Tim Duy

@TimDuy

Followers

35,399

Following

722

Media

979

Statuses

47,203

Husband, father, Chief U.S. Economist, @sghmacro , @uoregon economist, Tim Duy's Fed Watch, former columnist for @bopinion

Eugene, OR

Joined September 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Pakistan

• 454168 Tweets

Macron

• 438416 Tweets

#INDvsPAK

• 347750 Tweets

La France

• 239874 Tweets

Xbox

• 234669 Tweets

Bardella

• 179748 Tweets

Alcaraz

• 172610 Tweets

#CanadianGP

• 171191 Tweets

Bumrah

• 142700 Tweets

Le RN

• 139358 Tweets

Doom

• 107587 Tweets

Le Pen

• 106368 Tweets

Francia

• 90555 Tweets

Zverev

• 89066 Tweets

Ferrari

• 81583 Tweets

Lewis

• 80826 Tweets

Russell

• 79238 Tweets

Gears

• 61644 Tweets

Verstappen

• 59701 Tweets

#t20USA

• 56588 Tweets

Lando

• 52581 Tweets

Hamilton

• 52153 Tweets

Omar

• 49329 Tweets

Naseem

• 45606 Tweets

Leclerc

• 44713 Tweets

Life is Strange

• 41343 Tweets

#dissolution

• 40236 Tweets

Rizwan

• 29261 Tweets

Chloe

• 29096 Tweets

Demokratie

• 28482 Tweets

Fable

• 25554 Tweets

McLaren

• 25461 Tweets

Dragon Age

• 24540 Tweets

NUPES

• 23073 Tweets

Haas

• 21762 Tweets

Glucksmann

• 21139 Tweets

Ergebnis

• 21014 Tweets

Sainz

• 20411 Tweets

Imad

• 19045 Tweets

Perfect Dark

• 18939 Tweets

Indiana Jones

• 10717 Tweets

Last Seen Profiles

I have come to agree with this.

23

119

691

Maybe good economics about on some levels, but bad politics. Dems need to stop letting perfect econ be the enemy of sustainable political objectives. Warnock and Ossoff campaigned on the checks and delivered a win. Reward them. It’s really that simple.

21

64

495

Is this parody?

21

19

447

@dandolfa

We don’t have any of that set up yet. There are no masks, there is no widespread testing. Yes, if we had those things we could go back to work. But we don’t and won’t for weeks. Even if we did, we still will reveal the weakness of our health care system with even low infections.

4

29

380

The Millennial experience might be the norm not the exception. We don’t appreciate how lucky the Boomers and Xers had it. My Granda was born in 1910. By the time she was 35, she lived through two World Wars and the Great Depression.

35

63

371

Lol completely misses the biggest rate hike cycle in decades and still declares victory.

26

36

327

I guess the biggest risk to airlines in the long-run is that companies learn that much of the “essential” Tavel was not “essential."

Yesterday Amazon told employees of its at largest org (worldwide ops) to stop all foreign and ~~domestic~~ travel “until further notice” because of coronavirus, according to emails I saw.

Tucked a bit of news into

@MikeIsaac

’s newsletter

13

212

323

10

36

287

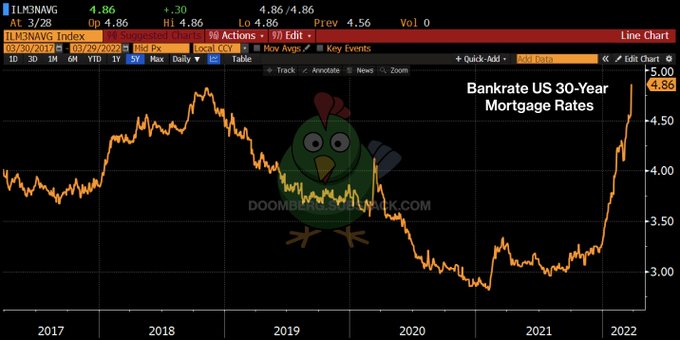

For those arguing that the Fed has lost control of the bond market, this is what losing control looks like.

12

32

302

Theory: There are three issues that if adequately addressed would improve the economic fortunes of a vast majority of people. Health care, housing, and education. None of those issues is beyond our capacity to deal with in even the short run.

7

68

279

Pro tip: Except during the very worst of recessions, employers almost always believe the labor markets are “too tight.” Beige Book doesn’t tell you labor markets are too tight; it tells you that employers think hiring takes a lot of effort.

16

58

275

This is a straight up bad take. If you are going to zero, you won’t have (traditional) ammunition left no matter how quickly you get there. Better to go early and go big and err on the side of being ahead of the curve rather than behind.

When you have limited ammunition you have to conserve it. The Fed has limited ammunition with interest rates so low. Interest rates don't cure the

#coronovarius

and interest rates don't repair supply chains.

