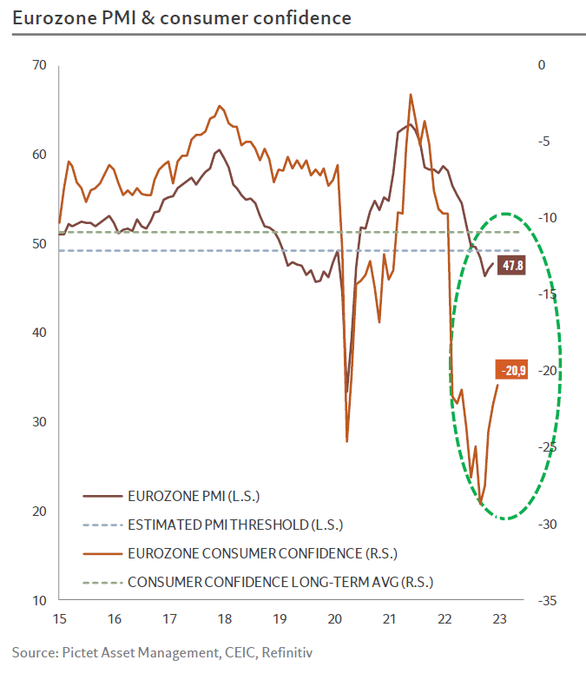

Best returns come when the situation goes from truly awful, to less bad (I think I’ve butchered Soros there)

Eurozone deep recession out of the cards. Even a small one is becoming relatively unlikely.

@skhanniche

#EurozoneRecession

#ECB

#BCE

4

15

32

1

5

12

Have enjoyed listening to this interview of

@DennisHong17

. 1 thing I found most surprising was Dennis talking about himself as a skeptic / negative person. I would never have got that impression based on Twitter. Also good chat around providing challenge.

0

0

13

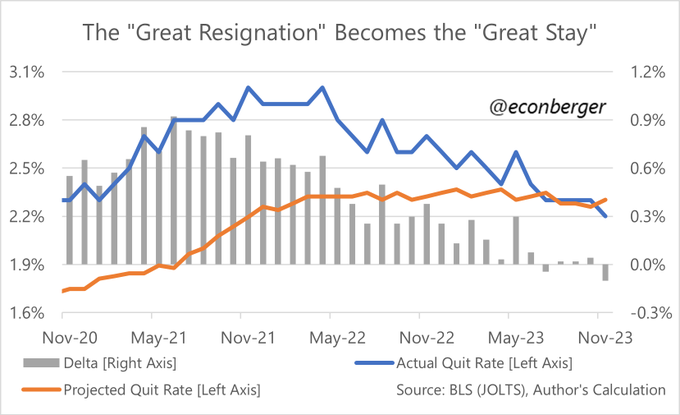

Quits as the more robust measure of future wages (versus Nfib future wage plans) continues to point to further wage disinflation over next 3-6 months.

2

2

11