Olivier Blanchard

@ojblanchard1

Followers

169,427

Following

388

Media

48

Statuses

1,391

Robert Solow Professor of economics emeritus, MIT Senior Fellow, Peterson Institute for International Economics

Washington DC

Joined November 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Cohen

• 371258 Tweets

Liverpool

• 121043 Tweets

OpenAI

• 120675 Tweets

Lima

• 93807 Tweets

GPT-4o

• 80695 Tweets

Fábio

• 45517 Tweets

#WWERaw

• 35577 Tweets

#ラヴィット

• 26628 Tweets

Richas

• 25084 Tweets

Bronny

• 22906 Tweets

Goff

• 21687 Tweets

Garland

• 20942 Tweets

Diniz

• 19596 Tweets

QSMP

• 18553 Tweets

Gallardo

• 17108 Tweets

Last Seen Profiles

This is insane.

#Brazil

and

#Argentina

to start preparations for a common currency

Other Latin American nations will be invited to join plan which could create world’s second-largest currency union

213

362

1K

262

769

5K

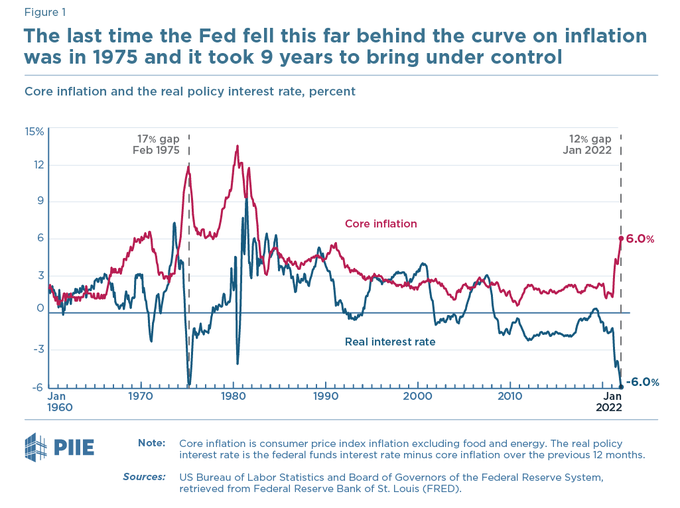

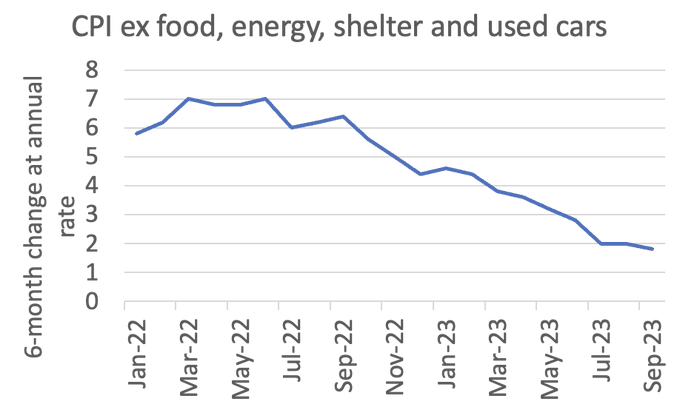

Larry: Are you becoming chartist? 😀(I kind of remember that something happened at the end of the 1970s, like a trippling of oil prices, which might be vaguely relevant. Do u expect it to happen again?)

49

187

1K

Take them.😀 Why are people still willing to pay tens of thousands in tuition when they can get these for free... This will change, and, with it, the business model of higher ed.

43

230

996

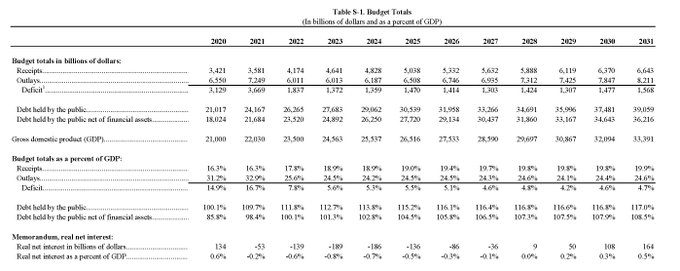

In the next few months, I intend to write a short book about fiscal policy today. The slides, used for a discussion with

@JohnHCochrane

below are a first pass. More to come as I make progress.

14

130

701

I very much agree. Macro is often getting a bum rap, because it has to answer big, essential, general equilibrium questions, where the kind of identification one dreams of is rarely/never available. Absolutism, be it in identification or in micro foundations is bad.

18

89

621

Ironic. Just saw the column by

@paulkrugman

, who refers to my work to develop the opposite position from mine.😀To be clear: Debt default in the US is not imminent. But I worry the needed adjustment may not come until financial markets make it unpleasantly clear that it has to.

42

108

562