35

113

270

24

51

266

Again, completely backwards use of the bank analogy. The financial flows are from the rest of the world to the US.

Just another

#G7

where other countries expect America will always be their bank. The President made it clear today. No more. (photo by

@RegSprecher

)

5K

8K

27K

19

91

224

I understand the framing because of his job, but can’t systemic racism just be wrong? I am really tired of having to have an economic justification for everything we do.

9

34

242

When I spoke with manufacturers last week, none complained about the Federal Reserve. Many, however, complained about trade wars.

7

50

220

The Fed has already acted differently this time. No way would a prior Fed have sat back while unemployment fell to 4.6% and core inflation rose to 4.6% and not even begun the tightening process.

13

23

210

I find it frustrating that policymakers continue to move the goalposts. There won't be inflation -> inflation is transitory -> not that kind of transitory, the longer kind -> (next up) more inflation this year means less next year -> (finally, maybe?) more inflation is good.

Yellen on inflation: "I believe it’s transitory, but I don’t mean to suggest these pressures will disappear in the next month or two"

She was on

@CBSNews

8

12

58

21

41

211

I suspect this is underrated as a source of tightness in the labor market.

7

30

200

I do so enjoy when people use OLS on 13 observations and think they have discovered the secrets of the universe. It’s adorable.

9

34

198

FOMC is hiking into the slowdown and it knows the consequences.

3

39

189

The Fed doesn’t see it this way. Assuming 2024 ends at 2% inflation (we are already there), 150bp of rate cuts leaves spot real policy rates at 1.8% compared to the long run real neutral of 0.5%. In the Fed’s world, that is less contractionary, not stimulative.

15

27

192

Lots going on here. If you want more daycare, we need to pay competitive wages. To pay competitive wages, we need parents who can afford higher costs. In particular, you need higher wages for women. Alternative is to subsidize wages for child care workers.

17

51

180

Master’s programs are cash cows for higher ed. I strongly advise my students to be very cautious about taking on additional debt for grad school. For many if not most of these programs, it will never pay off. Many will take anyone. MBA programs are a dime a dozen.

My WSJ investigation w/ the inimitable

@anfuller

shows master's programs at prestigious private universities often leave grads in worse financial shape than those at for-profit colleges. 1/

93

583

1K

20

30

180

Waller, Powell, Williams all told us repeatedly that the Fed didn’t need lower growth to cut, that inflation alone would do it. People just refused to listen, and still refuse to listen.

4

31

177

Nope. Wrong. Wrong. Expansions don’t die of old age. Age of a recession doesn’t predict probability of expansion.

@TheStalwart

Recessions have arrived periodically every 8-10 years. 1990-1991, 2000-2001, 2008. We’re overdue for another.

Plenty of other charts as well that show things at pre-2007 levels. But above all is feeling that the recovery is in asset prices, is fragile, and is sustained by QE.

11

1

14

8

12

172

It’s not a choice between a recession or zero rates forever.

10

9

155

No. This is a monthly chart of saving, the flow. The net acculumating of saving is savings, the stock.

"This distinction is often misunderstood, and even professional economists and investment professionals will often refer to "saving" as "savings”.” - Wikipedia

2

16

154

The strength of the Fed’s commitment to driving the unemployment rate higher is the key policy issue this year.

"The Fed intends to engineer a higher unemployment rate. I don’t know this will still be true in the second half of the year, but it is definitely true now." --

@TimDuy

1

13

56

12

39

150

Yep - still doing QE with inflation not seen in 40 years. Can you say “we don’t care about inflation” any louder than that?

6

32

143

@s_delhommer

@Claudia_Sahm

Everyone knows that occupational licensing is bad for all fields except your own.

5

9

144

Could dogs solve the testing crisis?

Dogs with a few days of training are capable of identifying people infected with the coronavirus, according to a study by a German university via

@business

4

50

136

Core measures less shelter tells us that underlying inflation is running at a pace not seen since the 1980s. Seems like its not just a year ago problem.

12

24

139

This implication is what you should be focusing on. The Fed is locking real rates at -2% despite substantial improvement in the economy. The Fed is begging you to buy risk assets.

7

29

135

Re-reading

@Neil_Irwin

‘s The Alchemists with a student. Makes me realize the debt we owe Bernanke. It took him years of tireless effort to design and implement the package of policies that the Powell Fed delivered this week.

5

17

129

In no way do we measure GDP sufficiently accurately to believe that GDP forecasts to three decimal points are anything other than a sad joke.

GDPNow from

@AtlantaFed

forecasts 3.396 percent GDP growth in Q4, down slightly from 3.418 percent estimate a week earlier

3

6

4

7

30

126